Bariatric Beds Market Research, 2034

The global bariatric beds market size was valued at $347.7 million in 2024, and is projected to reach $583.8 million by 2034, growing at a CAGR of 5.3% from 2025 to 2034. The growth of the bariatric beds market is driven by a rising prevalence of obesity and an aging population requiring specialized care. According to the World Health Organization (WHO), worldwide obesity has nearly tripled since 1975, and in 2022, over 1 billion people were living with obesity. In addition, by 2030, one in six people globally will be aged 60 years or older, with the number of individuals aged 60 and above projected to grow from 1 billion in 2020 to 1.4 billion by 2030, and further to 2.1 billion by 2050. This combination of increasing obesity rates and an expanding elderly population continues to elevate the need for bariatric care solutions, thus fueling the demand for bariatric beds globally and drive the growth of the bariatric beds market.

Bariatric beds are specialized medical beds designed to accommodate and support individuals with obesity, offering enhanced safety, comfort, and functionality. These beds are engineered with reinforced frames, wider sleeping surfaces, and higher weight capacities to meet the unique needs of bariatric patients. They play a critical role in promoting patient dignity, improving mobility, reducing the risk of pressure ulcers, and facilitating effective caregiving. Widely used in hospitals, long-term care facilities, and home healthcare settings, bariatric beds are an essential component in the management of obesity-related conditions, post-surgical recovery, and chronic care. With growing emphasis on inclusive and specialized healthcare infrastructure, bariatric beds are increasingly integrated into modern patient care strategies worldwide.

Key Takeaways

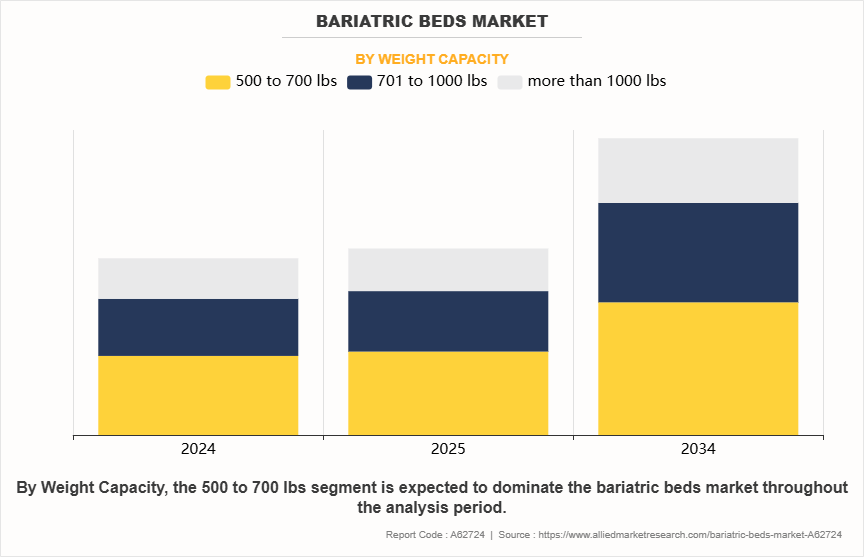

- On the basis of weight capacity, the 500-700 lbs segment dominated the bariatric beds market in terms of revenue in 2024. However, the 701-1000 lbs segment is anticipated to grow at the fastest CAGR during the forecast period.

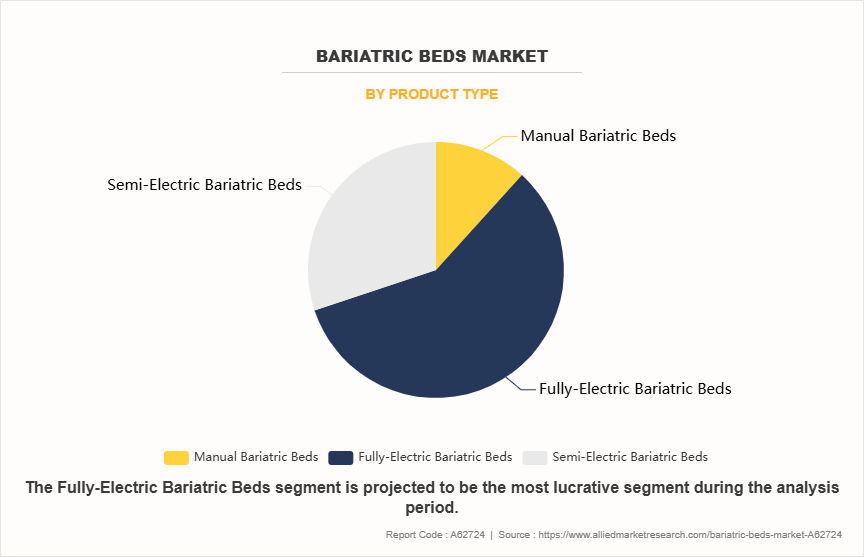

- On the basis of product type, the fully-electric bariatric bed segment dominated the bariatric beds market in terms of revenue in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

