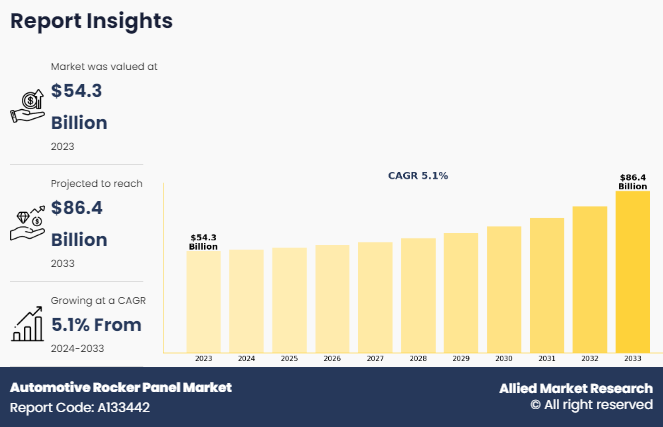

The global automotive rocker panel market size was valued at $54.3 billion in 2023, and is projected to reach $86.4 billion by 2033, growing at a CAGR of 5.1% from 2024 to 2033.

Factors such as increasing fleet of electric & hybrid vehicles, and growing focus on enhancing vehicle aesthetics are driving the growth of the automotive rocker panel market across the globe. Furthermore, the demand for lightweight material in vehicle production is expected to create ample opportunities for the growth of the market during the forecast period.

Rocker panel serves as a protective barrier for the lower section of a vehicle deployed below the doors and between the front and rear wheel wells. They protect the vehicle's lower body from potential harm caused by rocks, debris, and various road hazards. It is manufactured from materials such as steel or aluminum. The rocker panel is engineered to endure impacts and provide structural support to the vehicle frame. Currently, automotive rocker panels are widely utilized globally to preserve the structural integrity and visual appeal of automobiles.

Overview of United States Automotive Rocker Panels Industry

The demand for automotive rocker panels in the US. is poised for significant growth, driven by a variety of key factors specific to the market. As the U.S. economy is recovering and consumer confidence is strong, vehicle sales is expected to increase, and the demand for rocker panels increases as essential assembly line items. Furthermore, stricter safety regulations by government organization types such as those provided by the National Highway Traffic Safety Administration (NHTSA) force automakers to provide rocker panels into their vehicle.

Additionally, the growing market for light trucks, SUVs, and crossover vehicles in the US. market provides opportunities for rocker panel manufacturers to address the specific design and performance needs of these automotive parts. Also, the growing attention to luxury and custom cars in the US. consumers are experiencing an increasing demand for attractive rocker panels with refined design and styling as individuals seek to personalize their vehicles to reflect their unique style preferences.

Key Takeaways

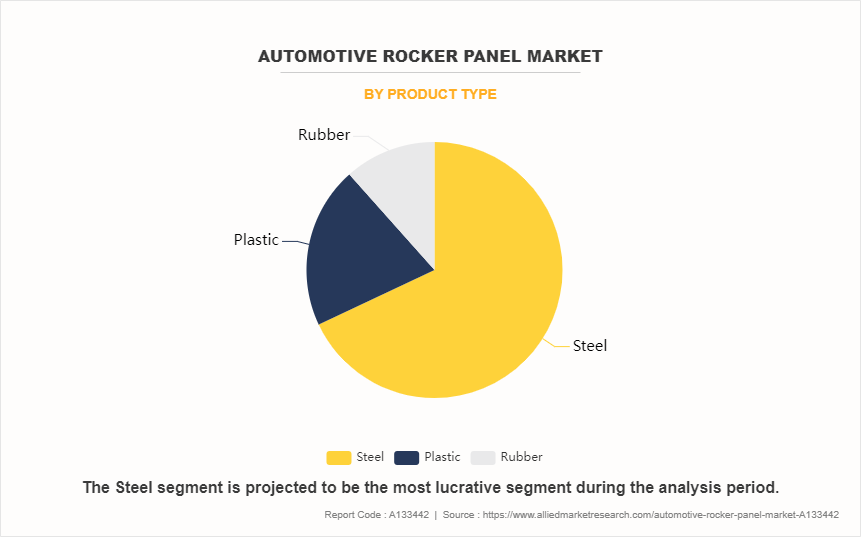

- By product type, the steel segment is likely to have a largest market share of automotive rocker panels.

