Banking Credit Analytics Market Research, 2032

The global banking credit analytics market was valued at $963.8 million in 2022, and is projected to reach $4.6 billion by 2032, growing at a CAGR of 17.4% from 2023 to 2032.

Banking credit analytics refers to the use of data analytics, machine learning, and other statistical techniques to analyze credit risk in the banking industry. This market includes software and services that help banks and financial institutions make informed decisions when it comes to lending money, managing credit risk, and reducing fraud. Moreover, in simple terms, it involves using data and technology to understand and evaluate the creditworthiness of borrowers and manage risks associated with lending money.

Credit risk management is a critical function for banks and financial institutions to assess the creditworthiness of borrowers and manage the risk associated with lending. Thus, with the growing complexity of the banking landscape and stricter regulatory requirements, banks are increasingly relying on advanced credit analytics solutions to effectively manage credit risk.

Furthermore, with the rise of big data and advanced analytics tools, banks and financial institutions are increasingly relying on data analytics to make informed decisions about credit risk management and loan underwriting. Hence, the growing demand for data-driven decision making is a major driver of the banking credit analytics market, and this trend is likely to continue in the years ahead as banks increasingly rely on data analytics to make informed decisions about credit risk management and loan underwriting.

Moreover, the adoption of credit analytics solutions is also helping banks to improve the customer experience by delivering more personalized and relevant services, while also improving risk management and operational efficiency. However, legacy systems and integration challenges act as a restraint for the banking credit analytics market by limiting the ability of banks and financial institutions to effectively adopt and implement credit analytics solutions. In addition, the shortage of trained professionals who have the necessary skills and knowledge to work in this area hampers the growth of the market. On the contrary, technology has played a critical role in transforming the banking credit analytics market, allowing banks and financial institutions to make better lending decisions and improve the overall efficiency and profitability of their lending operations.

The report focuses on growth prospects, restraints, and trends of the banking credit analytics market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the banking credit analytics market share.

Segment Review

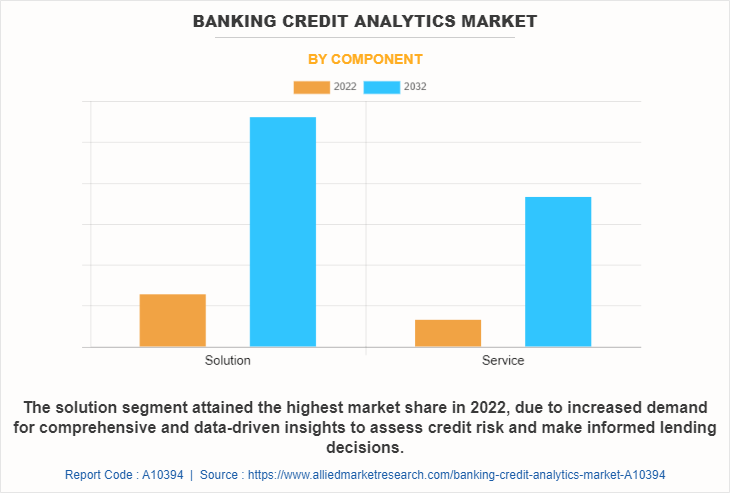

The banking credit analytics market is segmented on the basis of component, deployment mode, application, and region. Based on component, the banking credit analytics market it is segmented into solution and services. By deployment mode, it is segmented into on-premise and cloud. By application, it is segmented into risk management, fraud detection, credit analysis, portfolio management, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Based on component, the solution segment attained the highest growth in 2022 for the banking credit analytics market. This is because of the rise of big data, machine learning, and AI, banks are increasingly looking to leverage analytics solutions to improve their credit risk management and decision-making processes. These solutions help banks to identify and mitigate risks, optimize credit portfolios, and enhance customer experiences.

However, the services segment is considered to be the fastest growing segment during the forecast period. This is because the services segment in the banking credit analytics market is experiencing significant growth and presents numerous opportunities for banking credit analytics market players in the industry. One trend that is driving this growth is the increasing demand for data analytics and AI-powered solutions to improve credit risk assessment and management.

By region, North America attained the highest growth in 2022. This is because with the increasing digitization and automation of financial services, there is a growing demand for advanced credit analytics solutions in North America, which provide actionable insights to banks and financial institutions. However, the Asia-Pacific region is considered to be the fastest growing region during the forecast period. This is because, the proliferation of digital technologies and the rise of fintech companies in this region have contributed to the growth of the credit analytics market, as the companies in this region often rely on data analytics to assess credit risk for online lending and other innovative financial services.

The report analyzes the profiles of key players operating in the banking credit analytics market such as BNP Paribas, Citigroup, CRISIL Ltd, FIS, Fitch solutions, IBM Corporation, ICRA limited, Moody's Analytics, Inc., S&P global, and Wells Fargo. These players have adopted various strategies to increase their market penetration and strengthen their position in the banking credit analytics industry.

Market Landscape and Trends

The banking credit analytics market is witnessing significant growth and evolution, due to the increasing demand for data-driven insights, digitalization, and automation in the banking industry. Furthermore, the banking credit analytics market market is also expected to continue growing in the coming years, fueled by the rising need for accurate credit risk assessment, fraud detection, customer segmentation, and personalized product offerings.

