Base Oil Market Overview

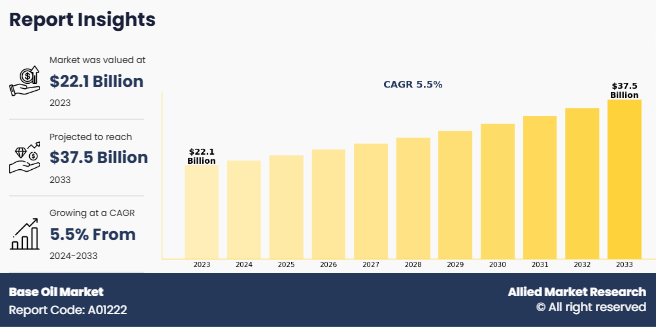

The global base oil market was valued at $22.1 billion in 2023, and is projected to reach $37.5 billion by 2033, growing at a CAGR of 5.5% from 2024 to 2033.

Base oils are essential lubricating materials derived from refining crude oil or other synthetic processes. They serve as a primary ingredient in manufacturing lubricants and are crucial for formulating products that minimize friction, control temperature, and protect machinery and other mechanical components. Base oils fall into different categories depending on their chemical composition and refining process, which ultimately influences their properties and performance. These categories include mineral-based oils, synthetic oils, and plant-based oils.

Introduction

A refinery can produce base oil as one of its specialty products. Base oil is the refined petroleum mineral or synthetic material produced by a refinery to a required set of specifications, typically lubricant base stock. Base oils are made by extracting and processing high-viscosity material from vacuum gasoil or vacuum reside distillation cuttings. This necessitates unique processing through a range of lubes plant units. The quality of a lubricant can depend upon the type of base oil used for the refining and/or production method used to produce the base oil. It is critical toward the grade of lubricant as base oils normally make up to 70–97% of formulation of lubricants.

Key Takeaways

- The base oil market study covers 20 countries. The research includes a segment analysis of each country in terms of both value and volume for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global base oil markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literatures, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the base oil market.

- The base oil market is highly fragmented, with several players including Phillips 66 Company, Chevron Corporation, Exxon Mobil Corporation , Evonik Industries AG, Neste Oyj, PT Pertamina, S-OIL Corporation, Royal Dutch Shell Plc, AVISTA OIL AG, and Saudi Aramco. Also tracked key strategies such as acquisitions, product launches, mergers, expansion etc. of the players operating in the base oil market.

Market Dynamics

Rise in demand for high-performance lubricants is expected to drive the growth of base oil market during the forecast period. High-performance lubricants, formulated from premium-quality base oils, provide better protection against wear, reduce friction, and enhance energy efficiency. As industries like automotive, manufacturing, power generation, and heavy equipment expand and modernize, the machinery they use becomes increasingly complex and demands higher-performance lubricants. These lubricants not only improve machine efficiency but also extend equipment lifespan, leading to reduced maintenance costs and downtime, which are critical for sectors relying on uninterrupted operations.

For instance, modern engines are designed to meet stringent emission standards and maximize fuel economy. These engines often operate at higher temperatures and pressures, creating a need for lubricants that can withstand severe conditions without degrading. This has driven the development of high-quality base oils, such as Group II, Group III, and even synthetic options, which possess high viscosity indexes, excellent oxidation stability, and low volatility. As electric vehicles (EVs) and hybrids become more common, the demand for specialized lubricants with excellent thermal management properties grows, further bolstering demand for advanced base oils.

However, volatile crude oil prices is expected to drive the growth of base oil market during the forecast period. Crude oil serves as the primary raw material for producing base oils, meaning that any variation in its cost directly impacts the production and pricing of base oils. When crude oil prices rise, manufacturers face higher raw material costs, which they may struggle to pass on to consumers, especially in competitive markets. Conversely, when crude oil prices drop, the base oil market experiences downward pricing pressure, affecting profit margins for producers. This inherent volatility creates a challenging business environment for base oil manufacturers, who must navigate fluctuating input costs while maintaining pricing strategies that ensure competitiveness and profitability.

Demand for oils in the automotive industry, especially from developing countries, and stringent environmental legislation leading to strict performance standards drive the global base oil market growth. Furthermore, increase in demand for hydraulic oil in the automobile industry drives the growth of base oil industry. However, fluctuating costs of crude oil and regulations concerning emission norms hamper the market growth. The global shift from group I base oils to group II & III present numerous growth opportunities to market players.

