Aviation Gasoline (Avgas) Market Research, 2031

The global aviation gasoline (avgas) market size was valued at $12.5 billion in 2021, and aviation gasoline (avgas) industry is projected to reach $18.8 billion by 2031, growing at a CAGR of 4.2% from 2022 to 2031.

Aviation gasoline is generally used to power piston engine aircraft. At typical operating temperatures, it is highly flammable and is primarily determined by its octane rating. The growth in demand for piston engine aircraft for training, sports, and aerial application have a positive impact on the aviation gasoline market growth.

Aircraft design has improved fuel-burning efficiency and made them cheaper, safer, quicker, and greener, resulting in increasing demand for aviation fuel. Piston-powered airplanes that use leaded aviation gasoline pollute the air, endangering human health and welfare. The aviation industry has invested much in research to produce lightweight engines and hybrid-electric engines to assist cut fuel consumption. Honeywell's efficient hybrid-electric turbo generator airplane, for example, utilizes energy to propel itself, conserving energy. Therefore, improved aircraft design is expected to boost aviation gasoline market opportunities in the coming years.

The specialized aviation branch of Air BP Plc renewed its partnership with BAA Training, one of Europe's leading independent aviation training schools. To facilitate the delivery of BAA Training's training programmes, Air BP is expected to supply Avgas 100 LL aviation fuel and unleaded Avgas to all BAA Training aircraft bases and other Spanish airports.

