Autonomous Vehicle Market Insights, 2040

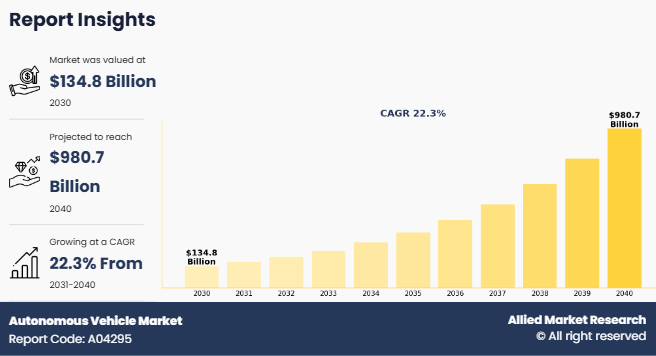

The global autonomous vehicle market size was valued at $134.8 billion in 2030, and is projected to reach $980.7 billion by 2040, growing at a CAGR of 22.3% from 2031 to 2040.

One of the important factors such as advancements in sensors, artificial intelligence, and connectivity are driving the development of self-driving cars. Safety concerns and the need to reduce road accidents are key reasons for their growing use. There is also increasing demand for faster, more efficient transportation, solutions to reduce traffic jams, and eco-friendly mobility options, all of which are boosting the market. This creates opportunities for companies to work on software, sensors, and infrastructure needed for autonomous vehicles. As rules become clearer and people become more open to the idea, the market for self-driving cars offers great potential for innovation and big changes in the automotive industry. However, lack of steady regulatory framework are restraining the market growth.

Autonomous vehicles, or self-driving cars, are a innovative improvement in the automotive sector. They are designed to work without human control, using technologies like sensors, cameras, radar, and artificial intelligence. These vehicles aim to make transportation safer, more efficient, and convenient. They can find their way, understand their surroundings, and make quick decisions, which could help reduce accidents, ease traffic, and offer mobility to people who have difficulty driving.

Report Key Highlighters

• The autonomous vehicle industry studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value available from 2031 to 2040.

• The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

• The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

• The autonomous vehicles market share is marginally fragmented, with players such as Waymo, Tesla Inc., General Motors, Aurora Innovation, Hyundai, Uber, Toyota Motor Corporation, Renault Group, AB Volvo, Valeo. Major strategies such as contracts, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Market Dynamics

Increased adoption of connected infrastructure due to advancement in technology

Technological advances have resulted in the growth of connected infrastructure, which drives autonomous vehicle market share. Automation technologies are used in autonomous vehicles that enable them to stay connected, such as sensors, machine learning systems, processors, RADAR, LiDAR, cameras, and other hardware and software. Autonomous vehicle technology facilitates the seamless coordination of an autonomous driving system to retain complete control over the vehicle and perceive the external environment. Similar to humans, autonomous vehicles need the ability to analyze judgments, interpret sensory data, and make informed decisions to respond intelligently to external factors. Autonomous vehicle technology plays a pivotal role in enabling these capabilities. Intelligent transportation systems are used that allow autonomous vehicles to plan and manage operations to optimize traffic flow. The focus on urban connectivity solutions drives the growth of autonomous vehicles as the deployment of LTE/5G small cells and public Wi-Fi end-to-end architectures is being implemented in both newly constructed and retrofitted modular street infrastructure assets.

Many of the federal state government have invested in the development of autonomous car infrastructure for instance in May 2023, USD 9.85 million federal grant was awarded to the University of Michigan by the U.S. Department of Transportation Federal Highway Administration to spur connected vehicle research. This project is considered part of the infrastructure of the federal government. Moreover, the U.S. is set to channel $200 billion in funding toward international infrastructure initiatives through its approach, the Partnership for Global Infrastructure and Investment (PGII). The collective target for investments, which includes contributions from G7 nations and private entities, aims to reach a total of $600 billion by the end of 2025.Such factors are fueling the autonomous vehicle industry demand during the forecast period of 2024-2033.

