Automotive Valves Market Insights, 2033

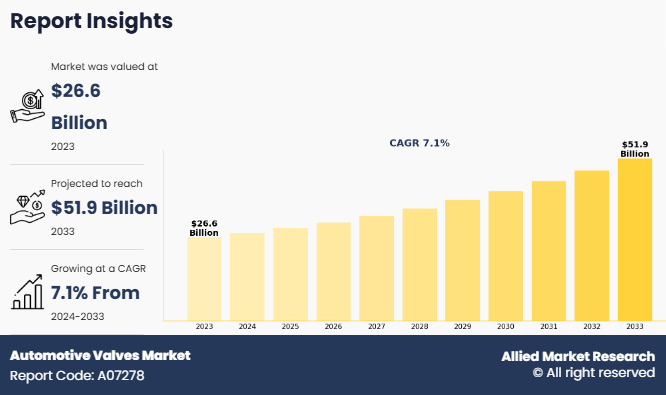

The global automotive valves market size was valued at USD 26.6 billion in 2023, and is projected to reach USD 51.9 billion by 2033, growing at a CAGR of 7.1% from 2024 to 2033.

Report Key Highlighters:

- The automotive valves industry study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2024-2033.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The automotive valves market share is highly fragmented, into several players including Denso Corporation, Hitachi Astemo, Ltd., BorgWarner Inc., Robert Bosch GmbH, Valeo S.A., Aisin Seiki Co., Ltd., DRiV Automotive Inc., Eaton Corporation, Continental AG, and MAHLE GmbH. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

Key Developments

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- On February 1, 2022 BorgWarner Inc.,leading manufacturer of Exhaust Gas Recirculation (EGR) technologies, launched EGR valves for automotive sectors. The Exhaust Gas Recirculation (EGR) valve is used in internal combustion engines to reduce nitrogen oxide (NOx) emissions. It works by recirculating a portion of the engines exhaust gases back into the combustion chamber, diluting the air-fuel mixture.

- On June 1, 2023 Continental AG partnered with Nisshinbo to start valve block manufacturing plant in Gurugram, India. Continental produced more than 7.3 million EBS units in India, including Electronic Stability Control (ESC) for passenger cars and Anti-lock Brake Systems (ABS) for passenger cars and two-wheelers. The Continental holds 40 percent share and Nisshinbo 60 percent. The new plant produces valve blocks for Continentals Electronic Brake Systems (EBS) in India.

- On November 1, 2021 Robert Bosch GmbH developed DEV6 high-pressure injection valves. It is based on latest generation high-pressure injection valve technology. & designed for nominal injection pressures of up to 350 bar.

Automotive valves are components majorly used in ICE vehicle engines to manage and regulate the flow of gases and fuel into and out of the engine's cylinders.Moreover, automotive valves are also used in the thermal management system of electric vehicles and the flow of coolant in thermal management systems, which are crucial for maintaining optimal operating temperatures for the battery, motor, and other electronic components.

The automotive valve market growth is driven by growing demand for passenger vehicles in developing regions, growing vehicle production globally, and integration of lightweight materials in manufacturing automotive valves. However, factors such as growing inclination towards electric vehicle segment and high cost and fluctuation in price of raw material hinder the growth of the market. Furthermore, factors such as growth in emission regulation and technological advancement in automotive valves are anticipated to offer lucrative market growth opportunity during the forecast period.

In recent years there has been an increase in sales of passenger vehicles especially in in the developing region particularly in Asia-Pacific and Africa region. The growing sales of passenger vehicles are particularly driven by an increase in economic activity in developing countries and growing disposable income among consumers. In countries such as China and India, the huge populations and rapid urbanization, the demand for passenger vehicles is increasing rapidly. The availability of affordable vehicles models, coupled with government incentives for the purchase of electric and other sustainable fuel vehicles, has further accelerated sales in these regions. Moreover, the availability of hybrid vehicles, plug-in hybrids, fully electric, hydrogen and other biofuels vehicles are further escalating the demand for automotive valves. For instance, according to the data by SIAM society of Indian automobile manufactures passenger vehicle sales in India in 2024 was around 5 million units including 4.2 million domestic vehicle sale which is a growth of 8.4% as compared to earlier year. The demand for passenger vehicle is anticipated to continue in coming years, the strong sales of passenger vehicle segment is expected to drive the market for automotive valves industry during the forecast period.

