Automotive Traction Inverters Market Insights, 2032

The global automotive traction inverter market size was valued at $10.5 billion in 2022, and is projected to reach $46.3 billion by 2032, growing at a CAGR of 16.4% from 2023 to 2032.

A traction inverter is a power electronic device that converts DC (Direct Current) power from battery to AC (Alternating Current) power to drive the electric motor in electric and hybrid vehicles. Automotive traction inverter play a crucial role in the propulsion system of electric and hybrid vehicles, providing efficient power conversion and control to drive the vehicle wheels.

Report Key Highlighters:

- The automotive traction inverter market study covers 15 countries. The research includes a segment analysis of each country in terms of both value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literatures, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The automotive traction inverter market is highly fragmented, with several players including BorgWarner Inc., Denso Corporation, Eaton Corporation, Hitachi, Ltd., Mitsubishi Electric Corporation, Robert Bosch GmbH, Curtiss-Wright Corporation, TDK Electronics, Valeo SA, and Vitesco Technologies Group Aktiengesellschaft. Also tracked key strategies such as product launch, partnership, contracts, expansion and collaboration etc. of the players operating in the automotive traction inverter market.

The automotive traction inverter market is segmented into Propulsion type, Output power, Semiconductor material, Technology type and Vehicle type.

Factors like utilization of silicon carbide (SiC) MOSFETs and high-voltage batteries and surge in demand for electric vehicles propel the growth of the automotive traction inverter market. In addition, increased demand for enhanced motor performance and operational efficiency propels the market growth. However, lack of sufficient infrastructure for electric vehicles hinders the growth of the market. On the contrary, the surge in demand for 800V traction inverters support is anticipated to offer remunerative opportunities for the players operating in the market.

