Automotive Smart Window Market Research, 2032

The global automotive smart window market was valued at $1.7 billion in 2022, and is projected to reach $12.3 billion by 2032, growing at a CAGR of 22.5% from 2023 to 2032.

Automotive smart windows are glass-based products in which light transmission properties vary when voltage, heat or light is applied. In an automotive smart window, glass normally transforms from translucent to transparent by blocking numerous wavelengths of light. It also blocks 99.0% of ultraviolet light by reducing fabric fading.

Growth of the global automotive smart window market is anticipated to be driven by factors such as surge in demand for smart window from the transportation sector. These windows play a crucial role in reducing costs for heating, air conditioning, and lighting, which drive the market growth. In addition, smart windows help in blocking ultraviolet light, which boosts product demand and contributes toward the overall market growth. However, high cost of smart windows acts as a major restraint for the global automotive smart window industry. On the contrary, surge in demand for solar energy solutions provided by smart windows is expected to create lucrative opportunities for the automotive smart window market.

Segment Review

The automotive smart window market is segmented into Technology, Type and Vehicle Type.

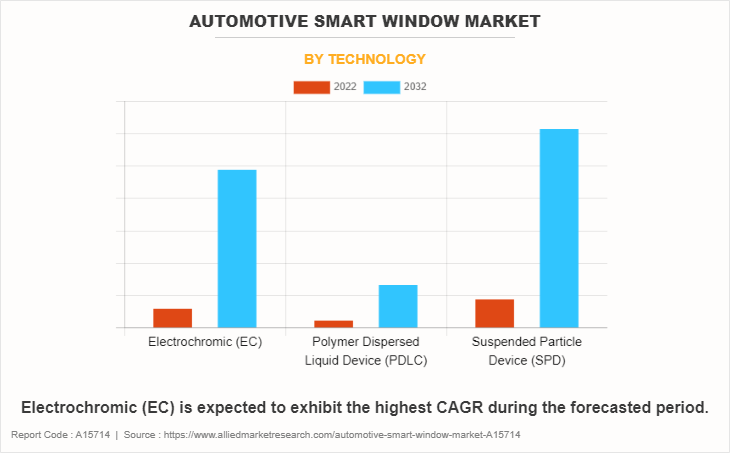

By technology, the market is classified into electrochromic, polymer dispersed liquid device, and suspended particle device.

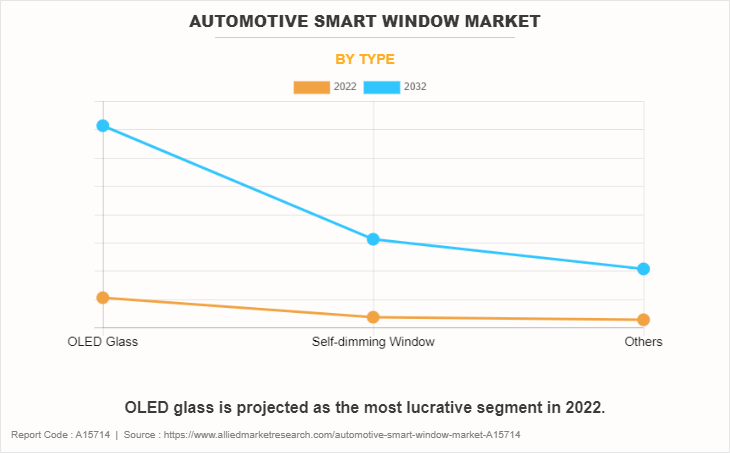

On the basis of type, the market is divided into OLED glass, self-dimming window, and others.

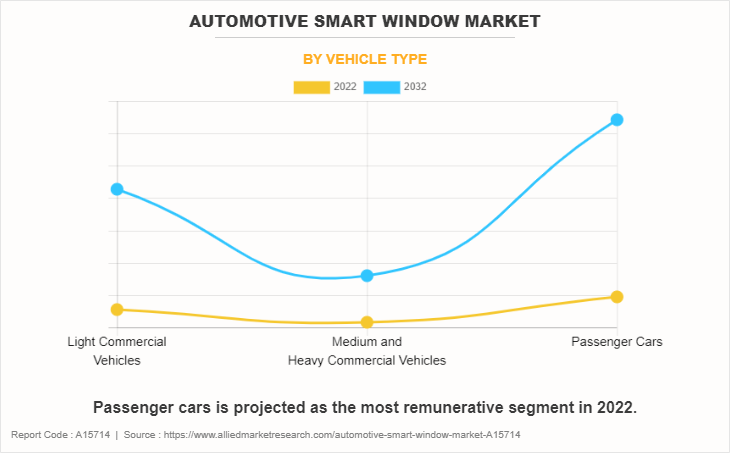

Depending on vehicle type, it is categorized into light commercial vehicles, medium & heavy commercial vehicles, and passenger cars.

