Autonomous Ships Market Summary

The global autonomous ships market size was valued at $89.3 billion in 2023, and is projected to reach $217.6 billion by 2033, growing at a CAGR of 9.5% from 2024 to 2033.

Key Market Trends and Insights

Region wise, Asia-Pacific generated the highest revenue in 2020.

The global autonomous ships market share was dominated by the hardware segment in 2020 and is expected to maintain its dominance in the upcoming years

The semiautonomous segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2023 Market Size: USD 89.3 Billion

- 2033 Projected Market Size: USD 217.6 Billion

- Compound Annual Growth Rate (CAGR) (2024-2033): 9.5%

- Asia-Pacific: Generated the highest revenue in 2020

Report Key Highlighters:

- The autonomous ships market growth covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($billion) for the projected period 2024-2033.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The autonomous ships market share is highly fragmented, into several players including WARTSIL, Northrop Grumman, ROLLS ROYCE, Kongsberg Maritime, MITSUI O.S.K. LINES, BAE Systems, L3Harris Technologies, Inc., Fugro, Hyundai Heavy Industries and Marine Technologies, LLC. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

Autonomous ships, also termed crewless ships, are equipped with software and hardware, and do not need human intervention for operation. They are equipped with components such as sensors, automated navigation, propulsion & auxiliary systems, GPS trackers, which enable ships to make decisions by analyzing different environmental conditions. Partially automated ships are monitored and controlled by off-board control centers, with human oversight. In addition, fully autonomous ships have advanced operating systems that enable them to make decisions and perform actions independently.

The global autonomous ships industry growth is driven by increase in demand for cargo transportation, surge in focus on reducing emissions, and increase in operational safety of ships. However, factors such as high development & operational cost and cybersecurity concerns hinder the growth of the market. On the contrary, advancement in real-time data sharing, connectivity solutions, and supportive regulatory frameworks are anticipated to offer lucrative opportunity for the growth for autonomous ships market during the forecast period.

A surge has been witnessed in the demand for transportation of cargo through water ways owing to increase in volume of cargo being transported by sea ways, as they are more economical. Moreover, cargo ships are less expensive for shipping goods as compared to other modes of transportation such as by road and air transits. By ships, more cargo is carried from one place to another within a short span of time. As per the records of UNCTAD, approximately 1.68 billion tons of cargo is transported every year in around 177.6 million containers covering 998 billion tons-miles. The recent developments in commercial vessels and the technological advancement by major players in the cargo ships equipped with latest technology such as advanced sensors, navigation systems, and other components, creates a growth opportunity for the autonomous ships market demand globally.

On May 14, 2024, the World Economic Forum announced that the global trade increased by more than two-fold in 2024 owing to low inflation and a booming U.S. economy. These statistics were in accordance with the data of three major international organizations including the International Monetary Fund, the Organization for Economic Co-operation & Development, and the World Trade Organization. The OECD anticipates that the global trade of goods and services is expected to grow by 2.3% in 2024 and 3.3% by 2025, which is more than double the 1% growth as compared to 2023. Meanwhile, the IMFs latest report on world economic outlook stated that the world trade is projected to grow at 3% and 3.3% for 2024 and 2025, respectively. Thus, the growing global trade is a major factor influencing the growth of autonomous ships market during the forecast period.

Key Developments

The leading companies have adopted strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- On June 2, 2023, Kongsberg Maritime announced its successful testing of autonomous vessel operations on Belgiums inland waterway network. As part of the test Zulu maneuvered and navigated on unrestricted waterways, to achieve this, the vessel was upgraded with onboard control technology, while an onshore remote operation center (ROC) provided support. The Zulu 4 completed a 16.5-kilometer circuit starting from a port in Niel on the Rupel River. The company also integrated autodocking, auto crossing, and automatic navigation systems. The company has developed cloud-based communications systems and advanced simulations to test and ensure that the vessel operated safely and optimally.