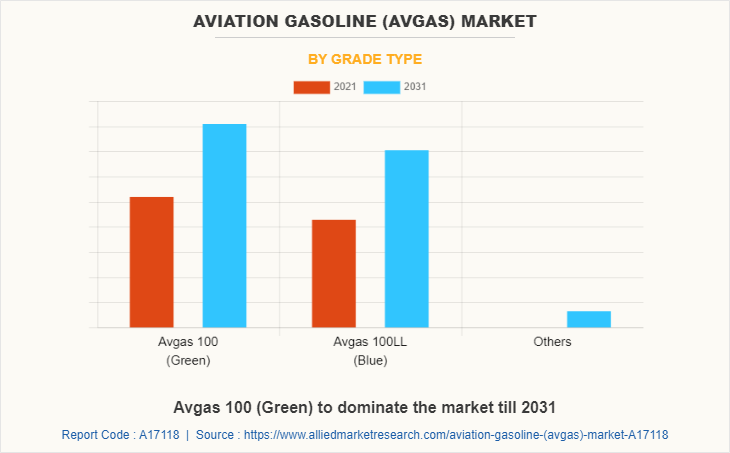

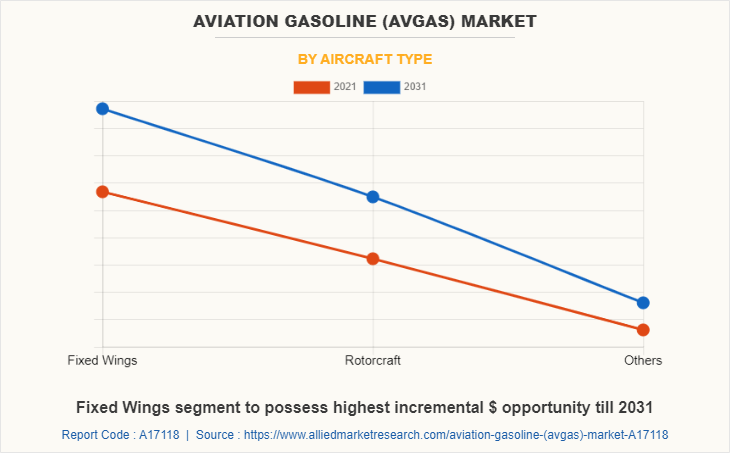

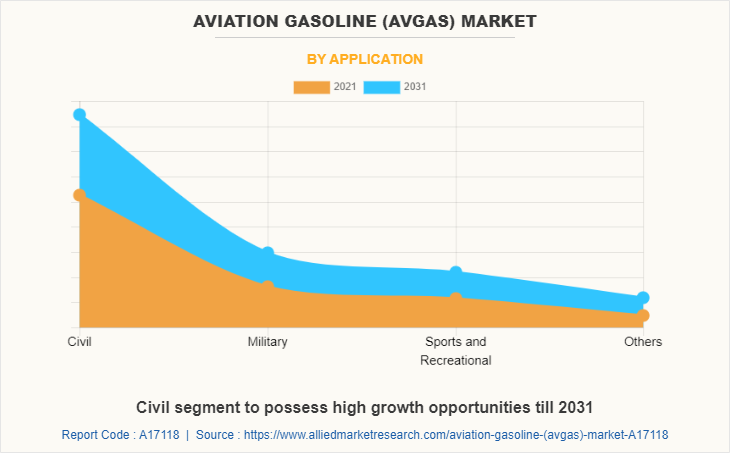

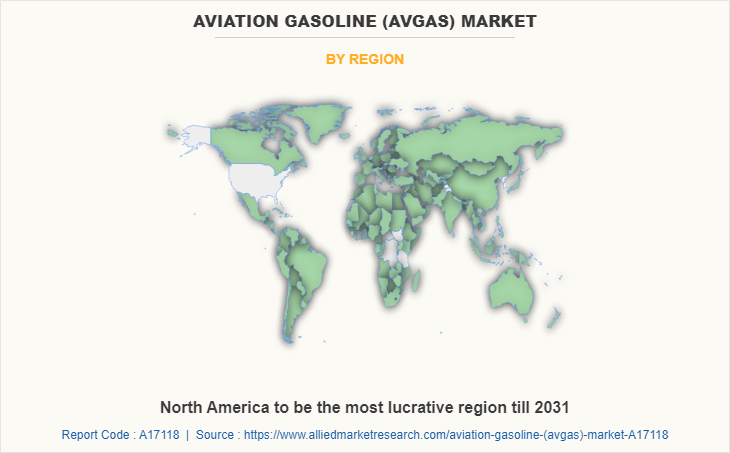

The aviation gasoline (avgas) market forecast is segmented on the basis of grade type, aircraft type, application, and region. By grade type, it is divided into Avgas 100, Avgas 100 LL, and Others. By aircraft type, the aviation gasoline market is classified into fixed wings, rotorcraft, and others. The fixed wings segment dominated the aviation gasoline market share in 2021 and is expected to remain dominant during the forecast period. By application, the market is categorized into civil, military, sports & recreational, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East and Africa). The aviation gasoline (Avgas) market was dominated by North America in 2021 while, Asia-Pacific is expected to grow at higher CAGR owing to high demand from emerging economies in the region.

The major companies profiled in this report include ExxonMobil Corporation, Shell plc, BP plc, TotalEnergies SE, Repsol S.A., Vitol Group, Phillips 66, Indian Oil Corporation Limited, Naftal, Hjelmco Oil AB, Chevron Corporation, Oman Oil Corporation SAOC, Sinopec Corp, Gazprom, and Sasol Limited. Modernization and spread of information through internet led to the development of tourism industry which in-turn has fuelled the demand for aviation gasoline due to rapid development of industrialization. Additional growth strategies such as expansion of production capacities, acquisition, partnership and research & innovation in the application of unleaded aviation gasoline have led to attain key developments in the global aviation gasoline (Avgas) market trends.

The Avgas 100 (Green) segment dominates the global aviation gasoline market. Avgas 100 is a gasoline specially designed for piston engine aircraft. It is a product blended with tetraethyl lead in a high amount in the refineries. This type of fuel is banned in most of the developed countries due to increase in health consciousness. This type of fuel has high percentage of tetraethyl lead in order to increase the safety of the passengers during the air travelling. The presence of application of aircraft in the agriculture especially in the U.S for the large scale planting is driving the demand for the Avgas 100. The increase in the air sport and recreation activities across the globe is augmenting the market growth.

The fixed wings segment dominates the global aviation gasoline market. Fixed wing aircraft uses an engine to keep the plane moving. The air flow around the wings generates lift. The engine only overcomes the drag of the airplane (in level flight). This drag is both due to the form drag of the plane and the generation of lift from the wings. Fixed wing aircrafts find use in civil, military, and recreational markets. Fixed wings are widely used when compared with other aircrafts. They generally have piston, turboprop, or turbojet engines. The wide use of fixed wings aircrafts in civil sector and increase in number of air passengers boosts the demand for new aircrafts. The presence of above mentioned advantages will drive the growth of the aviation gasoline market trends.

The civil segment dominates the global aviation gasoline market. Civil aviation comprises of private and general aviation. General aviation consists of commercial airlines, while private consists of business aircrafts. The commercial airlines are widely used to haul passengers and freight from one airport to other. They differ in size and engine types. There are single piston, double-piston, and turboprop engine based aircrafts. Business planes are used by salespeople, prospectors, farmers, doctors, missionaries, and others.

Business aircrafts are used to make the best use of top executives’ time by freeing them from commercial airline schedules and airport operations. Business aircrafts include those used for forest-fire fighting, agricultural operations, medical evacuation, traffic reporting, freight hauling, pipeline surveillance, and other applications. Such wide applications of business aircrafts drive the growth of the aviation gasoline market.

