Automotive Smart Camera Market Research, 2032

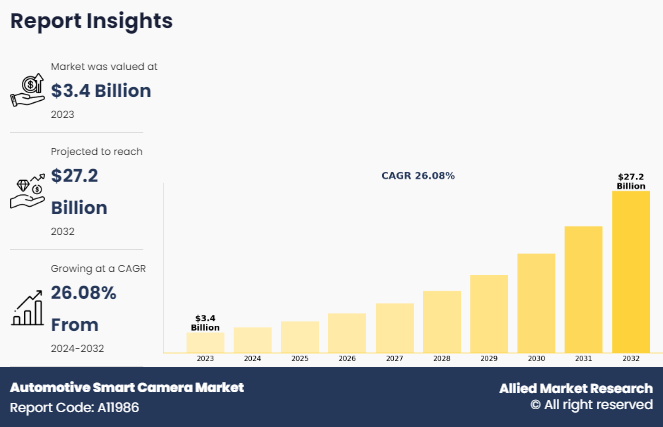

The global Automotive Smart Camera Market was valued at $3.4 billion in 2023, and is projected to reach $27.2 billion by 2032, growing at a CAGR of 26.1% from 2024 to 2032.The global automotive smart camera market is projected to witness substantial growth over the forecast period, driven by increase in safety regulations and growing demands for advanced driver assistance systems (ADAS) in vehicles. As the automotive industry continues to innovate and integrate more automation, the need for enhanced visual monitoring technologies becomes crucial. Innovations in camera sensors, image processing software, and artificial intelligence has helped the development of more sophisticated automotive smart cameras. These devices are essential for features such as collision avoidance, lane departure warnings, and traffic sign recognition, contributing to safer and more efficient driving experiences. Additionally, emerging markets offer significant growth potential as they adopt modern automotive technologies and standards, reflecting a global trend towards greater safety and technological advancement in the automotive sector.

An automotive smart camera is a specialized digital camera system integrated into vehicles to enhance safety, provide driver assistance, and support autonomous driving functions. These cameras are equipped with advanced sensors and use image processing algorithms to interpret visual data in real time. They contribute to various applications such as lane departure warnings, traffic sign recognition, collision avoidance systems, and parking assistance. By processing and analyzing the captured images, smart cameras can detect objects, measure distances, and provide critical data to the vehicle's control systems, enabling smarter and more responsive decision-making in complex driving environments.

Key Takeaways of Automotive Smart Camera Market Report:

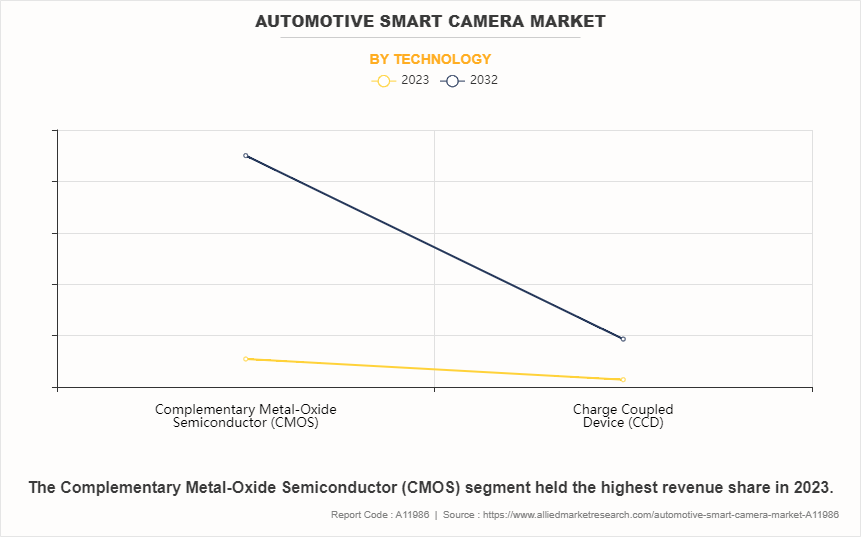

By technology, the Complementary Metal-Oxide Semiconductor (CMOS) segment held the largest share of the automotive smart camera market in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