Lack of steady regulatory framework

The global autonomous vehicle market lacks clear and consistent regulations. Different rules across regions create confusion and make it harder to roll out self-driving vehicles widely. Factors such as legal responsibility, safety standards, and compliance add to these challenges and can slow adoption. Despite advancements, autonomous vehicles also face technical problems. Bad weather, busy city streets, and unpredictable situations are still difficult for these systems to handle. Achieving full autonomy for all driving conditions remains a big obstacle.

In September 2023, California Governor Gavin Newsom rejected a bill that required human drivers to be present in self-driving trucks. Union leaders and truck drivers supported the bill, saying it would protect thousands of jobs. The proposed law aimed to stop self-driving trucks, over 10,000 pounds, including delivery vans and big rigs, from operating on public roads without a human driver.

Urbanization and Need for Efficient Mobility Solutions

The rapid growth of cities and the need for better transportation solutions are key factors driving the autonomous vehicle market. As urban areas expand, problems such as traffic jams, air pollution, and limited parking are becoming more common. Self-driving cars offer a way to tackle these issues by improving transportation efficiency and reducing the number of vehicles on the road.

Autonomous vehicles can optimize routes, ease traffic flow, and cut down on idle time, helping to reduce congestion. Ride-sharing services using self-driving cars can also lower the need for personal car ownership, leading to fewer cars and less traffic in cities. Many of these vehicles are electric, which helps reduce emissions and improve air quality. Governments and urban planners are recognizing these advantages and supporting autonomous vehicles with new infrastructure, policies, and incentives. As cities grow and the demand for efficient transportation increases, autonomous vehicles are playing an important role in solving urban mobility challenges and boosting market growth.

Segment Review

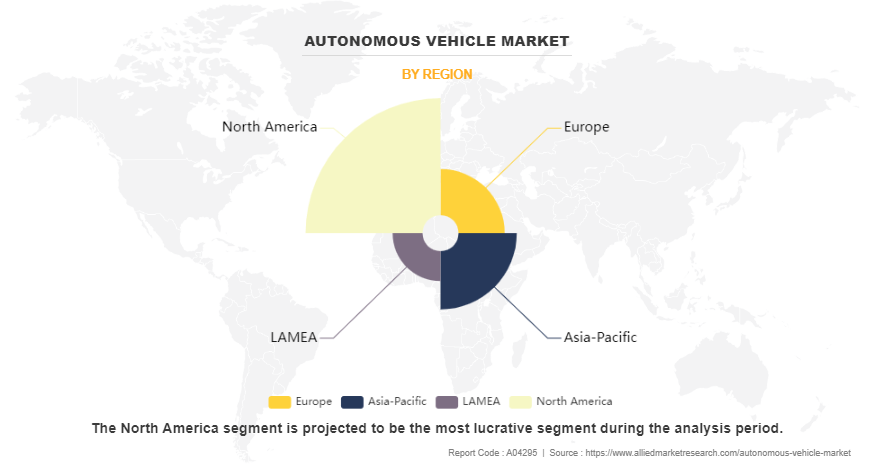

The autonomous vehicle market is segmented into mobility type, level of automation, component, application and region. By mobility type, the market is divided into shared and personal. On the basis of level of automation, the market is classified into level 3,level 4 and level 5. On the basis of component, the market is divided into software and hardware. On the basis of vehicle type, the market is bifurcated into passenger cars and commercial vehicles. Region-wise, the autonomous vehicles market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

