Bank Guarantee Market Outlook – 2030

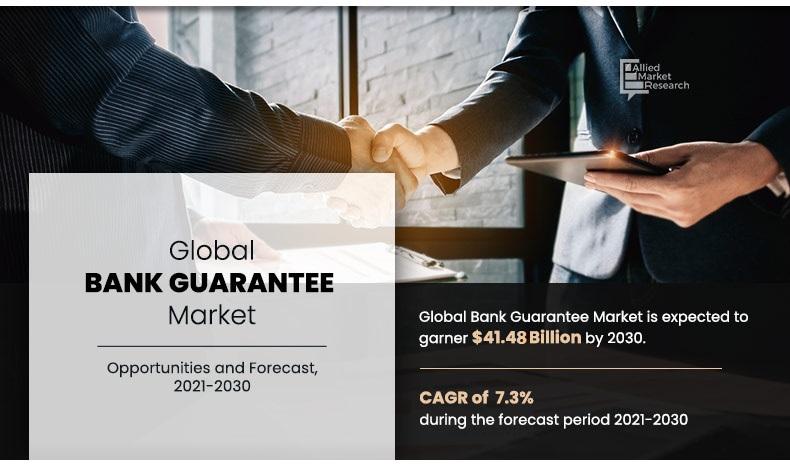

The bank guarantee market was valued at $20.28 billion in 2020, and is projected to reach $41.48 billion by 2030, registering a CAGR of 7.3% from 2021 to 2030. A bank guarantee is a guarantee issued by a lending institution. The bank guarantee indicates that the lending institution guarantees a debtor's obligations. In other words, if the debtor fails to meet their obligations, the bank will compensate the debtor. In addition, a bank guarantee allows a consumer, or debtor, to purchase products, equipment, or borrow money. Moreover, a bank guarantee is a pledge from a bank or other lending institution to reimburse the loss if a specific borrower defaults.

Bank guarantee promotes cross border trading between countries by providing financial assurance to various importers & exporters to successfully execute transactions, thus the demand for bank guarantee continues to rise, which acts as key driving force for the bank guarantee market. Furthermore, bank guarantee provides assurance to the seller that the payment will be made accordingly, thus lowering the financial risks and adoption of digitalized solutions in the process of bank guarantee, which accelerated the bank guarantee market growth.

However, exchange rate fluctuations and lack of credit facilities for small & medium-sized enterprises in various countries hamper growth of the market. On the contrary, rapid surge in import and export activities in various countries along with the government support toward increased trade activities &share of trade in the country economy are anticipated to provide a potential growth opportunity for the bank guarantee market.

The report focuses on growth prospects, restraints, and trends of the bank guarantee market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the bank guarantee market outlook.

By Type

Financial Guarantee segment accounted for the highest market share during 2021 - 2030

Segment Overview

The bank guarantee market is segmented on the basis of type, application, enterprise size, end user, and region. In terms of type, it is bifurcated into financial guarantee and performance guarantee. By application, it is divided into international and domestic. On the basis of enterprise size, it is segmented into small enterprises, medium enterprises, and large enterprises. By end user, it is bifurcated into exporters and importers. Region wise, the market is analysed across North America, Europe, Asia-Pacific, and LAMEA.

By Application

International segment will dominate the market throughout the forecast period

Competitive Analysis

The key players operating in the global bank guarantee market include BNP Paribas, Citibank Inc., DBS Bank Ltd., Deutsche Bank AG, HSBC Holdings plc, HDFC Bank Ltd., ICICI bank Limited, JPMorgan & Chase, Royal Bank of Scotland plc, Wells Fargo. These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to increase their market penetration and strengthen their foothold in the industry.

By Enterprise Size

Small Enterprises segment will grow at a highest CAGR of 12.4% during 2021 - 2030

COVID-19 Impact Analysis

The pandemic has hindered import and export commerce in a number of neighboring nations, and as a result, the bank guarantee market has been impacted. In addition, supply chain interruptions, low lending rates, and the potential of a worldwide recession have exacerbated the difficulties that importers and exporters confront. Moreover, banks and fintech industries provide their customers with options of bank guarantees digitally such as distributed ledger and block chain technology across the globe to speed up their financial obligations and enhance digitization in the market. This, in turn, has become one of the major growth factors for the bank guarantee industry during the global health crisis.

By End User

Importers segment will lead the market throughout the forecast period

Top Impacting Factors

Digitalization of Bank Guarantee Platforms

Technological advancement in the field of financing has given rise to new business practices and these forces have changed the financial services industry. This is especially true in cross-border trade finance, which invoices finance and factoring on the export side and supply chain finance on the import side. Bank guarantee has undergone rapid change from paper-based industry controlled by traditional banks into a digital landscape, where transactions can be largely conducted and funded online.

