Automotive Sunroof Market Overview

The global automotive sunroof market size was valued at USD 14.9 billion in 2023, and is projected to reach USD 42.4 billion by 2033, growing at a CAGR of 11.3% from 2024 to 2033. Rising consumer preference for luxury and comfort features is fueling demand in the automotive sunroof market. Sunroofs enhance aesthetics, ventilation, and cabin space—especially in urban markets. Technological advancements like panoramic and electric sunroofs further boost market opportunities.

Key Market Insights

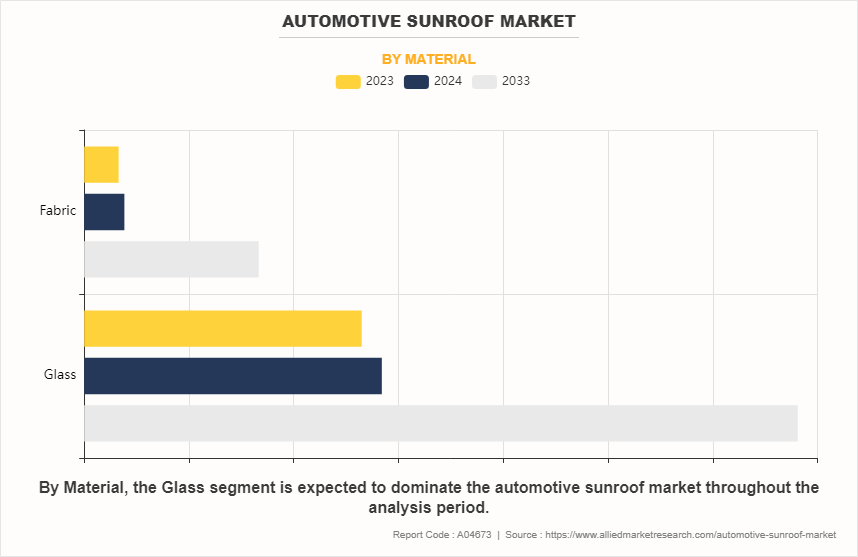

Glass Sunroofs Lead Material Segment

Glass dominates due to its premium look, durability, and popularity in both EVs and ICE vehicles.ICE Vehicles Drive Demand

ICE-powered vehicles held the largest share in 2023, especially in regions with limited EV infrastructure.Rising Demand for Premium Features

Sunroofs, once a luxury, are now in over 25% of cars sold in markets like India, driven by consumer preference for comfort and style.Popularity of Panoramic Sunroofs

Panoramic designs are gaining traction across vehicle segments for their open feel and enhanced cabin experience.Tech Innovations Boost Adoption

Features like solar-powered roofs, noise-reducing glass, and voice control increase appeal and functionality.EV and Autonomous Vehicle Growth

As EVs and autonomous vehicles rise, sunroofs are becoming key features to enhance passenger comfort and energy efficiency.Market Size & Forecast