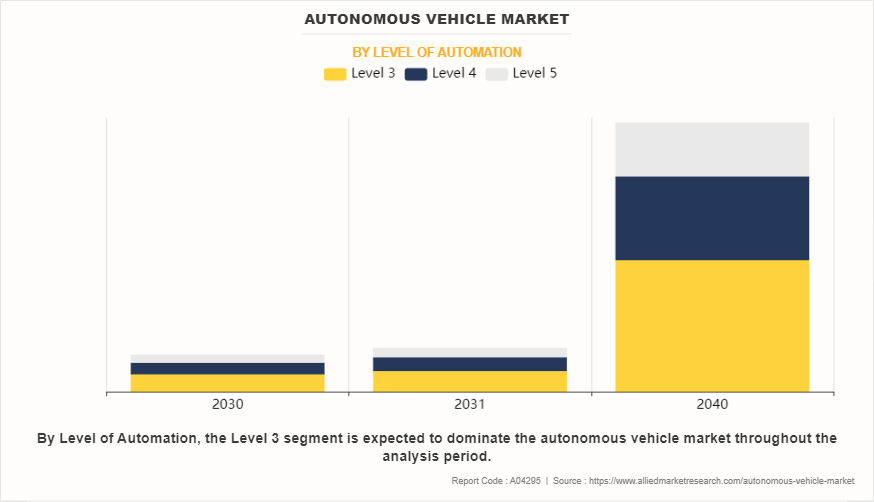

By Level of Automation

On the basis of level of automation, the autonomous vehicle industry is classified into level 3,level 4 and level 5. Level 3 segment generated the largest revenue in 2023.The increasing global population and rising transportation demands, combined with advancements in technology, have greatly accelerated the autonomous vehicle market demand. The rapid adoption of self-driving technologies is fueled by numerous advantages, including enhanced road safety, reduced traffic accidents, improved fuel efficiency, lower carbon emissions, and increased convenience for users. Autonomous vehicles also offer solutions for individuals with limited mobility and reduce human error in driving. These benefits are driving the growing demand for autonomous vehicle market forecast.

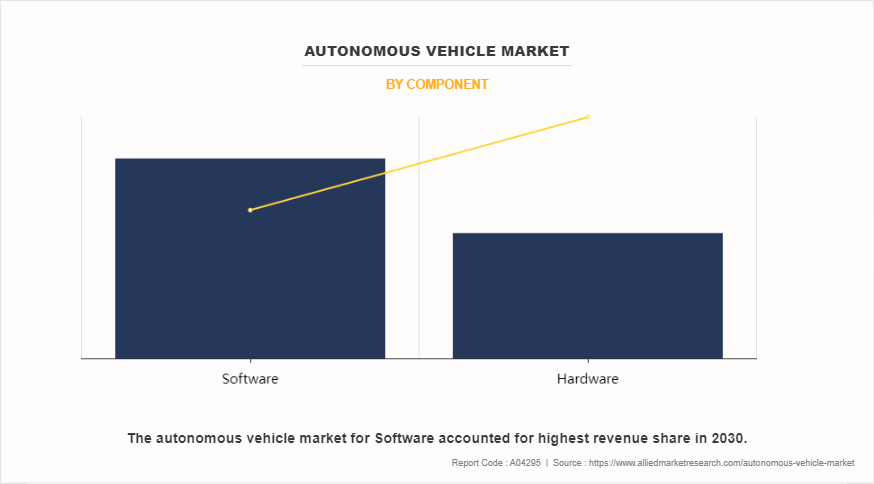

By Component

On the basis of component, the market is divided into software and hardware. Software segment accounted for the largest share in 2023. Owing to its critical role in enabling advanced functionalities, seamless integration, and automation across various industries. The growing adoption of AI, machine learning, and data analytics further bolstered the demand for software solutions, as businesses increasingly relied on these technologies to enhance efficiency and decision-making. Additionally, the need for customized software tailored to specific applications and the rise of SaaS (Software as a Service) models contributed significantly to the segment's dominance in 2023.