Furthermore, with these developments, to digitalize transactions related to trade, banks have concentrated particularly on bank guarantee products such as payment guarantee letter, performance bank guarantee, letters of credit and supply chain financing. Moreover, introduction of key technologies such as distributed ledger technology and block chain technology, have the potential to provide speed and security of transactions for buyers and sellers, during trading that propels the bank guarantee market growth.

For instance, Lygon - created by CBA, Westpac, ANZ, Scentre Group and IBM recorded the first digital banking guarantee on its block chain platform, thus leveraging the block chain technology to implement the process of bank guarantee to provide a clear pathway for applicants and beneficiaries to request the issuance of digital bank guarantees. Therefore, this is a major driving factor for the growth of bank guarantee market.

By Region

Asia-Pacific region would exhibit the highest CAGR of 9.7% during 2021 - 2030

Facilitate Importers and Exporters to Increase Cross Border Transactions

Bank guarantee letter facilitates the growth of cross border transactions between importers and exporters. Importers can import goods by availing financial guarantee from banks and pay back at a later stage of time. The exporter can be rest assured that there will be no default in payment since the bank provides guarantee for the payment. Therefore, importers and exporters can increase international business and deal with number of traders for different types of goods and services of cross border transactions. Thus, bank guarantee is a major boosting factor for the growth of cross border business in various trading countries.

Bank Guarantee Reduces the Chances of Financial Risks For Importers and Exporters

Bank guarantee involves financing of international and domestic trade flows. It reduces the risks involved in an international trade transaction such as default in payment by the importer after the delivery of the products. In case, the buyer fails to make the payment on time, the seller can be assured that payment will be made by the bank. Therefore, bank guarantee reduces the financial risk associated with doing business internationally or in the country.

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the global bank guarantee market share along with current trends and future estimations to illustrate the imminent investment pockets.

- Information about key drivers, restrains, and opportunities and their impact analysis on the global bank guarantee market size are provided in the report.

- The Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the bank guarantee market.

- An extensive analysis of the key segments of the industry helps to understand the bank guarantee market trends.

- The quantitative analysis of the global bank guarantee market forecast from 2021to 2030 is provided to determine the market potential.

Bank Guarantee Market Report Highlights

| Aspects | Details |

| By Type |

|

| By APPLICATION |

|

| By ENTERPRISE SIZE |

|

| By END USER |

|

| By Region |

|

| Key Market Players | DBS Bank Ltd., ICICI Bank Limited, HSBC Holdings plc, JPMorgan Chase & Co., Wells Fargo, HDFC Bank Ltd., BNP Paribas, Citigroup Inc., Royal Bank of Scotland plc, DEUTSCHE BANK AG |

Analyst Review

Financial assurance provided by the bank as guarantee for the importer and exporters, which reduces the risk of fraud in cross border transactions, and rapid growth of import & export activities are some of the major trends in the market. Furthermore, during the COVID-19 pandemic, the consumer’s trend shifted toward technologically advanced banking services.

Therefore, many banks adopted technology in providing bank guarantee services through technology, thus promoting social distancing in order to curb the spread of virus. For instance, two of Australia's big banks, the Commonwealth Bank of Australia and ANZ, are working with leading Singapore-based block chain company XinFin to boost automation and transparency in providing bank guarantee for trade asset and risk distribution.

The bank guarantee market is consolidated with the presence of key vendors such as BNP Paribas, Citibank Inc., DBS Bank Ltd., Deutsche Bank AG, HSBC Holdings plc, HDFC Bank Ltd., ICICI bank Limited, JPMorgan & Chase, Royal Bank of Scotland plc, Wells Fargo. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The Bank Guarantee Market is estimated to grow at a CAGR of 7.3% from 2021 to 2030.

The Bank Guarantee Market is projected to reach $41.48 billion by 2030.

To get the latest version of sample report

Factors such as digitalization and reduction in risk of default payment etc. boost the market growth.

The key players profiled in the report include BNP Paribas, Citibank Inc., DBS Bank Ltd., and many more.

On the basis of top growing big corporations, we select top 10 players.

The Bank Guarantee Market is segmented on the basis of type, application, enterprise size, end user, and region.

The key growth strategies of Bank Guarantee market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Financial Guarantee segment would grow at a highest CAGR of 8.1% during the forecast period.

Large Enterprises segment will dominate the market during 2021 - 2030.

Loading Table Of Content...