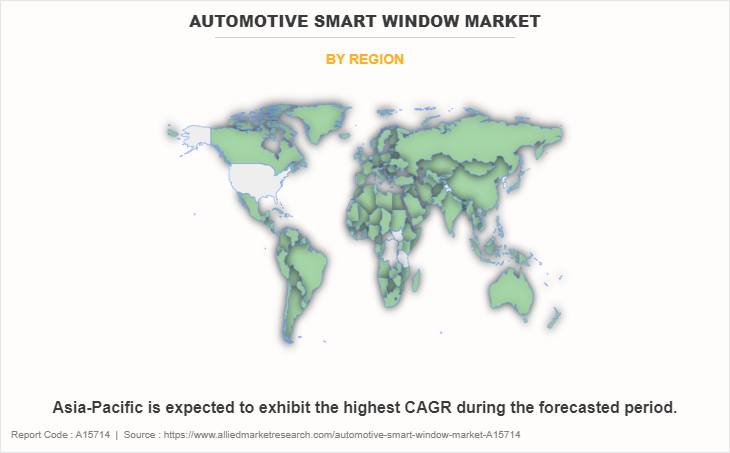

Region wise, the automotive smart window market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). North America dominated the Automotive Smart Window Market share in 2022 and is projected to register significant growth rate during the forecast period owing to growth of the commercial sector. However, Asia-Pacific is expected to witness significant growth by the end of the forecast period, followed by LAMEA.

Automotive smart windows' defensive features are essential for preserving the interiors of cars. These windows help lessen the negative impacts of UV radiation, such fabric fading, by filtering out a significant amount of UV light. This UV-blocking technology improves the overall driving experience for passengers as well as the durability of interior components. The worldwide automotive smart window market has significant challenges due to the high cost of smart windows, despite their many benefits. Widespread adoption of this cutting-edge technology has been hampered by the initial investment needed to install it. Experts in the field predict that the cost barrier will eventually go down as economies of scale and technical developments take hold.

The automotive smart window industry has witnessed a transformative evolution with the integration of cutting-edge technologies like AR car smart glass in smart car windshields and auto glass. These innovations redefine the driving experience by providing dynamic adjustments to light transmission, offering passengers enhanced control over privacy and comfort. Auto windscreens, equipped with AR smart auto glass, exemplify the industry's commitment to safety and technology convergence. The integration of AR smart glass in auto glass not only ensures a seamless transition from translucent to transparent states but also contributes to energy efficiency and UV protection. As the automotive sector continues to prioritize advancements in smart technologies, the smart car windshield and auto windscreens equipped with AR car smart glass are poised to play a pivotal role in shaping the future of automotive design and driving dynamics.

The automotive smart window market demand has expanded due to the increase in demand for environmentally friendly solutions. Smart windows' incorporation of solar energy solutions is in line with the worldwide movement towards environmentally and energy-efficiently designed technology. automobile smart windows are positioned as a major participant in the larger landscape of environmentally aware automobile advances as a result of the increased demand for sustainable solutions. The market for vehicle smart windows is expected to increase significantly since the transportation industry is becoming more and more interested in cutting-edge, energy-efficient solutions. The industry has the ability to address environmental issues and provide better driving experiences, which places it as a major participant in the future of automotive design and technology, even though cost is still a hurdle.

Competitive Analysis

The key players profiled in the report include AGC Inc., Gentex Corporation, Corning Incorporated, Saint Gobain, Pleotint LLC, PPG Industries, Hitachi Ltd., RavenWindow, View, Inc. and Research Frontiers Inc. Market players have adopted various strategies such as product launch, collaboration, partnership, agreement, expansion, and acquisition to expand their foothold in the Automotive Smart Window industry.

Top Impacting Factors

The automotive smart window market is expected to witness notable growth owing to surge in demand for electric and hybrid vehicles and high demand from passenger car segment.

Moreover, lower prices of advanced materials and high demand from Asia-Pacific are expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, high product cost and capital investment for r and d limit the growth of the automotive smart window market.