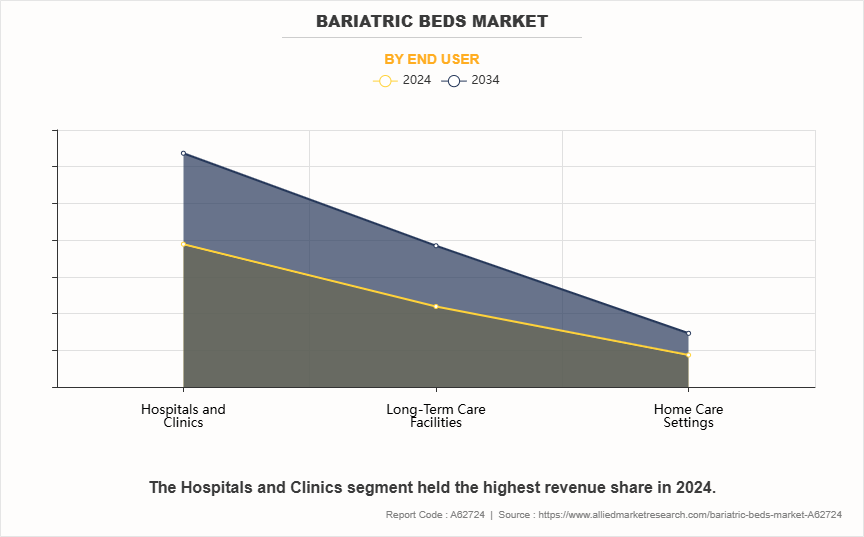

- On the basis of end user, the hospitals & clinics segment dominated the bariatric beds market in terms of revenue in 2024. However, the long-term care facilities segment is anticipated to grow at the fastest CAGR during the forecast period.

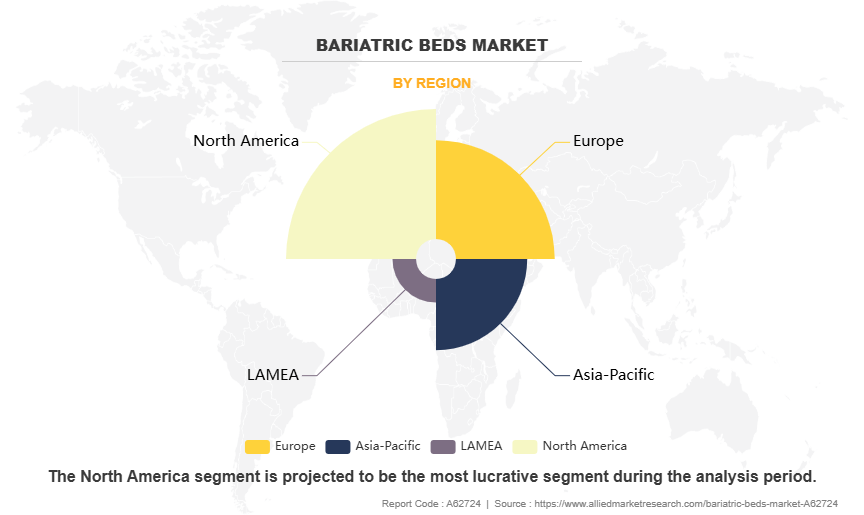

- Region-wise, North America generated the largest revenue in bariatric beds market in 2024. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

The bariatric beds market size is experiencing steady growth driven by a combination of demographic, medical, and technological factors. One of the primary drivers is the rising global prevalence of obesity and obesity-related comorbidities, such as diabetes, cardiovascular diseases, and osteoarthritis. As the number of bariatric patients continues to increase, there is a surge in demand for specialized hospital furniture designed to accommodate higher weight capacities and enhance patient safety, comfort, and mobility. Bariatric beds, with reinforced frames, wider dimensions, and advanced positioning features, are essential for managing the care of obese patients in hospitals, long-term care facilities, and home settings.

