Automotive Shredded Residue (ASR) Market Research, 2032

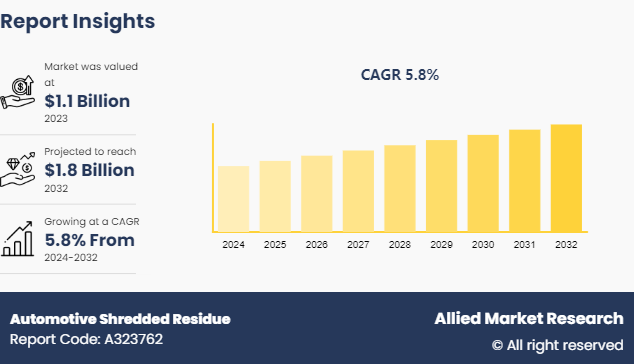

The global automotive shredded residue market size was valued at $1.1 billion in 2023, and is projected to reach $1.8 Billion by 2032, growing at a CAGR of 5.8% from 2024 to 2032.

Market Introduction and Defination

The automotive shredded residue industry refers to the industry and economic activities associated with the processing, recycling, and disposal of residual materials generated from the shredding of end-of-life vehicles (ELVs) . When vehicles are no longer operable or economically feasible to repair, they are dismantled, and their useful parts are removed. The remaining hulks are then shredded into smaller pieces, resulting in ASR, which consists of a mix of ferrous and non-ferrous metals, plastics, glass, rubber, wood, textiles, and other materials.

The primary focus is on recovering valuable materials from ASR. This involves separating ferrous and non-ferrous metals for recycling, which can be reused in various industries. Advanced separation technologies and processes are employed to maximize recovery rates and minimize waste. furthermore, proper disposal of non-recoverable residues is essential. The market includes activities related to the safe and environmentally compliant disposal of hazardous and non-hazardous materials found in ASR.

Key Takeaways

The automotive shredded residue market size study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major automotive shredded residue industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In June 2023, Torma system ASA unveiled its latest innovation Autosport Pulse. This cutting-edge technology machine incorporates dynamic laser induced breakdown spectroscopy (LIBS) and is designed for high throughput sorting of aluminum alloys and opens up possibilities for green aluminum production.

In June 2023, Galloo joint ventured with Stellantis to facilitate the end-of-life vehicles recycling. The service is scheduled for a late 2023 launch and is set to target France, Belgium and Luxembourg expanding its operation in Europe

In October 2022, MBA Polymers Inc. has inaugurated its third facility in the UK, situated in the EMR Duddeston site in central Birmingham. This new site provides an opportunity for UK based manufactures to minimize plastic waste generation during their production process and procure environmentally friendly recycled materials through a closed loop supply chain for postindustrial plastic

Key Market Dynamics

The circular economy initiatives are a significant driver of the automotive shredded residue market share. Growing emphasis on circular economy principles is encouraging the reuse and recycling of materials, driving demand for effective ASR management solutions to recover valuable materials from end-of-life vehicles. Furthermore, technological advancement, and regulatory pressure have driven the demand for the automotive shredded residue (ASR) market. However, high operational cost hampered the growth of the automotive shredded residue market growth. The cost of advanced recycling technologies and the operational expenses associated with processing ASR can be significant, potentially limiting the adoption of these systems by smaller recycling firms. Moreover, complex material composition, and market volatility for recycled material are major factors that hamper the growth of the automotive shredded residue (ASR) market. On the contrary, development of eco-friendly product is a significant and lucrative opportunity for the automotive shredded residue (ASR) market. Advances in material science and recycling processes open up opportunities to create high-quality, eco-friendly products from recycled ASR materials, meeting the increasing demand for sustainable products in various industries.

Vehicle Production and Sales statistics of Global Automotive Shredded Residue (ASR) Market

Higher vehicle production and sales eventually lead to an increased number of ELVs. This drives demand for ASR processing as more vehicles reach the end of their lifecycle. Furthermore, with the rise in the number of ELVs, the need for efficient recycling technologies becomes more critical. This impacts the ASR market positively, as more sophisticated processes and technologies are required to manage and recycle automotive shredder residue effectively.

as vehicle production and sales grow, so do the economic and environmental pressures to manage automotive waste. This includes recovering valuable materials from ASR, which can then be reused in manufacturing, thus supporting circular economy initiatives. Increased production and sales often lead to stricter regulations regarding vehicle disposal and recycling, further driving advancements and investments in the ASR market.

