Aviation Asset Management Market Research, 2033

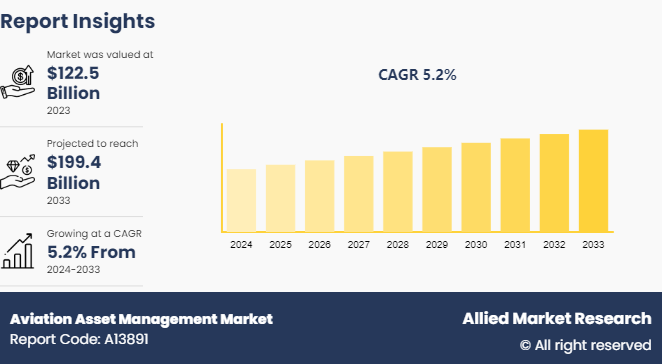

The global aviation asset management market size was valued at $122.5 billion in 2023, and is projected to reach $199.4 billion by 2033, growing at a CAGR of 5.2% from 2024 to 2033.

Market Introduction and Definition

Aviation asset management is a methodical approach to managing and maximizing all resources associated with aviation operations, such as aircraft, engines, buildings, spare parts, and other assets. This field encompasses a wide range of tasks, including risk assessment, compliance management, purchase, leasing, maintenance, repair, and utilization optimization. Maximizing the value of aviation assets over their entire lifecycle, ensuring operational effectiveness and safety, cutting costs, and coordinating asset management plans with the organization's overarching goals are the main objectives of aviation asset management. To efficiently manage aircraft assets and maximize their performance, this entails utilizing data-driven insights, cutting-edge technologies, and industry best practices.

Key Takeaways

- The aviation asset management market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major Aviation Asset Management industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In October 2022, Flydocs collaborated with Lufthansa Technik to launch new lease asset management software at the Airline & Aerospace MRO & Flight Operations IT Conference. The new software will provide custom measures to continuously optimise leases and ensure a smooth and on-time handover of aircraft back to the lessor. Along with preparing aircraft and documentation for cost-efficient phase-out, it will also offer aircraft assessment where the condition of the aircraft and its documents will be reviewed to minimise risk.

Key Market Dynamics

The global aviation asset management market size is growing due to several factors, such as rise in demand for aircraft leasing, growing focus on cost optimization and technological advancement. However, high initial investment and regulatory compliance and challenges restrain the development of the market. In addition, growing sustainable aviation initiatives and growth in air traffic travel provide aviation asset management market opportunity during the forecast period.

By reducing maintenance costs, downtime, and inefficiencies, aircraft asset management services assist airlines and lessors in optimizing their operations. Through the implementation of proactive maintenance techniques, fleet optimization, and operational process streamlining, asset management organizations enhance overall operational efficiency, resulting in financial savings for aviation stakeholders. In addition, a substantial number of airlines and aircraft lessors’ operational costs are devoted to maintenance. To reduce maintenance-related costs, asset management services prioritize streamlining maintenance plans, cutting turnaround times, and putting in place affordable maintenance solutions. Asset management organizations assist their consumers in reducing their overall maintenance costs by utilizing data analytics, predictive maintenance methods, and industry best practices.

For instance, in October 2023, EirTrade Aviation Ireland Limited has partnered with Acron to provide aviation asset management solution. This collaboration aims to bolster EirTrade's financial resources, enabling the company to further support its customers, suppliers, and consignors within the aviation industry, thereby enhancing its overall market position.

Moreover, to maximize income creation and profitability, aviation assets must be used efficiently. Asset management services provide opportunities for schedule adjustments, fleet right-sizing, and route optimization, assisting airlines and lessors in optimizing asset use. Asset management companies assist their customers in maximizing income and lowering operational expenses by making sure that aircraft are deployed in the most economical way possible. Therefore, focus on cost optimization is driving the demand for aviation asset management market share.