Another major bariatric beds market growth factor is the surge in bariatric surgeries, including gastric bypass and sleeve gastrectomy, particularly in North America, Europe, and parts of Asia. These procedures require post-operative care tailored to the unique needs of obese individuals, fueling demand for bariatric beds with features such as powered adjustments, side rail safety, and pressure redistribution mattresses. Healthcare providers are increasingly investing in these beds to ensure compliance with patient handling protocols and to reduce the risk of caregiver injuries during patient repositioning and transfer.

Moreover, technological advancements in bariatric bed design are also contributing to bariatric beds market expansion, as highlighted in the bariatric beds market outlook. Fully electric models with integrated weighing systems, remote-controlled adjustments, and compatibility with smart monitoring devices are gaining popularity for their ease of use and efficiency. The integration of IoT in patient care equipment enables real-time monitoring and remote diagnostics, which enhances care delivery in both acute and long-term settings.

In addition, the aging global population is amplifying the demand for bariatric care. Older adults are more prone to obesity-related complications, reduced mobility, and chronic illnesses, which require specialized support systems such as bariatric beds to maintain quality of life. This is particularly evident in regions such as North America, Europe, and East Asia, where healthcare systems are adapting to an increasingly elderly and overweight demographic.

Emerging markets in Asia-Pacific, Latin America, and the Middle East are creating new opportunities for bariatric beds market manufacturers. Factors such as increasing healthcare expenditure, urbanization, lifestyle shifts, and greater awareness of obesity management are driving demand. Governments in these regions are expanding public health initiatives and infrastructure to cope with rising obesity rates, while private healthcare providers are equipping facilities with advanced bariatric care solutions. Local and regional manufacturers are also introducing cost-effective bariatric beds that meet both clinical and budgetary requirements, boosting market penetration.

Segmental Overview

The bariatric beds industry is segmented into weight capacity, product type, end user, and region. On the basis of weight capacity, it is bifurcated into 500-700 lbs, 701-1000 lbs, and more than 1000 lbs. On the basis of product type, the market is segregated into manual bariatric beds, fully-electric bariatric beds, and semi-electric bariatric beds. On the basis of end user, the market is categorized into hospitals & clinics, long-term care facilities, and home care settings. Region-wise, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

By Weight Capacity

On the basis of weight capacity, the 500-700 lbs segment dominated the bariatric beds market share in 2024 due to widespread use across general bariatric care settings and its compatibility with most hospital infrastructure. These beds offer an optimal balance between weight capacity and cost-effectiveness, making them a standard choice in hospitals, long-term care facilities, and rehabilitation centers. Their ability to accommodate a broad range of bariatric patients without requiring specialized infrastructure has driven their high adoption.

However, the 701-1000 lbs segment is expected to witness the highest CAGR during the forecast period owing to the growing prevalence of extreme obesity, increasing demand for specialized care, and rising investments by healthcare providers in high-capacity bariatric equipment. In addition, regulatory emphasis on patient safety and staff ergonomics encourages facilities to adopt beds with higher load capacities to minimize the risk of injury during patient handling.

By Product Type

On the basis of product type, the fully electric bariatric beds segment dominated the bariatric beds market share in 2024 and is anticipated to register the highest CAGR during the forecast period of bariatric beds market. This growth is fueled by increasing demand for enhanced patient comfort, ease of use for caregivers, and integration of advanced features such as electric height adjustment, Trendelenburg positioning, and remote-control operation. Fully electric beds significantly reduce the physical strain on healthcare staff and improve operational efficiency in bariatric care. Moreover, the growing adoption of smart hospital infrastructure and emphasis on reducing hospital-acquired injuries further support the shift toward fully electric models.

By End User

On the basis of end user, the hospitals & clinics segment dominated the medical bariatric beds market in 2024, driven by the high volume of bariatric surgeries, emergency admissions, and acute care requirements for obese patients. Hospitals are typically the first point of care for patients with obesity-related complications, and they are better equipped with advanced infrastructure and funding to procure high-cost bariatric beds. In addition, reimbursement policies and growing awareness about obesity-related risks have contributed to the increased deployment of bariatric beds in hospital settings.

However, the long-term care facilities segment is expected to witness the highest CAGR during the forecast period of bariatric beds market owing to the rising aging population with obesity-related comorbidities, increasing demand for extended post-acute care, and the growing trend of shifting patients from acute care to long-term care settings. These facilities are increasingly investing in specialized equipment, including bariatric beds, to enhance patient mobility, reduce caregiver injury, and meet regulatory standards for obesity management.

