Automotive Shielding Market Size & Insights: 2032

The global automotive shielding market was valued at $21.9 billion in 2022, and is projected to reach $34.5 billion by 2032, growing at a CAGR of 4.7% from 2023 to 2032.

Introduction

Automotive shielding refers to the use of protective materials and technologies to safeguard a vehicle's electrical and electronic systems from electromagnetic interference (EMI), radio frequency interference (RFI), heat, and sound. With the rising integration of advanced electronics and wireless communication systems in modern vehicles, shielding has become a crucial component in automotive design and engineering. These shielding solutions are vital to ensure the optimal performance of critical systems, including infotainment, engine control units (ECUs), radar, navigation, and safety features like advanced driver-assistance systems (ADAS).

Modern vehicles are evolving into connected ecosystems with features like Vehicle-to-Everything (V2X) communication, Internet of Things (IoT) integration, and over-the-air (OTA) software updates. These advancements demand high data integrity and seamless electronic interactions, which further emphasizes the importance of effective shielding. Additionally, the push toward autonomous and electric vehicles (EVs) has heightened the need for comprehensive shielding solutions to protect high-voltage components and ensure the functional safety of the entire vehicle system.

Key Takeaways

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The automotive shielding market is consolidated in nature among companies such as Tech-Etch, Inc., Morgan Advanced Materials PLC, 3M, Laird Technologies, Inc., PARKER HANNIFIN CORP, ElringKlinger AG, Henkel AG And Co. KGaA, Schaffner Holding AG, Dana Limited, Marian, Inc., and Tenneco Inc.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), key regulation analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in global automotive shielding market such as product designing & development, undergoing R&D activities, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 2,200 automotive shielding-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global automotive shielding market.

Market Dynamics

The growing adoption of electric vehicles (EVs) is expected to drive the growth of the automotive shielding market. As automakers shift focus from internal combustion engine (ICE) vehicles to electric vehicles (EVs), the architecture and electronic complexity of vehicles have increased substantially. This transformation is driven by stricter emission regulations, government incentives, and growing consumer preference for sustainable mobility solutions. One of the key technical challenges that arise with this transition is the need for effective electromagnetic interference (EMI) shielding. Scheme to Promote Manufacturing of Electric Passenger Cars in India (SPMEPCI), launched in March 2024, aims to boost domestic and international investments in EV manufacturing. The scheme requires a minimum investment of approximately $500 million (₹4,150 crore), with manufacturers expected to achieve 25% domestic value addition (DVA) by the third year and 50% by the fifth year. This initiative is designed to reduce import dependency and position India as a global EV manufacturing hub.

However, the high cost of advanced shielding materials is expected to drive the growth of the automotive shielding market. The high cost of advanced shielding materials poses a significant restraint on the widespread adoption of automotive shielding, particularly in the context of cost-sensitive markets. Materials commonly used for shielding applications such as aluminum, copper, stainless steel, and conductive polymers, offer excellent thermal and electromagnetic protection but come at a premium price. These materials are essential for ensuring the safety and performance of modern vehicle electronics, in electric and hybrid vehicles where electromagnetic interference (EMI) and thermal management are critical concerns.

Moreover, 5G and connected vehicles are expected to provide lucrative opportunities in the automotive shielding market. The advent of 5G technology and vehicle-to-everything (V2X) communication is ushering in a new era of automotive connectivity, fundamentally transforming how vehicles interact with each other, infrastructure, and their environment. These advancements are central to enabling features such as real-time traffic updates, remote diagnostics, autonomous driving, and enhanced infotainment systems. However, the increased reliance on high-frequency data transmission brings with it a heightened vulnerability to electromagnetic interference (EMI), making effective shielding solutions more important than ever. In November 2024, the Federal Communications Commission (FCC) finalized new spectrum rules to advance Cellular Vehicle-to-Everything (C-V2X) communications technology. This decision allocated 30 MHz of the 5.9 GHz band for Intelligent Transportation Systems (ITS) and established technical standards for C-V2X, aiming to enhance road safety and foster innovation in wireless and transportation sectors.

