Baby Oral Care Market Research, 2031

The global baby oral care market was valued at $1.3 billion in 2021 and is projected to reach $2 billion by 2031, growing at a CAGR of 4.3% from 2022 to 2031.

Brushes, toothpaste, tooth mousse, floss, teethers, gum soothing gels, and other products are available in the baby oral care market. These products are specially formulated to be compatible with the internal composition of the mouth of a bay to avoid harm to the teeth and gums. The scope of the study includes babies aged 0-12 months classified as infants and babies aged 13-36 months classified as toddlers.

There is a rise in the disposable income of consumers all over the world, which is increasing their purchasing power. Many consumers spend a lot of money on their babies to ensure their health, safety, and well-being. Parents spend money on products such as baby monitors, baby educational toys, baby care products, and more to ensure that their babies are safe, entertained, and healthy. Consumers also spend more on premium and high-quality products to provide their babies with premium products that are safe for them. This includes toothbrushes, toothpaste, and teethers, which go into the mouths of the babies and may cause harm if the product quality is poor. This increases demand for baby products, including baby oral care products, resulting in massive growth for the baby oral care products market.

Cleaning the teeth and gums of babies and toddlers may be difficult because children aged zero to three years are generally either restless or incognizant, making products such as finger brushes, gum and tooth wipes, tongue cleaners, and other products difficult to use. Market participants in the Baby Oral Care industry are incorporating various designs and flavors into baby oral care products to make them appealing to children. Form factors for toothbrushes, tongue cleaners, and teethers include bananas, bears, dinosaurs, and other animals, while flavors for toothpaste, gum soothing gels, and tooth mousse include apple, strawberry, mixed berries, and other fruits. These products are appealing to children, causing them to want to use them, removing the need for parents to use products on children that they dislike, and making the process of cleaning their teeth and mouth easier. These appealing form factors and flavors of baby oral care products contribute to the Baby Oral Care Market Growth.

The global fertility rate is defined as the average number of children borne by women worldwide until the end of their fertility life cycles. According to the World Economic Forum, global fertility rates have been declining in recent years, with the fertility rate having dropped by 50% in the last 70 years. The primary reasons for the decline in fertility rates are increased consumer focus on education and career, as well as rise in global prices for housing, transportation, healthcare, and other basic necessities. These factors discourage the younger millennial and generation Z populations from having children, reducing the number of babies born globally. The decrease in the number of babies born has an impact on the sale of baby-related products, as demand for such products decreases significantly. This includes a decrease in demand for baby oral care products, which is projected to restrain the growth of the Baby Oral Care Market.

Parents all over the world are more aware of the best practices to follow when they raise their children. The younger generation of parents is working hard to learn and study the proper techniques and procedures for raising children, as well as how to properly care for their physical, emotional, and mental needs. There has been a massive increase in awareness regarding the oral health of babies around the world, particularly in developing countries due to an increase in the rate of education in these countries, and an increase in disposable income and expenditure on baby care products. Parents have begun to invest more in baby oral care products to ensure that their babies do not develop dental problems in their later years. This increase in awareness about infant oral health care is expected to lead to an increase in the Baby Oral Care Market Size in the future.