Moreover, the integration of artificial intelligence, machine learning, and big data analytics is also transforming the banking credit analytics landscape, enabling banks to leverage vast amounts of data to enhance decision-making, reduce risk, and improve operational efficiency. In addition, the emergence of open banking and the adoption of cloud-based solutions are expected to create new growth opportunities in the banking credit analytics market. Further, the rise of digital banking and fintech startups is creating new opportunities for credit analytics providers to offer innovative solutions to a growing market. Therefore, these are some of the major market trends of the banking credit analytics market size.

Top Impacting Factors

Growth in Demand for Data-driven Decision Making

Credit risk management is a critical function for banks and financial institutions to assess the creditworthiness of borrowers and manage the risk associated with lending. With the growing complexity of the banking landscape and stricter regulatory requirements, banks are increasingly relying on advanced credit analytics solutions to effectively manage credit risk. Furthermore, with the globalization of financial markets, the proliferation of new financial products, and the increasing complexity of credit risk, banks are facing greater challenges in managing their credit portfolios. Therefore, there is a growing demand for advanced credit analytics tools to help banks manage risk, improve decision-making, and comply with regulatory requirements.

Moreover, as the credit analytics solutions leverage advanced data analytics techniques to assess credit risk more accurately. These solutions analyze vast amounts of data, including borrower financials, credit history, industry trends, macroeconomic indicators, and other relevant data points to provide a comprehensive risk assessment. Thus, by improving risk assessment, banks can make more informed lending decisions, reduce the probability of default, and mitigate credit risk. In addition, regulatory requirements such as the Basel Accords and the Dodd-Frank Act have increased the pressure on banks to improve their risk management practices. This has led to increased adoption of credit analytics tools by banks as they seek to comply with these regulations and avoid potential penalties. Therefore, the increasing need for risk management is driving the demand for credit analytics tools in the banking industry, which is expected to continue to grow in the coming years.

Increase in Demand for Credit Risk Management

With the rise of big data and advanced analytics tools, banks and financial institutions are increasingly relying on data analytics to make informed decisions about credit risk management and loan underwriting. Furthermore, data-driven decision making allows banks to leverage a wealth of data from multiple sources to gain insights into customer behavior, credit risk, and market trends. Thus, by using data analytics tools and techniques, banks can analyze large volumes of data quickly and accurately, identify patterns and trends, and make data-driven decisions that help mitigate credit risk and improve loan underwriting practices.

In addition, the increasing use of artificial intelligence (AI) and machine learning (ML) technologies is also contributing to the growth of the banking credit analytics market. As these technologies enable banks to automate credit risk assessment and loan underwriting processes, reducing manual labor and improving efficiency. Hence, the growing demand for data-driven decision making is a major driver of the banking credit analytics market growth, and this trend is likely to continue in the years ahead as banks increasingly rely on data analytics to make informed decisions about credit risk management and loan underwriting.

Growth in Emphasis on Customer Experience

The growing emphasis on customer experience has been a significant driver of the banking credit analytics market. Banks and other financial institutions are increasingly adopting credit analytics solutions to improve their understanding of customer needs and preferences, to deliver more personalized and relevant services, and to enhance the overall customer experience. One example of this trend is the use of credit analytics by banks to develop more accurate credit risk models that can help them make better lending decisions. By analyzing a variety of data points, including credit scores, income, and other financial metrics, banks can more accurately assess a borrower's creditworthiness and make more informed decisions about loan approvals, interest rates, and other terms.

Furthermore, credit analytics can also be used to identify opportunities for cross-selling and up-selling additional products and services to existing customers. Thus, by analyzing transactional data and customer behavior patterns, banks can identify which customers are most likely to be interested in specific products or services and tailor their marketing and sales efforts accordingly. Overall, the adoption of credit analytics solutions is helping banks improve the customer experience by delivering more personalized and relevant services, while also improving risk management and operational efficiency.

Lack of Skilled Professionals

The banking credit analytics market is growing rapidly, and there is a high demand for skilled professionals in this field. However, there is a shortage of trained professionals who have the necessary skills and knowledge to work in this area. As a result, companies may face difficulties in finding qualified candidates for key positions, which can slow down the pace of innovation and progress in the field. Moreover, to address this challenge, companies may need to invest in training programs and education initiatives to develop the necessary skills in their existing workforce or attract and retain talented professionals. In addition, collaboration between academia and industry can also help to bridge the gap between theoretical knowledge and practical application in the field of banking credit analytics.

Legacy Systems and Integration Challenges

Banks and financial institutions still rely on outdated legacy systems that may not be compatible with modern credit analytics solutions. This can create significant challenges when it comes to integrating and implementing credit analytics solutions, which may hinder the adoption and effectiveness of credit analytics in the banking industry. Furthermore, legacy systems are typically built on older technology platforms, may lack standardized data formats, and may have limited flexibility for data integration and analytics. This makes it difficult to extract, transform, and load data from these systems into credit analytics platforms, leading to delays, increased costs, and potential data quality issues.

