Barcode Label Printer Market Research, 2032

The global Barcode Label Printer market was valued at $2.6 billion in 2022, and is projected to reach $4.3 billion by 2032, growing at a CAGR of 5.2% from 2023 to 2032. The increased demand from retail and logistics sectors for efficient inventory management and advancements in technology, such as the integration of wireless connectivity and cloud-based solutions, are driving market expansion by enhancing printing speed and accessibility.

A barcode label printer is a device that generates physical labels containing machine-readable barcodes. These printers are crucial for various industries, facilitating automated data capture, inventory management, and product identification. They produce labels that are quickly and accurately scanned by barcode readers, enhancing efficiency in tracking and tracing processes. Their primary objective is to automate data capture and enhance efficiency. In retail, they enable quick POS transactions and price tagging. In logistics, they streamline shipping and inventory management. Healthcare relies on them for patient and medication identification. Manufacturing industry utilizes barcode labels for product tracking, while education sector employs them for library management.

Key Takeaways of Barcode Label Printer Market Report

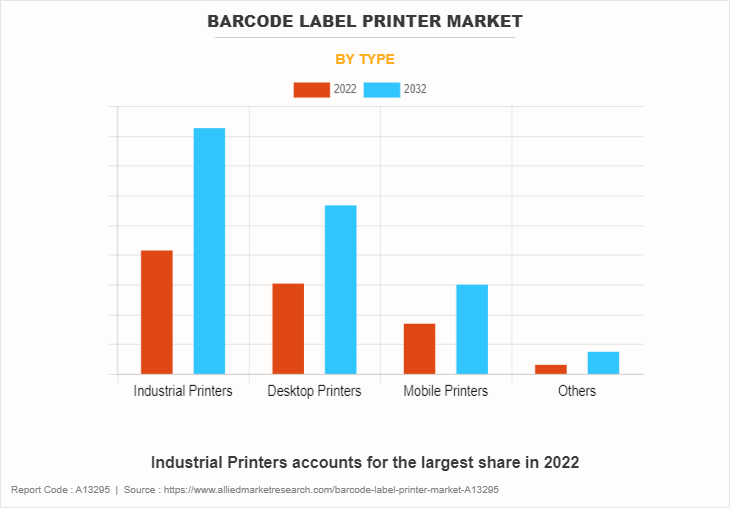

- Based on type, the industrial printer held the largest share of the barcode label printer market overview report in 2022 and is anticipated to grow at the fastest CAGR during the forecast period.

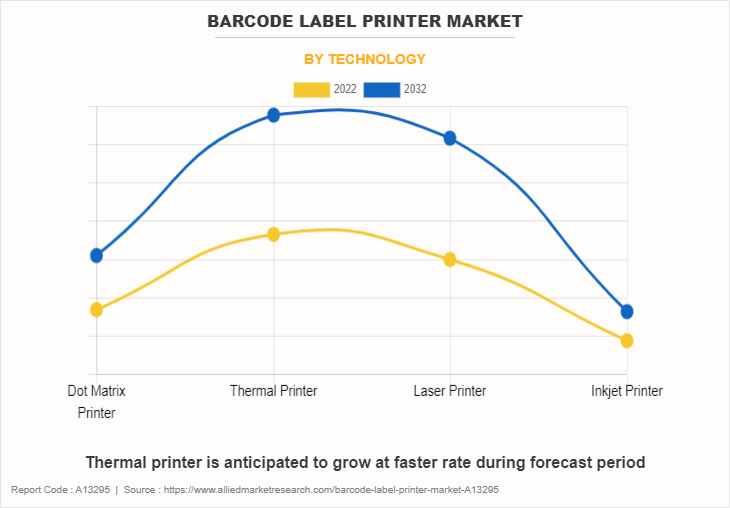

- Based on technology, the thermal printer segment dominated the barcode label printer market size in 2022. However laser printer is anticipated to grow at the fastest CAGR during the forecast period.

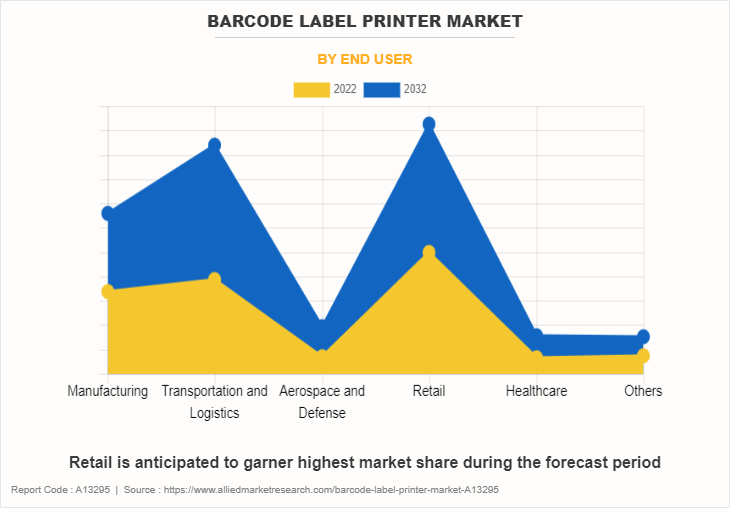

- Based on end user, the retail segment held the largest share in 2022. However transportation and logistics segment is anticipated to grow at the fastest CAGR during the forecast period.