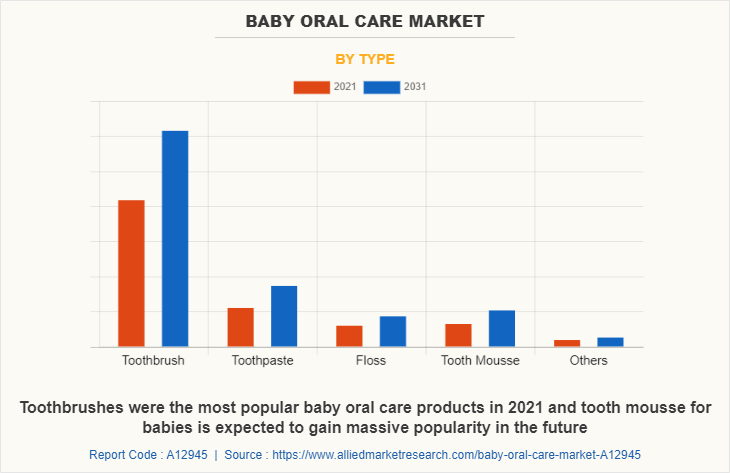

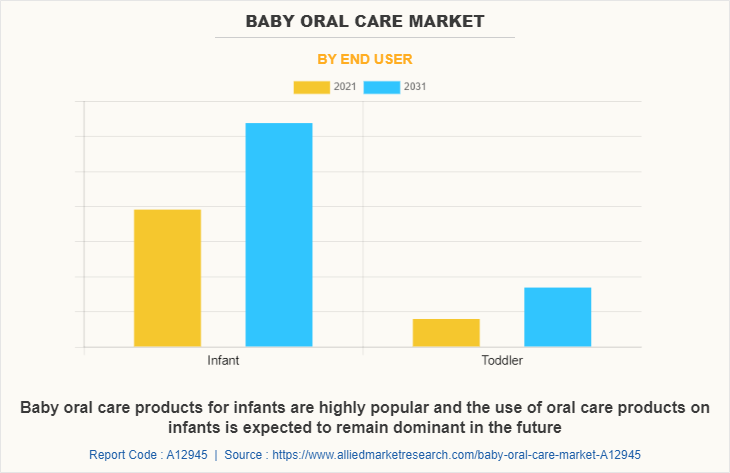

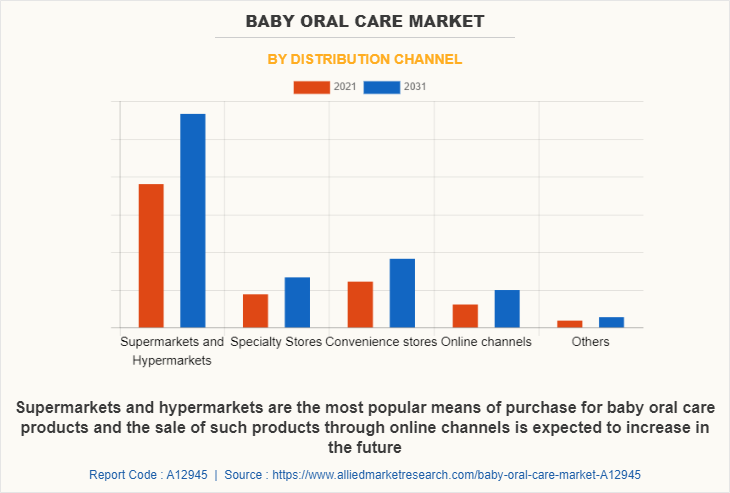

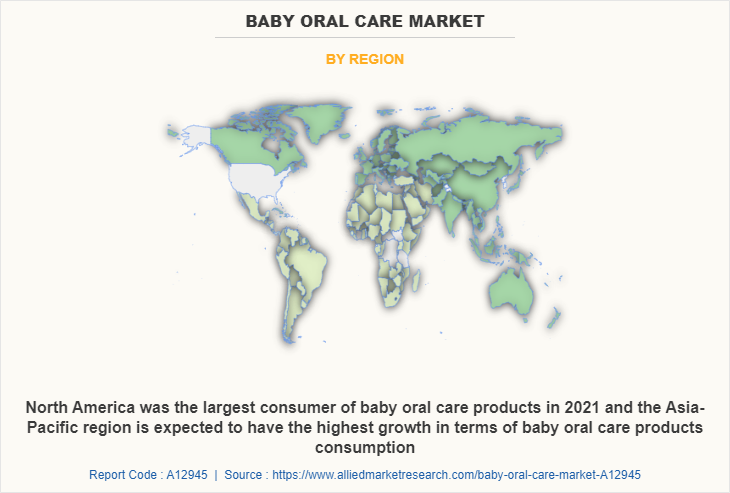

The baby oral care market is segmented into Type, End User, Distribution Channel, and Region. On the basis of type, the market is classified into toothbrush, toothpaste, floss, tooth mousse, and others. On the basis of age, the market is bifurcated into infant and toddler. On the basis of distribution channel, the market is segmented into supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others. On the basis of region, the market is divided across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, Saudi Arabia, United Arab Emirates, South Africa, and the Rest of LAMEA).

