Autotransfusion Devices And Consumables Market Outlook - 2026

Blood transfusion is a process of transferring of blood or blood components from a donor to a receiver intravenously. This process is used to replace the loss of blood count during various medical conditions. Blood transfusions are of two types—allogeneic blood transfusion and autologous blood transfusion. Allogeneic blood transfusion involves transfusion of blood from a donor to a recipient. Whereas, autotransfusion is a process of autologous blood transfusion in a patient’s body during a cardiac or orthopedic surgery, patient receives its own blood after component separation, washing, and filtration. After purification is complete, the blood is reinfused into the patient’s body. The risk of postoperative transfusion transmitted infection is very low in autologous blood transfusion as compared to allogeneic blood transfusion, which has a higher chance of transfusion transmitted infection. The global autotransfusion devices and consumables market size was valued at $864 million in 2018 and is estimated to reach $1,380 million by 2026, growing at a CAGR of 6.1% from 2019 to 2026.

There are three different methods of autologous transfusion. These include cell salvage, preoperative autologous donation, and acute normovolemic hemodilution or ANH. In cell salvage method, the blood is pumped out from the patient’s body and is infused back during the surgery. Cell salvage method can be further bifurcated into intraoperative and postoperative cell savage method. Preoperative autologous donation or PAD involves the donation of blood by a patient, which can be used by themselves in future. PAD involves is mostly used in hip replacement, hysterectomy, and total knee replacement surgeries. Acute normovolemic hemodilation is blood conservation technique in which the blood from the patient is removed after inducing anesthesia while maintaining the normal volume of blood in the body using crystalloid or colloidal replacement.

The global autotransfusion devices and consumables market is driven by increased prevalence of cardiac and vascular diseases, transplantation related infections, higher preference of people for autotransfusion technique over allogeneic due to higher chances of graft versus host disease induced infection, rise in the number of orthopedic, cardiac and vascular surgeries, and technological advancements in the development of autotransfusion devices and consumables. Furthermore, untapped market potential in developing regions with more population and lack of healthcare amenities is expected to provide lucrative opportunities for autotransfusion devices and consumables market trends. However, higher cost related with devices used for autotransfusion and its maintenance is expected to restrain the autotransfusion devices and consumables market growth as people in a developing nation would opt for allogeneic blood transfusion technique due to its cost effectiveness.

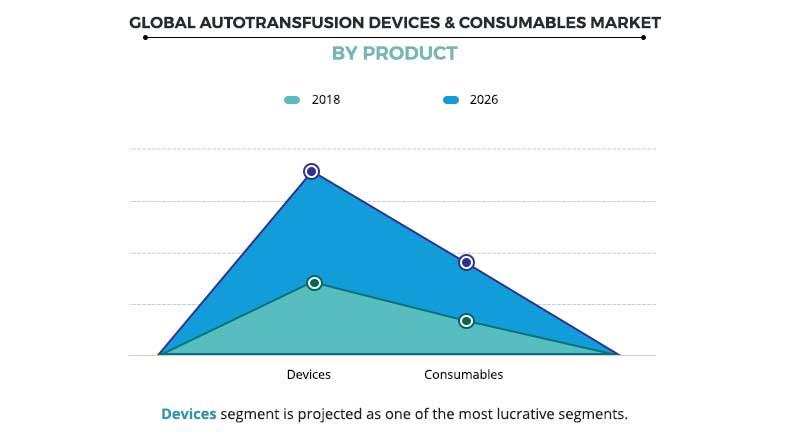

Product type segment review

Based on product type, the autotransfusion devices and consumables market can be segmented into devices and consumables. Devices can be further bifurcated into on pump transfusion devices and off pump transfusion devices. According to product type, the devices segment accounted for the highest share in 2018, whereas consumables is expected to be the fastest growing segment during the forecast period for global autotransfusion devices and consumables market. However, consumables used during the autotransfusion method are disposed and nor reused; thus, this segment is expected to be the fastest growing sector in the product type segment during the forecast period. The factors contributing toward the growth of autotransfusion devices and consumables market include lesser risk of transfusion transmitted infection, efficiency, and edge over other blood transfusion devices.

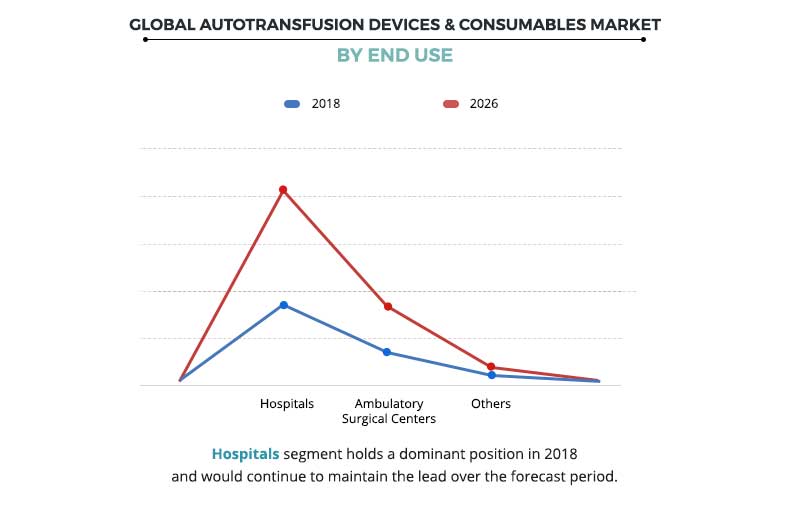

End Use segment review

Based on end use, the global autotransfusion devices and consumables market is segmented into hospitals, ambulatory surgical settings, and others. Among the end use, hospitals segment is the highest contributor for the end use segment and is expected to propagate at a higher growth rate owing to the preference over other centers owing to the availability of better autotransfusion facilities and patient care. However, ambulatory surgical settings is expected to be the fastest growing segment for global autotransfusion devices and consumables market.

