Aviation Insurance Market Overview

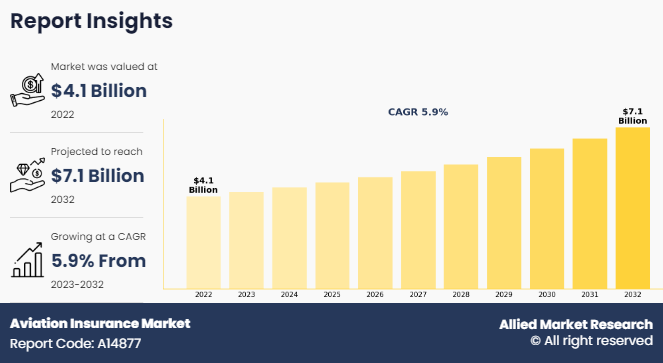

The global aviation insurance market was valued at $4.1 billion in 2022, and is projected to reach $7.1 billion by 2032, growing at a CAGR of 5.9% from 2023 to 2032. Rising global air traffic, increasing aircraft fleets, technological advancements, regulatory compliance, risk management needs, geopolitical tensions, and growing demand for specialized and comprehensive coverage contribute to the growth of the market.

Market Dynamics & Insights

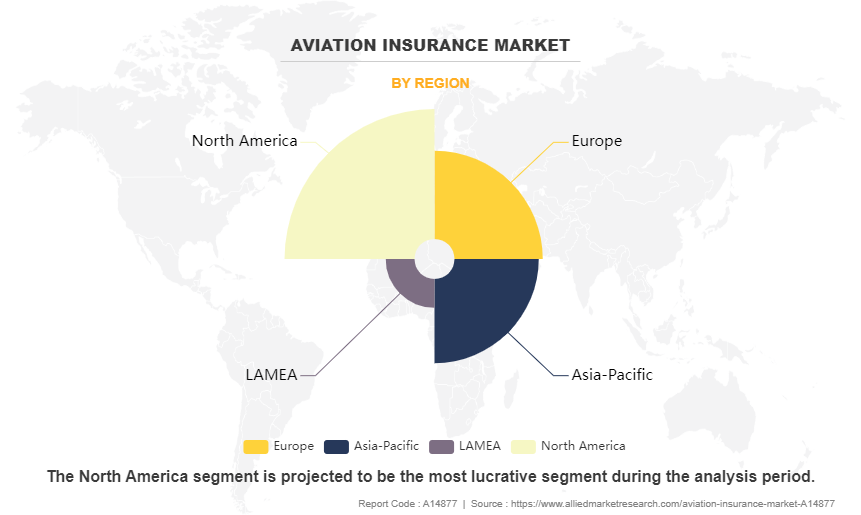

- The aviation insurance industry in North America held a significant share of 39% in 2022.

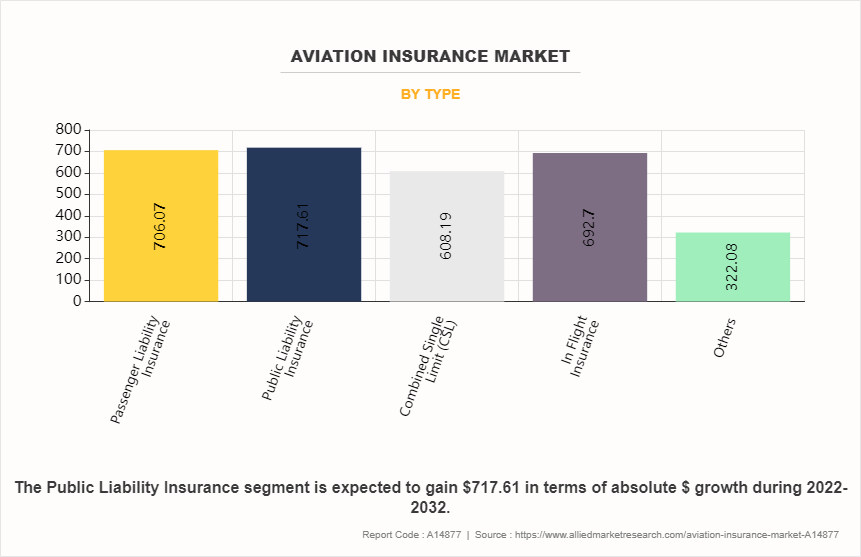

- By type, the passenger liability insurance segment dominated the industry in 2022 and accounted for the largest revenue share of 34%.