2033 Projected Market Size: USD 42.4 billion

2023 Market Size: USD 14.9 billion

Compound Annual Growth Rate (CAGR) (2024-2033): 11.3%

Key Takeaways

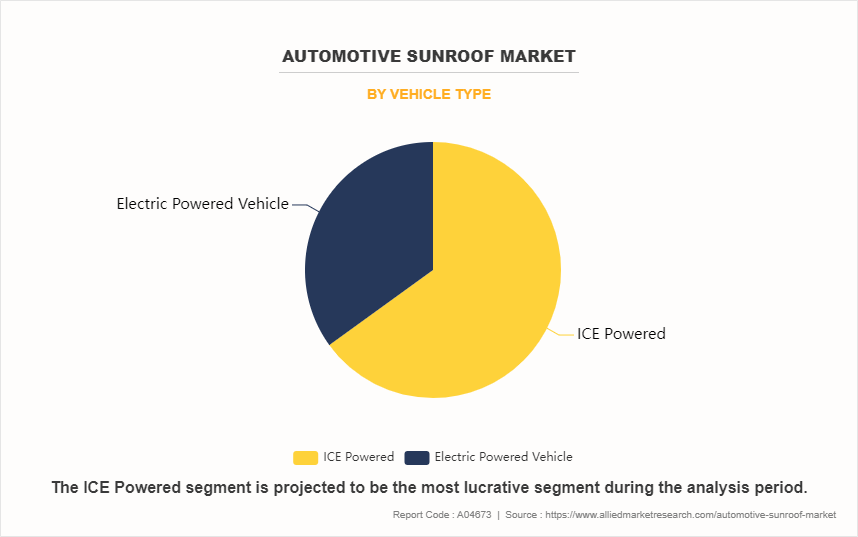

- By vehicle type, the ICE powered vehicle segment was the major shareholder in 2023.

- By product type, the panoramic sunroof dominated the market, in terms of share, in 2023.

- On the basis of material, the glass segment held the largest share in the automotive sunroof market in 2023.

- By operation type, the electric dominated the market, in terms of share, in 2023.

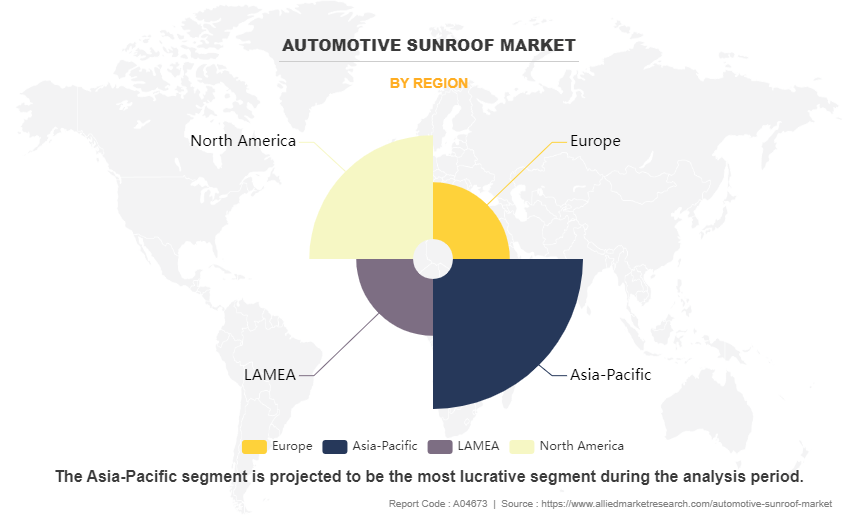

- Region wise, North America held the largest market share in 2023.

Introduction

An automotive sunroof is a movable panel, typically made of glass or metal, integrated into a vehicle's roof to allow light and fresh air into the cabin. Operable manually or electronically, sunroofs enhance the driving experience by offering an open-air feel and improved ventilation. They come in various types, such as panoramic sunroofs that extend across the roof, pop-up sunroofs that tilt for minimal airflow, and sliding or spoiler sunroofs that retract for full exposure. Furthermore, modern vehicles often feature electric sunroofs with advanced controls for convenience and aesthetics. Widely considered a luxury feature, sunroofs have become increasingly common across different car segments, catering to consumer preferences for comfort and style.

Market Dynamics

The automotive sunroof industry refers to the industry that focuses on the development, production, and sale of sunroof systems for vehicles. These systems enhance passenger comfort, aesthetics, and ventilation by allowing natural light and air into the cabin. The market includes various sunroof types, such as panoramic, pop-up, tilt-and-slide, and spoiler sunroofs, catering to diverse consumer preferences and vehicle segments, from luxury cars to affordable SUVs.

For instance, in June 2024, Minda Corporation partnered with a Taiwanese firm to locally manufacture sunroofs and closure systems for passenger vehicles in India. The partnership aims to localize production and reduce reliance on imports, addressing the rise in demand for advanced vehicle features in India's automotive market. By partnering with Spark Minda, the initiative focuses on developing innovative, integrated automotive sunroof and closure technologies for next-generation vehicles. This move aligns with the growing preference for premium car features such as sunroofs and supports India's push for self-reliant manufacturing under initiatives like "Make in India." The partnership is expected to enhance Minda Corp's footprint in the rapidly expanding passenger vehicle market while offering cost-effective, high-quality solutions.