Segments Overview

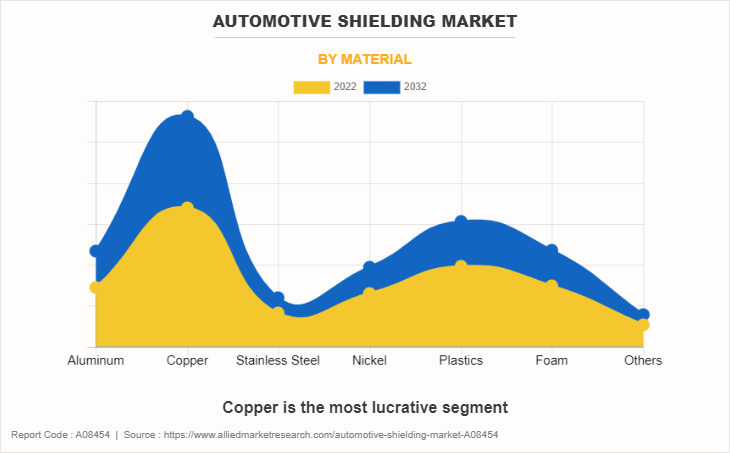

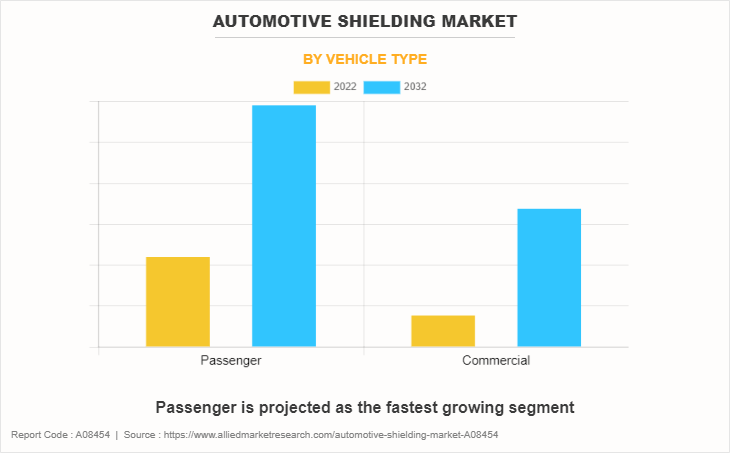

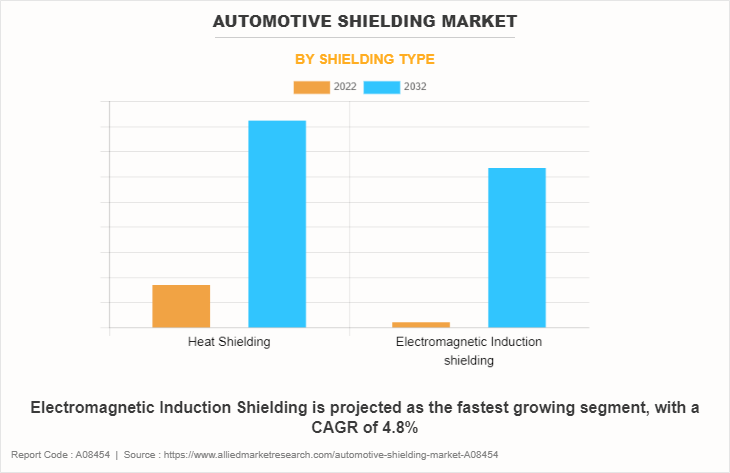

The automotive shielding market is segmented on the basis of material, vehicle type, shielding type, application, and region. On the basis of material, it is fragmented into aluminum, copper, stainless steel, nickel, plastics, foam, and others. By vehicle type, it is segmented into passenger and commercial. By shielding type, the market is classified into heat shielding and electromagnetic induction shielding. By application, it is classified into electromagnetic compatibility (EMC), infotainment systems, advance driver assistance systems (ADAS), electronic control modules, and others. By region, it is classified into North America, Europe, Asia-Pacific, and LAMEA.

