Automotive Tubeless Tire Market Overview:

Global automotive tubeless tire market is expected to reach $198 billion by 2023, growing at a CAGR of 6.2% from 2017 to 2023. Tubeless tires operate without an inner tube, while the outer casing makes an air tight seal with the rim of the wheel, and air is held in the assembly of casing and rim. The tubeless tire comprises of tread, steel belt, and spiral layer, and assist vehicles in numerous functions, such as supports vehicle load, transmits traction & breaking force to road surface, absorbs road shocks, and changes & maintains direction of travel. Moreover, to accomplish these basic functions, a tubeless tire is made up of steel belt covered with resilient rubber and inflated with high-pressure air (nitrogen, CO2, O2, and mixture of gases). The tubeless tire market is expected to witness lucrative growth during the forecast period, due to its advantages, such as easy puncture repair, more comfortable for higher speed, lower tire pressure, better bump absorption, and reduced rotating weight as compared to conventional tires. Commercial vehicles, such as heavy-duty trucks & buses may integrate 8 or more than 8 tubeless tires depending on the application and role of the vehicle, whereas two wheelers are integrated with 2 tires and passenger cars with 4 tires.

Market Segmentation

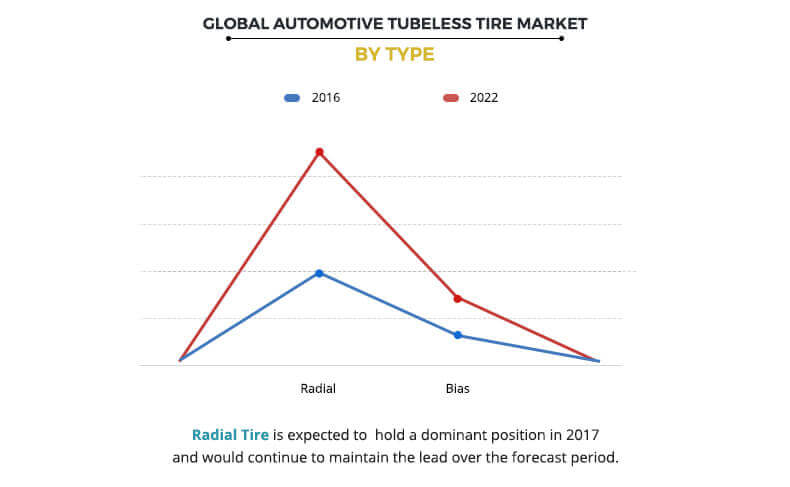

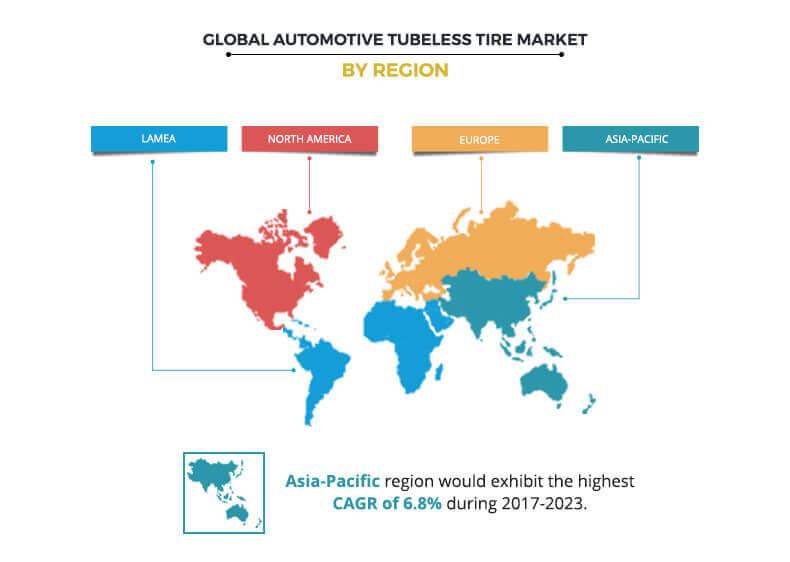

The market segmentation is based on type, vehicle type, distribution channel, and geography. Based on type, it is bifurcated into radial and bias tubeless tires. By vehicle types, it is categorized into two-wheelers, passenger cars, and commercial vehicles. Based on distribution channel, it is classified into original equipment manufacturer (OEM) and aftermarket. Geographically, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Market Dynamics

Global automotive tubeless tire market is driven by growth in production & sales of vehicles and stringent vehicular emission & fuel economy rules & regulation globally. However, volatile prices of raw material and technological advancement, such as rise in adoption of air-less tires in heavy-duty trucks & buses and off-road vehicles, hindering the market growth. Moreover, technological innovations in the automotive tire industry, such as lightweight tubeless tire, manufactured with advance rubber & metals, and rise in aftermarket for tubeless tire, due to increase in lifespan of vehicles, are expected to unfold various opportunities for the market growth. The main challenges for tubeless tire OEMs are to overcome problems such as vibration and excessive fuel consumption.