- By application, the commercial aviation insurance segment dominated the industry in 2022 and accounted for the largest revenue share of 57%.

- By product type, the airlines segment accounted for the largest market share in 2022, accounting for the revenue share of 38%

Market Size & Future Outlook

- 2022 Market Size: $4.1 Billion

- 2032 Market Size: $7.1 Billion

- CAGR (2023-2032): 5.9%

- North America: Dominated market share in 2022

- Asia-Pacific: Highest CAGR during the forecast period

What is Meant by Aviation Insurance

The aviation insurance market encompasses a specialized sector within the insurance industry that provides coverage for risks associated with aviation operations. This market offers a wide range of insurance products and services tailored to the unique needs of aviation stakeholders, including aircraft owners, operators, manufacturers, airports, and service providers. Aviation insurance typically covers various aspects of aviation-related risks, including aircraft hull and liability insurance, passenger liability, aviation-related liabilities such as product liability and hangar keeper's liability, and in-flight insurance for passengers and crew members. These insurance products are designed to protect against a diverse range of risks, including accidents, incidents, damage to aircraft or property, bodily injury, loss of life, and third-party liabilities. The aviation insurance market is characterized by its complexity and specialized nature, requiring insurers to have a deep understanding of aviation operations, regulatory requirements, and industry standards. Insurance underwriters assess risk factors such as aircraft type, usage, safety record, pilot experience, and geographic location to determine appropriate coverage and pricing for aviation insurance policies by aviation brokers.

Key players in the aviation insurance market include insurance companies, brokers, underwriters, and reinsurers specializing in aviation risks. These entities collaborate with aviation stakeholders to develop customized insurance solutions that meet their specific needs and provide financial protection against potential losses. The aviation insurance market is influenced by various factors, including trends in air travel, regulatory changes, technological advancements, safety standards, and emerging aviation risk management. As the aviation industry continues to evolve and expand globally, the demand for innovative and comprehensive insurance products and services in the aviation insurance market is expected to grow, creating opportunities for insurers to provide value-added solutions and support the evolving needs of aviation stakeholders.

Rise in air passenger traffic and increase in government rules & regulations for passenger safety positively impacts the growth of the market. However, factors such as costly aviation insurance premium hampers the market growth while increasing frequency and cost of claims are limiting the growth of the market. On the contrary, rising expenditure on international airlines is expected to offer remunerative opportunities for the expansion of the market during the forecast period.

Key Takeaways

- By type, the basic passenger liability insurance segment accounted for the largest aviation insurance market share in 2022.

- By application, the commercial aviation insurance segment accounted for the largest aviation insurance market share in 2022.

- By product type, the airline segment accounted for the largest aviation insurance market share in 2022.

- Region wise, according to the aviation insurance market analysis North America generated the highest revenue in 2022.

Aviation Insurance Market Segment Review

The global aviation insurance market is segmented on the basis of insurance type, application, product type, and region. Based on insurance type, the market is divided into public liability insurance, passenger liability insurance, combined single limit (CSL), in-flight insurance, and others. In terms of application, the market is categorized into commercial aviation, general & business aviation and others. On the basis of product type, the market is divided into airlines, contingent, general aviation, space and aerospace. Region wise, the market is analyzed across several regions such as North America, Europe, Asia-Pacific, and Latin America, Middle East & Africa (LAMEA).