The Global Automotive Shredded Residue (ASR) market is intricately linked to vehicle production and sales statistics, as ASR is a byproduct of the automotive recycling process. ASR comprises non-metallic materials such as plastics, rubber, glass, and textiles that remain after the shredding and recovery of valuable metals from end-of-life vehicles. With the automotive industry experiencing fluctuations in production and sales, the volume of ASR generated similarly fluctuates. Recent trends show an increase in vehicle production and sales, driven by demand in emerging markets and advancements in automotive technology.

This increase correlates with a rise in ASR generation, prompting the industry to focus on improving recycling technologies and regulatory frameworks to manage and mitigate the environmental impact of ASR. The global push towards sustainable practices and circular economy principles is also driving innovations in ASR processing and recovery, aiming to reduce waste and enhance material reuse within the automotive sector.

Market Segmentation

The automotive shredded residue (ASR) market is segmented into application, composition, technology and region. On the basis of application, the market is segmented into landfill, energy recovery, and recycling. As per vehicle composition, the market is segregated into metals, plastics, rubber, textile, and others. On the basis of technology, the market is divided into air classification, optical storing, magnetic separation, eddy current separation, screening, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East Africa.

Regional/Country Market Outlook

North America, robust automotive industry is a significant contributor to automotive shredded residue (ASR) generation, with a large volume of end-of-life vehicles processed annually. Furthermore, stringent environmental regulations in North America have compelled automotive manufacturers and recyclers to invest in advanced shredding and recycling technologies, resulting in higher efficiency and increased ASR recovery rates. In addition, the region's mature recycling infrastructure and established network of shredding facilities facilitate the effective management and processing of ASR. Moreover, growing awareness and adoption of sustainable practices among consumers and businesses in North America have fueled demand for recycled materials, including ASR, driving market growth. therefore, these factors have collectively positioned North America as the leading market for Automotive Shredded Residue, with its proactive approach towards sustainability and innovation setting a precedent for other regions globally.

The Asia-Pacific region has emerged as the fastest-growing market for the global automotive shredded residue (ASR) due to the rapid expansion of the automotive industry in countries like China, India, and South Korea has significantly increased the volume of end-of-life vehicles, consequently boosting ASR generation. Moreover, the region's burgeoning population and rising urbanization have led to increased vehicle ownership and subsequently higher demand for automotive recycling services. In addition, governments across Asia-Pacific are implementing stringent environmental regulations to address pollution and promote sustainable practices, encouraging the adoption of ASR recycling technologies. Furthermore, the growing focus on circular economy principles and resource conservation in the region has spurred investments in ASR processing infrastructure and innovation, driving market growth. Therefore, Asia-Pacific's dynamic automotive landscape, combined with regulatory support and sustainability initiatives, has propelled it to the forefront of the global automotive shredded residue market.

In June 2023, the Wendt Corporation (U.S.) joint ventured with Proman Infrastructure service limited (India) resulting in the establishment of a new company Wendt Proman Metal Recycling Pvt. Ltd. As it identified India and an emerging market for shredding and separation technologies

In July 2022, the Machinex industries, Inc. (Canada) launched a new project with long time partner Rumpke Waste and recycling that includes the delivery of a brand new 56 ton per hour (TPH) residential single stream system in Columbus, Ohio. The new material recovery facility will feature the best storing capabilities and the most automation available. This will also be one of the largest dedicated residential single system in the country.

Competitive Landscape

The report analyzes the profiles of key players operating in the automotive shredded residue (ASR) market such as GFG Alliance, LKQ Corporation, Schnitzer Steel Industries, Inc., Metso Outotec, Sims Limited, Kuusakoski Group, European Metal Recycling, Liberty Steel Group, Toyota Tsusho Corporation, and Galloo Group. These players have adopted various strategies to increase their market penetration and strengthen their position in the automotive shredded residue market opportunity.

Industry Trends

In April 2023, the Eastman has successfully completed a groundbreaking closed-loop recycling project for automotive mixed plastic waste, in collaboration with the U.S. Automotive Materials Partnership LLC (USAMP) , automotive recycler PADNOS, and global automotive interior supplier Yanfeng. This project is the first to demonstrate plastic recycling from the by-product of shredding end-of-life vehicles.