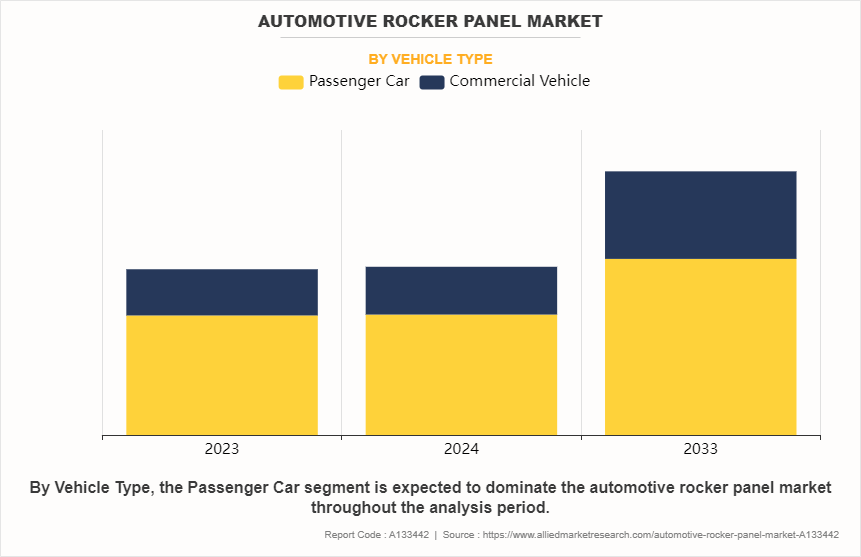

- By vehicle type, the commercial vehicle is expected to witness highest growth rate over the forecast period.

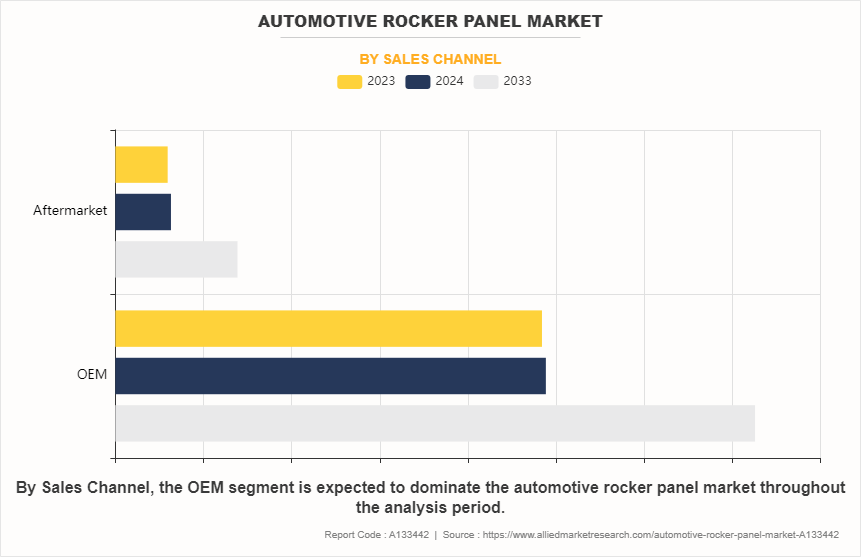

- By sales channel, the aftermarket segment is likely to exhibit largest CAGR during the forecast period.

- North America to hold the highest CAGR over the forecast period.

The expansion of the automotive industry, particularly in emerging economies, has boosted the demand for improved safety features and structural strength, leading to adoption of durable rocker panel solutions. In addition, various innovations in manufacturing technologies and materials, including lightweight composites and corrosion-resistant coatings, are playing a positive role in driving the market growth. Furthermore, the integration of sustainable materials in rocker panel production, driven by increasing environmental consciousness and alignment with eco-friendly automotive trends, is a significant factor contributing toward the market expansion.

Rocker panels are deployed in commercial vehicles as they provide enhanced protection. For instance, they safeguard the vehicle from various road hazards, including rock dings, chips, scratches, rust, and peeling. The vehicle’s exterior is protected due to the use rocker panels. Globalization and international trade have fostered the demand for commercial vehicles such as trucks, trailers, and other heavy-duty vehicles. To ship goods across borders and continents, the need for reliable and durable trucks to transport heavy cargo has grown. International trade relies heavily on shipping containers, and specialized heavy-duty trailers are often used to transport these containers from ports to distribution centers and beyond. Moreover, the need for sustainability and environmental considerations is influencing the demand for specialized trucks. Automotive rocker panel market manufacturers are developing eco-friendly trailers that are more fuel-efficient and produce fewer emissions, aligning with the global push for greener transportation solutions, which is impacting the market growth positively.