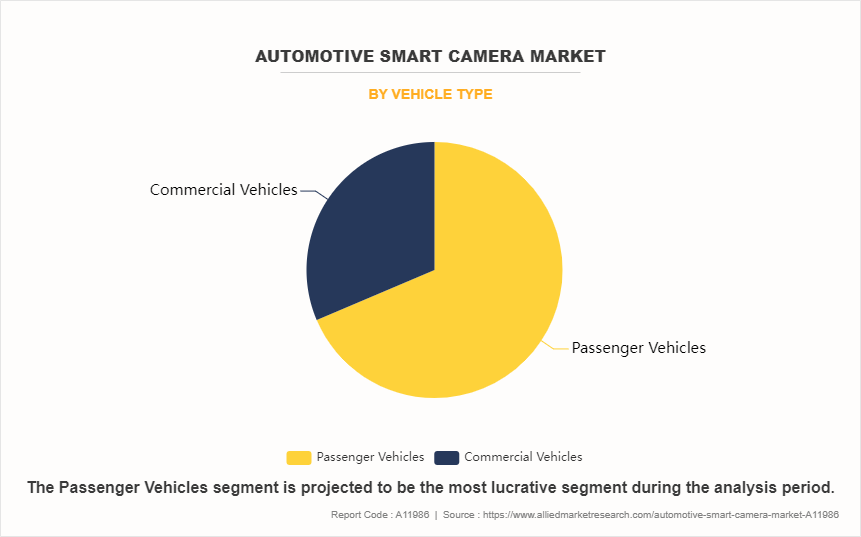

By vehicle type, the passenger vehicles segment held the largest share in the automotive smart camera industry in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

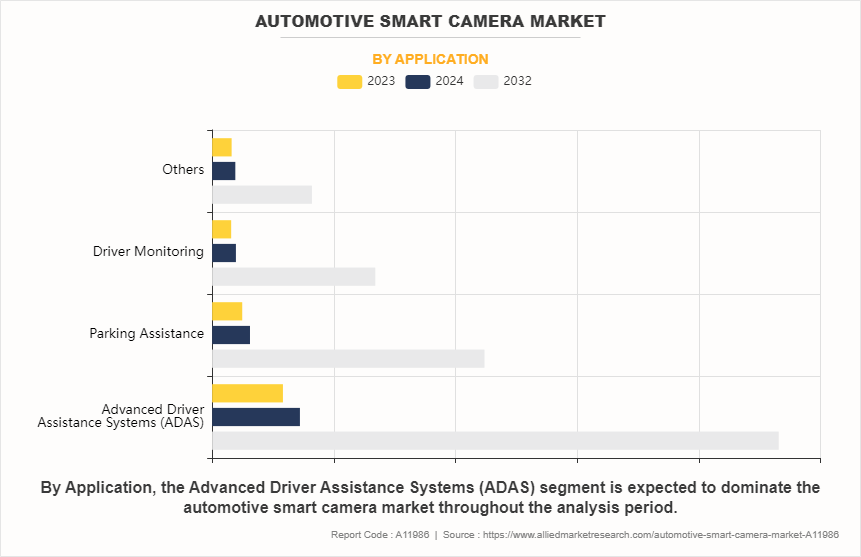

By application, the Advanced Driver Assistance Systems (ADAS) segment held the largest share in the automotive smart camera industry in 2023, however, the parking assistance segment is anticipated to grow at the fastest CAGR during the forecast period.

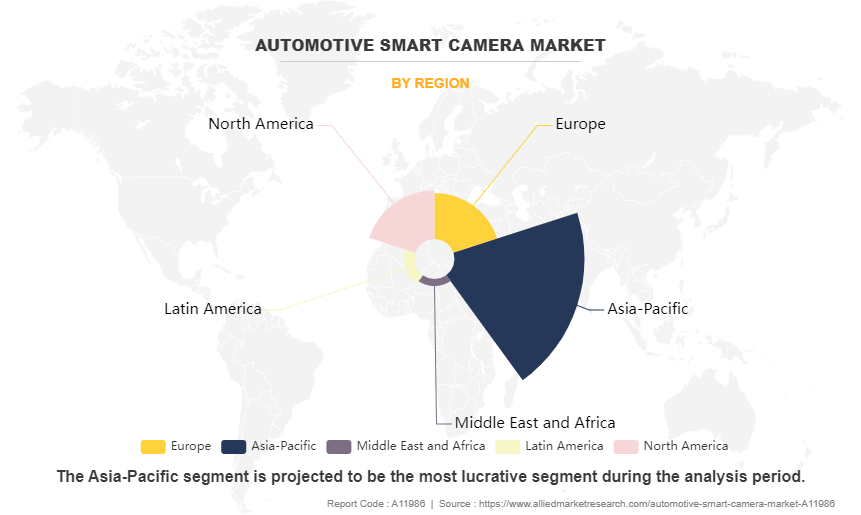

Region-wise, Asia-Pacific held the largest market share in 2023. China dominates the Automotive Smart Camera Market Size by Country. However, Latin America is expected to witness the highest CAGR during the forecast period.