Segments Overview

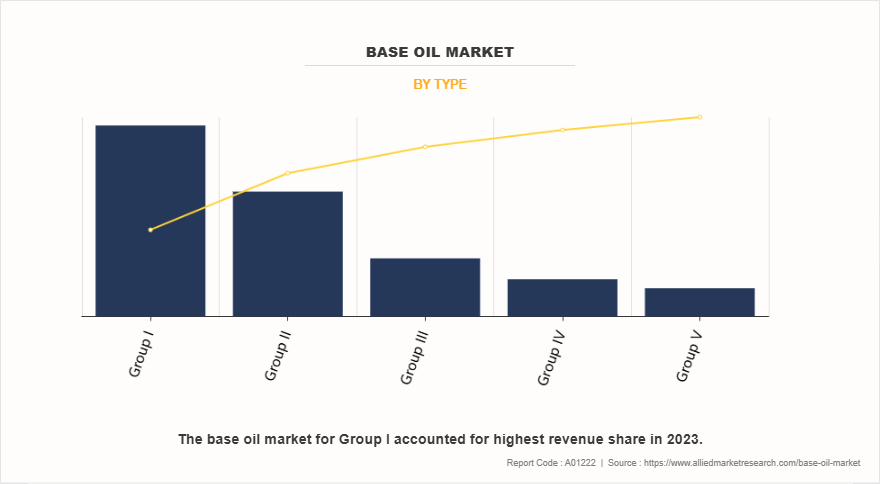

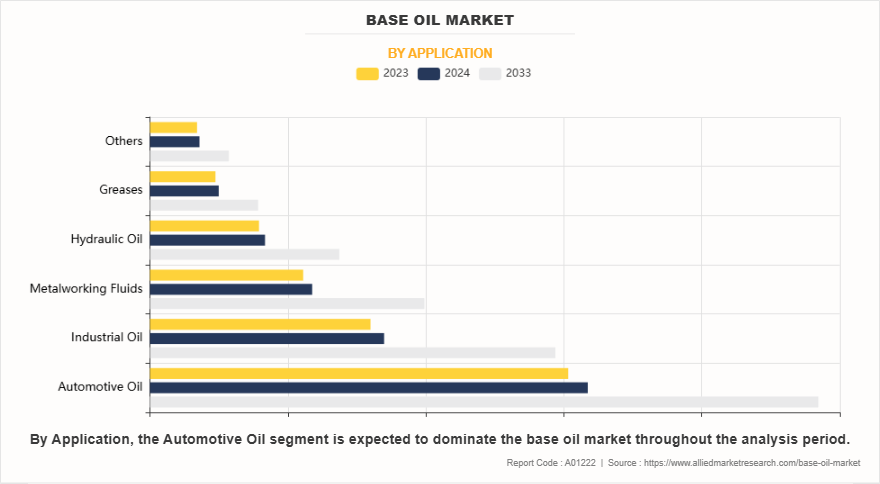

The base oil market is segmented on the basis of resin type, application, and region. Depending on type, the market is categorized into group I, II, III, IV, and V. According to application, it is classified into automotive oil, industrial oil, metalworking fluids, hydraulic oil, greases, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Based on type, the group I segment dominated the global base oil market size in 2023, and is expected to maintain its dominance during the forecast period. Group I base oils are primarily used in the production of lubricants. These include automotive engine oils, transmission fluids, and hydraulic fluids. Their chemical composition makes them suitable for applications where extreme pressure or high temperatures are not critical factors. They are also found in industrial gear oils, turbine oils, and circulating oils, which are used in machinery and industrial equipment that operate under moderate conditions.

On the basis of application, automotive oil dominated the base oil market during the forecast period. Base oil plays a crucial role in the formulation of automotive lubricants, particularly in engine oils, transmission fluids, and greases. It is the primary component in these products, making up about 70-90% of the lubricant's composition, depending on the specific product. The automotive industry relies heavily on base oils to ensure optimal performance and protection for vehicle engines, gearboxes, and other components. Base oils act as the foundation that determines the oil's viscosity, lubricating properties, and ability to withstand high temperatures and pressures, which are critical for minimizing friction and wear inside the engine.

Region-wise, Asia-Pacific accounted for the largest share of the base oil market in 2023, and is expected to grow at the highest CAGR, in terms of both volume and value, owing to the growing rate of motorization in the developing countries. This is driving the demand for lubricants, which, in turn, increases the demand for base oil. China leads the region in base oil consumption, driven by its expansive automotive industry and increasing industrialization. The country’s growth in vehicle ownership has spurred a strong demand for high-quality lubricants, including Group I, II, and III base oils.

Additionally, China is focusing on producing more eco-friendly lubricants as part of its environmental initiatives, pushing for higher-quality base oils. Other emerging economies in Southeast Asia, such as Indonesia, Thailand, and Vietnam, are also experiencing increased base oil usage due to rapid industrialization, growing automotive sectors, and rising transportation needs. These countries often rely on imports, especially of Group II and III base oils, to meet their lubricant manufacturing requirements.