North America dominates the aviation gasoline market. According to General Aviation Manufacturers Association (GAMA) and International Trade Association (ITA) a total of 211,000 aircrafts are based in the U.S. The presence of strong market players of aviation gasoline industry and developed countries contribute largely in the strong growth of the aviation gasoline market. Moreover, huge investments in R&D of various grades of fuel also drive the market growth for the region. However, increase concerns for carbon and lead emissions leading to strict rules and regulations for fuel production and consumption hamper the market growth. The presence of innovation and application of aviation gasoline panels in variety of sectors will provide lucrative opportunities for the growth of aviation gasoline market.

Impact of COVID-19 on Global Aviation Gasoline (Avgas) Market:

COVID-19 has severely impacted the global economy with devastating effects on global trade, which has simultaneously affected households, business, financial institution, industrial establishments and infrastructure companies. The novel coronavirus has affected several economies ad caused lockdown in many countries which has limited the growth of the market.

COVID-19 pandemic has triggered a full-fledged crisis in 2020, with travel restrictions and aircraft cancellations imposed to stem the virus’s spread. As a result, demand for aviation turbine fuel and aviation gas has declined drastically. During the peak time of the pandemic, several flights have witnessed a reduction in operations due to the coronavirus outbreak. The majority of countries around the world are gradually opening up their market. Owing to this, demand for aviation gasoline is likely to reach normal levels. However, owing to private and corporate aircraft restrictions, aviation gasoline consumptions is still low compared to pre COVID-19. COVID-19 has forced the closure of training schools and air sports related activities.

The price of aviation gasoline is directly dependent on the crude oil prices. The demand for crude oil is deficient due to pandemic and the price of crude oil is relatively low; hence, having a negative impact on aviation gasoline cost. As demand for these products began to rise, prices for jet fuel and aviation gasoline market have been normalized.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aviation gasoline (avgas) market analysis from 2021 to 2031 to identify the prevailing aviation gasoline (avgas) market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aviation gasoline (avgas) market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aviation gasoline (avgas) market trends, key players, market segments, application areas, and market growth strategies.

Aviation Gasoline (Avgas) Market Report Highlights

| Aspects | Details |

| By Grade Type |

|

| By Aircraft Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Sasol Limited, Vitol Group, Repsol, Phillips 66, Indian OIl Corporation Limited, Sinopec Corp, Exxon Mobil Corporation, TOTAL S.A., Chevron Corporation, Oman Oil Corporation SAOC, Gazprom, Shell Plc, Hjelmco Oil AB, Naftal, BP plc |

Analyst Review

According to CXO Perspective, the global aviation gasoline market is anticipated to grow at a considerable rate during the forecast period. This is attributed to rise in demand for aviation gasoline from various emerging economies and military sector. Moreover, introduction of new flight routes and investments from government for construction of new airports also foster the aviation gasoline market growth.

Furthermore, there is an increase in the demand from developing economies such as China and India owing to increased disposable income and boom in tourism industry, rise in air transportation, which fosters the aviation gasoline market growth. Demand from North America also contributed largely to the market growth owing to the presence of key market players and increased investment from government in the region. Aviation gasoline is capable of preventing engine knocking (premature detonation).

However, fluctuating crude oil prices and strict rules & regulation regarding carbon emissions impact the production process and limit the market growth. Meanwhile, emerging stainable aviation gasoline (SAF) is anticipated to hamper the growth of the aviation gasoline industry.

Increase in production and deliveries of aircraft and construction and expansion of airports are the key factors boosting the Aviation gasoline (Avgas) market growth.

The market value of Aviation gasoline (Avgas) in 2031 is expected to be $18.8 billion

ExxonMobil Corporation, Shell plc, BP plc, TotalEnergies SE, Repsol S.A., Vitol Group, Phillips 66, Indian Oil Corporation Limited, Naftal, Hjelmco Oil AB, Chevron Corporation, Oman Oil Corporation SAOC, Sinopec Corp, Gazprom, and Sasol Limited.

Civil application is projected to increase the demand for Aviation gasoline (Avgas) Market

The aviation gasoline (Avgas) market is segmented on the basis of grade type, aircraft type, application, and region. By grade type, it is divided into Avgas 100, Avgas 100 LL, and Others. By aircraft type, the market is classified into fixed wings, rotorcraft, and others. The fixed wings segment dominated the market share in 2021 and is expected to remain dominant during the forecast period. By application, the market is categorized into civil, military, sports & recreational, and others. Region wise, the market is analysed across North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East and Africa).

Increase in air transportation is the Main Driver of Aviation gasoline (Avgas) Market.

The price of aviation gasoline is directly dependent on the crude oil prices. The demand for crude oil is deficient due to pandemic and the price of crude oil is relatively low; hence, having a negative impact on aviation gasoline cost. As demand for these products began to rise, prices for jet fuel and aviation gasoline (Avgas) market have been normalized.

Loading Table Of Content...