Market Dynamics:

The surge in Advanced Driver-Assistance Systems (ADAS) drives the automotive smart camera market

The demand for Advanced Driver-Assistance Systems (ADAS) is significantly impacting the automotive smart camera market. This surge is driven by consumers' growing expectations for safety and comfort in their vehicles. Smart cameras are vital for ADAS because they provide the visual information needed for safety functions such as preventing collisions, keeping cars in their lanes, and maintaining a safe distance from other vehicles through adaptive cruise control. As car technology improves, integrating smart cameras has become crucial not only for increasing vehicle safety but also for enhancing the driving experience by making cars more autonomous and easier to use.

For example, in 2023, Mobileye N.V., an Intel Corporation subsidiary, launched the Mobileye DRIVE™ autonomous driving system, which relies heavily on advanced smart camera technology. This system uses Mobileye's specialized EyeQ® family of chips and advanced camera sensors to achieve accurate and reliable perception, which is essential for self-driving cars. By incorporating these high-tech smart cameras, Mobileye is responding to the growing consumer demand for strong ADAS features, showing how leading technology companies are using smart camera technology to advance automotive innovation and safety.

High initial cost restraining market growth

The integration of smart cameras into vehicles significantly increases manufacturing costs, which in turn raises the retail price. This added cost can be a major hurdle in the automotive smart camera market, particularly for budget-conscious consumers. While these cameras enhance vehicle safety and add advanced driving assistance features, the higher cost can limit their accessibility and acceptance among buyers who are sensitive to price increases. This could slow down the widespread adoption of such technologies, particularly in cost-sensitive segments of the market.

For instance, in 2022, Ford introduced its Co-Pilot360™ system, which includes advanced smart cameras for ADAS in its new line of vehicles. Although these features offer substantial safety benefits, they also contribute to an increase in the base price of these vehicles. This price rise has been noted as a concern for potential buyers looking for affordable vehicle options, highlighting how the high initial costs associated with integrating advanced technologies such as smart cameras can restrict market growth within certain consumer groups.

Advancement in sensor technology create opportunity in the automotive smart camera market

Advancements in sensor technology represent a significant opportunity for growth in the automotive smart camera market. Developments in high-resolution cameras, LiDAR, and radar have enhanced the capabilities of smart cameras, making them more efficient and versatile. These improvements enable better vehicle perception, more accurate object detection, and enhanced reliability under various environmental conditions. As sensor technologies evolve, they allow smart cameras to support a broader range of applications, from advanced driver-assistance systems (ADAS) to fully autonomous driving, expanding the potential market for these systems.

For instance, in 2023, Panasonic Corporation introduced a new line of automotive smart cameras that incorporate state-of-the-art high-resolution sensors and LiDAR technology. These cameras are designed to provide enhanced object detection and distance measurement capabilities, crucial for reliable autonomous driving functions.

Segment Overview

The global automotive smart camera market is analyzed by technology, vehicle type, application, and region.

By Technology

On the basis of technology, the automotive smart camera market is segmented into Complementary Metal-Oxide Semiconductor (CMOS), and Charge Coupled Device (CCD). In 2022, the Complementary Metal-Oxide Semiconductor (CMOS) segment held the largest automotive smart camera market share due to its lower cost, higher efficiency at lower power consumption, and better integration capabilities with modern manufacturing processes.

By Vehicle Type

On the basis of vehicle type, the automotive smart camera market is segmented into passenger vehicles and commercial vehicles. In 2022, the passenger vehicles segment held the largest automotive smart camera market size due to the rise in adoption of Advanced Driver-Assistance Systems (ADAS) and features like parking cameras.

By Application

On the basis of application, the automotive smart camera industry is segmented into Advanced Driver Assistance Systems (ADAS), parking assistance, driver monitoring, and others. In 2022, the Advanced Driver Assistance Systems (ADAS) segment was the highest revenue generator in the automotive smart camera industry, primarily due to the growing demand for safety features and autonomous driving technologies in vehicles.