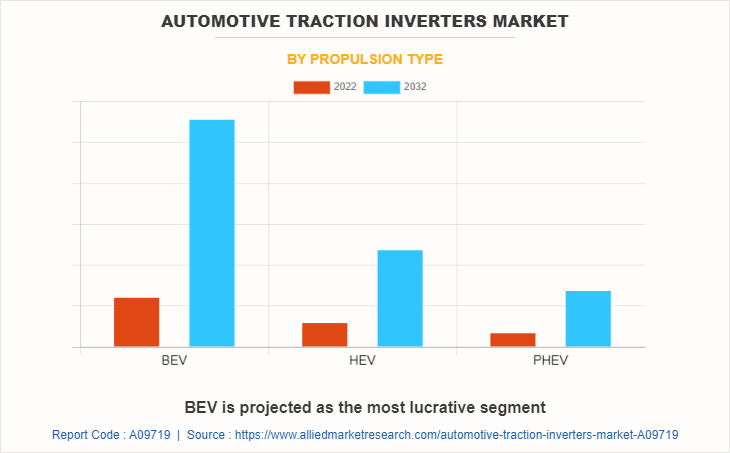

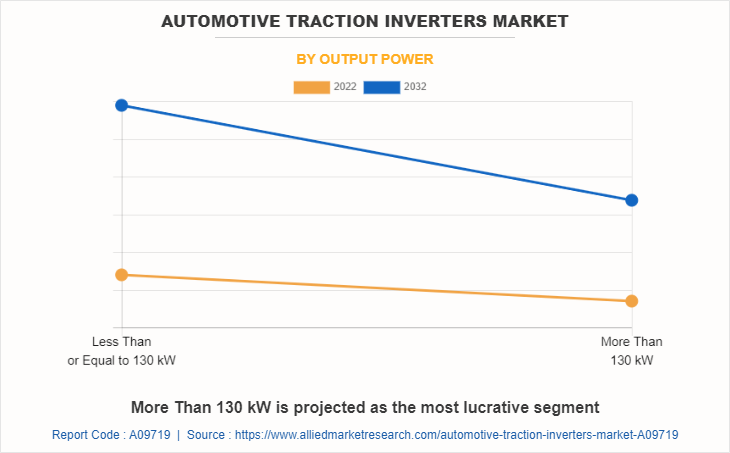

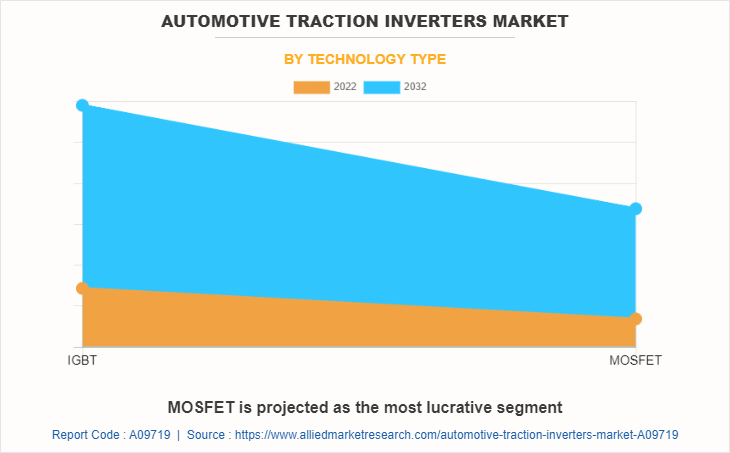

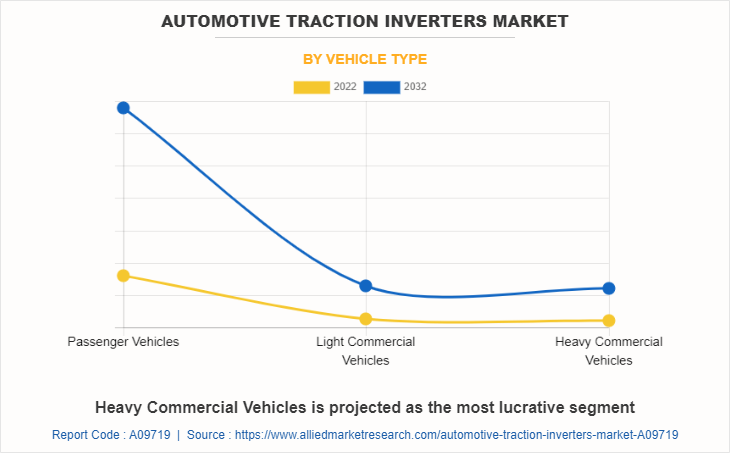

The automotive traction inverter market is segmented into propulsion type, output power, semiconductor material, technology type, vehicle type and region. On the basis of propulsion type, it is segregated into BEV, HEV, and PHEV. By output power, it is segmented into less than or equal to 130 KW, more than 130 KW. On the basis of semiconductor material, the market is fragmented into gallium nitride (GaN), silicon (Si), and silicon nitride (SiC). On the basis of technology type, it is fragmented into IGBT, and MOSFET. On the basis of vehicle type, it is segregated into passenger vehicles, light commercial vehicles, and heavy commercial vehicles. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The automotive traction inverter market share is expected to increase significantly in the Asia-Pacific region. Countries such as China, Japan, and South Korea are an important hub for automotive component manufacturing. Electric vehicle adoption in this region is major factor for this rise in production. China is the biggest market for EVs which contribute around 60% of total sales.

China observed a 60% rise in battery electric vehicle (BEV) sales in 2022 compared to 2021, at 4.4 million units. Furthermore, PHEV sales nearly tripled to 1.5 million units in 2022 compared to 2021. China also increased its percentage of exported electric vehicles, accounting for 35% in 2022, up from 25% in 2021.

In addition, traction inverter company expanded its presence in China. For instance, in August 2021, BorgWarner Inc. made notable progress in the Chinese mobility market, securing contracts to provide dual inverter for two prominent Chinese original equipment manufacturers (OEMs). These dual inverters will be utilized in hybrid electric vehicles (HEV) and plug-in hybrid electric vehicles (PHEV) based on the GWM LEMON platform. In addition, another major Chinese OEM is expected to incorporate BorgWarner dual inverter technology in their own HEV and PHEV passenger car models.

Key players profiled in the automotive traction inverter market report include BorgWarner Inc., Denso Corporation, Eaton Corporation, Hitachi, Ltd., Mitsubishi Electric Corporation, Robert Bosch GmbH, Curtiss-Wright Corporation, TDK Electronics, Valeo SA, and Vitesco Technologies Group Aktiengesellschaft. The leading companies adopt strategies such as product launch, partnership, contract expansion and collaboration to strengthen their market position.

Recent Developments

- In May 2023, Denso Corporation, entered into a collaboration with United Semiconductor Japan Co., Ltd. (USJC), a subsidiary of semiconductor foundry United Microelectronics Corporation (UMC). The collaboration aims to produce insulated gate bipolar transistors (IGBT) and has already achieved mass production at USJC's 300mm fab. IGBTs play a crucial role in electric vehicles by acting as switches in inverters, converting DC current from batteries into AC current to drive and control electric vehicle motors.