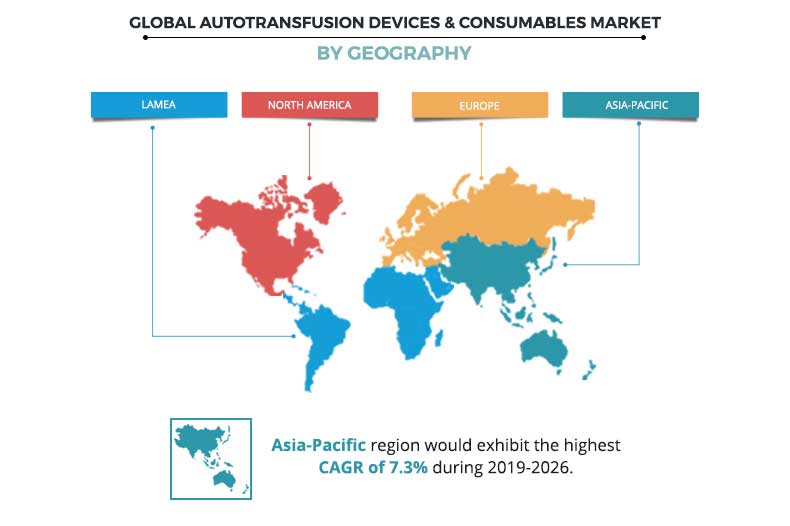

Region segment review

Based on regional presence, the global autotransfusion devices and consumables market is segmented into—North America, Europe, Asia-Pacific, and LAMEA. North America is the leading region for the global autotransfusion devices market due to better health care infrastructure and facilities, rise number of patient suffering from cardiovascular, orthopedic diseases, and increase in geriatric population, leading to a higher probability for the transplantation of organs. Emerging market such as LAMEA is expected to experience delayed growth owing to poor infrastructure and healthcare facilities along with lack of awareness amongst the population. Most of the developed countries have adopted autotransfusion technique, devices and consumables owing to the emphasis by the government bodies due to lesser risk of transfusion transmitted infection which has propelled the market growth throughout the autotransfusion devices and consumables market forecast period.

The report provides a comprehensive analysis of the key players operating in the global autotransfusion devices and consumables market. These players are Haemonetics, Becton, Dickinson and Company, Brightwake, Getinge AB, Fresenius Kabi, LivaNova, Medtronic, Advancis Surgical and Stryker.

Key Benefits for Autotransfusion Devices And Consumables Market:

- This report entails global autotransfusion devices and consumables market analysis along with the current trends from 2019 to 2026 to identify the prevailing opportunities along with the strategic assessment.

- The global autotransfusion devices and consumables market is studied from 2019 to 2026.

- The global autotransfusion devices and consumables market size and estimations are based on a comprehensive analysis of key developments in the industry.

- A qualitative analysis of global autotransfusion devices and consumables market share based on innovative products facilitates strategic business planning.

- The development strategies adopted by the key market players are enlisted to understand the competitive scenario of the market.

Autotransfusion Devices and Consumables Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | LivaNova PLC, Becton, Dickinson and Company (C.R. Bard), Haemonetics Corporation, Stryker, Medtronic Plc., Fresenius, Getinge AB, Brightwake Ltd. |

Analyst Review

The technological advancements in the autotransfusion devices and adoption of the same during different surgeries such as cardiac, orthopedic, and vascular surgeries by healthcare professionals propelled the growth of the autotransfusion devices and consumables market. Moreover, autotransfusion devices and consumables market is anticipated to witness significant growth due to increase in cases of cardiovascular, orthopedic, and other diseases. In addition, the improvement in healthcare infrastructure in the developing nations with rise in government support for better healthcare facilities allow lucrative opportunities for the growth of this market. Furthermore, the autotransfusion devices and consumables market has gained immense interest of the healthcare industry due to its high importance and affordability in surgeries. Asia-Pacific is projected to register highest growth rate in the global autotransfusion devices & consumables market due to massively increasing population, higher prevalence of diseases, and growth in the healthcare market.

Autotransfusion devices and consumables have gained popularity in developing countries, as it is the most cost effective and time efficient for cardiac, trauma, and orthopedic surgeries. However, failure in qualitative purification of blood adverse effects in few patients are expected to restrain the market growth.

North America was the leading revenue contributor to the global autotransfusion devices and consumables market in 2018 and is expected to remain dominant throughout the forecast period. This is attributed to the increase in demand due to rise in safety concerns for transfusion transmitted infections caused during to allogeneic transfusion and preference of autotransfusion devices and consumables over allogeneic transfusion. However, Asia-Pacific is expected to grow at the highest CAGR during the study period, as it offers lucrative opportunities for the market players due to robust growth medical devices and consumables industry in the region.

Loading Table Of Content...