Battery Raw Materials Market Overview:

The global battery raw materials market was valued at $47.5 billion in 2021 and is projected to reach $87.1 billion by 2031, growing at a CAGR of 6.3% from 2022 to 2031.

Key Market Insights

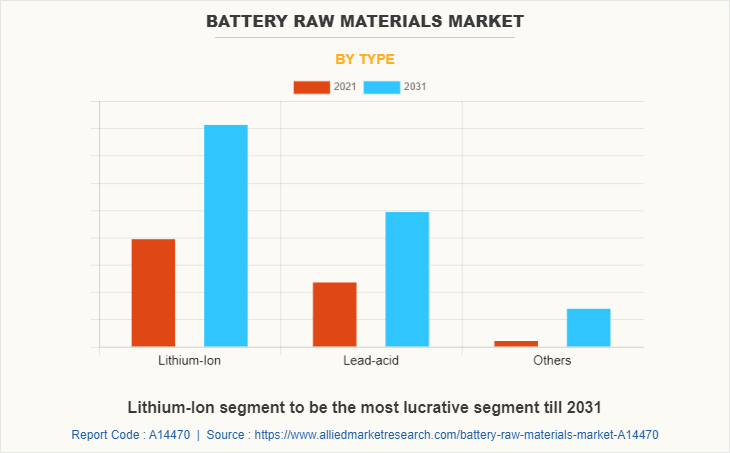

- By Type: Lithium-ion remains the most lucrative segment through 2031.

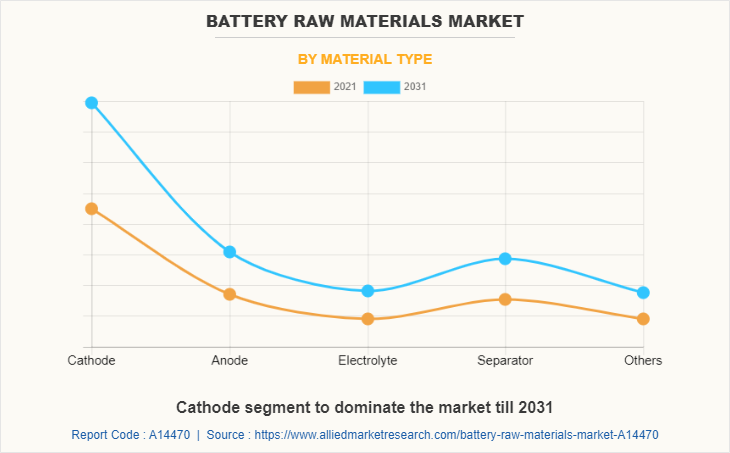

- By Material Type: Cathode materials dominate the global market.

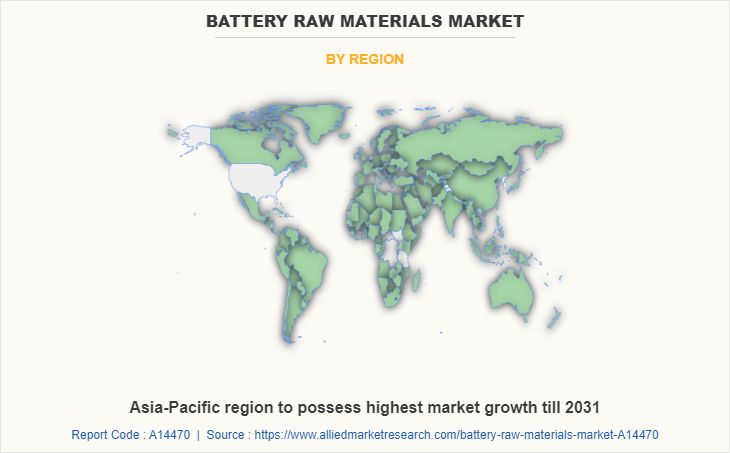

- By Region: Asia-Pacific holds the leading market share.

Market Size & Forecast

- 2031 Projected Market Size: USD 87.1 Billion

- 2021 Market Size: USD 47.5 Billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 6.3%

How to Describe Battery Raw Materials

Battery raw materials are the starting material in the upstream battery production. They mainly consist of lithium, nickel, and cobalt among others. These metals are mined by major mining companies before being processed in to metal compounds and precursors. Battery metal precursors are used for making electrolytes and anodes. Lithium can be mined from close to 100 different mineral ores; however, spodumene, lepidolite, petalite, amblygonite, and eucryptite are the five main sources of lithium metal. In addition, there are sources of obtaining battery raw materials such as brines.

