Automotive Seat Heater Market Research, 2033

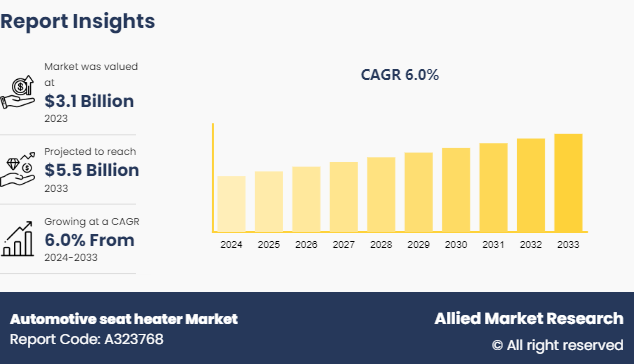

The global automotive seat heater market size was valued at $3.1 billion in 2023, and is projected to reach $5.5 billion by 2033, growing at a CAGR of 6% from 2024 to 2033.

Market Introduction and Definition

An automotive seat heater is a pad or cushion with an electric heating system that increases the surface temperature of the vehicle seat. An automotive seat heater is an electronic device that belongs to the category of automotive interior comfort goods. The temperature can be adjusted by the driver. The vehicle seat heater is located beneath the driver's seat. It provides cushioning and warmth, resulting in a more pleasant and enjoyable driving experience for the driver. Automotive seat heaters also have health benefits. It is prescribed by doctors for drivers who suffer from back problems.

Manufacturers attempt to provide a more pleasant and upmarket driving experience. There is a significant demand for aftermarket seat heaters. Consumers are equipping their automobiles with seat heaters, displaying a desire for more comfort in autos. The automobile seat heater market is always evolving as technology advances. This includes enhancements to heating elements, control systems, and energy efficiency.

Smart and programmable seat heaters are also becoming popular in the market. Automakers are focusing on producing energy-efficient seat heaters, both to address environmental concerns and to give a cost-effective solution for customers.

Key Takeaways

The automotive seat heater market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2032.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major automotive seat heater industry participants along with authentic industry journals, trade associations releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Developments

In July 2022, II-VI Incorporated acquired Coherent, establishing itself as a global leader in materials, networking, and laser technology.

In December 2022, BYD, an EV manufacturer, launched the BYD 2023 Dolphin 2022. The EV series has conveniences such as a six-way electronically adjustable driver seat and front seat heating, all while maintaining a nautical design.

In January 2023, ZF Friedrichshafen AG introduced heated automobile seat belts, which are expected to improve energy efficiency in EVs during cold weather.

?????Key Market Dynamics

The need for automobile seat heaters has constantly increased, with several manufacturers installing these devices into their vehicles. One of the key causes is rising consumer desire for comfort and luxury features in automobiles. Automotive seat heaters are no longer limited to premium or luxury car categories; they are becoming widespread in mid-range and even entry-level vehicles. Automotive seat heaters give extra comfort, especially in colder locations. The ability to fast warm seats during cold weather increases the entire driving experience and consumer satisfaction.

The automotive seat heater market share is likely to maintain its upward trend in the coming years. The addition of seat heaters to mid-range and economy automobiles is expected to increase the market base. Advancements in smart technology, such as connectivity features and integration with vehicle climate control systems, are likely to boost the popularity of automobile seat heaters.

Value Chain Analysis of Global Automotive Seat Heater Market

The value chain for automotive?seat heaters includes numerous essential steps, beginning with raw material acquisition and ending with final installation in vehicles. The process begins with the procurement of raw materials such as heating elements (often carbon fibre or wire) , electronic components, and insulating materials. These materials are then distributed to firms specialising in seat heating systems.

During this step, design and engineering teams collaborate to create seat heaters that meet specified performance and safety requirements. The manufacturing process includes assembling heating elements, integrating control units, and confirming the systems' durability and dependability. Quality control is critical at this step to guarantee that each component fulfils the necessary specifications.

After production, the seat heaters are sent to automobile OEMs (Original Equipment Manufacturers) and aftermarket suppliers. OEMs build these warmers into the seats during the vehicle assembly process. This stage requires collaboration between seat manufacturers and car assembly lines to ensure a smooth integration. Aftermarket suppliers, on the other hand, sell seat warmer kits directly to consumers or to service centres for installation in existing vehicles. Marketing and sales activities are critical for raising knowledge and demand for seat heaters, emphasising its benefits such as increased comfort and a better driving experience in cold weather. Finally, customer service and support, such as warranties and installation services, are critical in ensuring customer happiness and brand loyalty across the value chain.

Market Segmentation

The automotive seat heaters market is segmented into type, vehicle type, sales channel and region. On the basis of type, the market is divided into carbon heater and composite heater. On the basis of vehicle type, the market is segregated into passenger cars and vehicle type. On the basis of sale channel, the market is bifurcated into OEM and aftermarket. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The Asian-Pacific automotive seat heater market growth is primarily driven by the small and economy car segment, which sees higher adoption of interior components. Prominent automakers in this region, including Toyota, Honda, and Hyundai, are incorporating advanced seating systems, lighting, electronics, and various safety features across their car models, making these elements essential. The rise of electric vehicles in major economies such as Japan, China, and India further boosts market value.