However, the growing cost and constant fluctuation in the price of raw materials significantly hampers the growth of the automotive valves market. Raw materials are essential in manufacturing of automotive valves. The fluctuation in the price of raw materials increases the overall production cost of vehicle thus hampering the growth. For instance, due to the Russia-Ukraine war the prices of raw steel increased significantly which is a major raw materials used in manufacturing impacted the automotive valves market growth. Russia and Ukraine combined produced around 5-7% of the global steel, the war resulted in suspension of operation of 90% steel manufacturing facilities in Ukraine. For instance, Azovstal and Illich Steel facilities, in Mariupol, which account for about 41% of Ukrainian steel production completely halted their production due to damage to their manufacturing facility. Similarly, major countries enacted sanctions on Russian companies, resulting in the decline in the import of steel from Russia and increasing the price of steel. Thus, the fluctuation in the price of raw materials is anticipated to significantly impact the automotive valves market forecast.

Segmental analysis

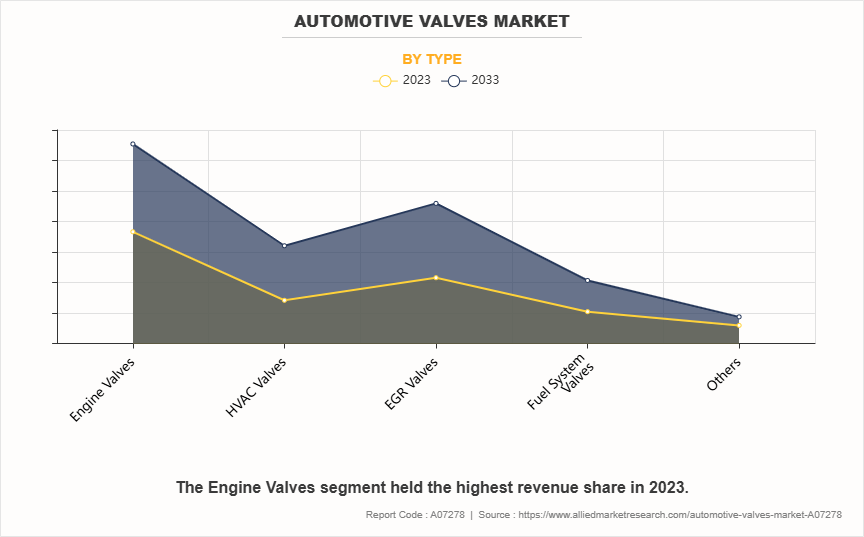

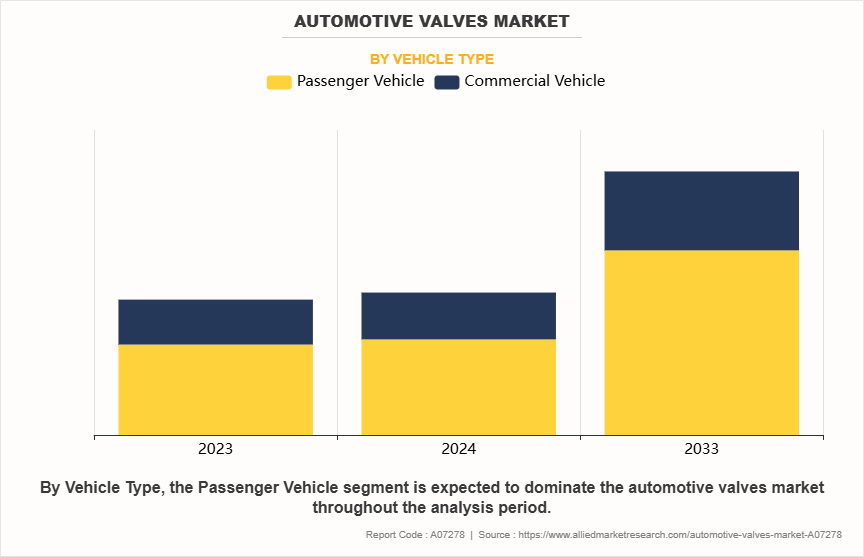

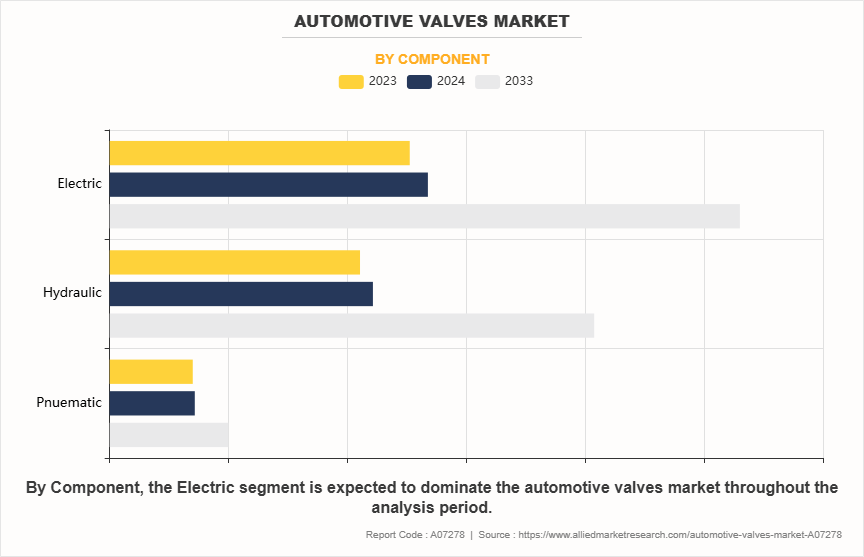

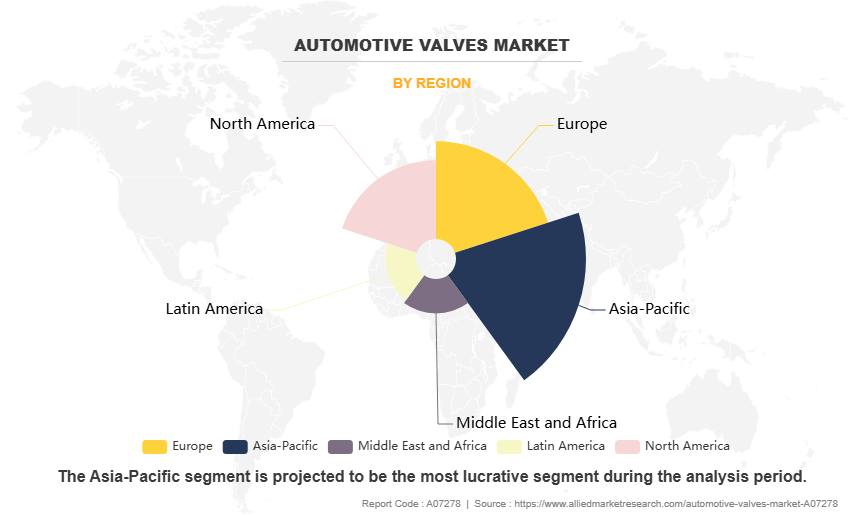

The global automotive valves market size is segmented into type, vehicle type, function, sales channel and region. Based on type the market is segmented into engine valves, HVAC valves, EGR valves, fuel system valves and others. On the basis of vehicle type the global market is segregated into passenger vehicle and commercial vehicle. Based on function the market is analyzed into pneumatic, hydraulic, and electric. On the basis of sales channel the global market is analyzed into OEM and aftermarket. Region wise the global market is analyzed into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America.