For instance, in May 2023, Gabriel India, the subsidiary company of the ANAND Group, partnered with Inalfa Roof Systems, a leading Dutch provider of roof systems for the automotive and truck industry, valued at $1.5 billion. Through this partnership, Gabriel India aims to manufacture sunroofs for the Indian automotive market under the alliance named Inalfa Gabriel Sunroof Systems (IGSS). Moreover, in August 2024, Uno Minda partnered with Aisin Corporation to manufacture vehicle sunroofs in India, aiming to address the rise in demand for innovative automotive features. This partnership is driven by the technological advancements and evolving consumer preferences in the Indian automotive market. The partnership were offer a diverse range of sunroofs, leveraging the combined expertise and production capabilities of both companies. Uno Minda emphasized the strategic goal of establishing a leadership position in the growing sunroof segment by capitalizing on this synergy and delivering advanced and high-quality sunroof systems tailored to the market̢۪s needs.

The rise in consumer preference for luxury and premium features in vehicles is significantly driving the demand for automotive sunroof industry. Sunroofs enhance vehicle aesthetics, provide a sense of spaciousness, and improve ventilation, making them a desirable feature. This trend is particularly strong in urban markets, where customers increasingly seek advanced comfort and style elements in their vehicles. Furthermore, advancements in sunroof technologies, including panoramic and electric sunroofs has driven the demand for automotive sunroof market opportunity.

However, high maintenance and repair costs associated with sunroof systems are hampering the demand for the automotive sunroof market. Issues such as leakage, motor malfunctions, or structural repairs increase ownership costs, deterring budget-conscious consumers, the complexity of sunroof mechanisms often requires specialized servicing, further adding to costs and limiting their appeal, particularly in price-sensitive markets. Moreover, potential safety concerns, such as leakage or structural vulnerabilities, limiting consumer confidence are major factors that hamper the growth of the automotive sunroof market demand.

On the contrary, the expansion of electric and autonomous vehicles presents a lucrative opportunity for the automotive sunroof market. As these vehicles focus on enhancing cabin experiences, sunroofs are becoming standard features. They offer added comfort, natural light, and an open feel, aligning with consumer demand for premium, innovative interiors, boosting their adoption in both electric and autonomous vehicle designs.

Market Segment Review

The global automotive sunroof market is segmented on the basis of vehicle type, product type, material, operation type, and region. By vehicle type, the market is bifurcated into ICE powered, and electric Powered. On the basis of product type, the market is segmented into panoramic sunroof, in-built sunroofs, and others. On the basis of material, the market is bifurcated into glass, and fabric. Â By operation type, the market is bifurcated into electric, and manual. Region wise, it is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

By Material

On the basis of material, the glass segment attained the highest market share in 2023 and is expected to dominated the market during the forecast period. This is due to their premium appeal, enhanced durability, and ability to provide superior visibility and aesthetics. Glass sunroofs are favoured in both electric and gasoline-powered vehicles, offering a modern, upscale look and allowing for the integration of features such as tinted glass or solar control coatings, which are attractive to consumers seeking comfort and style.

By Vehicle Type

On the basis of vehicle, the ICE powered segment acquired the highest market share in 2023 and. This is due to their widespread adoption and dominance in global vehicle production. Traditional internal combustion engine vehicles continue to account for a significant share of the automotive industry, particularly in developing economies where EV infrastructure remains limited. Consumers in these markets often prioritize premium features like sunroofs, enhancing vehicle aesthetics and comfort. Additionally, ICE-powered vehicles are commonly offered with a variety of trim options, including models with sunroof installations. The relatively higher production volume of ICE vehicles further drives the demand for sunroof systems, contributing to their market dominance.

