Banking Wearable Market Research, 2032

The global banking wearable market was valued at $13.7 billion in 2022, and is projected to reach $62.7 billion by 2032, growing at a CAGR of 16.8% from 2023 to 2032.

Banking wearable refers to a device that is designed to enable banking transactions and services through a wearable device, such as a smart watch or a fitness tracker. These wearables are typically equipped with technologies like near field communication (NFC) or Bluetooth that allow them to communicate with banking systems and perform various banking functions. One of the primary functions of banking wearables is to facilitate contactless payments. By linking the wearable device to a user's bank account or payment card, they can make purchases by simply tapping or waving the device near a compatible payment terminal.

The increase in demand for wearable payment devices is a key driver for the growth of banking wearable market. Wearable payment devices offer users a remarkable level of convenience and ease of use. These devices allow individuals to make payments effortlessly and seamlessly without the burden of carrying physical wallets or mobile phones. The inherent wearable design of these devices, such as smartwatches or fitness bands, grants users swift and convenient access to payment features, empowering them to conduct transactions on the move. In addition, the growth in adoption of cashless transactions and increase in demand for host card emulation (HCE) are the major driving factors for the market.

However, the high cost of banking wearable devices is a major factor hampering the growth of the market. The high costs associated with banking wearable devices have prevented individuals and businesses from adopting these devices, which is hindering the growth of the market. In addition, fees vary for services related to wearable devices and contactless payments, such as maintenance, referrals, and upgrades. Contrarily, the increasing use of near field communication (NFC) and radio frequency identification (RFID) presents a significant opportunity for the banking wearable industry. NFC and RFID technologies provide enhanced security features for banking wearables. NFC facilitates secure communication between wearable devices and payment terminals, ensuring protection of sensitive payment information.

The report focuses on growth prospects, restraints, and trends of the banking wearable market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the banking wearable market.

Segment Review

The banking wearable market is segmented into Type, Technology and Application.

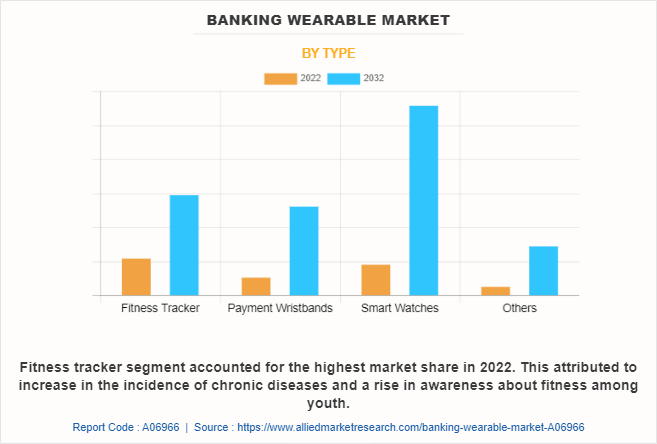

The banking wearable market is segmented on the basis of type, technology, application, and region. On the basis of type, it is categorized into fitness tracker, payment wristbands, smart watches, and others. By technology, it is divided into near field communication (NFC), quick response (QR) codes, radio frequency identification (RFID), and others. On the basis of application, it is classified into retail, entertainment centers, restaurants and bars, healthcare, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the fitness tracker segment attained the highest banking wearable market size in 2022. This is attributed to the fact that customers are widely opting for fitness trackers owing to their increased safety feature, which protects them from frauds and identity thefts at the time of payment processes. In addition, many businesses have started incorporating mobile payments into their fitness trackers.

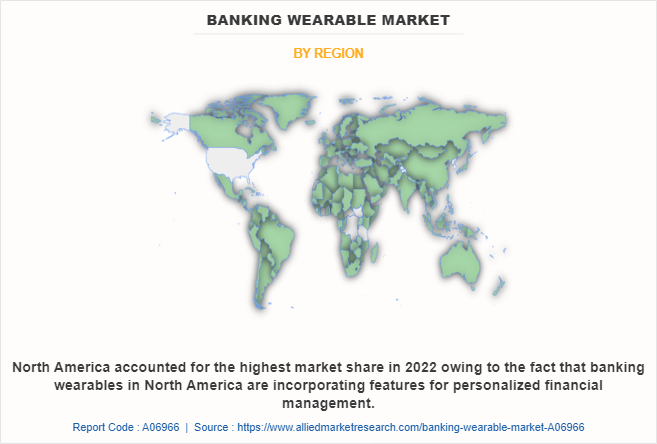

On the basis of region, North America held the highest banking wearable market share in 2022. Banking wearable’s in North America are incorporating features for personalized financial management. Users can track spending, set budgets, receive insights into financial habits, and get personalized recommendations to manage their finances more effectively. In addition, banking wearable’s in North America often work alongside existing mobile banking applications, allowing users to access account information and perform transactions seamlessly across devices.