- On September 22, 2021, ROLLS ROYCE and Sea Machines partnered to develop smart ships and autonomous ship control solutions. According to the agreement, both the companies are expected to be working collaboratively to develop and expand the new mtu NautIQ marine automation portfolio, which is projected to include remote & autonomous control systems and offer complete automation solutions from a single source. The collaboration is projected to majorly focus on developing solutions for yachts as well as commercial and government vessels. In addition, as a part of the agreement, Rolls-Royce Power Systems is expected to receive sales and service rights for existing and future sea machines products.

Segmental Analysis

The autonomous ships market is segmented into level of autonomy, component, ship type, propulsion, and region. By level of autonomy, the market is bifurcated into semi-autonomous and fully autonomous. On the basis of component, the market is segregated into hardware and software. By ship type, the market is fragmented into commercial ships, defense ships, and passenger ships. By propulsion, the market is divided into fully electric and hybrid. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

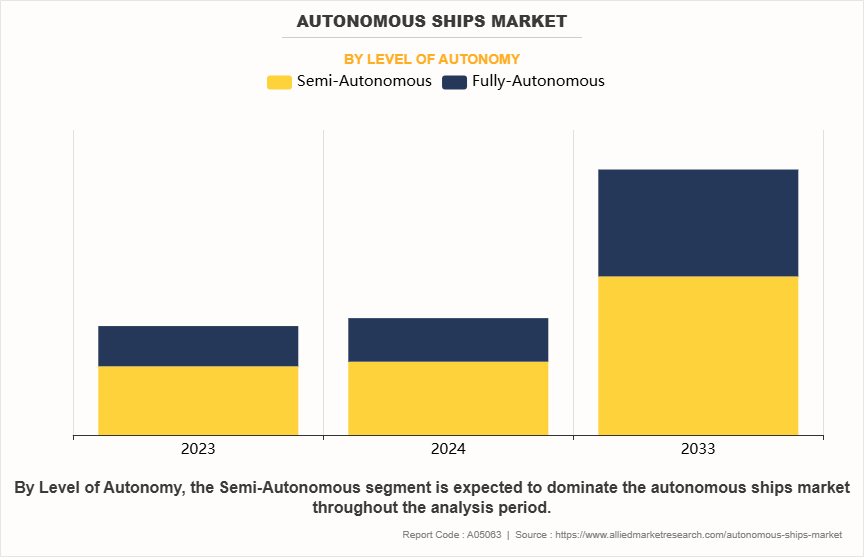

By Level of Autonomy

By level of autonomy, the market is segmented into semi-autonomous and fully autonomous. The semi-autonomous segment accounted for a dominant market share in 2023 as fully autonomous ships require advanced sophisticated technologies to handle all navigation, decision-making, and emergency responses. However, the technology is still developing, and there are concerns about its ability to handle unexpected situations, such as severe weather or equipment malfunctions without human intervention. Semi-autonomous ships benefit from having human operators who assist or take control when needed, improving overall safety. In addition, semi-autonomous systems are less expensive to develop and implement than fully autonomous solutions. Moreover, they require fewer changes to design vessels and are integrated more easily with existing fleet infrastructure.