By Region

Region wise, North America attained the highest market share in 2023 and emerged as the leading region in the automotive sunroof market. This is due to a combination of factors. The region has a well-established automotive industry, with a high demand for premium and luxury vehicles, which often come equipped with advanced sunroof features such as panoramic and electric sunroofs. Consumer preferences in North America lean toward vehicles with enhanced comfort and aesthetics, which sunroofs provide. The increasing adoption of electric vehicles in the region also contributes to the growth, as these vehicles often incorporate sunroofs to improve the overall cabin experience.

Why is Asia-PacificSeen as an Opportune Region?

Asia-Pacific is projected to grow at the fastest rate during the forecast period. This due to rapid industrialization, rise in disposable incomes, and an increase in middle-class population. The region is witnessing a surge in demand for both electric and premium vehicles, where sunroofs are increasingly becoming standard features. Automakers in Asia-Pacific are investing in innovative sunroof technologies to cater to evolving consumer preferences for comfort and luxury, driving the region's growth in the global automotive sunroof market.

Which are the Top Automotive Sunroof companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the automotive sunroof industry.

Johnan America Inc

Magna International Inc.

CIE Automotive

BOS Group

AISIN CORPORATION

Motherson Yachiyo Automotive Systems Co., Ltd.

Inalfa Roof Systems Group B.V.

Inteva Products

Webasto Group

What are the Top Impacting Factors

The report focuses on growth prospects, restraints, and trends of the automotive sunroof market analysis. The study provides Porter's five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the automotive sunroof market.

Key Market Driver

Rise in consumer preference for luxury and premium features in vehicles.

The rise in consumer preference for luxury and premium features in vehicles is driving significant growth in the automotive sunroof market. As consumers demand more comfort, aesthetics, and advanced technology in their vehicles, sunroofs, particularly panoramic and electric variants, have become highly sought-after features. Furthermore, the rise in demand for sunroofs in India has led car manufacturers to incorporate the feature in nearly half of all new cars sold. Once viewed as a luxury, sunroofs are now found in over 25% of vehicles sold locally, a significant increase from just 7% five years ago. In models that offer sunroofs, sales are robust, highlighting the rising consumer preference for this feature, which enhances both the visual appeal and driving experience of the vehicle.

Moreover, sunroofs not only enhance the visual appeal of a vehicle but also improve the overall cabin experience by offering natural light, better ventilation, and an open-air feel. This is especially true for high-end, luxury, and electric vehicles, where manufacturers are integrating sunroofs as a standard or optional feature to meet the evolving needs of consumers.

In addition, the rise of SUVs and premium models, which often come equipped with larger sunroofs, further boosts the market demand. As consumers increasingly prioritize an elevated driving experience, the automotive sunroof market continues to benefit from this trend, expanding across various regions, particularly in North America and Asia-Pacific. Therefore, rise in consumer preference for luxury and premium features in vehicles drives the demand for automotive sunroof market size.

Advancements in sunroof technologies, including panoramic and electric sunroofs

Advancements in sunroof technologies, particularly panoramic and electric sunroofs, are significantly driving the demand for the automotive sunroof market. Panoramic sunroofs, which offer expansive, uninterrupted views of the sky, have become increasingly popular in both luxury and mid-range vehicles, as they enhance the overall driving experience by allowing more natural light into the cabin. For instance, in November 2024, Tata Motors launched a panoramic sunroof on selected variants of its ICE-powered Nexon, becoming the second compact SUV after the Mahindra XUV300 to offer this feature. This product rises in demand from consumers for premium features in subcompact SUVs. The variant with the sunroof also includes advanced features such as voice assistance for sunroof operation and an 8-speaker JBL audio system, priced Rs 1.30 lakh higher than the Fearless+ dual-tone trim, enhancing both style and functionality for modern car buyers.

Furthermore, electric sunroofs provide convenience and ease of use with automated opening and closing, offering a seamless integration of functionality and comfort. Technological innovations such as UV-resistant glass, solar panels, and noise-reducing features have further boosted the appeal of these sunroofs. These advancements not only improve the vehicle̢۪s aesthetic and comfort but also support energy efficiency, particularly in electric vehicles, where solar sunroofs can contribute to charging the battery. As consumers demand more sophisticated and user-friendly features, automakers are increasingly adopting these technologies, driving growth in the automotive sunroof market. Therefore, Advancements in sunroof technologies, including panoramic and electric sunroofs is driving the demand for automotive sunroof market share.

