Basic Petrochemical Market Research, 2033

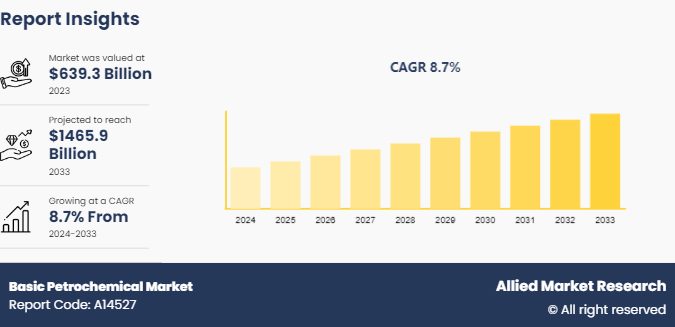

The global basic petrochemical market was valued at $639.3 billion in 2023, and is projected to reach $1, 465.9 billion by 2033, growing at a CAGR of 8.7% from 2024 to 2033.

Market Introduction and Definition

Basic petrochemicals are the foundational chemical compounds derived from petroleum and natural gas, serving as the building blocks for a vast array of products across numerous industries. These chemicals, often referred to as primary petrochemicals, are produced in large volumes through processes such as cracking and reforming of hydrocarbons. The primary categories of basic petrochemicals include olefins (such as ethylene, propylene, and butadiene) , aromatics (such as benzene, toluene, and xylene) , and synthesis gas components (hydrogen, carbon monoxide) . Ethylene and propylene, as part of the olefins group, are crucial to produce plastics, synthetic fibers, and elastomers. Aromatics, another major category, are pivotal in producing various chemicals and materials. Synthesis gas, composed of hydrogen and carbon monoxide, is essential for producing ammonia, methanol, and various other chemical products. The production and utilization of basic petrochemicals are thus integral to the functioning and advancement of numerous sectors, including automotive, agriculture, healthcare, consumer goods, and others.

Key Takeaways

- The basic petrochemicals market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2033.

- More than 2, 500 product literatures, industry releases, annual reports, and other such documents of major basic petrochemicals industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The surge in demand for plastics and polymers is a significant driver of the basic petrochemicals market. Plastics, produced from olefins like ethylene and propylene, are integral to packaging, automotive components, electronics, and consumer goods. Their lightweight, durable, and versatile nature makes them essential across numerous industries. As global populations grow and economies expand, the use of plastic products increases, driving the need for higher production of basic petrochemicals. Advances in packaging, especially in sustainable and smart solutions, further boost this demand, underscoring the crucial role of petrochemicals in addressing the diverse needs of contemporary societies.

The expansion of construction and infrastructure projects is a crucial driver of the basic petrochemicals market. Materials like plastics, resins, and synthetic rubbers, derived from petrochemicals, are essential in constructing durable, efficient, and cost-effective buildings and infrastructure. With increasing urbanization and economic development, the demand for residential, commercial, and industrial construction is soaring globally. These projects require large quantities of products like PVC for pipes, insulation materials, and coatings, all of which depend on basic petrochemicals. As countries invest more in modernizing and expanding their infrastructure, the reliance on petrochemical-derived materials continues to grow, fueling market expansion.

However, high capital and operational costs significantly restrain the growth of the basic petrochemicals market. Establishing and maintaining petrochemical facilities require substantial investments in infrastructure, technology, and regulatory compliance. These expenses can be prohibitive, especially for new entrants, limiting market expansion. Additionally, operational costs, including energy, labor, and maintenance, are consistently high, reducing profit margins and deterring further investment. The financial burden of these costs makes it challenging for companies to remain competitive and innovate, thereby constraining the overall growth potential of the petrochemicals sector.

The expansion of renewable energy and bio-based products presents a lucrative opportunity for the basic petrochemicals market. As the world shifts towards sustainable solutions, the demand for lightweight, durable materials in renewable energy technologies, such as wind turbines and solar panels, is rising. In addition, the growth of bio-based chemicals and bioplastics, which often incorporate petrochemical-derived components, offers new market avenues. This synergy between traditional petrochemicals and emerging green technologies supports the development of innovative, eco-friendly products, driving market growth and aligning with global sustainability goals.

Market Segmentation

The basic petrochemicals market is segmented into product type, processing technology, application, end-use industry, and region. By product type, the market is categorized into olefins, aromatics, syngas derivatives and others. Based on processing technology, the market is segmented into steam cracking, catalytic cracking, and others. By application, the market is divided into polymers and plastics, paints and coatings, solvents, rubber, adhesives and sealants, surfactants, detergents and dyes, and others. As per end-use industry, the market is categorized into automotive, construction, packaging, textiles, healthcare, electronics, agriculture, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Regulations

- Clean Air Act (CAA) - USA: The Clean Air Act (CAA) governs air emissions from both stationary sources, like petrochemical plants, and mobile sources, such as vehicles. It establishes stringent standards for significant pollutants, including volatile organic compounds (VOCs) , hazardous air pollutants (HAPs) , and greenhouse gases (GHGs) . The CAA requires the adoption of advanced technologies to minimize these emissions, ensuring that facilities, particularly in the petrochemical sector, implement measures to reduce their environmental impact.