The report analyzes the profiles of key players operating in the banking wearable market such as Google LLC, Apple Inc., Fidesmo, Xiaomi Corporation, Visa Inc., Wirecard, Thales, Nymi Inc., Gemalto NV, and Samsung Electronics. These players have adopted various strategies to increase their market penetration and strengthen their position in the banking wearable market.

Market Landscape and Trends

The adoption of banking wearables is steadily increasing due to technological advances and the popularity of wearable devices. With more consumers using smartwatches, fitness trackers, and other wearables, which has created a market opportunity for integrating banking and financial services into these devices.. Moreover, the decreasing costs for deploying NFC technology are encouraging the rise in demand for the technology. Businesses widely use this technology to transfer data from their devices to various contactless payment terminals, such as NFC tags and smartphones. In addition, the rapid growth in the use of contactless payments is driven by the mandates of digital payment networks by the governments across the globe, which, as a result, has increased the adoption of payment-enabled devices.

Furthermore, the banking wearable market has also seen the emergence of startups and fintech companies that specialize in developing innovative banking solutions for wearables. These companies focus on creating user-friendly banking apps, advanced security features, and personalized financial insights for wearable devices. Therefore, the banking wearable industry is constantly evolving, with new trends emerging as technology advances.

Top Impacting Factors

Increase in Demand for Host Card Emulation (HCE)

The increasing preference for convenience and speed in contactless transactions has spurred the demand for HCE technology. HCE technology help users to securely make contactless payments via their mobile devices, eliminating the need for physical cards. This viable solution simplifies the payment process and eliminates the need to carry multiple cards as consumers opt for contactless payments.

Moreover, banking wearables with HCE technology offer a hassle-free and time-saving payment experience. Users can simply tap their wearable devices to make payments, eliminating the need for physical cards or mobile phones. This convenient feature makes the payment process easier, particularly in situations when accessing a phone or wallet is inconvenient. In addition, advancements in wearable technology such as improved sensors, longer battery life and improved connectivity are making it easier to integrate HCE functionality into banking wearables. Growing demand for HCE continues to drive innovation in the banking wearables market, resulting in more feature-rich and advanced devices. Furthermore, the combination of HCE and banking wearables creates a compelling value proposition that expands the market and drives adoption of these devices among tech-savvy consumers. Therefore, these trends are driving banking wearable market growth.

Growth in Adoption of Cashless Transaction

Cashless transactions offer convenience and speed to consumers as they do not need to carry physical cash and reduce transaction time. Banking wearables provide a seamless and efficient method of cashless payments. Users only need to tap or wave the wearable device to complete the transaction, which is faster and more convenient than traditional payment methods. Ease of use and fast payment processing are contributing to the growing demand for banking wearables.

Moreover, the proliferation of digital wallets such as Apple Pay, Google Pay or Samsung Pay has played a vital role in driving the demand for banking wearables. These wallets allow users to securely store payment information on mobile devices and make transactions using NFC technology. Banking wearables seamlessly integrate with digital wallets, extending the convenience of cashless payments to the wearable form factor. Furthermore, the increasing popularity of cashless transactions has played a significant role in the expansion of the banking wearable market. For instance, as per LiveMint, the volume of digital payments in India has increased by 33% year-on-year during the financial year 2021-2022. A total of 7,422 crore digital payment transactions were recorded during this period, up from 5,554 crore transactions seen in FY 2020-21, said the Ministry of Electronics and IT (MeitY). This growth has been further driven by the convenience and enhanced security provided by banking wearables.

Increase in Demand for Wearable Payment Devices

Wearable payment devices have become more accessible and compatible with a wide range of payment terminals. Many point-of-sale systems and retailers have upgraded their infrastructure to support contactless payments, including wearable devices, which has further fueled their demand. In addition, the appearance and layout of wearable payment devices have undergone changes to meet the preferences of fashion-savvy consumers. Currently, manufacturers provide fashionable and personalized choices that seamlessly merge technology and fashion, resulting in wearable payment devices that are more attractive and socially embraced.

The fusion of fashion and technology has broadened the range of consumers, appealing to individuals who value both functionality and style. For instance, in March 2021, Axis Bank became the first bank in India to launch its own range of wearable contactless payment devices ‘Wear N Pay’, these wearable devices are directly linked to the customers’ bank account and function like a regular debit card. Furthermore, advancements in wearable technology, such as improved sensors, longer battery life, and enhanced connectivity, have played a significant role in the growth of wearable payment devices.

High Costs of Banking Wearable Devices

The high costs associated with banking wearable devices have prevented individuals and businesses from adopting these devices, which is hindering the growth of the market. In addition, fees vary for services related to wearable devices and contactless payments, such as maintenance, referrals, and upgrades.