Market Dynamics:

The annually growing electric vehicle market, ongoing surge in consumer electronics market for smartphones and laptops owing to rising consumer incomes, and increase in demand for energy storage systems in power generation and utilities segments are driving the battery raw materials market growth. The global electric vehicle (EV) market is gaining from the global trend of shifting toward renewable energy from conventional fuels, which has further strengthened its presence in the mainstream automotive industry. Increase in demand for batteries in various industries as backup power supply, as energy storage systems in the power generation and renewable power station have driven the battery raw material market growth. Increase in demand for EV’s and consumer electronics across the globe has positive impact on the demand for battery raw materials market. The above-mentioned factors are expected to provide ample battery raw materials opportunities during the forecast period.

New manufacturing plants and development centers are being constructed where there is a huge demand for batteries, which led to more demand for battery raw materials development. In addition, battery manufacturers are expected to collaborate with battery metal suppliers to strengthen the supply of battery metals that are projected to face a shortage in the future.

North America region is second largest market of battery raw materials. U.S. as a most advanced technological country has high application of lithium sulfur batteries in various fields. U.S. is also a major manufacturer of lithium batteries. Canada is a country with low temperature all the year so fuel-based vehicles and heat systems require huge number of raw materials. Hence, lithium sulfur batteries are mostly used here in recreation vehicles (RV), marine and other electronic applications. Mexico is one of the most rapidly developing country due to the presence of highly advanced neighbor such as the U.S. and increase in government policies to adopt EVs in transportation sector and the usage of energy storage devices in the power transmission and distribution sector.

The U.S. government has been proactive in the growth of the U.S. electric vehicle market. In April 2021, the U.S. Department of Energy announced new research funding opportunities on three EV charging related topics to boost EV adoption. A $10 million was funded to develop new technologies and designs to significantly reduce the cost of electric vehicle supply equipment for DC fast charging that will be needed in large number to support high volumes of EVs. In addition, $20 million was funded to accelerate the adoption of commercially-available plug-in electric vehicles (PEVs) and support infrastructure through community-based public-private partnerships. Furthermore, a $4 million funding to encourage new programs to increase workplace EV charging regionally or nationally to increase the feasibility of PEV ownership for consumers in underserved communities. The above factors are expected to drive the growth of the battery raw materials market during this forecast period.

Battery Raw Materials Market Segment Review:

The global battery raw materials market forecast is segmented on the basis of type, material type, and region.

On the basis of type, it is segmented into lithium ion, lead acid, and others. Furthermore, lithium-ion segment is further classified into electric vehicles, consumer electronics, industrial, and others. Lead acid segment is categorized into automotive, industrial and others. On the basis of material type, the battery raw materials market is segmented into cathode, anode, electrolyte, separator, and others.

Region wise, the battery raw material market is studied across North America, Europe, Asia-Pacific, and LAMEA. Presently, Asia-Pacific accounts for the largest battery raw materials market share, followed by North America, and Europe.

The lithium-ion segment dominates the global battery raw materials market share. Lithium-ion battery consists of lithium as a core to generate electricity needed by the products. Lithium is a soft, white, and lustrous alkali metal. Lithium materials used in battery production consist of various lithium compounds such as Lithium hydroxide, Lithium carbonate, Lithium fluoride, and Lithium chloride. Lithium has lowest density of all metals and reacts with water. It is most widely used in battery applications for mobile phones, laptop, digital camera, electric vehicle, robots, and power grid storage. Rapid growth of the electric vehicle industry boosts the demand for Li-ion batteries, which propels the growth of the battery raw materials market. Li-ion battery is the rapidly adopted battery type, owing to its lightweight and high consumer acceptance, which drive its demand, thereby augmenting the market growth. The advantages offered by Li-ion battery such as its high energy density, low maintenance, low self-discharge, and lightweight are the key factors, which draw the attention of consumers, thus fueling the battery raw material market growth.

The cathode segment dominates the global battery raw materials market. Cathode material in the battery is the major component, which determines the energy density of the cell. The energy density is measured using cell capacity. The selection of cathode materials depends on various factors such as cell voltage, capacity, energy & power capabilities, cycle life and operating temperature. Various materials are used in the cathode of a lithium-ion battery such as cobalt, manganese, phosphate, nickel cobalt manganese, lithium iron phosphate, and others. Enhanced reliability and compatibility of lithium batteries have led to increase in the demand for cathode materials. Furthermore, increase in applications of lithium-ion battery has driven the battery raw material market growth. The development of superior lithium and lead acid batteries with higher capacity and better management systems is expected to drive the market. The above-mentioned factors will provide ample opportunities for the development of the market during the forecast period.

