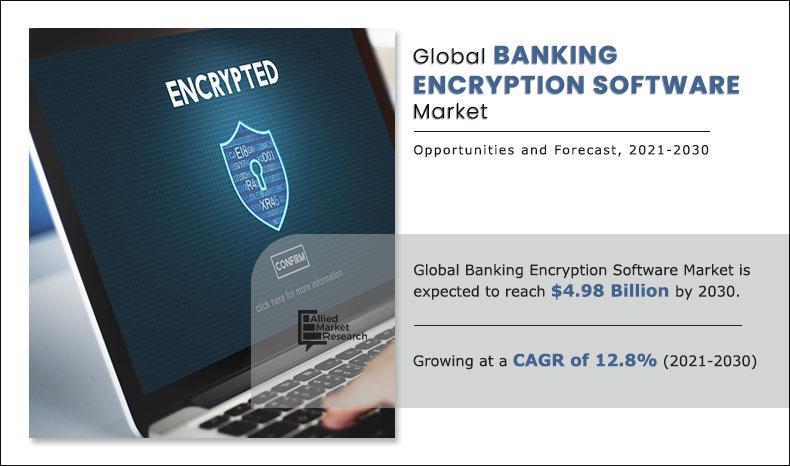

The global banking encryption software market size was valued at $1.49 billion in 2020, and is projected to reach $4.98 billion by 2030, growing at a CAGR of 12.8% from 2021 to 2030.

Banking encryption software is data protection platform that allows banks to confidentially exchange the transaction detail document with their customers. Furthermore, numerous benefits provided by banking encryption software service include high security, hassle free data transaction service, and others. In addition, various banks and financial institutions are using banking encryption software service to provide secure payment processing service to its customer. This increases the adoption of encryption software among banks, thereby driving the banking encryption software market growth.

The key factors driving the growth of the global banking encryption software market trends include increase in use of digital payment technology among the people and rise in cyberattack among the fintech institutes across globe. In addition, rise in demand of data security technology among the banks and financial institutions positively impacts the growth of the market. However, factors, such as implementation issues and lack of awareness toward encryption software among the banks of developing nations, is expected to hamper the market growth. On the contrary, penetration of AI based banking software across the developing nations of Asia-Pacific and LAMEA regions is expected to offer remunerative opportunities for the expansion of the banking encryption software market during the forecast period.

The disk encryption segment is expected to garner a significant share during the forecast period. Encrypted disks are safe as even if they get stolen or misplaced, the access to their contents remains limited to authorized users, which drives the growth of the market in this segment. However, the cloud encryption segment is expected to grow at the highest rate during the forecast period, owing to the adoption of cloud encryption by various banking companies. Thus, drives the growth of the encryption software market in this segment.

By Component

Software is projected as one of the most lucrative segments.

Region-wise, the banking encryption software market share was dominated by North America in 2020, and is expected to retain its position during the forecast period. This is attributed to increase in demand by the private and public banks for encryption software to secure and ensure privacy of data and rise in government support to deploy data security technology. However, Asia-Pacific is expected to witness significant growth rate during the forecast period, owing to rise in demand for encryption software to secure and ensure privacy of data among the banks across the developing nations of Asia-Pacific such as China and India.

The report focuses on the growth prospects, restraints, and trends of global banking encryption software market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on global banking encryption software market.

By Deployment Model

On-Premise is projected as one of the most lucrative segments.

Segment review

The banking encryption software market share is segmented into component, deployment model, enterprise size, function, and region. In terms of component, the market is fragmented into software and service.

Depending on deployment model, it is bifurcated into on-premise and cloud. On the basis of enterprise size, it is categorized into large enterprises and small and medium sized enterprises. According to function, it is classified into disk encryption, communication encryption, file / folder encryption and cloud encryption. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Enterprise Size

Large Enterprises is projected as one of the most lucrative segments.

The key players operating in the global banking encryption software industry include Broadcom, ESET, IBM Corporation, Intel Corporation, McAfee, LLC, Microsoft Corporation, Sophos Ltd., Thales Group, Trend Micro Incorporated and WinMagic. These players have adopted various strategies to increase their market penetration and strengthen their foothold in the banking encryption software industry.

COVID-19 impact analysis

The emergence of COVID-19 is expected to have a considerable impact on the growth of the banking encryption software market sales. The spending on the encryption software industry is expected to increase as compared to the spending planned before this pandemic, owing to multiple factors such as rise in adoption of mobile payment services among the people and increase in use of digital banking services. Furthermore, COVID-19 pandemic has brought radical changes to banking and financial institutions. In addition, banking encryption software is expected to grow significantly at a higher CAGR in the coming years, owing to working from home (WFH), social distancing, and digital transformation of payment industry.

