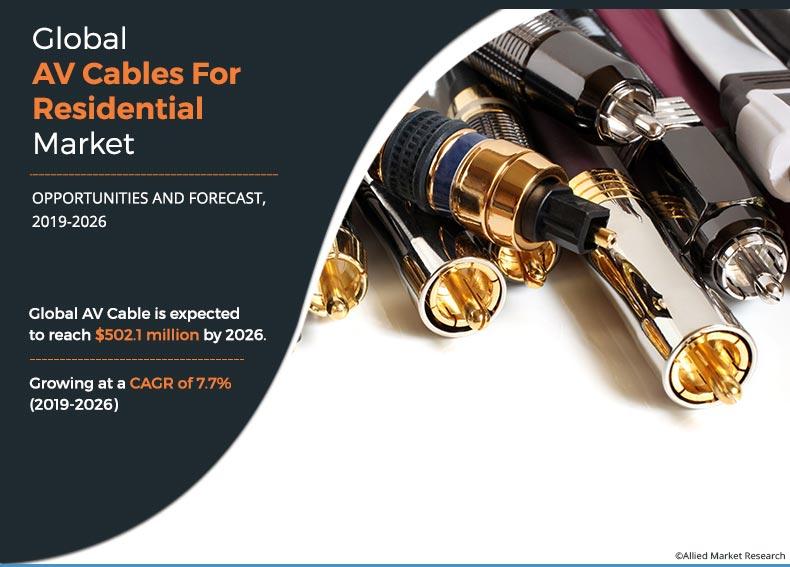

AV Cables for Residential Market Outlook-2026

The global AV cables for residential market size was valued at $273.0 million in 2018, and is projected to reach $502.1 million by 2026, growing at a CAGR of 7.7% from 2019 to 2026.

AV cables are electronic probes that are used to connect multimedia devices to transfer audio and video signals. The various range of ports and cables are available in the market to match the global standards across different product ranges such as monitor, television, home theaters, and others. Electrical, optical, and digital are different modes of data transfer through these cables. There are various types of AV cables such as HDMI, RCA, DVI, VGA, and others. HDMI, coaxial cables, and fiber optic are mostly used to transfer AV signals, as they make quicker and efficient data exchange from one terminal to other. DVI cables are used for gaming purposes because of their higher bandwidth and data transfer rate. Further, the increased adoption of multimedia equipment in households is expected to rise the demand of AV cables for residential market.

The factors such as surge in usage of audio video devices, increase in demand for 4K/UHD televisions, and rise in penetration of miniature multimedia devices are expected to boost the growth of AV cables for residential industry. The increase in innovation of multimedia devices, in terms of features and quality, attracts large consumer base who use AV cables for I/O connections. Further, the adoption of 4K/UHD TVs in households, which offer multiple HDMI ports for AV connections, such as Sony 4K Ultra HD Android LED TV provides 4 HDMI ports and 3 USB ports, thereby, increases the demand for AV cables. Moreover, the innovation of cameras and use of pico projectors that require AV ports for connection of audio video signals increases the demand for AV cables. However, rise in adoption of wireless streaming platform reduces the need of AV cables, which can hinder the AV cables for residential market growth.

By Type

HDMI segment is projected as one of the most lucrative segments.

Currently, HDMI cable version 2.0a and version 2.0b are mainly used in the market. Furthermore, advancements in HDMI cable, such as to version 2.1 to provide better bandwidth up to 48Gbps and resolutions up to 10K, is expected to increase its demand in the global AV cables for residential market. In addition, the emergence of the multimedia & entertainment industry across the globe, promotes higher cable network subscription in the market. This ultimately drives the AV cables for residential market as network cable connection requires the use of AV cables.

By Cable Category

Coaxial Cable segment is expected to secure leading position during forecast period.

SEGMENT OVERVIEW

The global AV cables for residential market trends are analyzed across various segments including type, component, cable category, and region. On the basis of type, it is categorized into HDMI, RCA, DVI, VGA, and others, among which the HDMI segment secured the highest market share. Depending on component, connectors and adapters used for AV cables are analyzed. The connectors are sub segmented into pin connectors, spade connectors, banana connectors, and others. The adapters are sub segmented into wall mounted and panel mounted adapters. The cable category segment includes copper cable, fiber optics, and coaxial cable. The copper cables market is further sub segmented into CAT3, CAT5, CAT5E, CAT6, CAT6A, and CAT7.

By Geography

Asia-Pacific region would exhibit the highest CAGR of 26.0% during 2019-2026

Region-wise, AV cables for residential market analysis includes trends and forecast for each segment across North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific market is expected to grow at the highest CAGR during the forecast period, owing to advancements in multimedia devices and rise in purchasing capacity of a huge consumer base.