Asia-Pacific segment dominated the global battery raw materials market. Owing to huge demographic of consumers for electronic products and automotive in this region is a major factor driving the demand for battery raw material market. Presently, a major share of battery material value chain is dominated by China. Battery anodes and cathodes are imported from Chinese and Japanese manufacturers across the globe. In order to emerge as a key player in decarbonization, emerging country such as India needs to focus on vertical integration of battery materials which starts from domestic sourcing to battery packing. Government incentives and favorable policies need to be implemented. Moreover, a political conflict between the two countries increases the risk of import restrictions which means shortage of key battery materials. In addition, India looks to reduce its fuel import dependency over the next few years. Such conditions are conducive for the local battery manufacturers and research institutes, thus boosting the battery raw materials market. The above-mentioned policies and investments are major factors driving the growth of the battery raw material marketing this region during the forecast period.

Which are the Leading Companies in Battery Raw Materials

The major companies profiled in the battery raw materials industry report include Asahi Kasei Corporation, BASF SE, ECOPRO, Entek International, Johnson Matthey plc., LG Chem Ltd, NEI Corporation, Showa Denko K.K., Targray Technology International Inc., Toshiba Corporation, Hitachi Chemical Co. Ltd., 3M, Nichia Corporation, Valence Technology, Inc., Mitsubishi Chemical Corporation, Celgard, LLC, and Nippon Denko Co., Ltd. Additional growth strategies such as expansion of storage capacities, acquisition, partnership and research & innovation in the optimization and improvement in efficiency of the battery have led to attain key developments in the global battery raw materials market trends.

What are the Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the battery raw materials market analysis from 2021 to 2031 to identify the prevailing battery raw materials market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the battery raw materials market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global battery raw materials market trends, key players, market segments, application areas, and market growth strategies.

Battery Raw Materials Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 87.1 billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 350 |

| By Type |

|

| By Material Type |

|

| By Region |

|

| Key Market Players | BASF SE, ECOPRO, ENTEK INTERNATIONAL, TARGRAY TECHNOLOGY INTERNATIONAL INC., Nichia Corporation, Nippon Denko Co, Ltd, TOSHIBA Corporation, Celgard, LLC, ASAHI KASEI CORPORATION, NEI CORPORATION, Valence Technology, Inc., 3M, Mitsubishi Chemical Corporation, LG Chem Ltd, Johnson Matthey plc, Hitachi Chemical Co. Ltd., showa denko k.k. |

Analyst Review

According to CXO Perspective, the global battery raw materials market is expected to witness increased demand during the forecast period, due to surge in demand for lithium-based batteries, owing to surge in sales of electric vehicles and consumer electronics across the globe. Electric vehicle supply chain will look to secure the supply of critical battery materials such as Lithium and Nickel. Moreover, there will be proactive research into battery technology to develop new battery materials and refining processes. On the other hand, the global battery raw materials market is also expected to witness growth during the forecast period, owing to increased incomes and internet penetration.

The battery raw material is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Among the analyzed regions, Asia-Pacific is expected to account for the highest revenue in the market throughout the forecast period, followed by North America, Europe, and LAMEA.

Increase in adoption of electric vehicles and surge in demand for consumer electronics are the key factors boosting the Battery raw materials market growth.

The market value of Battery raw materials in 2031 is expected to be $87.1 billion

Asahi Kasei Corporation, BASF SE, ECOPRO, Entek International, Johnson Matthey plc., LG Chem Ltd, NEI Corporation, Showa Denko K.K., Targray Technology International Inc., Toshiba Corporation, Hitachi Chemical Co. Ltd., 3M, Nichia Corporation, Valence Technology, Inc., Mitsubishi Chemical Corporation, Celgard, LLC, and Nippon Denko Co., Ltd.

Automotive industry is projected to increase the demand for Battery raw materials Market

The global battery raw materials market is segmented on the basis of by type, material type, and region. On the basis of type, it is segmented into lithium ion, lead acid, and others. Furthermore, lithium-ion segment is further classified into electric vehicles, consumer electronics, industrial, and others. Lead acid segment is categorized into automotive, industrial and others. On the basis of material type, the market is segmented into cathode, anode, electrolyte, separator, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA

Rapid development in the renewable energy sector is the Main Driver of Battery raw materials Market.

During the second half of the pandemic, there was a sudden surge in the demand for consumer electronics such as laptops, smart phones and other gadgets that were used to do work online. The increase in concept of work from home led to increase in demand for portable electronic gadgets during the pandemic period.

Loading Table Of Content...