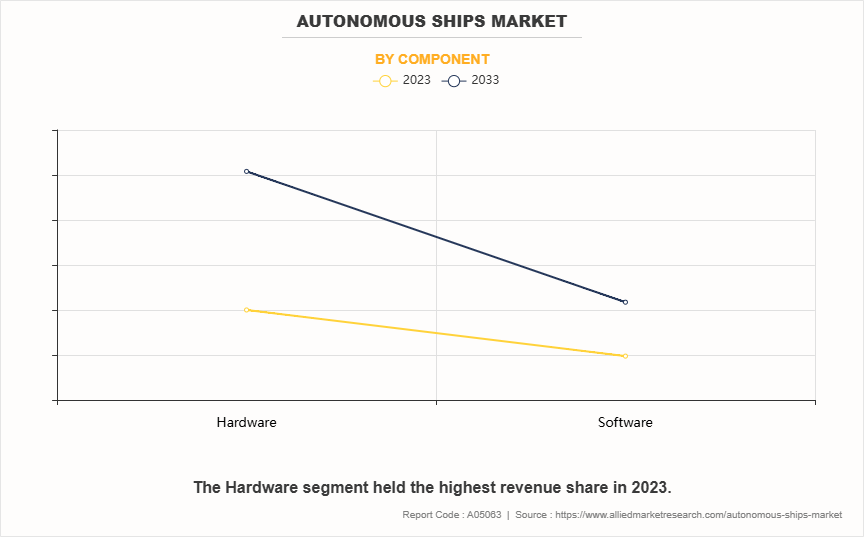

By Component

By component, the global autonomous ships market analysis is fragmented into hardware and software. The hardware segment accounted for a dominant market share in 2023 as autonomous ships are required to operate in harsh marine environments, where hardware must withstand extreme weather, saltwater corrosion, and constant motion. High-quality, durable hardware such as sensors, radar, and propulsion systems are essential for ensuring reliable operation over long distances and extended periods without direct human intervention. Moreover, autonomous ships handle vast amounts of real-time data from multiple sensors. Processing this data requires high-performance computing hardware that can deliver rapid responses.

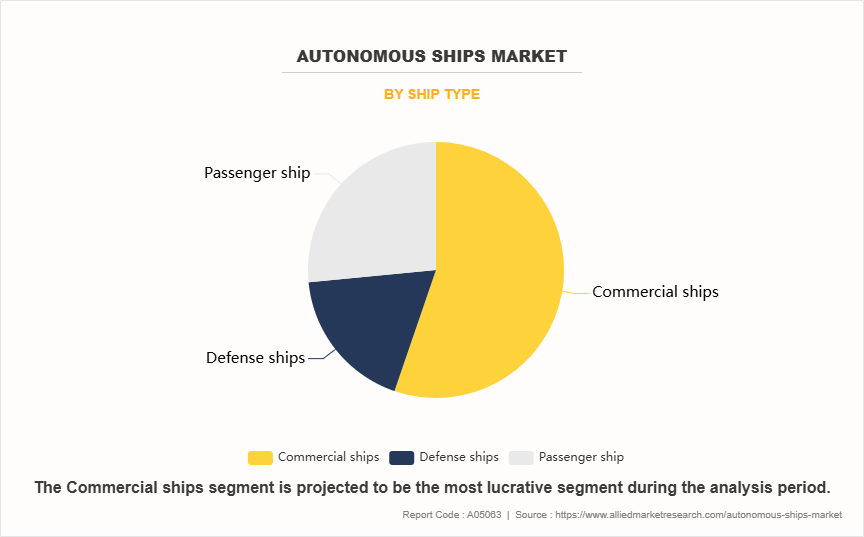

By Ship Type

On the basis of ship type, the global market is segregated into commercial ships, defense ships, and passenger ships. The commercial ship segment dominated the global market share in 2023, as in comparison to both defense and passenger shipping, the commercial shipping industry is substantially larger and has a wider range of operations. The global trade market involves extensive fleets of container ships, bulk carriers, and tankers that constantly move goods across international waters.

By Propulsion

By propulsion, the global autonomous ship market is fragmented into fully electric and hybrid. The hybrid propulsion segment accounted for a dominant market share in 2023 as fully electric ships are limited by current battery technology, which restricts their range and the duration they operate before needing to recharge. Hybrid ships, on the other hand, combine traditional fuel engines with electric power, enabling them to travel for longer distances without the need for frequent recharging, making them more suitable for long haul operations. Moreover, fully electric ships typically require expensive, high-capacity batteries, which add significant upfront costs. Hybrid ships, however, have lower battery requirements, resulting in a lower initial investment.