By Region

Region-wise, North America held the largest share of the bariatric beds industry in 2024, due to the high prevalence of obesity, well-established healthcare infrastructure, favorable reimbursement policies, and strong adoption of advanced bariatric care equipment across hospitals and long-term care facilities. The presence of key market players and higher healthcare spending per capita further support the region’s dominance.

However, Asia-Pacific is projected to register the highest CAGR during the bariatric beds market forecast period owing to the rapidly rising obesity rates, increasing awareness about bariatric care, growing investments in healthcare infrastructure, and the expanding elderly population prone to obesity-related comorbidities. Government initiatives aimed at improving access to quality care and the rising penetration of private healthcare providers are also contributing to the region’s accelerated growth.

Competition Analysis

Competitive analysis and profiles of the major players in the bariatric beds market include Drive DeVilbiss Healthcare, Invacare Corporation, Baxter International Inc. (Hill-Rom Holdings), Stryker Corporation, GF Health Products, Inc., Cobi Rehab, Alerta Medical, Rotec International, Arjo, and Joerns Healthcare LLC.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bariatric beds market analysis from 2024 to 2034 to identify the prevailing bariatric beds market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bariatric beds market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global bariatric beds market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bariatric beds market trends, key players, market segments, application areas, and market growth strategies.

Bariatric Beds Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 583.8 million |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2024 - 2034 |

| Report Pages | 324 |

| By Product Type |

|

| By Weight Capacity |

|

| By End User |

|

| By Region |

|

| Key Market Players | Rotec International, Drive DeVilbiss Healthcare, Invacare Corporation, Baxter International Inc., Stryker Corporation, GF Health Products, Inc., Alerta Medical Ltd., Arjo, Cobi Rehab, Joerns Healthcare LLC |

Analyst Review

The market for bariatric beds has witnessed steady growth due to the global surge in obesity and related comorbidities such as diabetes, cardiovascular diseases, and reduced mobility. These conditions have significantly increased the demand for specialized care solutions across hospitals, rehabilitation centers, and home healthcare settings. The expanding geriatric population, particularly in North America and Europe, has further driven the need for bariatric support equipment, as elderly patients often require enhanced safety, comfort, and mobility assistance.

Technological advancements, such as beds with integrated pressure-relieving surfaces, patient monitoring features, and motorized adjustability, are enhancing patient outcomes and caregiver efficiency, making these products more appealing to healthcare providers. Government initiatives aimed at upgrading long-term care facilities and hospital infrastructure have also boosted the procurement of bariatric beds. Moreover, the growing trend toward home care and outpatient treatment has increased the demand for bariatric beds that are easy to move and assemble, making them suitable for use outside traditional hospital settings.

North America accounted for the largest revenue share in 2024, supported by strong healthcare infrastructure, higher obesity rates, and rise in preference for technologically advanced patient care systems. Leading players in the region, such as Stryker and Invacare, continue to drive innovation and expand distribution networks. However, Asia-Pacific is expected to record the highest CAGR during the forecast period, driven by improving healthcare access, rise in obesity prevalence, and increase in investments in hospital infrastructure, particularly in China, India, and Southeast Asia.

The top companies holding significant market share in the bariatric beds market include Stryker Corporation, Invacare Corporation, Arjo AB, Hill-Rom Holdings, Inc. (now part of Baxter International Inc.), and GF Health Products, Inc. These companies are recognized for their extensive product portfolios, technological innovations, and strong global distribution networks that cater to the rising demand for advanced bariatric care solutions.

Bariatric Beds Market to Reach $407.89 Mn by 2027 in the short run and $583.8 Mn by 2034 Globally, at 5.3% CAGR

North America is the largest regional market for bariatric beds, primarily driven by the high prevalence of obesity, advanced healthcare infrastructure, and strong reimbursement policies. The region also benefits from increased awareness regarding bariatric care and the presence of leading market players, contributing to significant demand for specialized medical equipment.

Technological innovation is accelerating, with smart, IoT?enabled electric beds featuring integrated sensors, remote control, and automated positioning becoming mainstream to enhance patient safety and caregiver efficiency.

The primary application driving the bariatric beds market is within hospital settings, where high patient turnover—including bariatric surgery, ICU care, and post-operative recovery—accounts for the largest share (around 60?% globally.

Loading Table Of Content...

Loading Research Methodology...