- OSHA (Occupational Safety and Health Administration) : In the United States, petrochemicals are regulated under OSHA's Hazard Communication Standard (HCS) . These standards mandate that manufacturers and importers of petrochemical products assess the hazards associated with their chemical formulations and communicate these hazards effectively to users through Safety Data Sheets (SDS) and appropriate labeling.

- International Organization for Standardization (ISO) : ISO sets international standards for quality, safety, and environmental management across industries, including petrochemicals. These standards, such as ISO 9001 for quality management systems, ISO 14001 for environmental management, and ISO 45001 for occupational health and safety, are pivotal in ensuring organizations in the petrochemical sector meet rigorous criteria.

Competitive Landscape

The key market players operating in the basic petrochemicals market include BASF SE, INEOS, SABIC, TotalEnergies, Exxon Mobil Corporation., Reliance Industries Limited., Manali Petrochemicals Limited., Bharat Petroleum Corporation Limited, HPCL-Mittal Energy Limited (HMEL) , LG Chem, and others.

Recent Key Strategies and Developments

- In February 2024, SABIC and Fujian Energy and Petrochemical Group Co. Ltd. (Fujian Energy Petrochemical) held a groundbreaking ceremony to announce the establishment of the new construction phase of the SABIC Fujian Petrochemical Complex in Fujian Province, China.

- In January 2024, LyondellBasell revealed an agreement to acquire a 35% stake in Saudi Arabia's National Petrochemical Industrial Company (NATPET) for over USD 500 million. This joint venture, leveraging LyondellBasell's advanced Spheripol polypropylene (PP) technology, strategically positions the company to expand and strengthen its core PP operations.

- In October 2023, BASF announced the expansion of its ethylene oxide and derivatives complex at its Verbund site. The company is increasing its production capacity by 400, 000 metric tons annually, with an investment of over USD 529.3 million. This expansion strengthens BASF's market position in Europe.

- In August 2023, INEOS and SINOPEC established a 50:50 joint venture for an ethylene project at Tianjin Nangang. Currently under construction by SINOPEC, this significant petrochemical initiative features a 1.2 million tons per year ethylene cracker and a 500 kilotons per year high-density polyethylene plant.

Regional Market Outlook

In the Asia-Pacific and Europe regions, the basic petrochemicals market is experiencing substantial growth driven by several factors. A strong surge in demand for plastics and polymers is fueled by increasing consumer goods production and packaging needs. Rapid expansion in construction and infrastructure projects is boosting the demand for chemicals used in paints, coatings, and building materials across both regions. Moreover, the shift towards renewable energy sources and bio-based products is creating new opportunities for petrochemical applications, particularly in biofuels and bioplastics production. This growth is supported by technological advancements and government initiatives that promote sustainable development and environmental conservation.

- According to the India Brand Equity Foundation, the Plastic Export Promotion Council (PLEXCONCIL) has set a target to increase the plastic exports of the India to US$ 25 billion by 2027. There are multiple plastic parks that are being set up in the country in a phased manner that will help improve the plastic manufacturing outputs of the country. Under the plastic park schemes, the Government of India provides funds of up to 50% of the project costs or a ceiling cost of Rs. 40 crore (US$ 5 million) per project. Government initiatives like “Digital India”, “Make in India”, and “Skill India” will also boost India’s Plastic industry. For instance, under the “Digital India” program, the government aims to reduce the import dependence on products from other countries, which will lift the local plastic part manufacturers.

- According to the Department of Chemicals & Petrochemicals, India’s chemical and petrochemical (CPC) industry holds a significant position in the world market, worth $ 178 billion in 2023, and it is expected to grow to about $ 300 billion by 2025. India appears as one of the major potential investment regions with Asia’s growing contribution to the production and sales of the CPC industry

- According to IBEF, In FY24 (Until December 2023) , the Indian exports of major chemicals and petrochemicals stood at US$ 15.1 billion. In FY23, exports of major chemicals and petrochemical products stood at US$ 23.8 billion.

- According to the Plastics Industry Association, the plastic sector in the US made a substantial impact in 2022, creating more than a million jobs and generating impressive sales totaling $548 billion. This growth in demand for plastic is driving the expansion of the petrochemical industry.