The expansion of logistics industry coupled with increasing cold chain transportation is driving the requirement of commercial vehicles, which, in turn, is driving the need for rocker panels. Road transportation is the most utilized mode of transportation in the logistics sector as it offers better cost advantages over other modes. Thus, logistics is one of the key end-use industries for commercial vehicles. In addition, rapid expansion of manufacturing, agriculture, electronics, and textile & apparel industries increases the demand for logistics & supply chain services. Moreover, most companies rely on third-party logistics companies to decrease investments in fleet, reduced workforce, and availability of various types of containers, tanks, and flatbeds as per the requirement of companies.

Owing to rapid industrialization across the globe, the demand for efficient transportation and logistics solutions has been increasing simultaneously to cater to the movement of goods and materials. Trucks are vital in this context due to their capability of transporting large volumes over great distances efficiently. Moreover, the worldwide need for cold chain logistics is rising due to the escalating global demand for perishable goods such as pharmaceuticals, poultry, fresh flowers, fish, dairy items, and produce. These perishable goods are transported from one place to another through trucks and other heavy duty vehicles driving the growth of rocker panels as they are deployed in these vehicles at the time of production.

Key Developments in Automotive Rocker Panel Industry

The leading companies have adopted strategies such as product launch, acquisition, agreement, expansion, partnership, and contract to strengthen their foothold in the competitive market.

- In July 2021, Marelli Automotive Lighting and Samvardhana Motherson Automotive Systems Group (SMRP BV) collaborated to develop smart illuminated exterior body parts. The collaboration aimed for the development of illuminated rear ends, illuminated fenders, and illuminated rocker panels.

Segmental Overview

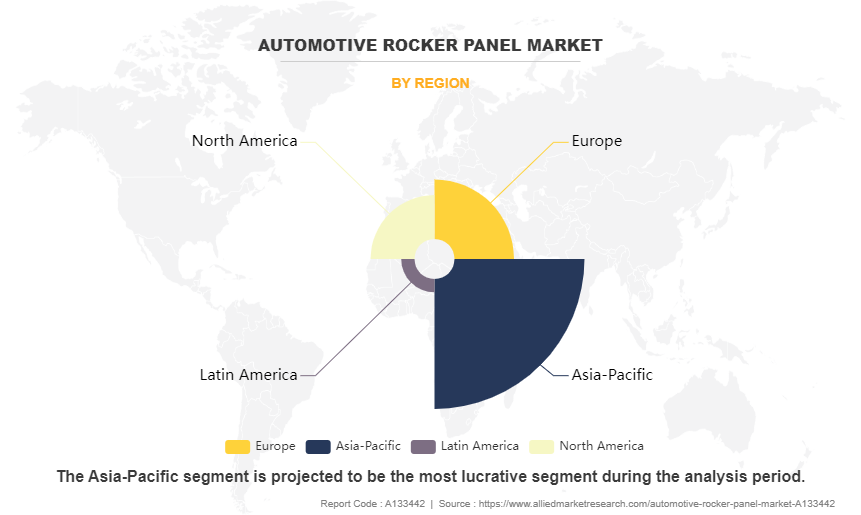

The global automotive rocker panel market is segmented into product type, vehicle type, sales channel, and region. On the basis of product type, the market is categorized into steel, plastic, and rubber. By vehicle type, it is bifurcated into passenger car and commercial vehicle. Depending on sales channel, it is divided into OEM and aftermarket. Region wise, it is studied across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

By Product Type

The steel segment dominated the global automotive rocker panel market share in 2023, owing to high use of steel for automotive component manufacturing. This is attributed to the fact that rocker panels are commonly made from steel, a resilient and durable material capable of enduring the regular wear and tear associated with daily driving. In addition, its robust nature makes it an ideal material to provide essential support for both small and large vehicles. Furthermore, its cost-effectiveness, particularly when compared to other materials with similar characteristics, positions advanced high-strength steel (AHSS) as a preferred option for constructing vehicle rocker panel.

By Vehicle Type

The passenger car segment was the major shareholder in 2023 owing to the surging demand for passenger vehicles due to enhanced lifestyles and economic conditions. With rising purchasing power and disposable income, increased brand visibility, and competition among OEMs to provide enhanced features, rocker panels are finding applications in passenger cars.

By Sales Channel

The OEM segment dominated the automotive rocker panel market share in 2023, OEMs attract customers by providing selection of components. Moreover, OEMs maintain their customer base by offering quality assurance, competitive pricing, comprehensive warranty coverage, patented part designs, and excellent after-sales.