In April 2022, Chinese passenger car production reached 996, 000 units, with sales hitting 965, 000 units. This represents a significant decline of 41.9% in production and 43.4% in sales compared to the previous year. From January to April 2022, passenger car production in China saw a year-on-year decrease of 2.6%, totaling 6.494 million units.

In China, local companies are collaborating to produce top-tier interior products. For example, BAIC Yunxiang Automobile Co. Ltd partnered with ADAYO to develop vehicle infotainment systems. This collaboration aims to create new platforms for BAIC Yinxiang and helps restructure the production model for intelligent vehicle manufacturing.

Competitive Landscape

The major players operating in the automotive seat heater market analysis include Continental AG, Panasonic Corporation, Gentherm Incorporated, II-VI Incorporated, Roadwire LLC, Rostra Precision Controls Inc., Firsten Automotive Electronics Co., Ltd., Guangzhou Tachibana Electronic Co., Ltd., SINOMAS, Champion Auto Systems.

Industry Trends

In 2020, low back pain (LBP) afflicted 619 million people globally in 2020, with this number expected to rise to 843 million by 2050.

High-end premium car manufacturers including BMW, Mercedes-Benz, and Audi have used HUDs and smart seating systems. In 2022, China was BMW's largest sales market. China accounted for around 33.1% of Rolls-Royce, BMW, and MINI sales. The growing desire for luxury vehicles has led to an increase in demand for car interior components.

In November 2021, China's leading automotive supplier for interior components, Yanfeng Automotive Interiors (YFAI) , introduced an industry-first camera under panel onboard intelligent screen, which is co-developed with TCL and its subsidiary TCL CSOT.

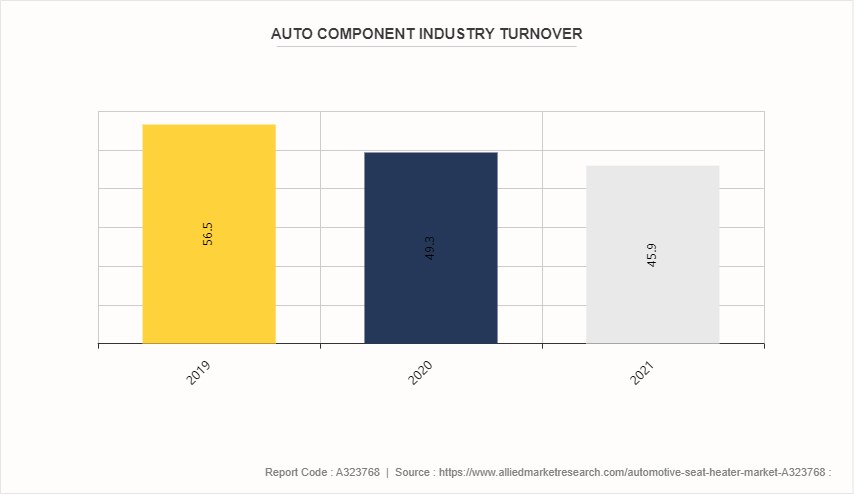

The auto component industry exported USD 19 billion and imported USD 18.3 billion worth of components in 2021-22, resulting in the highest export surplus of USD 700 million.

Key Sources Referred

World Health Organization

National Ocean Industries Association

Occupational Safety and Health Administration

ANSI Organisation

U.S. Department of Transportation

National Aeronautics and Space Administration

International Transport Forum

Maryland Department of Natural Reseources

Key Benefits For Stakeholders

This report provides a quantitative analysis of the automotive heat seater market segments, current trends, estimations, and dynamics of the automotive heat seater market analysis from 2022 to 2032 to identify the prevailing automotive seat heater market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the automotive seat heater market size segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global automotive seat heater industry.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the automotive seat heater market forecast market players.

The report includes the analysis of the regional as well as global automotive seat heater market trends, key players, market segments, application areas, and market growth strategies.

Automotive seat heater Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 5.5 Billion |

| Growth Rate | CAGR of 6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 324 |

| By Type |

|

| By Vehicle Type |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Gentherm Incorporated, Rostra Precision Controls Inc., Champion Auto Systems, II-VI Incorporated, Guangzhou Tachibana Electronic Co., Ltd., SINOMAS, Continental AG, Panasonic Corporation, Firsten Automotive Electronics Co., Ltd., Roadwire LLC |

Europe is the largest regional market for automotive seat heater.

The upcoming trends of Automotive seat heater market include growing level of competition in the automotive industry and improving consumer affordability

Continental AG, Panasonic Corporation, Gentherm Incorporated, II-VI Incorporated, and Roadwire LLC are the top companies to hold the market share in Automotive seat heater.

Passenger cars is the leading vehicle type automotive seat heater market

The global automotive seat heater market was valued at $3.1 billion in 2023.

Loading Table Of Content...