- In March 2023, Denso Corporation developed its first-ever inverter utilizing silicon carbide (SiC) semiconductors. This inverter integrated into the eAxle, an electric driving module developed by BluE Nexus Corporation, and will be employed in the new Lexus RZ, first dedicated battery electric vehicle (BEV) model from the automaker.

- In April 2022, Eaton Corporation expanded its Vehicle Group and eMobility businesses into Europe, a prominent hub for EV technology. The company established a new office and research center in Karlsruhe, Germany, to support this expansion. The focus of the eMobility production lines at this facility is expected to be on manufacturing traction inverters. These inverters, designed for a major European automaker, are expected to improve energy efficiency, enhance EV range, and contribute to longer battery life.

- In December 2021, Robert Bosch GmbH introduced its first generation of SiC MOSFETs for automotive traction inverters to optimize the power modules.

Adoption of Silicon Carbide (SiC) MOSFETs and high-voltage batteries

Silicon Carbide (SiC) MOSFETs are innovative semiconductor devices that offer several advantages over traditional silicon-based components. SiC MOSFETs possesses higher power handling capabilities, high-temperature tolerance, and reduced switching losses. These features contribute to improved efficiency and performance of automotive traction inverters. By using SiC MOSFETs, automakers may achieve faster switching speeds, higher power density, and lower power losses, resulting in enhanced overall system efficiency and reduced energy consumption.

Moreover, to offer these benefits to automakers the traction inverter providers collaborated to expedite the use of SiC MOSFETs in the automotive industry. For instance, in March 2022, Energy, a subsidiary of Hitachi, Ltd., and NXP Semiconductors collaborated to advance the use of silicon carbide (SiC) power semiconductor modules in e-mobility. The collaboration aims to develop more efficient, reliable, and safe solutions for powertrain inverters. The project involves utilizing GD3160 isolated HV Gate Drivers of NXP and RoadPak automotive SiC MOSFET power modules of Hitachi Energy.

This collaboration is expected to contribute to the wider adoption of SiC technology in the e-mobility sector, enhancing performance and driving the transition to electric vehicles. In addition, in December 2021, Robert Bosch GmbH introduced its first generation of SiC MOSFETs for automotive traction inverters to optimize the power modules. In addition to SiC MOSFETs, the adoption of high-voltage batteries is another crucial driver for the market. High-voltage batteries, typically operating at voltages of 400V and above, provide greater energy storage capacity, enabling longer electric driving ranges for hybrid and electric vehicles. These batteries may deliver higher power output, supporting the demand for increased performance in electric vehicles.

![]()

Automotive traction inverters play a vital role in managing the power flow between high-voltage batteries and the electric motor, converting DC power from the battery into AC power to drive the motor efficiently. The adoption of high-voltage batteries necessitates the use of compatible traction inverters capable of handling the increased voltage requirements, thereby driving the market growth. Therefore, the adoption of Silicon Carbide (SiC) MOSFETs and high-voltage batteries is a significant driver, which propels the growth of the automotive traction inverter market.

Surge in demand for electric vehicles

Electric vehicles provide several advantages like low operating cost compared to conventional petrol engine, implementation of stringent government regulations to minimize environment pollution, and decreased emissions from vehicles, which significantly boost their demand across the globe. For instance, electric vehicle sales increased, owing to growth in adoption of EVs in China, the U.S., and Europe. The total global electric vehicles contributed to 26 million in 2022, experiencing a 60% increase compared to 2021, owing to a rise in sales of EVs. Further, this in turn, is expected to escalate the need for automotive traction inverters for electric vehicles during the forecast period.

In addition, key players operating in the electric vehicle traction inverter market are adopting various strategic moves such as partnership to tap the business potential. For instance, in July 2022, Renault Group and Vitesco Technologies formed a strategic partnership to collaboratively develop and produce power electronics for electric and hybrid powertrains. The focus of this partnership is to create a "One Box" solution, which integrates multiple components into a single housing. This includes the DC-DC converter, the on-board charger (OBC), and the inverter. By combining these elements into a compact electronic unit, the aim is to enhance efficiency and simplify the integration of power electronics in electric and hybrid vehicles of Renault.

Moreover, the electric vehicles market has grown exponentially due to factors, such as climate change and efforts to achieve net zero emissions. In addition, favorable incentives and policies introduced by governments of different countries to promote electric vehicles boost the growth of the EV industry. For instance, in 2021, in California, the Clean Vehicle Rebate Project (CVRP) propelled clean vehicle utilization in California by providing incentives ranging from $1,000 to $7,000 for purchases or leases of new zero-emission vehicle. Moreover, in 2021, New Zealand initiated clean car discount, in which new car buyers received $8,625 rebate for electric vehicles (EVs) less than $80,000, including GST and road costs.

