Automotive Speed Encoder Market Research, 2033

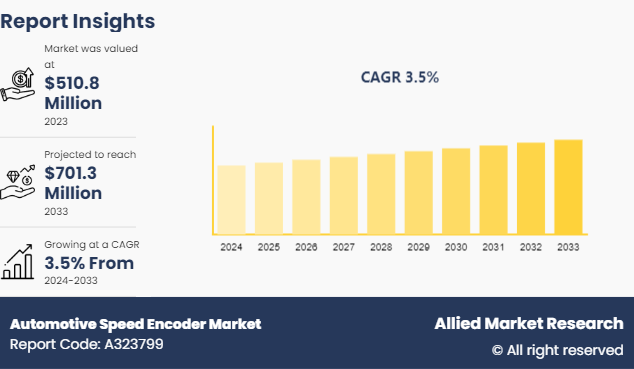

The global automotive speed encoder market was valued at $510.8 million in 2023, and is projected to reach $701.3 Million by 2033, growing at a CAGR of 3.5% from 2024 to 2033.

Market Introduction and Definition

The automotive speed encoder market refers to the industry segment involved in the production, distribution, and sales of speed encoders specifically designed for automotive applications. Speed encoders are sensors or devices used to measure the rotational speed of various automotive components such as wheels, camshafts, crankshafts, or transmission shafts. These measurements are crucial for various vehicle systems, including engine management, transmission control, traction control, and anti-lock braking systems (ABS) . The automotive speed encoder market forecast encompasses the development of sensor technologies, encoder systems, and related components tailored to meet the demands of modern automotive applications for accurate speed sensing and control.

An automotive speed encoder, also known as a vehicle speed sensor (VSS) , is a device used to measure the speed of a vehicle's wheels or drivetrain components. It provides crucial data to the vehicle's electronic control systems, such as the engine control unit (ECU) and the transmission control module (TCM) . This information is used for various functions including speedometer readings, cruise control operation, anti-lock braking systems (ABS) , and traction control systems (TCS) .

Key Takeaways

The automotive speed encoders market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major Automotive speed encoder industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In December 2021, C&K, a leading manufacturer of high-quality electromechanical switches, launched a new 24-position optical encoder switch with an integrated pushbutton.

June 2023, British Encoder announced the launch of its newest catalog that showcases a collection of encoders tailored for various industries, starting from manufacturing and robotics to aerospace and medical devices. These encoders are purpose-built to excel in specific applications and ensure that each encoder seamlessly integrates into the unique environments and challenges of different industries.

Key Market Dynamics

The vehicle safety regulation is a significant driver of the automotive speed encoder market. Stringent regulations mandating the integration of safety features such as ABS (Anti-lock Braking Systems) and ESC (Electronic Stability Control) in vehicles are driving the demand for accurate speed sensing technologies. Speed encoders play a crucial role in enabling these safety systems to function effectively, thereby boosting market growth. Furthermore, rise in automotive production, and rise in electric vehicle adoption have driven the demand for the automotive speed encoder market size.

However, high cost of advanced speed encoders has hampered the growth of the automotive speed encoder market share. Advanced speed encoder technologies, such as magnetic encoders and optical encoders, can be costly to implement, particularly for manufacturers operating in price-sensitive markets. The high cost of these technologies can act as a restraint on market growth, especially in regions with budget constraints. Moreover, compatibility issues with legacy systems and mechanical failure in harsh conditions are major factors that hamper the growth of the automotive speed encoder market size. On the contrary, the increasing integration of ADAS features such as adaptive cruise control, lane departure warning, and collision avoidance systems creates opportunities for automotive speed encoder market growth. These systems rely on accurate speed sensing for their operation, driving the demand for advanced speed encoder solutions.