Historical Data & Information

The global Automotive Smart Window market is highly competitive, owing to the strong presence of existing vendors. Vendors in the Automotive Smart Window market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

Top market players have adopted various strategies, such as product development, acquisition, innovation, partnership, and others to expand their foothold in the Automotive Smart Window market.

- In June 2022, to offer Corning Incorporated with boron specialized materials, 5E Advanced Materials, Inc., a globally recognized leader in advanced materials and boron, signed a letter of intent with the latter. Under the terms of the agreement, Corning and 5E will work together to create sophisticated materials containing boron, which will be utilized in the production of Corning's goods.

- In May 2022, AGC, Inc. created a light-controlled panoramic roof with low e-coating. Furthermore, Toyota Motor Corporation has chosen to use the product for its BEV prototype, LEXUS RZ, which is scheduled to be unveiled in the second half of 2022.

- In September 2021, Cetelon Lackfabrik GmbH, a significant coating manufacturer for light truck wheels and automotive applications, was bought by PPG. According to reports, PPG expects the acquisition to help strengthen its current coatings offering.

- In May 2021, Saint Gobain offered its SageGlass Harmony electrochromic glass, to Bagmane Group in India. This glass will be used for the Rio Business Park, a 148,600 square meter office development in Bangalore, India.

- In January 2021, Gentex announced that it is partnering with Simplenight to provide drivers and vehicle occupants with access to enhanced mobile capability for booking personalized entertainment and lifestyle experiences in addition to everyday purchases. Gentex plans to integrate Simplenight into its current and future connected vehicle technologies, including HomeLink, the automotive industry's leading car-to-home automation system.

Key Benefits For Stakeholders

- This automotive smart window market forecast report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive smart window market analysis from 2022 to 2032 to identify the prevailing automotive smart window market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive smart window market segmentation assists to determine the prevailing automotive smart window market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global automotive smart window market size.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive smart window market trends, key players, market segments, application areas, and automotive smart window market growth strategies.

Automotive Smart Window Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 12.3 billion |

| Growth Rate | CAGR of 22.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 251 |

| By Technology |

|

| By Type |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | View, Inc., PLEOTINT LLC, saint gobain, Hitachi, Ltd, Gentex Corporation, Corning Incorporated, RavenWindow, Research Frontiers Inc., PPG Industries, AGC Inc. |

Analyst Review

According to insights of CXOs of leading companies, the global automotive smart window market is flourishing at a rapid pace. However, high initial investment is still a concern for new entrants. Market players are generously investing in R&D activities to develop improved solutions to reduce overall costs of automotive smart window products. In addition, according to industry experts, it is essential to optimize affordable prices for automotive smart window products for long-term growth.

Growth of the global automotive smart window market is anticipated to be driven by factors such as surge in demand for smart window from transportation sector. Also, smart window plays a crucial role in reducing costs for heating, air conditioning, and lighting which drive its market. In addition, smart windows help in blocking ultraviolet light, which boosts the product demand and contributes to the overall market growth. However, high cost of smart windows acts as a major restraint for the global automotive smart window market industry. On the contrary, surge in demand for solar energy solution provided by smart window is expected to create lucrative opportunities for the automotive smart window market.?

Key players of the market focus on introducing technologically advanced products to remain competitive in the market. Partnership, acquisition, and product launches are expected to be the prominent strategies adopted by the market players. North America accounted for a major share of the market in 2022, owing to the presence of major players in the region; However, Asia-Pacific is expected to grow at the highest CAGR, owing to rise in adoption of automotive smart window market in a variety of fields.

The Automotive Smart Window Market was valued at $1,658.8 million in 2022 and is estimated to reach $12,303.4 million by 2032.

North America dominated the Automotive Smart Window Market in 2022 and is projected to register significant growth rate during the forecast period.

The automotive smart window market is exhibiting a CAGR of 22.50% from 2023 to 2032.

Leading automotive smart window market manufacturers such as AGC Inc., Gentex Corporation, Corning Incorporated, Saint Gobain, Pleotint LLC, PPG Industries, Hitachi Ltd., RavenWindow, View, Inc. and Research Frontiers Inc.

Lower prices of advanced materials and high demand from Asia-Pacific are expected to provide lucrative opportunities for the growth of the automotive smart window market during the forecast period.

Loading Table Of Content...

Loading Research Methodology...