Baby and infant toothbrushes are made with soft bristles and are generally much smaller in size to make them easier to use for children. Most baby toothbrushes are designed in fun shapes or with images of various cartoon characters or pretty designs to make them appealing to babies. Toothbrushes for babies hold the highest Baby Oral Care Market Share. Toothpaste for babies is typically free of several chemical ingredients found in toothpaste for other age groups, such as fluoride and sugar. These toothpastes are designed to strengthen and fortify teeth to prevent tooth decay. Most baby toothpaste is made in smaller sizes. Baby dental floss is commonly used for babies aged one year and up. Dental floss assists in removing food buildup from between the teeth of the baby, thereby preventing cavities and tooth decay. Baby dental floss is typically made of plastic with a small piece of floss attached to the end of the stick to make it easier to use on babies. Tooth mousse is a type of dental paste that is used to fortify teeth and supplement them with minerals and nutrients. It is gaining popularity among consumers due to its beneficial properties and ease of use. It is made from natural materials, which has increased the demand for tooth mousse. Teethers, gum soothing gels, tongue cleaners, and tooth and gum wipes are some other baby oral care products. These products are typically used in the early stages of an oral care routine for the baby, even before teeth have formed in the mouth. These items are mostly used to help with teething as well as to maintain oral health before teething.

Infants are babies aged up to 12 months. These babies are in their early stages of development, learning to explore, play, speak, and do other things. Teeth of the baby begin to emerge around 6 months of age, making it critical to use baby oral care products during infancy in order for them to gain stronger teeth later in life. The dental development of babies during the infant stage has the potential to affect the person's dental health of a person for the rest of their life. As a result, parents increasingly use a variety of baby oral care products to supplement oral health care routine of their children. This has resulted in an increase in the demand for products such as teethers, baby tongue cleaners, baby gum wipes, and baby tooth mousse, which may help improve the quality of the teeth of the baby and maintain oral hygiene. Toddlers are babies aged 13 to 36 months. These babies almost develop teeth in the first half of the age groups and fully developed primary teeth at around 2 years, or 24 months. The use of regular oral care products begins during this period of development, and special care is taken to improve their oral health. The toddler stage of baby development is critical for oral health care because this is when babies start growing and the growth of the teeth is completed. Most parents begin introducing soft bristle toothbrushes and fluoride-free toothpaste to their babies at this age to ensure proper teeth and gum cleaning. Flossing of the teeth begins at this age as the teeth of the babies begin to touch each other and cleaning between the teeth becomes necessary.

Supermarkets and hypermarkets are gaining popularity as a result of easy availability of a wide range of consumer goods. Growth in urbanization, an increase in the global working population, and competitive pricing all contribute to the global appeal of such establishments. Furthermore, such companies sell items in a variety of categories, giving customers more options for purchasing their preferred baby oral care products from both well-known and lesser-known brands. Mom and baby shops, as well as baby product shops, specialize in baby oral care products. These businesses sell baby oral care products from a variety of brands, and their own, at a variety of price points to appeal to a wide range of customers. A convenience store is a small retail establishment that sells everyday items. Convenience stores are excellent places to purchase baby oral care products because they almost always stock products from major oral care brands and are the most convenient places to purchase baby oral care products in remote areas. There is a rapid expansion of online sales channels for baby oral care products. Customers can purchase toothbrushes, toothpaste, floss, teethers, gum wipes, and other baby oral care products at various price points from a variety of e-commerce and online retailers. Furthermore, many businesses and brands are developing their own online storefronts to sell their products, allowing them to interact more effectively with their customers. Baby oral care products are also available in mom-and-pop shops, pharmacies, general stores, and other locations. These sales channels for baby oral care products gaining popularity as more such establishments begin to store and sell a broader range of personal care and hygiene products, which provides Baby Oral Care Market Opportunities for growth.