On the basis of material, the copper segment dominated the automotive shielding market accounting for more than one-fourth of the market share in 2022. Automotive shielding plays a critical role in ensuring the safety and efficiency of modern vehicles by protecting sensitive electronic components from electromagnetic interference (EMI) and radio frequency interference (RFI). Among the various materials used for this purpose, copper stands out due to its excellent conductivity, corrosion resistance, and formability. With the growing integration of electronic systems in vehicles—ranging from infotainment and advanced driver-assistance systems (ADAS) to electric powertrains, copper’s usage in shielding applications has significantly expanded. Henkel introduced the Bergquist Gap Pad TGP EMI4000 in September 2023, a silicone-free substance that combines high thermal conductivity with EMI shielding capabilities, effective up to 77 GHz frequencies.

On the basis of vehicle type, the passenger segment dominated the automotive shielding market in 2022. Modern cars are equipped with numerous electronic systems such as infotainment units, navigation systems, advanced driver-assistance systems (ADAS), and electric powertrains, all of which generate and are susceptible to electromagnetic interference. EMI can disrupt the functioning of these systems, leading to malfunctions or degraded performance. To combat this, shielding materials often composed of metals like aluminum, copper, or specialized conductive composites are integrated into wiring harnesses, electronic control units (ECUs), sensors, and other critical components. This shielding minimizes signal interference, ensuring reliable communication and operation of the vehicle’s electronic systems. Bharat NCAP launched in August 2023; the Bharat New Car Assessment Program (Bharat NCAP) evaluates the safety performance of cars sold in India. In October 2024, the Tata Nexon became the first car to achieve a 5-star rating under this program, which is gaining popularity for automotive shielding market.

On the basis of shielding type, the heat shielding segment was the largest revenue generator, and is anticipated to grow at a CAGR of 4.6% during the forecast period. Heat shielding is experiencing growth in various industries, including the automotive sector, due to several factors that highlight the increasing importance of managing heat generated by components and systems. The growth of heat shielding solutions is driven by technological advancements, regulatory requirements, efficiency considerations, and the expanding use of high-temperature components. In addition, modern vehicles use electronic components and systems that generate heat during operation. Efficient heat shielding is essential to prevent overheating and maintain the performance and reliability of these electronics. Furthermore, the shift towards electric and hybrid vehicles introduces new thermal challenges. Batteries, electric motors, power electronics, and charging systems require effective heat shielding to manage heat generated during charging, discharging, and operation. These factors may surge the utilization of heat automotive shielding type over modern vehicles; thus, fueling the growth of the automotive shielding market.