- Region-wise, North America held the largest market share in 2022. However Asia-Pacific is anticipated to grow at the fastest CAGR during the forecast period.

Segment Overview

The barcode label printer market is segmented into Type, Technology and End User.

On the basis of type, the barcode label printer market segmentation is done into industrial printers, desktop printers, mobile printers and others. In 2022, the industrial printer segment held the largest share of the barcode label printer market due to its robust performance and high-volume printing capabilities, catering to the needs of large-scale manufacturing and logistics operations. These printers are designed to withstand demanding environments, ensuring durability and reliability. Moreover, their ability to print on various materials and sizes further solidifies their position as the preferred choice for industrial.

On the basis of technology, the barcode label printer market is classified into dot matrix printer, thermal printer, laser printer and inkjet printer. In 2022, the thermal printer segment dominated the market in terms of revenue. However laser printer is expected to grow at faster CAGR during the forecast period owing to superior print quality, high-speed printing, and versatility offered by laser technology. In addition, increasing adoption of laser printers across various industries, driven by their ability to produce durable and high-resolution labels, contributes to their expected accelerated growth trajectory in the market.

On the basis of end user, the barcode label printer market is classified into manufacturing, transportation and logistics, aerospace and defense, retail, healthcare and others. In 2022, the retail segment dominated the market in terms of revenue. However, transportation and logistics grow at faster CAGR owing to escalating demand for efficient tracking and labeling solutions. As e-commerce and supply chain complexities increase, there is a heightened need for barcode labeling systems to streamline operations, driving accelerated growth in this sector.

On the basis of region, the barcode label printer market size by Country analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Russia, and rest of Europe), Asia-Pacific (China, Japan, India, Australia South Korea, and rest of Asia-Pacific), and Latin America (Brazil, Argentina, and rest of Latin America) and Middle East and Africa (UAE, Saudi Arabia, and rest of MEA). North America, remains a significant participant in the barcode label printer in 2022. However Asia-Pacific to grow at faster CAGR of 6.62% due to expanding industrialization, booming e-commerce activities, and increasing adoption of automation technologies across various sectors. Rising investments in manufacturing and logistics infrastructure, coupled with the burgeoning retail sector, are further propelling the demand for barcode label printers in this region.

Competetive Analysis

Competitive analysis and profiles of the major barcode label printer companies, such as SATO Holdings Corp., Toshiba TEC Corporation, Zebra Technologies, Fujitsu Ltd., Brother Industries Ltd., Honeywell International Inc., Seiko Epson Corp., Canon Inc., TSC Auto Id Technology Co Ltd, and Brady Corp. are provided in barcode label market report. Business strategies such as product launch, product development, acquisition and partnership were adopted by the major barcode label printer market share by company in 2022. For instance, in November 2023, SATO Corporation, a global pioneer in auto-ID and labeling solutions,with Mitsubishi Electric Corporation,, launched sample programs for Mitsubishi Electric MELSEC sequencers to further automate label printing by sending commands to SATO label printers at designated events in the production line.

Market Dynamics

Innovations in product offerings

The barcode label printer industry growth is fueled by innovations in product offerings, which stand as a prominent trend driving the barcode label printer market. Companies in this industry leverage cutting-edge technologies to maintain their market standing. For instance, TSC Auto ID Technology Co. Ltd. introduced the Alpha-30R 3-inch performance mobile barcode label printer in June 2022. This printer, available in basic and premium models, boasts a robust design, substantial media capacity, and an IP54 rating for dust and water protection. With print speeds of up to 5 ips for the basic model and 6 ips for the premium model, it caters to various receipt and label printing needs, offering versatility for indoor and outdoor applications. Furthermore, the increase in thefts and fraud is a major reason to drive the expansion of the barcode label printer industry. Illicit activities, such as unauthorized acquisition of assets or deceptive financial practices, pose risks. Barcode label printers play a vital role in minimizing these risks through improved inventory management, authentication, and access control measures. Reports from the National Council on Identity Theft Protection in 2023 highlighted a staggering 5.7 million fraud and identity theft reports received by the FTC, with identity theft accounting for 1.4 million instances, leading to total losses of $10.2 billion. This escalation underscores the pivotal role of barcode label printers in combating rising threats of theft and fraud.