Technological advancements, such as solar-powered sunroofs, noise-reducing glass, and automatic opening/closing mechanisms

Technological advancements, such as solar-powered sunroofs, noise-reducing glass, and automatic opening/closing mechanisms, are significantly boosting the demand for the automotive sunroof market. Solar-powered sunroofs allow vehicles to harness solar energy, providing a sustainable and energy-efficient way to power vehicle systems, particularly in electric vehicles, making them an attractive feature. Noise-reducing glass enhances the comfort of passengers by minimizing external noise, adding a premium feel to the vehicle.

For instance, in February 2024, Renault, partnered with Saint-Gobain to develop the Solarbay opacifying glass roof, aligns with the rise in trend of solar-powered sunroofs by offering advanced features that enhance comfort and energy efficiency. While not directly solar-powered, the Solarbay roof's ability to adjust light levels and reduce heat reflects the innovation seen in solar sunroof technology, which also focuses on improving vehicle energy efficiency and providing a more sustainable, eco-friendly driving experience.

Moreover, automatic opening and closing mechanisms offer convenience and ease of use, increasing the appeal of sunroofs for consumers that prioritize modern features. These innovations not only improve the functionality and energy efficiency of sunroofs but also enhance the overall driving experience, making them a sought-after feature in both luxury and mainstream vehicles, driving the growth of the automotive sunroof market. Therefore, Technological advancements, such as solar-powered sunroofs, noise-reducing glass, and automatic opening/closing mechanisms is driving the growth of the automotive sunroof market growth.

Restraints

High maintenance and repair costs associated with sunroof systems.

High maintenance and repair costs associated with sunroof systems are a significant factor hindering the growth of the automotive sunroof market. Sunroofs, especially panoramic and electric variants, involve complex mechanisms and specialized components that can be expensive to repair or replace if damaged. The intricate wiring, motorized components, and sealing systems can be costly to maintain, leading to increased ownership costs for vehicle owners.

In addition, sunroof systems are prone to issues such as leaks, motor malfunctions, and glass breakage, all of which require professional service, further driving up repair costs. This can deter consumers, especially in budget-conscious markets, from opting for vehicles equipped with sunroofs. The high costs also contribute to longer-term maintenance concerns, which may discourage buyers from choosing sunroof-equipped vehicles, ultimately limiting the market's growth potential. As a result, while sunroofs are seen as a premium feature, the associated costs can be a barrier for many consumers. Therefore, high maintenance and repair costs associated with sunroof systems is hampering the growth of the automotive sunroof market.

Potential safety concerns, such as leakage or structural vulnerabilities, limiting consumer confidence

Potential safety concerns, such as leakage and structural vulnerabilities, are significantly impacting consumer confidence in automotive sunroofs and hindering market demand. Sunroofs, particularly in vehicles with panoramic designs, can be prone to leaks, especially if seals degrade over time or in extreme weather conditions, leading to water entering the vehicle. In addition, concerns about the structural integrity of the sunroof, especially in the event of accidents, may arise. While advancements in materials and manufacturing processes aim to address these issues, many consumers remain wary about the safety and durability of sunroof systems. Structural vulnerabilities, such as improper sealing or malfunctioning mechanisms, could lead to issues such as glass breakage or sunroof detachment in the event of a collision. These potential risks diminish consumer confidence, particularly among safety-conscious buyers, deterring them from choosing vehicles equipped with sunroofs. As safety remains a top priority, these concerns continue to limit the widespread adoption of automotive sunroofs. Therefore, Potential safety concerns, such as leakage or structural vulnerabilities, limiting consumer confidence is hampering the growth of the automotive sunroof market forecast.