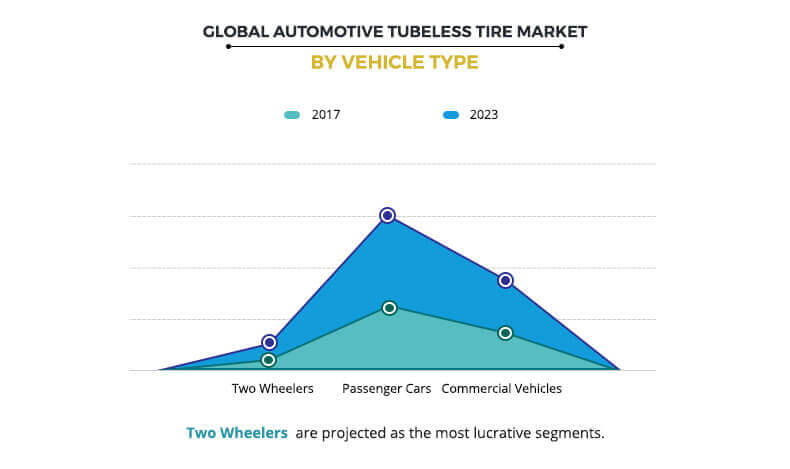

Passenger Car Segment Leads the Automotive Tubeless Tire Market

The passenger car segment accounted for the highest market share in 2016, in the overall automotive tubeless tire market. As per the OICA Car Association, in 2016, approximately 69 million passenger cars were sold across the globe, which further boosted the demand for tubeless tire in automotive industry. Moreover, rise in passenger cars mostly in Asia-pacific drives the market growth. In addition, factors such as increasing life span of vehicles & increasing annual average annual miles travel by passenger cars, boosting the demand of tubeless tire in aftermarket.

Asia-Pacific Most lucrative market

Asia-Pacific is the most lucrative and largest automotive tubeless tire market, owing to rise in automotive industry in China, Japan, and South Korea and growth in number of joint ventures with international brands. The penetration level of passenger cars and two wheelers are highest in this region as compared to others, which is further boosting the demand for tubeless tires.

Key Benefits

The report includes an extensive analysis of the factors that drive and restrain the market.

The factors affecting growth and the market projections from 2016 to 2023 are included.

The report also provides quantitative and qualitative trends to assist the stakeholders to understand the situations that prevail in the market.

In-depth analysis of key segments demonstrates stakeholders with different types of tubeless tire and different vehicle type & distribution channels.

Competitive intelligence highlights the business practices followed by key market players globally.

Automotive Tubeless Tire Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Vehicle Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Hankook Tire Co. Ltd, MICHELIN, Pirelli Tyre S.p.A, Yokohama Tire Corporation, Sumitomo Rubber Industries, Ltd, Continental AG, CST, Bridgestone Corporation, Toyo Tire & Rubber Co. Ltd, The Goodyear Tyre & Rubber Company |

| Other Players in the Value Chain | CEAT Ltd., MRF Limited, Kumho Tire Co., Inc., Apollo Tyres Ltd |

Analyst Review

Currently, tubeless tires have gained huge momentum in the global automotive industry, owing to the augmented safety and reliability offered by these tires as compared to the conventional pneumatic tires. Air in these tires is enclosed between the tire wall and the metal rim, thereby forming an air tight seal that prevents rapid deflation in case of any damage or tear. In addition to providing enhanced safety, tubeless tires provide better fuel efficiency & heat dissipation, less balance weight requirement, and cost saving on tube. All these advantages aid the rise in the usage of tubeless tires across all types of vehicles. However, commercialization of air less tire is expected to slow down the market growth in future. As of now, air less tire mostly found its application in heavy-duty vehicles, and off road or construction vehicles. Moreover, due to technological advancement it is anticipated that air less tire would be commercializing in passenger cars and two-wheelers in the coming future.

The presence of numerous companies in the market that include The Goodyear Tyre & Rubber Company, Bridgestone Corporation, Hutchinson SA, Maxxis International, MICHELIN, Continental AG, and Pirelli Tyre S.p.A., the tubeless tire industry is posting decent growth on the global scale. Majorly driven by the aftermarket sales, these companies focus on the integration of technology with the manufacturing and testing process of the tires. For instance, Bridgestone Tires, one of the leading tire and rubber company, utilizes Contact Area Information Sensing (CAIS) that sense the road conditions by collecting and analyzing tire contact area.

Moreover, the participation of emerging countries in the tire industry has proved to be very vital for the persistent growth of the tubeless tire market. India, for instance, has huge growth potential in the near future in the market. Indian tubeless tire industry is experiencing progressive trends in the current scenario, owing to the growth in domestic manufacturing base of tubeless tires and the huge influx of imported tires from neighboring countries, such as China.

Loading Table Of Content...