Indian Petrochemical industry overview

Production of Major Petrochemicals in India (in MTs) Petrochemicals 2021-22 (Production in MTs) 2022-23 (Production in MTs) Synthetic Fibres 40,40,006 40,06,381 Polymers 124,70,653 114,86,615 Synthetic Rubber Elastomers 3,82,632 344,856 Synthetic Detergent Intermediates 780,388 703,023 Performance Plastics 16,97,684 19,60,164

In 2021-22 and 2022-23 years, India has shown significant production capabilities in key petrochemical sectors. Synthetic fibers, polymers, synthetic rubber elastomers, synthetic detergent intermediates, and performance plastics are among the major categories where the country has demonstrated notable output. Despite slight fluctuations in production figures from year to year, these sectors remain crucial contributors to India's industrial landscape. This production not only supports domestic demand but also plays a pivotal role in regional and global supply chains, underscoring India's growing importance in the petrochemical industry. As the sector continues to evolve, investments in technology and infrastructure are expected to further bolster India's position as a key player in the global petrochemical market.

India Government Initiatives

- Setting up of Centers of Excellence in Polymer Technology: The Centers of Excellence in Polymer Technology scheme, operational from 2013 to 2020, aimed to enhance petrochemical research and application development. It provided up to 50% funding, limited to US$ 7, 25, 448 (Rs. 6 crore) per project, fostering technology transfer and applied research across 13 institutes. The scheme's goal is to improve the country's existing petrochemical technology and research, as well as to encourage the development of new polymer and plastic applications.

- Petrochemicals Research & Innovation Commendation Scheme 2023: The Indian government has revamped its initiatives for the petrochemical sector, renaming and integrating schemes into the Petrochemicals Research & Innovation Commendation Scheme starting January 2023. Emphasizing R&D and human resource development, the new policy aims to institutionalize innovation to achieve strategic goals in the petrochemical industry.

- Revised Petroleum, Chemical and Petrochemical Investment Regions (PCPIRS) Policy (2020-35) : The PCPIR Policy 2020-35 aims to transform India's petrochemical industry by focusing on four regions: Vishakhapatnam, Dahej, Paradeep, and Cuddalore/Nagapanam. It targets attracting substantial investments: US$ 142 billion by 2025, US$ 213 billion by 2030, and US$ 284 billion by 2035. Each region's size will decrease to 50 sq km for focused development, supported by Viability Gap Funding. This cluster-based approach aims to generate 33.83 lakh jobs and enhance sectoral integration sustainably.

Industry Trends

- Advanced technologies such as AI, IoT, and 3D Imaging are boosting the petrochemical industry. Advanced technologies like 3D seismic imaging and the Internet of Things (IoT) are becoming increasingly prevalent in the petrochemical industry. The integration of artificial intelligence (AI) and digital tools is improving production processes and supply chain management, leading to more efficient and eco-friendly operations.

- Industries are increasingly exploring the use of bio-based feedstocks, such as bio-ethylene derived from sugarcane ethanol, to reduce reliance on fossil fuels. For instance, Braskem, a major petrochemical company, has invested significantly in its "I’m green" bio-based polyethylene, suitable for a wide range of rigid and flexible applications. This portfolio comprises around 25 grades in the HDPE, LLDPE and LDPE families with a renewable content range of 80% to 100%, certified by ASTM D6866 standard.

- According to Plastics Europe, global plastics production reached 400.3 million tons (Mt) in 2022, marking a slight increase compared to the previous year. This rise in production has consequently heightened the demand for petrochemicals, which are essential in the manufacturing of plastic products.

Key Sources Referred

- Invest India

- India Brand Equity Foundation

- American Chemistry Council (ACC)

- International Council of Chemical Associations (ICCA)

- European Petrochemical Association (EPCA)

- American Institute of Chemical Engineers

- Plastics Europe

- European Chemicals Agency

- Occupational Safety and Health Administration

- World Trade Organization

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the basic petrochemical market analysis from 2024 to 2033 to identify the prevailing basic petrochemical market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the basic petrochemical market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global basic petrochemical market trends, key players, market segments, application areas, and market growth strategies.

Basic Petrochemical Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1465.9 Billion |

| Growth Rate | CAGR of 8.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 380 |

| By Product Type |

|

| By Processing Technology |

|

| By End-Use Industry |

|

| By Application |

|

| By Region |

|

| Key Market Players | Exxon Mobil Corporation, INEOS, LG Chem, TotalEnergies, HPCL-Mittal Energy Limited (HMEL), Manali Petrochemicals Limited, Bharat Petroleum Corporation Limited, Reliance Industries Limited, BASF SE, SABIC |

The global basic petrochemical market was valued at $639.3 billion in 2023, and is projected to reach $1465.9 billion by 2033, growing at a CAGR of 8.7% from 2024 to 2033.

Rising emphasis of renewable energy and bio-based products is the upcoming trends of basic petrochemicals market in the globe.

Polymers and Plastics is the leading application of basic petrochemicals market

Asia-Pacific is the largest regional market for basic petrochemicals

The key market players operating in the basic petrochemicals market include BASF SE, INEOS, SABIC, TotalEnergies, Exxon Mobil Corporation., Reliance Industries Limited., Manali Petrochemicals Limited., Bharat Petroleum Corporation Limited, HPCL-Mittal Energy Limited (HMEL), LG Chem, and others.

Loading Table Of Content...