Opportunity

Expansion of Electric and Autonomous Vehicles

The expansion of electric and autonomous vehicles presents a lucrative opportunity for the automotive sunroof market. As electric vehicles (EVs) continue to grow in popularity, automakers are increasingly integrating premium features, including sunroofs, to attract environmentally conscious consumers who seek a modern, luxurious driving experience. In addition, autonomous vehicles, with their focus on passenger comfort and experience, offer an ideal platform for sunroof technology, as passengers are no longer concerned with driving but instead prioritize comfort and enhanced cabin experiences. Panoramic and solar-powered sunroofs, in particular, are seen as desirable features for these vehicles, providing natural light, reducing energy consumption, and offering a sense of openness and connection with the outside environment. As both electric and autonomous vehicle markets expand, demand for sunroofs is expected to rise, positioning the market for significant growth in the coming years.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive sunroof market analysis from 2023 to 2032 to identify the prevailing automotive sunroof market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive sunroof market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive sunroof market trends, key players, market segments, application areas, and market growth strategies.

Automotive Sunroof Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 42.4 billion |

| Growth Rate | CAGR of 11.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 345 |

| By Vehicle Type |

|

| By Product Type |

|

| By Material |

|

| By Operation Type |

|

| By Region |

|

| Key Market Players | INALFA ROOF SYSTEMS GROUP, JOHNAN AMERICA INC, AUTOMOTIVE SUNROOF COMPANY (ASC, INC.), BOS GMBH & CO. KG, AISIN SEIKI CO., LTD, MAGNA INTERNATIONAL INC, WEBASTO ROOF SYSTEMS INC, YACHIYO INDUSTRY CO.LTD, CIE AUTOMOTIVE, INTEVA PRODUCTS |

Analyst Review

The global automotive sunroof market holds high potential for the automotive industry. The current business scenario has been witnessing an increase in the demand for automotive sunroofs, particularly in the developing regions, such as China, Germany, and others. The key players operating in the industry have adopted various techniques to provide customers with advanced and innovative product offerings.

The global automotive sunroof market is driven by innovation in glass technology and rise in demand for safety, comfort, & convenience features. Furthermore, rise in demand for premium cars and stylish greater glass surface area in automobiles including larger sunroofs propels the growth for the automotive sunroof market. In addition, increasing consumer preference toward automotive sunroof vehicles in developing nations further boosts the demand for automotive sunroofs in the global market.

High integration & maintenance cost, low penetration of sunroofs in low segment vehicles, and incidents of shattering & crushing of sunroofs are some of the major restraining factors of this market. Furthermore, increasing penetration of solar sunroofs in electric vehicles across the globe and surging sales of automotive vehicles ensure emerging growth opportunities for this market globally.

Europe exhibits the highest adoption of automotive sunroofs. On the other hand, Asia-Pacific is expected to grow at a faster pace, predicting lucrative growth.

The key players operating in the global automotive sunroof market are Aisin Seiki Co., Ltd., Inalfa Roof Systems Group B.V., Webasto Roof Systems, Inc., Inteva Products, LLC., Johnan America, Inc., Yachiyo Industry Co., Ltd., CIE Automotive, BOS GmbH & Co. KG, Automotive Sunroof Company, Inc., and Magna International, Inc.

Upcoming trends in the global automotive sunroof market include the rising adoption of panoramic sunroofs, advancements in smart glass technologies, increasing integration of solar-powered sunroofs, and growing demand for sunroofs in electric and autonomous vehicles to enhance aesthetics and energy efficiency.

The leading application of the automotive sunroof market is in passenger vehicles, driven by rising consumer demand for enhanced comfort, luxury features, and improved aesthetics in mid-range and premium cars.

Asia-Pacific is the largest regional market for Automotive Sunroof

$42387.1 million is the estimated industry size of Automotive Sunroof

johnan america inc, Magna International Inc., CIE Automotive, BOS Group, AISIN CORPORATION, Motherson Yachiyo Automotive Systems Co., Ltd., Inalfa Roof Systems Group B.V., Inteva Products, and Webasto Group.

Loading Table Of Content...

Loading Research Methodology...