By Region

On the basis of region, the automotive smart camera market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Argentina, Chile, rest of Latin America ), and Middle East & Africa (UAE, Saudi Arabia, South Africa, rest of MEA). In 2022, Asia-Pacific held the largest market share in the automotive smart camera industry due to its robust automotive production, growing adoption of ADAS and autonomous vehicles, and emphasis on vehicle safety and regulatory standards.

Top Impacting Factors

The growth of the automotive smart camera market is significantly influenced by a variety of factors. The automotive smart camera growth drivers include technological advancements, which enhance the functionality and integration capabilities of smart cameras and increase in safety regulations that mandate the installation of advanced safety systems in vehicles. However, the market faces a major restraint in the form of high costs associated with advanced camera technologies, which can deter widespread adoption among budget-conscious consumers. Despite this, an opportunity arises from the rapid development of autonomous vehicles, where smart cameras play a crucial role in navigation and understanding the surroundings of the vehicle, potentially opening new markets and applications for these technologies.

The integration of a wireless car camera into modern vehicles enhances safety by providing drivers with a clearer view of their surroundings without the clutter of wires. Similarly, a smart car camera utilizes advanced technology to analyze and interpret road conditions, making driving safer and more efficient. The addition of a 360 camera offers a panoramic view around the vehicle, ensuring no blind spots remain. As the demand for advanced safety features grows, the implementation of a wireless car camera, a smart car camera, and a 360 camera has become essential in new vehicle models. These technologies not only improve vehicle safety but also enhance the overall driving experience by providing comprehensive visibility and intelligent feedback to the driver.

Competitive Analysis

The automotive smart camera industry report highlights the highly competitive nature of the automotive smart camera market, owing to the strong presence of existing vendors. Vendors with extensive technical and financial resources are expected to gain a competitive advantage over their counterparts by effectively addressing automotive smart camera market demands. The competitive environment in this market is expected to increase as product launches and collaborative strategies adopted by automotive smart camera manufacturers intensify. Competitive analysis and profiles of the major automotive smart camera companies that have been provided in the report include Robert Bosch GmbH, Continental AG, Denso Corporation, Valeo SA, Aptiv PLC, Mobileye N.V. (Intel Corporation), Magna International Inc., ZF Friedrichshafen AG, Sony Corporation, and Panasonic Corporation. The report delves into automotive smart camera market insights and evaluates the automotive smart camera market value while highlighting the competitive landscape among automotive smart camera manufacturers.

Key Developments/Strategies

According to the latest automotive smart camera market forecast, Robert Bosch GmbH leads the automotive smart camera market share by company, the leading automotive smart camera companies are adopting strategies such as product launch and collaboration to strengthen their market position in the automotive smart camera market.

In February 2024, Continental AG revealed its new 8MP automotive camera. The satellite camera will help automakers with features like autonomous driving platform, parking assist, 3D surround view, and more.

In February 2024, ZF Aftermarket, division of ZF Friedrichshafen AG expanded its commercial vehicle offerings by introducing OE-quality sensors for driver assistance systems, including automotive smart cameras, under its WABCO brand. Now available to the independent aftermarket, these smart cameras are integral to systems like automatic emergency braking and lane departure warnings. Catering to a range of trucks, including DAF and Iveco models.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive smart camera market analysis from 2023 to 2032 to identify the prevailing automotive smart camera market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive smart camera market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive smart camera market trends, key players, market segments, application areas, and market growth strategies.

Automotive Smart Camera Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 27.2 billion |

| Growth Rate | CAGR of 26.1% |

| Forecast period | 2023 - 2032 |

| Report Pages | 300 |

| By Technology |

|

| By Vehicle Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Valeo SA, Robert Bosch GmbH, ZF Friedrichshafen AG, Aptiv PLC, Magna International Inc., Sony Corporation, DENSO CORPORATION, Panasonic Corporation, Mobileye N.V.(Intel Corporation), Continental AG |

The industry size of Automotive Smart Camera is estimated to be $3.4 billion in 2023.

Asia-Pacific is the largest regional market for Automotive Smart Camera.

The leading application of the Automotive Smart Camera Market is Advanced Driver Assistance Systems (ADAS).

The Automotive Smart Camera Market is expected to grow at a CAGR of 26.08% during the period of 2023 to 2032.

The top companies to hold the market share in Automotive Smart Camera include Robert Bosch GmbH, Continental AG, Denso Corporation, Valeo SA, Aptiv PLC, Mobileye N.V. (Intel Corporation), Magna International Inc., ZF Friedrichshafen AG, Sony Corporation, and Panasonic Corporation.

Loading Table Of Content...

Loading Research Methodology...