By Region

Region wise, North America held the largest market share in 2023, driven by several factors such as advancements in autonomous ship technology, strong investment in the sector, and a growing interest in enhancing operational efficiency and sustainability in the maritime industry. In addition, the U.S. Coast Guard and other regulatory bodies in North America, particularly in the U.S., are working to develop frameworks and standards that govern the use of autonomous vessels. This regulatory support aims to establish safe operational guidelines, particularly for testing and commercial use in inland and coastal waters. Furthermore, with rising labor and fuel costs, there is a strong demand for cost effective automated shipping solutions as they offer improved fuel efficiency, and reduced labor costs.

Growing Focus on Reducing Emissions

In recent years, there has been a growing inclination towards reducing emission from the shipping industry. According to an estimate the shipping industry, responsible for approximately 3% of global greenhouse gas emissions, and the industry is under increasing pressure to meet ambitious climate goals. To decrease emissions from ships manufacturers are developing energy efficient ship designs, optimize routes, and use of alternative fuels to lower fuel costs, to further reduce emission.

On, July 2023, the International Maritime Organization revised its initial greenhouse gas emissions reduction strategy. The new strategy sets a goal of net zero emissions from ships by the year 2050. The new strategy has also been set at reducing GHG emissions from ships by at least 20% by 2030 and at least 70% by 2040. Thus, the increasing focus on reducing emissions is anticipated to be the major driving factor for the growth of the autonomous shipping industry.

Growing Advancement in Real-Time Data Sharing and Connectivity Solutions

A surge in trend of integrating real-time data sharing in autonomous vehicles has been witnessed as it is used to improve navigation capabilities, operational efficiency, and overall safety of ships. Autonomous ships rely on real-time data from sensors, radars, cameras, and satellites to optimize routes and increase the efficiency of ships. Moreover, real time data allows monitoring the status of autonomous vessels and remote diagnostics. Moreover, autonomous ships are capable of sharing real-time data for coordinated operations, such as maintaining optimal distances, optimizing fuel usage, and synchronizing docking schedules with other autonomous ships. There are various satellite systems such as Inmarsat, Iridium, and SpaceX Starlink which provides global coverage to ships and vessels, thus the growing advancement in real time data sharing and growth of connectivity solution offers lucrative opportunity for the autonomous ships market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the autonomous ships industry analysis from 2023 to 2033 to identify the prevailing opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities for autonomous ships market forecast.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of autonomous ships market opportunities, market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global autonomous ships market trends, key players, market segments, application areas, and market growth strategies.

Autonomous Ships Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 217.6 billion |

| Growth Rate | CAGR of 9.5% |

| Forecast period | 2023 - 2033 |

| Report Pages | 278 |

| By Level of Autonomy |

|

| By Component |

|

| By Ship Type |

|

| By Propulsion |

|

| By Region |

|

| Key Market Players | Hyundai Heavy Industries, Northrop Grumman, Kongsberg Maritime, BAE Systems, WÄRTSILÄ, Rolls Royce, L3Harris Technologies, Inc., Marine Technologies, LLC, MITSUI O.S.K. LINES, FUGRO |

| DEVICE PROVIDERS | SEA MACHINES ROBOTICS, INC., NEPTEC TECHNOLOGIES CORP, INTEL CORPORATION, GOOGLE (ALPHABET INC.), SHONE AUTOMATION INC, BUFFALO AUTOMATION |

Integration of artificial intelligence and machine learning are the upcoming trend in the autonomous ship market.

Commercial ships is the leading application of autonomous ships.

North America is the largest regional market for autonomous ships.

The autonomous ship industry was valued at $89.3 billion in 2023.

WÄRTSILÄ, Northrop Grumman, ROLLS ROYCE, Kongsberg Maritime are some of the major companies operating in the autonomous ships market.

Loading Table Of Content...

Loading Research Methodology...