By Region

Asia-Pacific garnered the major share of the automotive rocker panel market in 2023 and is expected to maintain its dominance during the forecast period. This is attributed to continuous advancements in automotive component manufacturing technologies, such as improved production processes and sales of vehicles, which result in cost reduction and increased availability of these components. These advancements make rocker panels more accessible and attractive to the automotive industry.

Market Dynamics

Rising Fleet of Electric and Hybrid Vehicles

Surge in trend of vehicle electrification, rise in penetration of hybrid vehicles, availability of smart mobility services, elevated fuel prices, and inclination toward non-fossil fuel-based vehicles contribute to the expansion of the electric vehicle market. Rocker panels play a pivotal role in absorbing a portion of the impact during a collision, assisting in preventing the car's body from damaging as a result of the impact.

Furthermore, rise in emphasis from cities and governments on sustainable transportation solutions has driven the demand for electric and hybrid vehicles, thereby driving the market for rocker panels. This aims to mitigate carbon emissions and enhance air quality in a concerted effort to address environmental concerns. For instance, according to the International Energy Agency (IEA), global electric car sales exceeded 10 million units in 2022, indicating a 35% increase in 2023, reaching a total of 14 million units. This remarkable surge in sales signifies a substantial rise in electric cars' market share of 4%. These factors are projected to lead to surge in sales of automotive rocker panels in electric vehicles.

Rising Focus on Enhancing Vehicle Aesthetics

Rising focus on vehicle aesthetics has led to the use of various styling options and technological advancements in the rocker panel manufacturing process. In addition, increase has been witnessed in the demand for features related to comfort, luxury, safety, and security benefits in the automotive industry. These include elements such as steering-mounted controls, heads-up displays, advanced infotainment systems, gesture control systems, telematics, and central controllers. These vehicles are manufactured by advanced components, which include rocker panels, as lack of rocker panels impacts the structural integrity of the car, allowing the forces of an accident to severely impact other body parts.

Fluctuations in the Prices of Raw Materials

Rubber, polymers, and metals are among the elements that make up rocker panels. These materials are acquired from a variety of suppliers across the globe. Cost changes are common owing to the supply chain disruptions.

Rocker panels are directly impacted by increase in the price of raw materials. Maintaining profitability is a common struggle for manufacturers, particularly when they are bound by contract or the demands of the market to keep costs from being passed on to consumers. Therefore, when cost of raw materials is high, the profit margins of rocker panels producers decrease. Rocker panel producers frequently look for long-term supplier relationships and use strategic sourcing techniques to reduce the impact of changes in raw material prices to solve these price fluctuations, which hamper the market growth. Moreover, creating cutting-edge pump technologies, particularly for electric and hybrid vehicles, needs significant engineering expertise. All these factors notably contribute toward the overall expenses of development.

Demand for Lightweight Material in Vehicle Production

Enhancing the fuel efficiency of automobiles along with maintaining safety and performance relies significantly on advanced materials. The potential for increased vehicle efficiency lies in the use of lightweight materials, as it requires less energy to accelerate a lighter object compared to a heavier one. A 10% decrease in vehicle weight has the potential to yield a 6–8% improvement in fuel economy. Rocker panels manufactured from carbon fibers are lighter compared to steel and aluminum due to which it is replacing the same for vehicle part production.

The market is experiencing growth driven by a rising need for vehicle stability on roads and a focus on enhancing the durability and performance of vehicles to ensure efficient fuel consumption across the regions. In addition, stringent pollution regulations in North America and Europe have compelled manufacturers to incorporate lightweight materials in the production process, thereby bolstering the demand for automotive rocker panels.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive rocker panel market analysis from 2023 to 2033 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Automotive Rocker Panel Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 86.4 billion |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2023 - 2033 |

| Report Pages | 305 |

| By Product Type |

|

| By Vehicle Type |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Rugged Ridge, Will-Mor Manufacturing, Inc., Auto Metal Direct (AMD), Smittybilt Inc., Classic 2 Current Fabrication, QMI, Nor/Am Auto Body Parts, B&I Trim Products, Inc., ICI - Innovative Creations Industries, Putco |

The industry size of automotive rocker panel in 2023 is $54,341.2 Mn.

The market size of automotive rocker panel market in 2033 will be $ 86,444.32 Mn.

C2C Fabrication, Putco, Smittybilt, Innovative Creations, Rugged Ridge, B&I, QMI Sharp, Willmore Manufacturing, Nor/Am Auto Body Parts, and Auto Metal Direct

Increased adoption of lightweight materials, integration of advanced safety features, and customization & personalization are the upcoming trends of automotive rocker panel market in the world.

Asia-Pacific is the largest regional market for automotive rocker panel market.

Loading Table Of Content...

Loading Research Methodology...