By Type

By type, the global automotive valve market has been segmented into engine valves, HVAC valves, EGR valves, fuel system valves, and others. The engine valve segment accounted for the largest market share in 2023, owning to the growing emission regulation in the automotive industry which is pushing automakers to develop more economical and environmentally friendly engines. Moreover, with rising fuel costs and growing environmental awareness, modern consumers are increasingly seeking vehicles that offer better fuel efficiency thus driving the growth of engine valve market.

Vehicle Type

Based on vehicle type the global automotive valves market analysis is segregated into passenger vehicle and commercial vehicle. The passenger vehicle segment accounted for a dominant market share in 2023, owning to the growing demand for the passenger segment due to the increasing demand for personal mobility solutions from developing economies especially in countries located in Asia-Pacific and Africa region. Moreover, modern passenger vehicles utilize turbocharging and direct fuel injection technology to enhance engine power and increase fuel efficiency while maintaining or reducing engine size. These technologies require precise control and regulation of fuel and air intake thus driving the demand for automotive valve.

Function

By function type the market is segmented into pneumatic, hydraulic, and electric. The electric segment accounted for the dominant market share in 2023, owning to electric valves are majorly deployed where precise control and quick response are essential and are majorly deployed in modern vehicles. With the growing focus on development of fuel-efficient engines the demand for electric valves is anticipated to continue to grow.

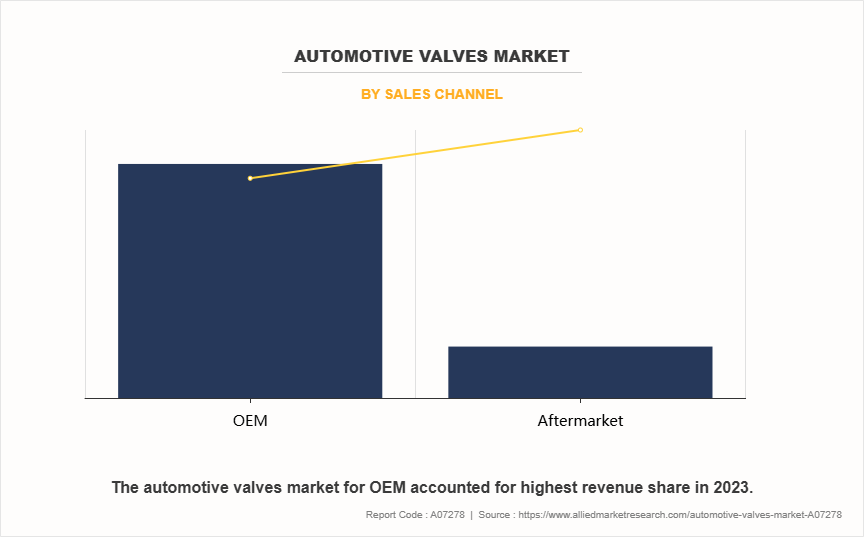

Sales Channel

Based on sales channel, the market is segregated into OEM and aftermarket. The OEM segment dominated the global market share in 2023, owning to the increasing demand for valves from OEM authorized manufactures, as OEM valves usually come with a guarantee of quality and reliability as they meet the automotive manufacturer's original standards and specifications.

Region

Region wise the Asia-Pacific region held the largest market share in 2023, driven by several factors such as in recent years, Thailand, India, Indonesia and Vietnam have seen a considerable surge in the adoption of the passenger vehicle segment, majorly driven by the increase in disposable income among consumers. Likewise, the automotive production in these countries have grown immensely owning to cheap labor force, and strong government focus on the development of the automotive industry. For instance, as per the data by the IBEF India Brand Equity Foundation, India is the largest tractor manufacturer, second-largest bus manufacturer, and third-largest heavy truck manufacturer in the world. As per the data India annual production of automobiles in FY23 was 25.9 million vehicles including three and four wheelers. The automotive industry employed around 19 million people directly and the share of the automotive industry national GDP increased from 2.77% in 1992-1993 to around 7.1% currently. The automotive industry in the Asia-Pacific region is expected to grow at a considerable growth rate in coming years, thus with the growth of automobile industry the demand for automotive valves.