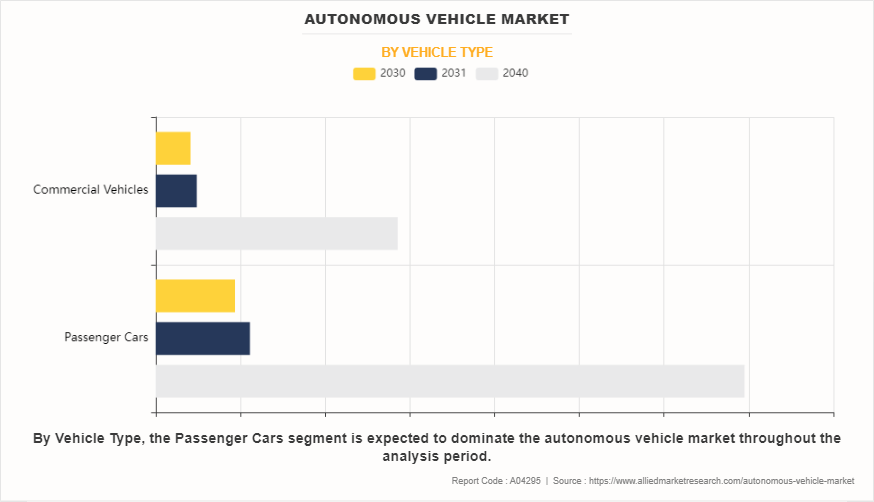

By Vehicle Type

On the basis of vehicle type, the autonomous vehicle market analysis is bifurcated into passenger cars and commercial vehicles. Passenger cars generated the largest revenue in 2023. This growth is driven by the rising demand for personal mobility, increasing disposable incomes, and growing urbanization across key regions. The shift towards electric and hybrid passenger vehicles further accelerated this growth, as governments worldwide introduced incentives and subsidies to promote eco-friendly transportation solutions. Additionally, advancements in connected car technologies and the integration of advanced driver-assistance systems (ADAS) enhanced the appeal of passenger cars, attracting a larger consumer base.

By Region

Region-wise, the autonomous vehicles market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). North America generated the largest share in 2023. This is growth is primarily due to the region's robust technological infrastructure, high consumer spending power, and widespread adoption of advanced solutions across various industries. The presence of key market players and strong investments in research and development further bolstered the region's leadership. Additionally, the growing demand for sustainable and energy-efficient technologies, coupled with favorable government policies and incentives, played a pivotal role in driving market for autonomous vehicles.

Competitive Analysis

Competitive analysis and profiles of the major global autonomous vehicles market players that have been provided in the report include Waymo, Tesla Inc., General Motors, Aurora Innovation, Hyundai, Uber, Toyota Motor Corporation, Renault Group, AB Volvo, Valeo, Nuro. The key strategies adopted by the major players of the global autonomous vehicles market are product launch and mergers & acquisitions.

Top Impacting Factors

The global autonomous vehicles market is expected to witness notable growth registering a CAGR of 22.3%. The market for autonomous vehicles is expected to witness significant growth due to increased adoption of connected infrastructure due to advancement in technology. However, lack of steady regulatory framework is restricting the market growth. Moreover, urbanization and need for efficient mobility solutions will create lucrative autonomous vehicle market opportunity.

Historical Data & Information

The global autonomous vehicles market is competitive, owing to the strong presence of existing vendors. Vendors in the global autonomous vehicles industry report with extensive technical and financial resources are expected to gain a competitive advantage over their competitors as they can cater to market demands, which are higher than the supply. The competitive environment in this market is expected to increase owing to technological innovations, product extensions, and different strategies adopted by key vendors.

Key Developments/Strategies in Autonomous Vehicles

In May 2023, Valeo partnered with DiDi Autonomous Driving through a strategic collaboration and investment agreement to develop advanced safety solutions for L4 robotaxis. The collaborative effort between the two entities focuses on crafting intelligent safety solutions for L4 robotaxis.

In August 2023, Baidu expanded its autonomous ride-hailing platform, Apollo Go, to Wuhan Tianhe International Airport, extending its driverless car services.