Competitive Analysis

The global base oil market profiles leading players that include Phillips 66 Company, Chevron Corporation, Exxon Mobil Corporation, Evonik Industries AG, Neste Oyj, PT Pertamina, S-OIL Corporation, Royal Dutch Shell Plc, AVISTA OIL AG, and Saudi Aramco. The key players have adopted strategies such as product launch to increase their market share. The global base oil market report provides in-depth competitive analysis and profiles of these major players.

Industry Trends of Base Oil Market

In February 2023, Shell PLC introduced its new passenger car motor oil, the Shell Helix SP HX8 0W-20. This fully synthetic engine oil meets BS VI standards and is specifically formulated for turbocharged gasoline direct injection (TGDI) engines, providing protection against low-speed pre-ignition (LSPI) damage. Shell highlights that this product not only supports improved fuel economy but also reduces emissions, aligning with advancements in engine design and performance requirements.

In September 2023, PETRONAS Lubricants International and PT Kilang Pertamina Internasional entered a Joint Study Agreement (JSA) to assess the feasibility of establishing a new greenfield lube base oil facility at Refinery Unit (RU) IV in Cilacap, Central Java. This collaboration aims to deliver a comprehensive technical and feasibility study, addressing the demand within Indonesia and the expanding regional markets, such as China and Southeast Asia.

In July 2023, Chevron Corporation initiated the production of four centiStoke API Group III base stocks at its Richmond, California refinery. This move is set to increase the U.S. output of Group III stocks, addressing the growing demand for this category and decreasing reliance on imports.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the base oil market analysis from 2023 to 2033 to identify the prevailing base oil market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the base oil market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global base oil market trends, key players, market segments, application areas, and market growth strategies.

Base Oil Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 37.5 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Phillips 66 Company, Exxon Mobil Corporation, Chevron Corporation, S-OIL Corporation, Neste OYJ, AVISTA OIL AG, Royal Dutch Shell Plc, PT Pertamina, Evonik Industries AG |

Analyst Review

According to the opinions of various CXOs of leading companies, the base oil market is expected to witness significant growth in the upcoming years. Urbanization and infrastructure development are key drivers of economic growth, particularly in developing regions, and they significantly impact the demand for base oils. As cities expand and modernize, there is a surge in construction activities, including the building of roads, bridges, residential complexes, and industrial facilities. These activities rely heavily on industrial machinery such as excavators, loaders, cranes, and other heavy equipment, which require regular lubrication to operate efficiently. This directly increases the consumption of lubricants, and by extension, base oils, which are a primary component of lubricants. Additionally, the rapid pace of urbanization leads to an increase in the manufacturing and transportation sectors to meet the growing needs of urban populations. Industrial machinery in manufacturing plants, as well as vehicles and equipment used in transportation, depend on base oil-derived lubricants for smooth operation and longevity. The cumulative effect of these activities creates a robust demand for base oils, particularly in developing countries experiencing significant urban expansion.

The volatility in crude oil prices significantly impacts the base oil market due to the strong interconnection between crude oil and base oil production. As crude oil serves as the primary raw material for producing base oils, fluctuations in its price have a direct effect on the cost structure of base oil manufacturing. When crude oil prices rise sharply, the cost of producing base oils also increases, which often leads to higher market prices for end-users. Conversely, a drop in crude oil prices can reduce production costs, but such fluctuations make it challenging for manufacturers to maintain stable pricing strategies.

This volatility affects not only manufacturers but also downstream industries and consumers. For manufacturers, sudden increases in crude oil prices can squeeze profit margins, particularly if they are unable to pass on these additional costs to consumers due to competitive pressures. This uncertainty forces producers to adopt hedging strategies or diversify raw material sources, which may not always be feasible. On the other hand, for end-users, such as lubricant manufacturers and industrial consumers, fluctuating base oil prices can disrupt budgeting and financial planning, making it difficult to predict operational costs.

The global base oil market was valued at $22.1 billion in 2023, and is projected to reach $37.5 billion by 2033, growing at a CAGR of 5.5% from 2024 to 2033

The major operating players in the base oil market includes Phillips 66 Company, Chevron Corporation, Exxon Mobil Corporation, Evonik Industries AG, Neste Oyj, PT Pertamina, S-OIL Corporation, Royal Dutch Shell Plc, AVISTA OIL AG, and Saudi Aramco.

Asia-Pacific is the largest region for base oil market.

Automotive oil is the leading application of base oil market.

Increase in demand for recycling and re-refining are the upcoming trends of base oil market.

Loading Table Of Content...

Loading Research Methodology...