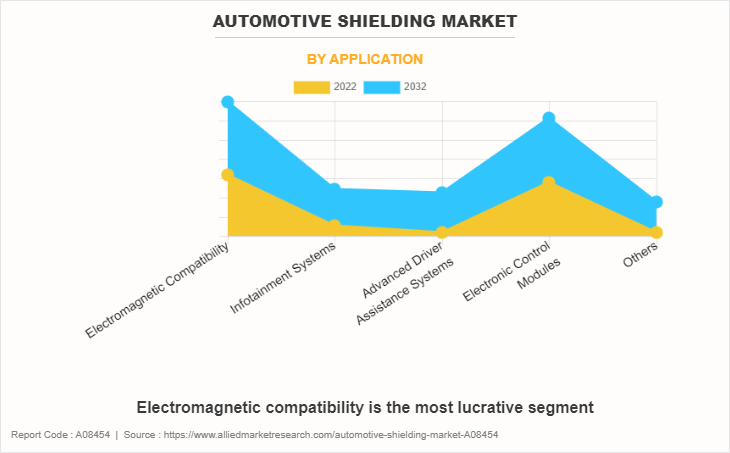

By application, the electromagnetic compatibility (EMC) segment was the largest revenue generator, and is anticipated to grow at a CAGR of 4.9% during the forecast period. Automotive shielding is experiencing growth in electromagnetic compatibility (EMC) due to several factors that highlight the increasing importance of managing electromagnetic interference (EMI) and ensuring proper EMC within vehicles. The growth of automotive shielding for EMC is driven by technological advancements, increasing complexity of vehicle electronics, regulatory requirements, and the expanding use of electronic components. In August 2023, the UK Department for Business and Trade announced the indefinite extension of CE marking recognition for businesses, including those related to EMC. This extension applies to various regulations, ensuring continued market access for compliant products.Furthermore, the incorporation of advanced technologies such as infotainment systems, advanced driver assistance systems (ADAS), connectivity features, and autonomous driving functionalities require precise and reliable operation of electronic systems. Effective shielding is essential to prevent interference and ensure these systems function as intended. These factors surge demand for automotive shielding process for electromagnetic compatibility (EMC) application; thus, fueling the market growth.

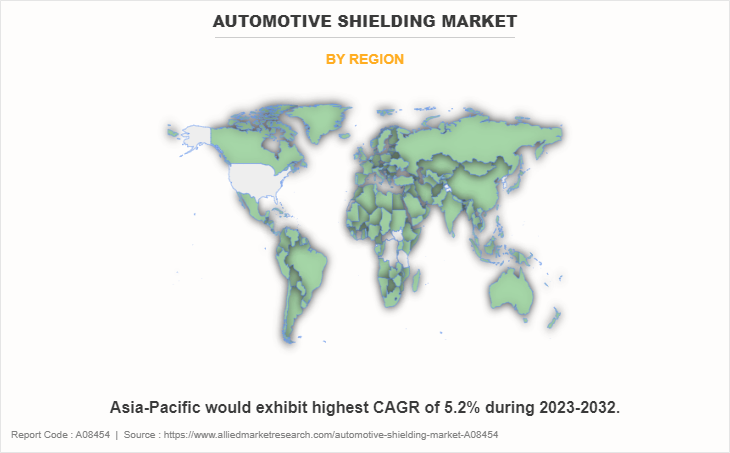

By region, Asia-Pacific was the largest revenue generator and is anticipated to grow at a CAGR of 5.2% during the forecast period. The Asia-Pacific automotive market is one of the fastest-growing globally, with countries like China, Japan, South Korea, India, and Southeast Asian nations leading production and consumption. This surge in vehicle manufacturing correlates strongly with the expanding use of automotive shielding materials. As modern vehicles increasingly rely on sophisticated electronic systems, including infotainment units, advanced driver assistance systems (ADAS), navigation, and electric vehicle (EV) powertrains the need to shield sensitive electronics from EMI and RFI becomes critical to ensure safety, reliability, and compliance with regulatory norms. In May 2024, China's Ministry of Industry and Information Technology urged major automakers, including SAIC Motor, BYD, and FAW Group, to source 20–25% of their automotive chips locally by 2025. This move aims to reduce dependence on foreign suppliers and bolster the domestic semiconductor industry amid escalating tensions with the U.S.

Competitive Analysis

The major companies profiled in this report include Tech-Etch, Inc., Morgan Advanced Materials PLC, 3M, Laird Technologies, Inc., PARKER HANNIFIN CORP, ElringKlinger AG, Henkel AG And Co. KGaA, Schaffner Holding AG, Dana Limited, Marian, Inc., Tenneco Inc.

Recent Key Developments in the Automotive Shielding Market

In March 2023, Tech-Etch partnered with Heilind Electronics, expanding its distribution network for EMI and radio frequency interference (RFI) shielding solutions across North America.