High initial costs

However, high initial costs significantly hinder the expansion of the barcode label printer market growth. Substantial upfront investments, particularly for advanced models with sophisticated features, pose a financial barrier, especially for small and medium-sized enterprises. This cost challenge has the potential to discourage potential users, limiting the market reach. Affordability issues impede the barcode label printer growth projections, restricting their ability to enhance operational efficiency and data management across diverse industries. Overcoming this financial barrier is essential to promote broader acceptance and stimulate the growth of the market.

The growth of e-commerce and demand for efficient last-mile delivery

The growth of e-commerce and the demand for efficient last-mile delivery solutions present a significant barcode label printer market opportunity in the coming years. The booming online shopping sector demands efficient inventory management and precise order fulfillment processes. Barcode label printers play a crucial role in producing labels or transparent barcode labels and QR code stickers for products and shipments, ensuring quick and accurate scanning throughout the supply chain. As the emphasis on speed and accuracy in last-mile delivery grows, the importance of printable barcodes technology rises. Barcode label printers contribute to optimizing logistics, minimizing errors, improving tracking capabilities, and enhancing the overall efficiency of the last-mile delivery process. In the dynamic domain of modern retail and e-commerce, barcode label printers prove essential.

Recent Developments in Barcode Label Printer Market

- In April 2023, Toshiba launched the BC400P industrial colour label printer which combines high speed, high print quality and high durability to create the right solutions for customers wanting to produce their own on-demand colour labels. Toshiba are experts in printing, with more than 20 years of providing colour solutions to their workspace solutions customers and now brings this expertise to industrial labelling customers.

- In May 2021, Zebra Technologies Corporation launched the ZSB Series printer, the company’s wireless label printing solution designed for the small office home office (SOHO) market. It is easy to load, eco-friendly label cartridges along with a modern label designer and mobile app software experience, the ZSB Series enables entrepreneurs and small business owners to effortlessly design, create and print transparent barcode labels, allowing them to focus on the details of their business.

Key Benefits for Stakeholders

- This study comprises an analytical depiction of the market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current global barcode label printer market analysis forecast is quantitatively analyzed from 2022 to 2032 to benchmark financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in label printing.

- The report includes the market share of key vendors and barcode label printer market trends.

Barcode Label Printer Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.3 billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By End User |

|

| By Type |

|

| By Technology |

|

| By Region |

|

| Key Market Players | Zebra Technologies, Brady Corporation, Honeywell International Inc., SATO Holdings Corporation., Brother Industries, Ltd., Toshiba Tec Corporation, Canon Inc., SEIKO EPSON CORP, Fujitsu, TSC Auto ID Technology Co., Ltd. |

Analyst Review

The global Barcode Label Printer Market Overview has promising potential for increasing the production of barcode labels tailored for multiple industries. The business scenario witnesses increase in demand for barcode label printer, particularly in manufacturing hubs, highly commercialized economy and developing regions, such as China, India, Japan, U.S., UK, and Brazil. Companies in this industry have adopted various innovative techniques to provide customers with advanced and innovative product offerings.?

Increased adoption of automated data capture technologies drives the growth of the market. However, high initial cost impedes this growth. Furthermore, the growth of e-commerce and the demand for efficient last-mile delivery solutions is expected to create lucrative opportunities for the key players operating in the market.?

The market participants are expected to introduce technologically advanced products to remain competitive in the market. Product launch, product development, acquisition and collaboration are the prominent strategies adopted by market players. For instance, on Jan 13, 2023, Citizen Systems America Corporation, a leading global printing technology manufacturer, launched its latest desktop barcode printer lineup, CL-H300SV, at NRF 2023 in New York City. It is launched at NRF 2023, the CL-H300SV barcode label printers are anti-microbial and disinfectant-ready.

The growing demand for mobile barcode label printers and adoption of cloud-based label printing solutions are the upcoming trends of Barcode Label Printer Market.

The leading application of barcode label printer is in the retail sector.

North America is the largest regional market for Barcode Label Printer.

The barcode label printer market was valued for $2.63 billion in 2022.

SATO Holdings Corp., Toshiba TEC Corporation, Zebra Technologies, Fujitsu Ltd., Brother Industries Ltd., Honeywell International Inc., Seiko Epson Corp., Canon Inc., TSC Auto Id Technology Co Ltd, and Brady Corp. are the top companies to hold the market share in Barcode Label Printer.

Loading Table Of Content...

Loading Research Methodology...