In December 2023, A molecular recycling study has demonstrated a closed-loop solution for automotive plastic waste, showing that it is possible to efficiently recycle plastics from end-of-life vehicles back into high-quality materials that can be reused in the automotive industry.

In January 2022, automotive shredded residue (ASR) was the focus of a big-ticket project in Greece by Belgium-based Ad Rem NV, which is providing advanced heavy media separation technology to a plant in Polykastro, Greece, designed to process over 10 metric tons per hour of mixed plastics and metals from shredded end-of-life vehicles. This state-of-the-art plant, owned by Greece's largest recycling company, Konstantinidis Bros. SA, aims to enhance the efficiency of material separation and recycling.

In October 2022, the Tomra finder offered metals reprocessing with high-throughput sensor-based sorting coupled with high yields. It is capable of effectively recovering high-purity metal fractions, regardless of compositional complexity or grain size. FINDER’s modular design means it is suited to both mixed waste and metal recovery streams, but at Ward’s ASR plant, it is used to sort and recover high-purity target metal fractions from the ASR infeed.

Key Sources Referred

INTERNATIONAL ENERGY OUTLOOK

Environmental and Energy Study Institute (EESI)

U.S. Department of Energy

ITRI Ltd.

International Hydropower Association

International Energy Agency

World Economic Forum

European Association for Storage of Energy

Key Benefits for Stakeholders

This report provides a quantitative analysis of the automotive shredded residue market trends segments, current trends, estimations, and dynamics of the Automotive Shredded Residue (ASR) market analysis from 2022 to 2032 to identify the prevailing Automotive Shredded Residue (ASR) market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the Automotive Shredded Residue (ASR) Market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global automotive shredded residue market forecast Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global Automotive Shredded Residue (ASR) market trends, key players, market segments, application areas, and market growth strategies.

Automotive Shredded Residue (ASR) Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.8 Billion |

| Growth Rate | CAGR of 5.8% |

| Forecast period | 2024 - 2032 |

| Report Pages | 234 |

| By Application |

|

| By Composition |

|

| By Technology |

|

| By Region |

|

| Key Market Players | GFG Alliance, Liberty Steel Group, Schnitzer Steel Industries, Inc., Galloo Group, Metso Outotec, Toyota Tsusho Corporation, LKQ Corporation, European Metal Recycling, Kuusakoski Group, Sims Limited |

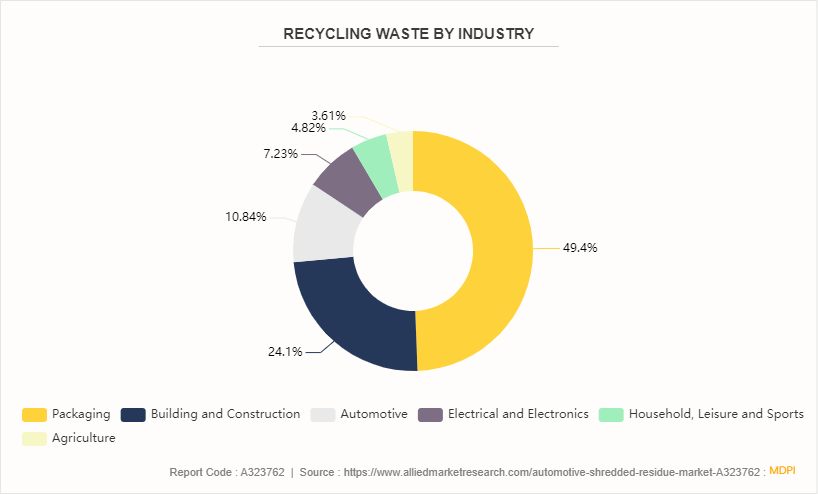

The recycling is the leading application of Automotive Shredded Residue (ASR) Market.

The upcoming trends of Automotive Shredded Residue (ASR) Market include increase in consumer awareness of environmental issues and sustainability concerns is driving demand for recycled materials, including ASR.

Asia-Pacific is the largest regional market for Automotive Shredded Residue (ASR).

GFG Alliance, LKQ Corporation, Schnitzer Steel Industries, Inc., Metso Outotec, Sims Limited are the top companies to hold the market share in Automotive Shredded Residue (ASR).

Loading Table Of Content...