Growing Vehicle Production Globally

In recent years there has been increase in production and sales of automobile. The major factor driving the sales of the automobiles are increasing technological advancement in the automotive industry and increase in sales of hybrid vehicle. The growth in sales of automobiles is majorly driven by increase in disposable income among consumer, and growing demand for automobiles from the emerging markets such as China, India, Brazil, Indonesia, Mexico and others. Furthermore, the growth in urbanization along with increase in population is boosting the demand for automobiles among consumers.

Additionally, in recent years with the growing prices of fuel consumers are shifting their focus towards hybrid vehicles as hybrid vehicles can deliver 20% - 35% more fuel economy when compared to traditional gasoline-powered vehicles. Moreover, governments around the world are implementing stricter emission norms on traditional ICE vehicle, in order to reduce tapeline emission and greenhouse gases, the governments are also encouraging the adoption of green mobility solution such as hybrid and other sustainable fuel vehicles. Thus the increased inclination of customers towards hybrid technology is resulting in increased production and sales of automobiles globally, during the forecast period this trend is anticipated to be the major driving factor for the automotive valves market trends.

Growing Inclination Towards Electric Vehicle Segment

In recent years the growing inclination of consumers towards electric and other sustainable fuel vehicle which is hindering the growth of automotive valves. Recently there is an steep decrease in sale of ICE vehicle which is negatively impacting the demand for automotive valve as they are majorly used in ICE vehicles. The decrease in sales of ICE vehicle is due to increasing focus towards reducing environmental pollution. Major regions worldwide, such as the U.S., European Union, China, India, Japan, and Australia, have implemented stringent rules and legislation regarding vehicle emissions, requiring automakers to implement cutting-edge technology in their products to reduce pollution from the vehicles.

In October 2022, the European Union proposed the Euro 7 standard, which focuses on reducing pollutants from vehicles to improve air quality. The proposal aims to reduce the pollutants from new vehicles sold in the region; the proposal aims to meet the European Union's zero pollution action plan. The European Union also anticipates that by 2035 all the cars sold in the European region will have zero C02 emissions.

Similarly, on July 2021, the Government of Japan set a target for all new cars sold in Japan to be environmentally friendly by 2035. The growth in strengthening regulation by government towards ICE vehicle are negatively impacting the sales of ICE vehicle and thus are anticipated to restrain the market for automotive electric coolant valve during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive valve market analysis from 2023 to 2033 to identify the prevailing automotive valve opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive valve market trends, key players, market segments, application areas, and market growth strategies.

Automotive Valves Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 51.9 billion |

| Growth Rate | CAGR of 7.1% |

| Forecast period | 2023 - 2033 |

| Report Pages | 280 |

| By Type |

|

| By Sales Channel |

|

| By Vehicle Type |

|

| By Component |

|

| By Region |

|

| Key Market Players | Valeo, AISIN CORPORATION, Hitachi Astemo, Ltd., BorgWarner Inc., MAHLE GmbH, Robert Bosch GmbH, DRiV, Continental AG, Eaton, DENSO CORPORATION |

Integration of lightweight materials are the upcoming trend in the automotive valve market.

Engine valves are the leading application of automotive valve market.

Asia-Pacific is the largest region for automotive valve market.

The automotive valve industry was valued at $26,631.0 million in 2023.

Denso Corporation, Hitachi Astemo, Ltd., BorgWarner Inc., Robert Bosch GmbH, Valeo S.A are some of the major companies operating in the market.

Loading Table Of Content...

Loading Research Methodology...