One the basis of type, the passenger liability insurance segment dominated the market share 2022 and, is expected to maintain its dominance during the aviation insurance market forecast period, owing to stringent government regulations making it compulsory to avail passenger liability insurance to protect damages to the passengers. Moreover, companies majorly focus on creating novel opportunities for growth and revenue generation, thereby increasing the preference for AI and advance machine learning algorithms across industries, which is further expected to propel the segment growth in the global market. However, the in-flight insurance segment is expected to exhibit the highest growth during the forecast period, owing to increasing cases of airline accidents from various causes such as bird collision, bad weather, engine failure and other, which drives the segment growth in the aviation insurance market.

Region-wise, North America attained the highest growth in 2022, is expected to maintain its dominance during the forecast period, owing to strong domestic demand from the U.S., one of the largest domestic aviation markets in the world. However, Asia-Pacific is expected to exhibit the highest growth during the forecast period owing to economically emergent countries like China and India which have manufacturing plants of several industries in the Asia-Pacific region, which further contribute to the growth of global market.

Competition Analysis

Competitive analysis and profiles of the major players in the aviation insurance market are American International Group, Inc., AXA, BWI Aviation Insurance, EAA, Global Aerospace, Inc., Tokio Marine HCC, Travers & Associates Aviation Insurance Agency, LLC, STARR INTERNATIONAL COMPANY, INC., USAA, and USAIG. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the growth of the aviation insurance market globally.

What are the Recent Developments in the Aviation Insurance Industry

In October 2021, Tata AIG General Insurance Co. Ltd partnered with TropoGo, a deep-tech startup to launch Remotely Piloted Aircraft System (RPAS) insurance. In addition, Tata AIG RPAS insurance is providing a comprehensive product covering both Hull and Third-Party Liability risks faced by drone owners and operators. Tata AIG RPAS insurance also provides optional coverage for BVLOS operations, night flying, data loss liability, and others. Moreover, aviation industry and insurance providers are collaborating by leveraging solutions from technology providers to improve their insurance policies.

In July 2021, Chubb Canada launched hub to develop further its domestic general aviation and non-major aerospace business. The Canadian Aviation hub is part of a new regional focus for the aviation team from Chubb Global Markets (CGM), which comprises Chubb London market wholesale and specialty arm, including the company Lloyd platform. Thus, growing number of such developments across the globe is expected to drive the growth of the market.

On 22nd February 2021, the Longtail Aviation Flight 5504 cargo plane scattered mostly small metal parts over the southern Dutch town of Meerssen, causing damage and injuring a woman. Thus, driving the demand for aviation insurance market to recover the expensive cost of repair.

What are the Top Impacting Factors in Aviation Insurance Market

Rise in Passengers

Rise in number of passengers opting for air travel mode has increased tremendously in the market. In addition, with this growing demand for airline services, emerging nations are developing and expanding their existing airport terminals. Therefore, massive development of airports, which involves automated baggage handling & self-check-ins, further propels the market growth. In addition, rapid increase in national and international travelling for business is accelerating the growth of the aviation insurance market across the globe. With rise in tourism, the incidence such as cancelled flights, accidents, natural calamities, and other such occurrences of uncertainties has been increasing during travelling. This fosters the demand for aviation insurance, thereby contributing toward the growth of the global market. Moreover, due to rapid digitalization in the corporate and tourism sectors and surge in penetration of Internet of Things (IoT) various business have boosted international travelling, which notably contributed toward the growth of the market.

Increase in Government Rules & Regulations for Passenger Safety

With rise in travelers across the globe, various governments are introducing new regulations for aviation industry, which acts as a key driving force of the global market. In addition to this, various countries across the European region requires aviation insurance while travelling from one place to another, which enhances the growth of the market. Moreover, various countries have aviation insurance policies to meet the diplomatic relations, which propel the growth of the market. For instance, due to the adverse relationship between Cuba and the U.S., both countries agreed to allow travel for limited reasons. The Government of Cuba has mandated aviation insurance for each individual travelling to the U.S., which is driving the growth of the market. In addition, with rise of COVID-19 cases, many countries are mandating business travel insurance, and some international destinations are now mandating travelers to have a specific aviation insurance market that covers COVID-19. Thus, all these factors are anticipated to foster the aviation insurance market growth in the upcoming years.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the aviation insurance market size, segments, current trends, estimations, and dynamics of the analysis from 2022 to 2032 to identify the prevailing aviation insurance market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aviation insurance market segmentation assists to determine the prevailing aviation insurance market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players and aviation insurance market outlook.