Vehicle Safety and Security System Adoption of Global Automotive Speed Encoder Market

Vehicle safety systems, such as anti-lock braking systems (ABS) , erlectronic stability control (ESC) , and traction control systems (TCS) , rely on accurate speed sensing provided by speed encoders. By integrating advanced speed encoder technologies, these safety systems can better detect vehicle speed and respond effectively to hazardous driving conditions, thereby improving overall vehicle safety. automotive speed encoder industry can also play a role in vehicle security systems by providing real-time speed data for theft detection and prevention. Integrated with vehicle immobilizers and alarm systems, speed encoders can help track vehicle movement and detect unauthorized access or tampering, enhancing vehicle security and reducing the risk of theft.

Advanced safety systems such as collision avoidance systems (CAS) use speed and distance sensing to detect potential collisions and alert drivers or initiate autonomous braking to mitigate the risk of accidents. Speed encoders provide crucial speed data for these systems to accurately assess the proximity of other vehicles or obstacles and take preventive action when necessary. Moreover, with the rise of connected vehicle technologies, speed encoders can be integrated with vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication systems to enhance safety and security. By sharing real-time speed and location data with other vehicles and roadside infrastructure, vehicles equipped with speed encoders can receive advanced warnings about potential hazards, improving overall safety on the road.

Market Segmentation

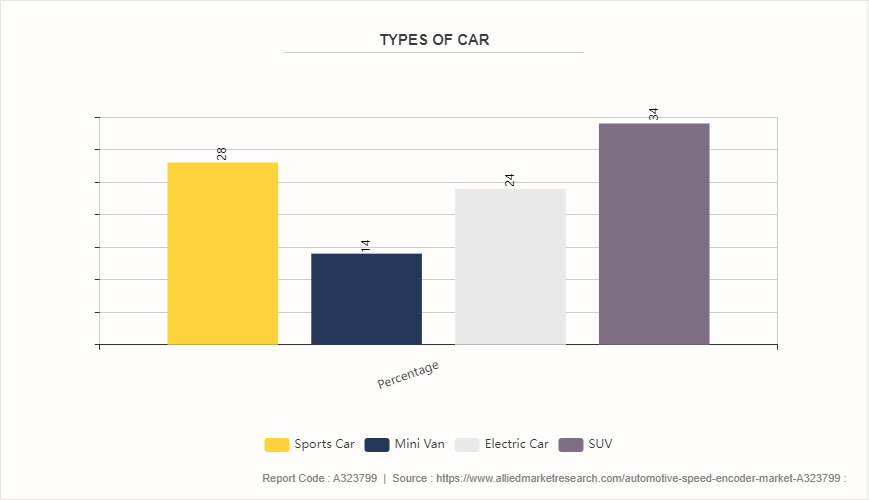

The automotive speed encoder market is segmented into type, application, and region. On the basis of type, the market is divided into axial encoder, and radial encoder. As per application, the market is segregated into passenger cars, and commercial vehicles. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East Africa.

Regional/Country Market Outlook

North America is home to some of the leading automotive technology companies and research institutions. The region has been at the forefront of developing advanced automotive technologies, including speed encoder systems. This technological leadership attracts investments and drives innovation, leading to the development and adoption of advanced speed encoder solutions in the region. North America has stringent safety regulations governing the automotive industry, mandating the implementation of safety features such as ABS (Anti-lock Braking Systems) , ESC (Electronic Stability Control) , and collision avoidance systems in vehicles. These safety systems rely on accurate speed sensing provided by speed encoders, driving the demand for such components in the region.

Asia-Pacific is the largest automotive manufacturing region globally, with countries such as China, Japan, South Korea, and India being major contributors. The region's rapid industrialization, economic growth, and rise in disposable incomes have led to increased demand for vehicles. This surge in automotive production has directly fueled the demand for automotive components, including speed encoders. Moreover, Asia-Pacific is increasingly adopting advanced automotive technologies, including advanced driver assistance systems (ADAS) and autonomous driving features. These technologies rely heavily on accurate speed sensing for functions such as adaptive cruise control, collision avoidance, and lane departure warning systems. As the adoption of these technologies grows, so does the demand for high-quality speed encoder systems.