Huge investment in hardware, software, and IT systems is frequently necessary for the implementation of complete aviation asset management solutions. In particular, for smaller aviation players with limited financial resources, setting up data centers, networking infrastructure, and software platforms might involve significant upfront expenses. In addition, a lot of aviation asset management systems are available via subscription or licensing, requiring one-time software payments or recurring membership dues. Purchasing software licenses or subscription plans can be a substantial financial commitment for airlines, lessors, and MRO providers, especially for large-scale installations or enterprise-wide implementations.

Furthermore, resources, time, and effort are needed for staff training and the installation of new asset management systems. For asset management solutions to be successfully adopted and used, aviation stakeholders need to make investments in user education, training programs, and change management activities. The total upfront expenditure needed for asset management projects may include charges for training, consulting, and implementation. Therefore, high initial investment is hampering the growth of the aviation asset management market growth.

Parent Market Analysis

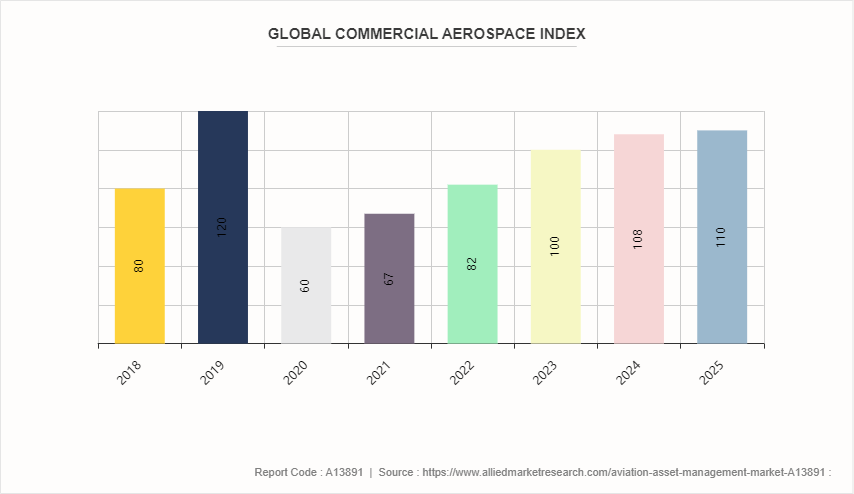

Globally, the aerospace industry is growing at a faster pace due to growing air travel and growth in air freight. Rising disposable incomes, urbanization, and an expanding middle class in growing economies have further fueled the growth in passenger air travel. Moreover, according to a data from International Air Transport Association (IATA) , air passenger traffic is expected to continue to grow steadily in the coming years. Furthermore, the growth of aerospace industry resulted in increase in demand for its manufacturing, maintenance, and logistics which is further driving the demand for aviation asset management. The COVID-19 pandemic resulted in a steep decline for the overall aerospace industry; however, with an improvement in the supply chain, rise in air traffic and growth in demand for MRO, the market is expected to reach pre-pandemic level by 2025.

The graph below depicts the commercial aerospace index for companies involved in manufacturing, maintenance, repair, and overhaul (MRO) .

Market Segmentation

The aviation asset management market is segmented into aircraft type, service type, end-use, purchase type and region. Based on aircraft type, the market is analyzed into wide-body aircraft, narrow-body aircraft, private jets and helicopters. On the basis of service type, the market is analyzed into leasing service, technical service, regulatory certification and end-to-end. Based on end-use, the market is bifurcated into commercial platforms and MROs. On the basis of purchase type, the global market is fragmented into direct purchase operating lease, finance lease, and sales and lease back. Region-wise, the market is analyzed in North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America accounted for a sizeable portion of the asset management market, owning a sizable and varied fleet of private and business jets in addition to regional, wide-body, and narrow-body commercial aircraft. There is a significant need for asset management services, such as leasing, MRO, technical consulting, and regulatory compliance services, due to the large size and diversity of the fleet.