In January 2023, ElringKlinger renamed its "Shielding Technology" business unit to "Metal Forming & Assembly Technology" to reflect its broader focus on stamped and formed metal components for e-mobility, beyond traditional shielding products.

In June 2022, Bourns introduced the AEC-Q200-compliant SRN8040HA Series, a semi-shielded power inductor utilizing advanced magnetic silicon-based coating technology. This innovation provides superior magnetic shielding and operates across a temperature range of -40°C to 150°C, catering to the demands of modern automotive electronic systems.

Import Export Analysis of Automotive Shielding Market

Export Trends

In FY22 (April 2021–March 2022), India’s auto component exports, which include automotive shielding products, grew by approximately 43% year-on-year, reaching $19.0 billion.

North America was the largest export destination, followed by Europe and Asia. The U.S. accounted for 28% of India's auto component exports in 2022, with Germany, Thailand, Bangladesh, and the UK also being major destinations.

Import Trends

Imports of auto components into India increased by about 33% in FY22, reaching $18.3 billion. China remained the largest source of imports (30%), followed by Germany (11%), South Korea (10%), and Japan (9%).

The main imported segments were drive transmission, steering, and engine components, which are significant users of shielding technologies. Imports from Germany grew 48% year-on-year, reflecting increased competitiveness and government incentives in Germany.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive shielding market analysis from 2022 to 2032 to identify the prevailing automotive shielding market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive shielding market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive shielding market trends, key players, market segments, application areas, and automotive shielding market growth strategies.

Automotive Shielding Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 34.5 billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 335 |

| By Material |

|

| By Vehicle Type |

|

| By Shielding Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Morgan Advanced Materials PLC, Tech-Etch, Inc., Henkel AG & Co. KGaA, Tenneco Inc., PARKER HANNIFIN CORP, Dana Limited, Marian, Inc., Laird Technologies, Inc., 3M, Schaffner Holding AG, ElringKlinger AG |

Analyst Review

According to CXOs of leading companies, the automotive shielding market presents both, challenges and opportunities that are crucial for the success and growth of automotive companies. The automotive industry is evolving at an unprecedented pace with advancements in electric vehicles, connectivity, autonomous driving, and more. Ensuring that shielding solutions keep up with these technological changes is a challenge.

In addition, as vehicles become more connected and electronic systems become more intricate, ensuring seamless integration of shielding solutions without hindering performance or adding weight can be complex. Furthermore, meeting stringent electromagnetic emissions and interference regulations requires careful engineering and design of shielding solutions. Non-compliance can lead to regulatory penalties and customer dissatisfaction. Moreover, automotive shielding contributes to safety-critical systems and reliable vehicle operation. Companies that offer innovative and effective shielding solutions can position themselves as leaders in vehicle safety.

From a CXO perspective, the automotive shielding market requires a strategic and forward-looking approach that balances innovation, regulatory compliance, customer satisfaction, and collaboration to stay competitive in an industry undergoing rapid transformation.

Rapid electrification and connectivity, Advanced Driver Assistance Systems (ADAS) and Autonomous Driving, stringent emission regulations, and rise of electric vehicles are the upcoming trends of the automotive shielding market.

Electromagnetic compatibility, infotainment systems, advance driver assistance systems, electronic control modules, and others the leading application of automotive shielding market.

Asia-Pacific is the largest regional market for automotive shielding.

The global automotive shielding market was valued at $21.9 billion in 2022, and is projected to reach $34.5 billion by 2032, growing at a CAGR of 4.7% from 2023 to 2032.

Tech-Etch, Inc., Morgan Advanced Materials PLC, 3M, Laird Technologies, Inc., PARKER HANNIFIN CORP, ElringKlinger AG, Henkel AG And Co. KGaA, Schaffner Holding AG, Dana Limited, Marian, Inc., Tenneco Inc are the top companies to hold the market share in the automotive shielding market.

Loading Table Of Content...

Loading Research Methodology...