The surge in acknowledgement towards climate change and rise in demand for electric cars lead to an increase in the production of electric vehicles. For instance, according to a report by the IEA organization, 2022, sales of electric vehicles surpassed 10 million units in 2022. Moreover, some countries announced policies banning and phasing out gasoline and diesel cars in the near future. In line with the European Union regulations, specific carbon emission guidelines have been implemented for different vehicle categories. These guidelines require a 15% reduction in carbon emissions for new cars and vans by 2025, relative to the levels recorded in 2021. Furthermore, a target of 55% reduction for cars and 50% reduction for vans by 2030 has been set, with the aim of achieving 100% reduction in emissions by 2035.

Hence, factors like the surge in adoption of EVs along with government incentives are expected to fuel the growth of electric vehicles across the globe which in turn is expected to fuel the demand for automotive traction inverters. The growth of traction inverter market is directly related to the sales of electric vehicles as these vehicles are equipped with traction inverters. Thus, owing to this, the growth in the electric vehicles market is expected to propel the market for automotive traction inverter market during the forecast period.

Increased demand for enhanced motor performance and operational efficiency

The increasing focus on improving electric and hybrid vehicle motors has led to a greater emphasis on enhancing the performance and efficiency of traction inverter. These inverters are vital in regulating the torque and speed of the motors, significantly influencing the overall driving experience and performance of the vehicle.

To meet the expectations of consumers and regulatory requirements, there is a strong demand for traction inverters that may enable higher motor performance. This includes achieving faster motor speeds, delivering greater torque output, and ensuring smooth acceleration and deceleration. By leveraging advanced control algorithms and innovative technologies, traction inverters are expected to optimize motor performance and enhance the overall driving experience.

Operational efficiency is another important factor driving the demand for automotive traction inverters. Efficiency improvements translate into higher energy conversion rates, reduced power losses, and increased range for electric and hybrid vehicles. Companies are coming up with new and advanced traction inverters for vehicles owing to these benefits. For instance, in April 2022, Eaton Corporation expanded its Vehicle Group and eMobility businesses into Europe, a prominent hub for EV technology. The company established a new office and research center in Karlsruhe, Germany, to support this expansion. The focus of the eMobility production lines at this facility is projected to be on manufacturing traction inverters. These inverters, designed for a major European automaker, are expected to improve energy efficiency, enhance EV range, and contribute to longer battery life. Moreover, semiconductor companies collaborated to work on traction inverters to maximize range of EVs. For instance, in June 2020, Vitesco Technologies Group Aktiengesellschaft partnered with ROHM Semiconductor, a leading company in SiC power semiconductors, to enhance the efficiency of its power electronics for electric vehicles (EVs). By incorporating SiC components, Vitesco Technologies aims to extend the range of EVs or reduce battery costs without compromising on performance. Such developments are expected to support the growth of the automotive traction inverter market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive traction inverter market analysis from 2022 to 2032 to identify the prevailing automotive traction inverter market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive traction inverter market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive traction inverter market trends, key players, market segments, application areas, and market growth strategies.

Automotive Traction Inverters Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 46.3 billion |

| Growth Rate | CAGR of 16.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 392 |

| By Propulsion type |

|

| By Output power |

|

| By Semiconductor material |

|

| By Technology type |

|

| By Vehicle type |

|

| By Region |

|

| Key Market Players | Eaton Corporation, BorgWarner Inc., Mitsubishi Electric Corporation., Hitachi, Ltd., Robert Bosch GmbH, Curtiss-Wright Corporation, Denso Corporation, Vitesco Technologies Group Aktiengesellschaft, Valeo SA, TDK Electronics |

Key players profiled in the report include BorgWarner Inc., Denso Corporation, Eaton Corporation, Hitachi, Ltd., Mitsubishi Electric Corporation, Robert Bosch GmbH, Curtiss-Wright Corporation, TDK Electronics, Valeo SA, and Vitesco Technologies Group Aktiengesellschaft.

The global automotive traction inverters market was valued at $10,450.1 million in 2022, and is projected to reach $46,320.9 million by 2032.

Europe is the largest regional market for automotive traction inverters market

MOSFET is the leading application of automotive traction inverters market.

Surge in demand for 800V traction inverters and adoption of Silicon Carbide (SiC) MOSFETs and high-voltage batteries are the upcoming trends of automotive traction inverters market.

Loading Table Of Content...

Loading Research Methodology...