TOP IMPACTING FACTORS

The significant impacting factors in the AV cables for residential market include surge in usage of audio video devices, increase in demand for 4K/UHD televisions, and growth in penetration of miniature multimedia devices. However, rise in adoption of wireless streaming platform in the AV industry pose a major threat, thus hampers the market growth globally. Conversely, advancements in HDMI cables for higher bandwidth applications coupled with display technology and growth in the multimedia & entertainment industry in emerging economies is projected to offer remunerative opportunities for the market. Each of these factors are anticipated to have a definite impact on the AV cables for residential market during the forecast period.

Some major factors impacting the market growth are given below:

Surge in usage of audio video devices

There has been a rise in adoption of audio video multimedia electronics which have ports for AV I/O for connections. Latest technologies such as IoT and AI has catalyzed the demand for audio video devices such as home theater systems, which offer AV ports. For instance, home theater systems integrated with artificial intelligence software such as Alexa, Google Assistant, and others provide in-built intelligence and convenience for consumers. This is expected to drive the demand for AV cables in the residential sector during the forecast period. Furthermore, multimedia devices such as DVD players and music systems provide ports for connection to video panels and vice versa, which increases demand of AV cables for residential Market.

Increase in demand for 4K/UHD televisions

Over the years, the advancement in display technologies has lured large consumer base. The fast-growing adoption of 4K or Ultra High Definition TVs in the residential sector has increased the demand for AV cables industry. This offers HDMI ports that are capable of supporting high transfer rate. These TVs also provide ports for connection of various entertainment systems such as gaming consoles, home theatre systems, and others.

Rise in penetration of miniature multimedia devices

The increase in use of miniature multimedia devices such as video cameras, digital cameras, peco projectors, and various other latest devices that use various AV cables for connection leads to the increase in demand of AV cables for residential Market. Furthermore, the innovation of mobile camera photography apps, that provide 4K videos and improved 360-degree video capturing, make use of the latest HDMI ports, which are compatible with latest audio video qualities.

COMPETITIVE ANALYSIS

The key players profiled in the report include Amphenol Corporation, AV Supply group, Black Box Corporation, Belden Inc., Commscope, Foxconn Technology Group (Belkin), LEGRAND SA, Nexans, WESCO International (Liberty AV), and Prysmian Group. The report also includes profiles of some distributors including Extron and Eurocables. These key players have adopted strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations to enhance their position in the AV cables for residential market.

Key Benefits for AV Cables For Residential Market:

- This study comprises analytical depiction of the global AV cables for residential market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The AV cables for residential market forecast is quantitatively analyzed from 2019 to 2026 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

- The report includes the AV cables for residential market share of key vendors and market trends.

AV Cables for Residential Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Component |

|

| By Cable Category |

|

| By Region |

|

| Key Market Players | PRYSMIAN GROUP, AMPHENOL CORPORATION, BLACK BOX CORPORATION, BELDEN, INC., LEGRAND, FOXCONN TECHNOLOGY GROUP (BELKIN), EUROCABLE, NEXANS, EXTRON, AV SUPPLY GROUP, WESCO DISTRIBUTION, INC. (Liberty AV), COMMSCOPE |

Analyst Review

AV cables are the connecting components, which are used in multimedia devices for communication of audio and video signals. The cables either provide electrical, optical, or digital modes of transfer. Most of these cables have an outer shield to transfer data without loss and are designed to carry maximum bandwidth with higher transfer rate.

The demand for AV cables in the residential sector is expected to increase rapidly during the forecast period, owing to various factors such as surge in usage of audio video devices, increase in demand for 4K/UHD televisions, and rise in penetration of miniature multimedia devices. However, growth in adoption of the wireless streaming platform hampers the market growth. The market for AV cables in residential sector is analyzed and estimated in accordance with the impacts of the drivers, restraints, and opportunities.

Presently, the coaxial cables segment accounts for the largest market share, followed by the fiber optic segment, due to increase in adoption of high bandwidth components. However, the HDMI segment dominates the market, owing to the benefits associated with advancements in these cables. The Asia-Pacific region accounted for about 31% of the global residential AV cables market due to the immense popularity of these cables in Japan, China, and Singapore.

Moreover, surge in adoption of wireless connectivity solutions and streaming platforms act as restraints for the market. Moreover, development in the multimedia & entertainment industry in emerging economies is expected to generate tremendous growth opportunities for the players in Asia-Pacific.

Loading Table Of Content...