Moreover, integrating credit analytics solutions with legacy systems may require extensive customization, data mapping, and system upgrades, which can be time-consuming, complex, and costly. In addition, legacy systems may not have the necessary computing power or infrastructure to support advanced credit analytics techniques such as machine learning or big data analytics, limiting the effectiveness and scalability of credit analytics solutions. Hence, legacy systems and integration challenges act as a restraint for the banking credit analytics market by limiting the ability of banks and financial institutions to effectively adopt and implement credit analytics solutions.

Advancement in Technology

With the advent of new technologies such as artificial intelligence, machine learning, and credit analytics in banking and financial institutions are now better equipped to analyze credit risk and make more informed lending decisions. One example of this is the use of Artificial Intelligence (AI) and Machine Learning (ML) algorithms to analyze vast amounts of financial data in real-time. By leveraging advanced algorithms and models, banks and other financial institutions can quickly and accurately assess the creditworthiness of borrowers and make better lending decisions. These technologies can help identify patterns and trends that would be difficult or impossible for humans to detect, resulting in more accurate risk assessments and more profitable lending decisions. In addition, these technologies provide banks with the ability to process and analyze vast amounts of data from various sources, including credit bureaus, financial statements, and social media. This data analysis helps them identify potential risks and opportunities and make more accurate credit assessments, which can ultimately lead to more profitable lending decisions.

Furthermore, the use of blockchain technology also helps to increase transparency and efficiency in credit markets by enabling secure, decentralized lending and borrowing. Thus, eliminating the need for intermediaries, blockchain-based lending platforms can reduce costs and improve access to credit for underserved populations. Hence, technology has played a critical role in transforming the banking credit analytics market, allowing banks and financial institutions to make better lending decisions and improve the overall efficiency and profitability of their lending operations.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the banking credit analytics market forecast from 2023 to 2032 to identify the prevailing banking credit analytics market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the banking credit analytics market outlook assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global banking credit analytics market trends, key players, market segments, application areas, and market growth strategies.

Banking Credit Analytics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.6 billion |

| Growth Rate | CAGR of 17.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 413 |

| By Component |

|

| By Deployment Mode |

|

| By Application |

|

| By Region |

|

| Key Market Players | ICRA limited, CRISIL Ltd , Wells Fargo, FIS, IBM CORPORATION, Moody's Analytics, Inc., S&P global, BNP Paribas, Fitch solutions, Citigroup |

Analyst Review

The banking credit analytics refers to the use of advanced analytics and data-driven techniques in the banking and financial services industry to analyze credit risk and make informed decisions related to lending and credit management. It involves the use of various statistical and machine learning algorithms, as well as data mining and predictive modeling techniques, to assess the creditworthiness of borrowers, evaluate their risk profiles, and determine appropriate credit terms and conditions. Furthermore, the banking credit analytics market is poised for significant growth in the coming years, driven by the increasing demand for data-driven insights and the growing adoption of advanced technologies such as artificial intelligence and machine learning. Moreover, with the rise of digital banking and the proliferation of big data, banks and other financial institutions are looking for ways to enhance their credit risk management capabilities and improve their decision-making processes. In addition, credit analytics solutions also offer to provide real-time data analysis and predictive modeling, which is high in demand, enabling financial institutions to assess creditworthiness more accurately and efficiently, and minimize the risk of default. As competition in the banking industry intensifies, credit analytics solutions will become an essential tool for banks to gain a competitive edge, optimize their loan portfolios, and increase profitability.

Furthermore, market players are adopting strategies like product development for enhancing their services in the market and improving customer satisfaction. For instance, in April 2022, Moody’s Analytics enhanced its services and developed its climate risk assessment into Credit Lifecycle Management Solution (CLM) solutions. Therefore, by integrating climate risk assessment capabilities into its flagship credit lifecycle management platform, it enables lenders to assess the impact of climate on their customers’ credit quality to inform lending decisions. Therefore, such strategies are boosting the growth of the banking credit analytics market in the upcoming years.

Moreover, some of the key players profiled in the report include BNP Paribas, Citigroup, CRISIL Ltd, FIS, Fitch solutions, IBM Corporation, ICRA limited, Moody's Analytics, Inc., S&P global, and Wells Fargo. These players have adopted various strategies to increase their market penetration and strengthen their position in the banking credit analytics industry.

The banking credit analytics market is witnessing significant growth and evolution, due to the increasing demand for data-driven insights, digitalization, and automation in the banking industry. Furthermore, the market is also expected to continue growing in the coming years, fueled by the rising need for accurate credit risk assessment, fraud detection, customer segmentation, and personalized product offerings.

North America is the largest regional market for Banking Credit Analytics Market

The global banking credit analytics market was valued at $963.84 million in 2022, and is projected to reach $4,637.9 million by 2032, growing at a CAGR of 17.4% from 2023 to 2032.

BNP Paribas, Citigroup, CRISIL Ltd, FIS, Fitch solutions, IBM Corporation, ICRA limited, Moody's Analytics, Inc., S&P global, and Wells Fargo.

Loading Table Of Content...

Loading Research Methodology...