- The report includes the analysis of the regional as well as global aviation insurance market trends, key players, market segments, application areas, and market growth strategies.

Aviation Insurance Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 294 |

| By Type |

|

| By Application |

|

| By Product Type |

|

| By Region |

|

| Key Market Players | USAIG, USAA, AXA, STARR INTERNATIONAL COMPANY, INC., EAA Company Ltd, Global Aerospace, Tokio Marine HCC, American International Group, Inc., BWI Aviation Insurance, Travers & Associates Aviation Insurance Agency, LLC |

Analyst Review

The aviation insurance market presents a complex landscape with unique challenges and opportunities for aviation industry leaders. One of the primary considerations for companies in the aviation insurance market is risk management. Aviation operations involve inherent risks, including accidents, incidents, and liability exposures. Insurance companies and airlines must work closely with insurance providers to develop robust risk management strategies that effectively mitigate these risks while ensuring adequate insurance coverage. This involves assessing various risk factors, such as aircraft type, usage, safety record, and regulatory requirements, to determine appropriate insurance solutions that protect the organization's financial interests and support operational continuity. Additionally, insurers must navigate the complexities of insurance pricing and coverage options in the aviation insurance market. Premiums for aviation insurance policies can be substantial, particularly for operators with significant exposure to risks such as commercial airlines. Insurers must evaluate the cost-effectiveness of insurance coverage options and negotiate favorable terms with insurers to optimize coverage while managing costs effectively. Moreover, regulatory compliance is a critical concern for organizations in the aviation insurance market. Aviation authorities, such as the Federal Aviation Administration (FAA) in the United States or the European Aviation Safety Agency (EASA) in Europe, impose stringent regulations and safety standards on aviation operations. Insurers must ensure that their insurance policies comply with these regulations and provide adequate coverage to meet legal requirements, thereby mitigating the risk of non-compliance penalties and ensuring operational integrity. Furthermore, insurers must stay abreast of emerging risks and trends in the aviation insurance market. This includes monitoring developments in aircraft technology, regulatory changes, and emerging risks such as cybersecurity threats. By proactively addressing these risks and incorporating them into their risk management strategies, insurers can better protect their organizations and optimize insurance coverage to support long-term sustainability and growth. For instance, in November 2020, SkyWatch, the leading InsurTech company for aviation in collaboration with Global Aerospace, Inc. launched a usage-based insurance product for rented light aircraft that offers yearly, monthly, weekly, and daily coverage options. With the collaboration, SkyWatch will distribute the product - available in most U.S. states - directly to pilots and via select partners, while Global Aerospace will provide underwriting expertise and prompt claims handling. Furthermore, many insurance agencies are collaborating with tech companies to enhance their existing AI system for better and secure systems.

The global aviation insurance market was valued at $4.1 billion in 2022, is projected to hit $7.1 billion by 2032, growing at a CAGR of 5.9% from 2023 to 2032.

Rise in passengers and increase in government rules & regulations for passenger safety are the upcoming trends of Aviation Insurance Market in the world.

Surge in number of international airlines is the leading application of Aviation Insurance Market

North America is the largest regional market for Aviation Insurance.

American International Group, Inc., AXA, BWI Aviation Insurance, EAA, Global Aerospace, Inc., Tokio Marine HCC, Travers & Associates Aviation Insurance Agency, LLC, STARR INTERNATIONAL COMPANY, INC., USAA, and USAIG are the top companies to hold the market share in Aviation Insurance

Loading Table Of Content...

Loading Research Methodology...