In October 2023, Uber did partnership with Waymo, the autonomous car company under Google's parent company, Alphabet. Phoenix has become the inaugural city where Uber has officially introduced access to Waymo's autonomous cars. Waymo vehicles are responsible for providing the autonomous rides offered by Uber and the pricing for these rides is consistent with traditional car rides provided by Uber.‐¯

In October 2022, Ford decided to develop lower-level automated driving technology in-house instead of collaborating with Argo, whose L4 technology lacked steering wheels, brakes, or accelerator pedals. The technology designed for vehicles by Argo lacked steering wheels, brakes, or accelerator pedals (referred to as L4 technology).

In December 2022, Apple enhanced its self-driving objectives for the forthcoming electric vehicle, opting to delay the vehicle’s targeted launch date by approximately one year to 2026.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the autonomous vehicle market size analysis from 2030 to 2040 to identify the prevailing autonomous vehicle market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the autonomous vehicle market growth segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The autonomous vehicles industry report analysis of the regional as well as global autonomous vehicle market trends, key players, market segments, application areas, and market growth strategies.

Autonomous Vehicle Market Report Highlights

| Aspects | Details |

| Market Size By 2040 | USD 980.7 billion |

| Growth Rate | CAGR of 22.3% |

| Forecast period | 2030 - 2040 |

| Report Pages | 213 |

| By Level of Automation |

|

| By Component |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | AB Volvo, Hyundai Motor Group, Tesla, Inc., General Motors, Renault SA, Mercedes-Benz AG (Daimler AG), Toyota Motor Corporation, Bayerische Motoren Werke AG (BMW AG), Volkswagen Group, Ford Motor Company |

Analyst Review

An autonomous car is a vehicle that senses its environment and navigates without human input. Presently, there is an increase in demand for the autonomous vehicles from developed countries such as the U.S, Canada, and others. Companies in this industry adopt various techniques to provide customers with advanced and innovative product offerings.

Autonomous vehicles use less battery capacity & less consumption of gas, which reduces pollution. In addition, development in automotive sector, demand for luxury cars, and government regulation also contribute to the market growth. However, high cost and the burgeoning threat from hackers in driving operation impede the growth of the market. In future, rise in investment for smart cars, and favorable government regulations are expected to create lucrative opportunities for the key players operating in the autonomous vehicle market.

Among the analyzed geographical regions, North America is expected to account for the highest revenue in the global market throughout the forecast period (2019-2026) followed by Asia-Pacific, Europe, and LAMEA. However, Europe is expected to grow at a higher growth rate, predicting a lucrative market growth for autonomous vehicle.

General Motors, Daimler AG, Ford Motor Company, Volkswagen Group, BMW AG, Renault-Nissan-Mitsubishi Alliance, Volvo-Autoliv-Ericsson-Zenuity Alliance, Groupe SA, AB Volvo, Toyota Motor Corporation, and Tesla Inc. Other companies listed in accordance with auto suppliers are Robert Bosch GMBH, Aptiv, Continental AG, Denso Corporation. Also, by technology providers the list includes Waymo, NVDIA Corporation, Intel Corporation, Baidu, and Samsung. And based on autonomous vehicle as service provider, it includes Uber, Lyft, and Didi Chuxing. These are the key market players that occupy a significant revenue share in the autonomous vehicle market.

The passenger cars are the leading vehicle type of autonomous vehicle market.

The upcoming trends of Autonomous Vehicle Market in the globe includes increased adoption of connected infrastructure due to advancement in technology.

North America is the largest regional market for autonomous vehicle market.

The autonomous vehicle market was valued at $134.8 billion in 2030, and is estimated to reach $980.7 billion by 2040, growing at a CAGR of 22.3% from 2031 to 2040.

Waymo, Tesla Inc., General Motors, Aurora Innovation, Hyundai are the top companies to hold the market share in Autonomous Vehicle.

Loading Table Of Content...

Loading Research Methodology...