In July 2023, Twk launched safe compact encoder for autonomous vehicles specifically designed for autonomous vehicles. These encoders are engineered to meet the stringent safety and reliability requirements necessary for autonomous driving applications.

In December 2021, C&K, a leading manufacturer of high-quality electromechanical switches, launched a new 24-position optical encoder switch with an integrated pushbutton.

June 2023, Bourns, Inc., a leading manufacturer and supplier of electronic components, announced the release of the PEC11J series encoder as a drop-in replacement for the discontinued ALPS Model EC11J Series. This modified version of the Bourns PEC11S series is designed to allow customers to support existing applications without altering their mechanical or electrical layouts.

Competitive Landscape

The report analyzes the profiles of key players operating in the automotive speed encoder market such as NTN-SNR, ams-OSRAM AG., Dynapar, EMBL System, Freudenberg-NOK, Haining Zhongteng, Hutchinson, Renishaw, TE Connectivity Ltd, and Timken. These players have adopted various strategies to increase their market penetration and strengthen their position in the automotive speed encoder market.

Industry Trends

June 2023: British Encoder announced the launch of its newest catalog that showcases a collection of encoders tailored for various industries, starting from manufacturing and robotics to aerospace and medical devices. These encoders are purpose-built to excel in specific applications and ensure that each encoder seamlessly integrates into the unique environments and challenges of different industries.

In March 2023, POSITAL announced the launch of a major upgrade to its IXARC family of incremental rotary encoders that features new magnetic sensor technology and more energy-efficient embedded microcontrollers. The new encoders are expected to benefit customers by reducing power consumption while remaining mechanically and electrically compatible with earlier models.

In March 2023, Celera Motion announced the introduction of the Field Calibration IncOder, which is a groundbreaking new absolute inductive encoder solution that enables next-level accuracy angle measurement in motion control applications and position feedback in robotics in the most demanding environments. The product is designed for applications that need precise angle measurements but in conditions not suited for optical encoders: dusty, dirty, and wet environments or in conditions where high shocks and vibrations are common.

November 2022: Maxon announced the launch of five new products at the upcoming SPS trade fair in Nuremberg. They include the ECX SPEED 8 motors with pin connection, the integrated ENX 32 MILE encoder for drives from the ECX flat motor series with 32 mm diameter, and the powerful IDX 56 and 70 industrial drives.

Key Sources Referred

INTERNATIONAL ENERGY OUTLOOK

Environmental and Energy Study Institute (EESI)

U.S. Department of Energy

ITRI Ltd.

International Hydropower Association

International Energy Agency

World Economic Forum

European Association for Storage of Energy

Key Benefits for Stakeholders

This report provides a quantitative analysis of the automotive speed encoder market segments, current trends, estimations, and dynamics of the Automotive speed encoder market analysis from 2022 to 2032 to identify the prevailing Automotive speed encoder market opportunity.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the automotive speed encoder market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global automotive speed encoder market Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global automotive speed encoder market trends, key players, market segments, application areas, and market growth strategies.

Automotive Speed Encoder Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 701.3 Million |

| Growth Rate | CAGR of 3.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 456 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | ams-OSRAM AG., Dynapar, Timken, Freudenberg-NOK, Hutchinson, Haining Zhongteng, NTN-SNR, Renishaw plc., TE Connectivity Ltd., Embla Systems |

Upcoming trends in the global Automotive Speed Encoder Market include the integration of advanced sensing technologies for higher precision, increasing use of magnetic and optical encoders for improved reliability, growing adoption of encoders in electric and autonomous vehicles, enhanced durability and miniaturization for better performance, and the development of smart encoders with real-time data processing capabilities for predictive maintenance and enhanced vehicle safety.

Passenger Cars is a leading application of automotive speed encoder market.

North America is the largest regional market for automotive speed encoder.

$701.3 million is the estimated industry size of automotive speed encoder

NTN-SNR, ams-OSRAM AG., Dynapar, EMBL System, Freudenberg-NOK, Haining Zhongteng, Hutchinson, Renishaw, TE Connectivity Ltd, and Timken.

Loading Table Of Content...