Furthermore, the high initial production price of banking wearables leads to additional costs. In addition, banking wearable device manufacturers have to spend large sums of money on research, marketing and promotion, shipping, licensing, software, and wearable development, thus incurring significant costs. Moreover, high costs can impede the achievement of economies of scale. Manufacturing and producing banking wearable devices at large volumes can help reduce production costs per unit. Overall, high cost of banking wearable devices is major restraining factor for the growth of market.

Increase in use of NFC and RFID

NFC and RFID technologies provide enhanced security features for banking wearables. NFC facilitates secure communication between wearable devices and payment terminals, ensuring protection of sensitive payment information. In addition, RFID technology enables secure access control and authentication, adding an extra layer of security to portable devices. The increasing emphasis on secure payment methods creates an opportunity for banking wearables that use NFC and RFID technology. Furthermore, the development of contactless cards and wearable devices by many manufacturers, including Apple, Samsung, and Huawei, uses NFC and RFID technologies, which are projected to provide lucrative chances for global market expansion.

Additionally, many businesses are implementing host card emulation and NFC technology to give their customers simple access to the merchandise displayed on their smartphones. For instance, KFC launched an NFC-based advertising campaign in the UK in 2020. The campaign's main objective was to publicize KFC's Hot Shots Meal Box. KFC launched this service to encourage home delivery services and broaden the use of contactless payment methods. In addition, businesses are using host card emulation technology in their wearable devices to empower wearables and boost the performance of various mobile and wearable devices, which is a potential growth prospect for the industry.

Integration of Digital Banking Services

The integration of banking wearables and digital banking services allow users to access various banking functions directly from their wearables. Users may check account balances, view transaction history, send money, receive real-time notifications, and more. This integration will enhance the overall banking experience, giving users convenient and instant access to financial information and services. In addition, integration with digital banking services allows for personalization and customization of banking wearables. Users can customize their preferences, such as selecting specific accounts to display, setting spending limits, or choosing notification preferences. Personalization features create a tailored experience, making banking wearables more engaging and relevant to individual users. Furthermore, digital banking services often incorporate robust security measures such as multi-factor authentication and real-time fraud detection. This integration ensures safe and secure transactions and increases user confidence when using banking wearables for financial transactions. These advantages create a compelling proposition for users, will contribute to the adoption and growth of banking wearable in the market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the banking wearable market forecast from 2022 to 2032 to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities of banking wearable market outlook.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the banking wearable market segmentation assists in determining the prevailing banking wearable market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global banking wearable market trends, key players, market segments, application areas, and market growth strategies.

Banking Wearable Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 62.7 billion |

| Growth Rate | CAGR of 16.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 266 |

| By Type |

|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | Nymi Inc., Xiaomi Corporation, Apple Inc., Gemalto NV, Samsung Electronics, Visa Inc., Wirecard, Google LLC, Fidesmo, Thales |

Analyst Review

As per the insights of the top-level CXOs, a banking wearable is a device developed to make it possible to access banking services and transactions using a wearable device, like a smart watch or a fitness tracker. These wearables commonly include near field communication (NFC) or Bluetooth technology, which enables them to interact with banking systems and carry out different financial tasks. Wearables for banking frequently have built-in security safeguards to safeguard user information and transactions. These include functions like remote wearable device deactivation in the event of loss or theft, secure encrypted communications, and biometric identification. Furthermore, banking wearables allow users to check their account balances conveniently. With just a glance at their wearable device, users can access their available funds without the need to log in to a banking app or visit an ATM.

The CXOs further added that market players are adopting strategies like partnership for enhancing their services in the market and improving customer satisfaction. For instance, in March 2023, DIGISEQ, the wearable payments tech pioneer, announced its partnership with financial super app, Curve, bringing large-scale wearable payment technology to the UK fintech’s 4 million customers across 31 European countries. Furthermore, the growth of the market is expected to be driven by the increasing use of contactless payments at places such as gas stations, toll stations, ticketing devices and vending machines. Therefore, such strategies are expected to boost the growth of the banking wearable market in the upcoming years.

Moreover, some of the key players profiled in the report are Google LLC, Apple Inc., Fidesmo, Xiaomi Corporation, Visa Inc., Wirecard, Thales, Nymi Inc., Gemalto NV, and Samsung Electronics. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The banking wearable market is estimated to grow at a CAGR of 16.8% from 2023 to 2032.

The banking wearable market is projected to reach $62.70 billion by 2032.

Increase in demand for host card emulation (HCE), growth in adoption of cashless transaction and increase in demand for wearable payment devices majorly contribute toward the growth of the market.

The key players profiled in the report include banking wearable market analysis includes top companies operating in the market such as Google LLC, Apple Inc., Fidesmo, Xiaomi Corporation, Visa Inc., Wirecard, Thales, Nymi Inc., Gemalto NV, and Samsung Electronics.

The key growth strategies of banking wearable players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...