North America is studied across the U.S., Canada, and Mexico. Greater concern for the welfare of is prevalent in the region, as is increased spending on baby care and baby well-being products. Furthermore, the presence in the region of several global brands associated with baby oral care boosts the market. Europe is studied across the UK, Germany, France, Italy, Spain, Russia, the Netherlands, and the Rest of Europe. The region adheres strictly to good child-rearing practices, which provides ample growth opportunities and increases the Baby Oral Care Market Demand. Furthermore, preference of the region for high-quality products drives the market growth. China, Japan, India, South Korea, Australia, and the Rest of Asia-Pacific are all studied in the Asia-Pacific region. Countries in the region are at various stages of development, making premium product purchases difficult for the majority of the population of the region. Consumers in the region are expected to stick with traditional methods of child-rearing. The LAMEA region is studied across Brazil, Argentina, Saudi Arabia, the United Arab Emirates, South Africa, and the Rest of LAMEA. The majority of the LAMEA countries are underdeveloped or in various stages of development, with many in the Middle East being fully developed. Many countries in the region lack adequate baby care; however, progress is being made in this area, which provides positive trends for the Baby Oral Care Market Forecast for the region.

Some of the major players of the Baby Oral Care industry analyzed in this report are Amway, Church & Dwight Co., Inc., Colgate-Palmolive Company, Dr. Fresh, LLC., Haleon plc, HCP Wellness, Himalaya Wellness Company, Honasa Consumer Pvt. Ltd., Pigeon Corporation, Prestige Consumer Healthcare Inc., Procter & Gamble, Punch & Judy, Quip NYC, Inc., Unilever, and Y-Brush.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the baby oral care market analysis from 2021 to 2031 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global baby oral care market trends, key players, market segments, application areas, and market growth strategies.

Baby Oral Care Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 2 billion |

| Growth Rate | CAGR of 4.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 450 |

| By Type |

|

| By End User |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Himalaya Wellness Company, Pigeon Corporation, HCP Wellness Pvt Ltd., Punch & Judy, Y-Brush, Amway Corp., Prestige Consumer Healthcare Inc., Colgate-Palmolive Company, Church & Dwight Co., Inc., Honasa Consumer Ltd., Haleon plc, Unilever plc, Dr. Fresh, LLC., The Procter & Gamble Company, Quip NYC, Inc. |

Analyst Review

According to the CXOs of several leading companies, baby oral care products are being rapidly adopted by parents to maintain the oral hygiene of their children. Greater concern amongst parents, especially in the millennial and gen z population, are some of the primary boosting factors for the market, especially in the developed regions of the world where young parents are willing to spend large amounts of money on their children.

There is a greater exposure of consumers in the developing regions of the world due to the urbanization of the regions as well as the increasing penetration of highly specified and value-added products in the regions. Parents in the region pay greater attention to the upbringing of their children, which includes the cultivation of proper mannerisms and hygiene techniques. This leads to an increase in the demand for baby oral care products in the region. However, the emerging trend of being childfree in the younger generation of consumers due to increased costs of living and lowering wage rates, coupled with a greater focus on education and career by both women and men may cause roadblocks to the market growth in the future.

Innovations by engaged stakeholders in the form of the creation of electric toothbrushes for children as well as U-shaped toothbrushes that may brush all of the teeth together is expected to help supplement the growth of the baby oral care market. Furthermore, the increase in adoption of products such as baby tongue cleaners, gum soothing gels, tooth mousse, and gum wipes may augment the growth of the market in the future. Further spread of baby oral care products in developing regions across the world is anticipated to help the market grow in the future.

The baby oral care market was valued at $1,336.3 million in 2021 and is estimated to reach $2.010.2 million by 2031, registering a CAGR of 4.3% from 2022 to 2031.

The global baby oral care market registered a CAGR of 4.3% from 2022 to 2031.

Raise the query and paste the link of the specific report and our sales executive will revert with the sample.

The forecast period in the baby oral care market report is from 2022 to 2031.

The top companies that hold the market share in the baby oral care market include Colgate-Palmolive Company, Procter & Gamble, Unilever, and Pigeon Corporation.

The baby oral care market report has 3 segments. The segments are type, age, and distribution channel.

The emerging countries in the baby oral care market are likely to grow at a CAGR of close to 7.0% from 2022 to 2031.

Following COVID-19, increased expenditure on babies and children's products, as well as the increasing availability of baby oral care products through online channels led to an increase in baby oral care sales.

North America will dominate the baby oral care market by the end of 2031.

Loading Table Of Content...

Loading Research Methodology...