Asia-Pacific region is projected to witness a strong growth rate for the aviation asset management market during the forecast period. This growth is attributed to the fact that Asia-Pacific region is experiencing rapid economic growth, driving increased air travel demand and expansion of the aviation industry. As economies in the region continue to develop, there is a growing need for aviation asset management services to support the acquisition, operation, and maintenance of aircraft fleets.

In?Europe, passenger traffic was 2.3 billion passengers in 2023. In 2024, it is expected to be around 2.5 billion passengers. After recovering to pre-pandemic levels in the following year, by 2025 passenger traffic is expected to reach 2.7 billion.

The?Latin America-Caribbean?region surpassed its passenger traffic to 2019 level in 2023, accounting for 740 million which is nearly 108% of the 2019 level. In 2024, passenger traffic is expected to reach around 795 million passengers, and 849 million in 2025.

Competitive Landscape

The major players operating in the aviation asset management market include AerCap Holdings N.V, Airbus, Lufthansa Technik AG, General Electric Company, GA Telesis L.L.C, MTU Aero Engines AG, Boeing, AerData B.V., Avolon and BBAM Aircraft Leasing & Management.

Other players in the aviation asset management market include Dubai Aerospace, SMBC Aviation, BOC Aviation, Aercap Holding NV, ST Engineering, Carlyle Aviation Partners, CIT Aerospace, ICBC Leasing, Jackson Square Aviation, Macquarie AirFinance, ORIX Aviation, Willis Lease Finance Corporation, Intrepid Aviation and so on.

Industry Trends

Growing focus on sustainability

There is growing concern related to sustainability in the aviation industry. Airlines operators are increasingly focusing on improving the efficiency of their fleets and reducing emissions and operational costs. Asset management strategies often include considerations for sustainable practices and lead to better fuel efficiency for airline operators. Asset management also helps in optimizing fleet utilization and reducing downtime through predictive maintenance and real-time monitoring; this helps enhance operational efficiency and reduce overall environmental impact by minimizing unnecessary flights and maximizing aircraft availability.

Growing trend towards aircraft leasing

Airline operators are shifting their focus towards aircraft leasing as it provides airlines with flexibility in fleet management. Aircraft leasing often provides better management of cash flows by effectively avoiding large upfront payments and maintenance costs. Additionally, leasing aircraft also enables airlines to access newer, more fuel-efficient aircraft models without committing to long-term ownership.

Key Sources Referred

Airports Council International (ACI)

Federal Aviation Administration (FAA)

European Union Aviation Safety Agency (EASA)

Motor & Equipment Manufacturers Association (MEMA) ?

Society of Automotive Engineers (SAE) ?

Aerospace Component Manufacturers Association (ACMA)

European Association of Aerospace Industries (ASD)

Aerospace Industries Association (AIA)

International Aerospace Quality Group (IAQG)

Japan Aerospace Exploration Agency (JAXA)

National Aerospace Standards (NAS)

German Aerospace Industries Association (BDLI)

Key Benefits For Stakeholders

This report provides a quantitative analysis of the aviation asset management market forecast, segments, current trends, estimations, and dynamics of the aviation asset management market analysis from 2023 to 2033 to identify the prevailing aviation asset management market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the aviation asset management market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global aviation asset management market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global aviation asset management market trends, key players, market segments, application areas, and market growth strategies.

Aviation Asset Management Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 199.4 Billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Aircraft Type |

|

| By Service Type |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | General Electric Company, GA Telesis L.L.C, Boeing, MTU Aero Engines AG, BBAM Aircraft Leasing & Management, Airbus, AerCap Holdings N.V, Avolon, Lufthansa Technik AG, AerData B.V. |

Integration of data analytics is the upcoming trend in the aviation asset management industry.

Leasing service are the major application of the aviation asset management industry.

North America is the largest region for the aviation asset management industry.

The aviation asset management industry was valued at $122.5 billion in 2023.

AerCap Holdings N.V, Airbus, Lufthansa Technik AG, General Electric Company, GA Telesis L.L.C, and MTU Aero Engines AG are some of the major companies operating in the market.

Loading Table Of Content...

Loading Research Methodology...