By Function

Disk Encryption is projected as one of the most lucrative segments.

Top impacting factors

Increase in use of digital payment technology among the people

Increase in use of digital payment technologies such as debit cards, credit cards, and mobile banking among the people drives the growth of the banking encryption software market. It offers several benefits such as higher payment security, reduction of fraudulent activities in banking process, and improvement in the payment transaction service due to integration of encryption technology in the electronic payment method. In addition, encryption technology allows banks to ensure and protect the security and confidentiality of customer financial records while making digital payment. Furthermore, surge in need to protect financial records of banks and fintech institute against anticipated threats propels the growth of the market. More number of such benefits offered to customers by banks at the time of making digital payment, which accelerate the growth of banking encryption software market revenue globally.

Rise in demand of data security technology among the banks and financial institutions

Banks and financial institutions have been handling large amounts of financial and personal data about their customers. Thus, to protect huge number of financial records and to enhance the security of various critical documents of the customer’s banks and fintech are adopting encryptions software, which enhances the growth of the market. Furthermore, rise in digitalization across the globe have led to many innovations in the payment sector over the past several years, which includes wire transfers, mobile payments, and online banking technologies. Thus, due to continuously changing payment industries, financial service providers need data security technology to protect banking information from cyber-attacks, which drives the growth of the market. In addition, increase in demand for authentication while initiating a payment transaction accelerates the growth of the banking encryption software market across the globe.

By Region

Asia-Pacific would exhibit the highest CAGR of 14.2% during 2021-2030.

Key Benefits For Stakeholders

- The study provides an in-depth analysis of global banking encryption software market forecast along with the current trends and future estimations to elucidate the imminent investment pockets.

- Information about key drivers, restraints, and opportunities and their impact analysis on global banking encryption software market share is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the banking encryption software market from 2021 to 2030 is provided to determine the market potential.

Key Market Segments

By Component

- Software

- Services

By Deployment Model

- On-premise

- Cloud

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Industry Vertical

- Disk Encryption

- Communication Encryption

- File / Folder Encryption

- Cloud Encryption

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Netherlands

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- Singapore

- Australia

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

Key Market Players

- Broadcom

- ESET

- IBM Corporation

- Intel Corporation

- McAfee, LLC

- Microsoft Corporation

- Sophos Ltd.

- Thales Group

- Trend Micro Incorporated

- WinMagic

Banking Encryption Software Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Deployment Model |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Microsoft, Trend Micro Incorporated, McAfee, LLC, Thales Group, BROADCOM, Intel Corporation, SOPHOS LTD, ESAT, IBM CORPORATION, WinMagic |

Analyst Review

The adoption of banking encryption software has increased over the years to boost the security of financial transaction during payment process. In addition, rise in use of advanced technology in banks and financial institutions, and increase in integration of contactless payment technologies in banking payment app are some of the important factors, which boost the adoption of banking security technology across the globe. Furthermore, numerous benefits provided by banking encryption software include improving operational efficiency by reducing payment transition security, and reducing fraudulent activities in money transaction process, propels the growth of the banking encryption software market across the globe.

Key providers of banking encryption software, such as IBM Corporation, Trend Micro Sophos, and Thales Group among others account for a significant share in the market. According to industry experts, the banking encryption software market is expected to witness increased adoption in the coming years, owing to rise in adoption of digital technology among banks for delivering fast and secure payment transaction service. In addition, increase in investment made by banks into security payment transaction platform across China, India, and Japan, is expected to provide lucrative opportunities for the market growth. North America is expected to dominate the market during the forecast period while emerging countries in Asia-Pacific and Latin America are projected to offer significant growth opportunities.

The Banking Encryption Software Market is estimated to grow at a CAGR of 12.8% from 2021 to 2030.

The Banking Encryption Software Market is projected to reach $4.98 million by 2030.

To get the latest version of sample report

The key factors driving the growth of the global banking encryption software market trends include increase in use of digital payment technology among the people and rise in cyberattack among the fintech institutes across globe.

The key players profiled in the report include Broadcom, ESET, IBM Corporation, Intel Corporation, McAfee, LLC, Microsoft Corporation, Sophos Ltd., Thales Group, Trend Micro Incorporated and WinMagic.

On the basis of top growing big corporations, we select top 10 players.

The Banking Encryption Software Market is segmented on the basis of component, deployment model, enterprise size, function, and region.

The key growth strategies of Banking Encryption Software Market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

The software segment accounted major for the banking encryption software market share.

Loading Table Of Content...