Oilfield Auxiliary Rental Equipment Market Research, 2030

The global oilfield auxiliary rental equipment market size was valued at $28.3 billion in 2020, and is projected to reach $42.9 billion by 2030, growing at a CAGR of 4.1% from 2021 to 2030. Oilfield equipment are used for supporting activities at oilfields, including drilling, power supply, transportation of materials, and pressure & flow control. These supporting processes are required in all major functions at oil fields. Oil extraction companies avail such oilfield equipment on rent or on a project basis by rent. The oilfield equipment consists sewage systems, mud labs, flow systems, distribution panels, storage tanks, debris junk catchers, transportation system, heat exchangers, flaring systems, and drilling instruments.

Lockdown imposed due to the outbreak of COVID-19 pandemic resulted in temporary ban on import & export and manufacturing & processing activities across various industries, which decreased the demand for oil & gas products from consumers. This resulted in decline in oilfield auxiliary rental equipment market growth in the second, third, and fourth quarters of 2020. However, the oilfield auxiliary rental equipment market was recovered in the second quarter of 2021 as COVID-19 vaccination had started in various countries across the globe, which improved the global economy.

The growth of the global oilfield auxiliary rental equipment market is driven by rise in demand for oil & gas from various operations in end users, such as transportation, manufacturing, and power generation . However, implementation of stringent government regulations toward environmental pollution from conventional fuels and rapid development of the electric vehicle industry are the key factors hampering the growth of the oilfield auxiliary rental equipment market. On the contrary, R&D toward improvement of oilfield exploration and production technologies, discovery of new oilfields in Asia-Pacific & Africa, and development of shale producing fields in North America are anticipated to provide lucrative opportunities for the key players to maintain their position in the market in the future.

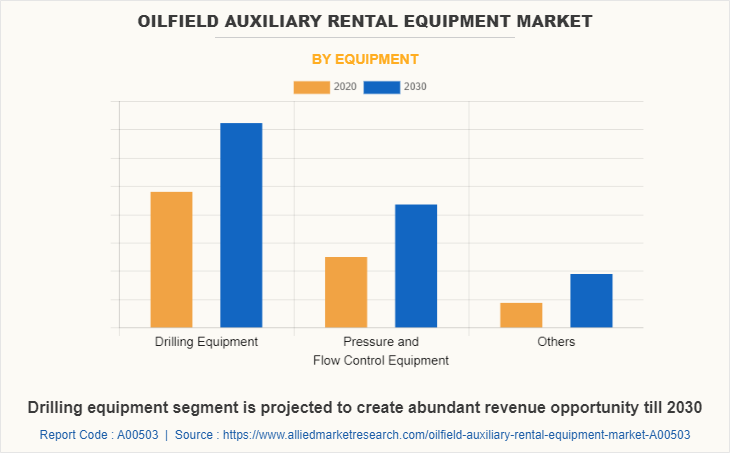

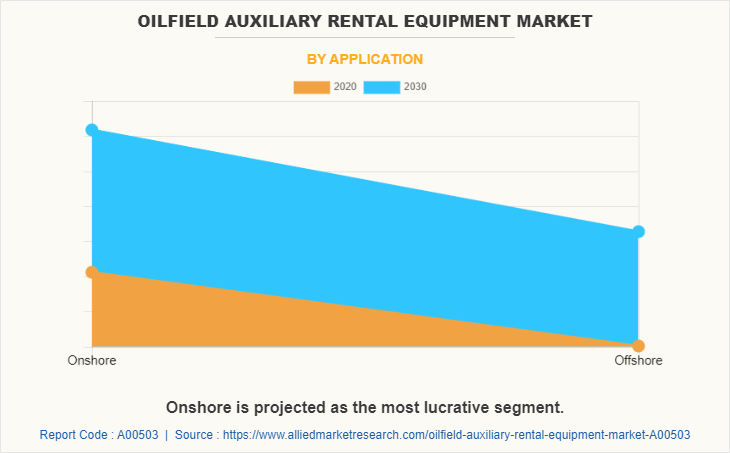

The oilfield auxiliary rental equipment market is segmented on the basis of equipment, application, and region. Depending on equipment, it is classified into drilling equipment, pressure & flow control equipment, and others. According to application, it is divided into onshore and offshore. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The global market covers in-depth information of the major oilfield auxiliary rental equipment industry participants. Some of the major players in the market include Halliburton Company, Schlumberger Limited, Weatherford International Plc., Key Energy Services, Ensign Energy Services Inc., Parker Drilling Company, Superior Energy Services, Inc., Oil States International, TechnipFMC, and Odfjell Drilling.

The other players operating in the value chain of the global oilfield auxiliary rental equipment market are John Energy Limited, Savanna Energy Corporation, Basic Energy Services, Inc., Bestway Oilfields & Gas Equip. LLC, Circle T Service & Rental Ltd., Certified Oilfield Rentals LLC, and Seadrill Ltd.

The key players adopt numerous strategies, including agreement, partnership, acquisition, and business expansion to stay competitive in the oilfield auxiliary rental equipment market.

For instance, in May 2021, Odfjell Drilling signed an agreement with Baker Hughes and BP Plc. for transforming platform drilling and completions activity at the Clair field, 75 km (47 mi) west of Shetland. Through this agreement, Odfjell Drilling will provide integrated services covering equipment rental, wellbore clean up, and tubular running services on three of BP’s platforms in the UK North Sea.

Depending on equipment, the drilling equipment segment held the largest oilfield auxiliary rental equipment market share in 2020. This is attributed to rise in number of oil & gas exploration and production activities in the countries, including North America, Asia-Pacific, and Africa. In addition, rise in awareness of maintenance and recovery of aged & abandoned oil wells to enhance production propels the growth of oilfield auxiliary rental equipment market.

On the basis of application, the onshore segment exhibited the highest market share in 2020. This is attributed to increase in efficiency of onshore exploration & production compared to offshore wells and rise in number of developed onshore oil wells across the globe. In addition, presence of large number of onshore sites in the countries, including the U.S., Middle East, and Southeast Asia propels the market growth, as onshore sites are easily operatable and take less years for production in comparison to offshore. Moreover, 70% of the world’s oil & gas come from onshore sites, which notably contribute to the growth of the oilfield auxiliary rental equipment market.

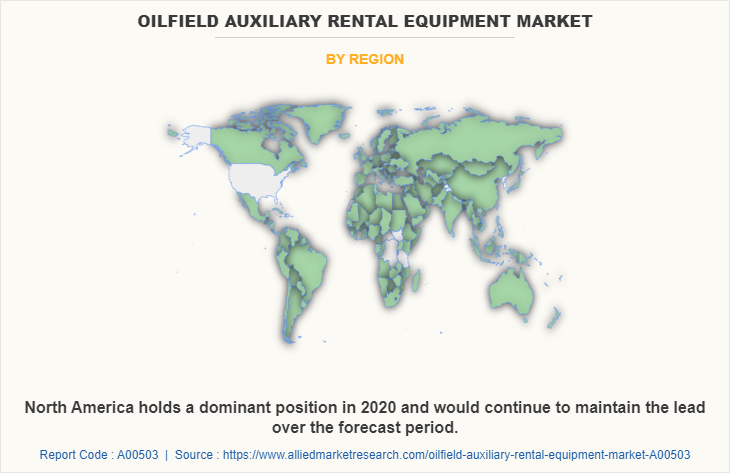

North America garnered the highest share in the oilfield auxiliary rental equipment market in 2020, in terms of revenue, and is anticipated to maintain its dominance during the oilfield auxiliary rental equipment market forecast period. This is attributed to the presence of key players and huge consumer base in the region. In addition, rise in number of new exploration fields, improvements in shale oil production in North America, and rise in oilfield services in onshore oilfields to enhance the productivity fuel the growth of the global oilfield auxiliary rental equipment market during the forecast period.

The oilfield auxiliary rental equipment market is analyzed and estimated in accordance with the impacts of the drivers, restraints, and opportunities. The period studied in this report is 2021–2030. The report includes the study of the oilfield auxiliary rental equipment market with respect to the growth prospects and restraints based on regional analysis. The study includes Porter’s five forces analysis of the industry to determine the impact of suppliers, competitors, new entrants, substitutes, and buyers on the market growth.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the oilfield auxiliary rental equipment market analysis from 2020 to 2030 to identify the prevailing oilfield auxiliary rental equipment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the oilfield auxiliary rental equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global oilfield auxiliary rental equipment market trends, key players, market segments, application areas, and market growth strategies.

Oilfield Auxiliary Rental Equipment Market Report Highlights

| Aspects | Details |

| By Equipment |

|

| By Application |

|

| By Region |

|

| Key Market Players | Key Energy Services, Inc., Superior Energy Services, Inc., Schlumberger Limited, Oil States International, Odfjell Drilling, Halliburton Company, TechnipFMC, Weatherford International, Plc, Parker Drilling Company, Ensign Energy Services, Inc |

| OTHER PROMINENT VENDORS | The Olayan Group, Key Energy Services Inc. |

Analyst Review

According to the CXOs of leading companies, rapid industrialization is the key factor attributed to the leading position of North America and Asia-Pacific in the global oilfield auxiliary rental equipment market. North America is expected to provide lucrative growth opportunities to leading oilfield equipment providers, owing to its huge potential to enhance exploration & production activities and surge in demand for petroleum products across the globe.

Increase in demand for conventional fuels, including petrol, diesel, kerosene, and others from the transportation and power generation industry drives the growth of the global oilfield auxiliary rental equipment market during the forecast period. However, implementation of stringent government regulations toward environmental pollution, owing to the use of petroleum products is expected to hamper the growth of the market during the forecast period. On the contrary, use of smart control systems in oilfield equipment and R&D toward efficient oilfield services are anticipated to provide remunerative growth opportunities for the key players to maintain the pace in the oilfield auxiliary rental equipment market in the future.

Among the analyzed regions, North America is expected to account for the highest revenue in the market by the end of 2030, followed by LAMEA, Asia-Pacific, and Europe.

Rise in offshore exploration and production activities, technological advancements in oilfield equipment, rise in investment towards drilling activities in Asia-Pacific region are the upcoming trends of Oilfield Auxiliary Rental Equipment Market

Onshore is expected to be the leading application of Oilfield Auxiliary Rental Equipment Market

North America is the largest regional market for Oilfield Auxiliary Rental Equipment Market

Halliburton Company, Schlumberger Limited, Weatherford International Plc., Key Energy Services, Ensign Energy Services Inc., Parker Drilling Company, Superior Energy Services, Inc., Oil States International, TechnipFMC, and Odfjell Drilling are the top companies to hold the market share in Oilfield Auxiliary Rental Equipment Market

Oilfield Auxiliary Rental Equipment Market was valued at $28.3 billion in the year 2020 and is estimated to reach $42.9 billion by 2030 at a CAGR of 4.1% during the forecast period

Loading Table Of Content...