Battery Recycling Market Overview

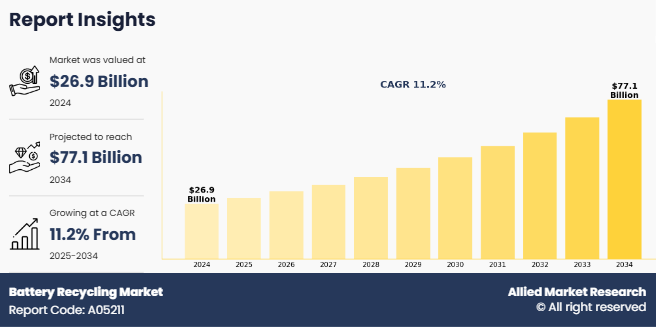

The global battery recycling market size was valued at USD 26.9 billion in 2024, and is projected to reach USD 77.1 billion by 2034, growing at a CAGR of 11.2% from 2025 to 2034. Rising EV adoption and the growing volume of end-of-life batteries are driving demand for efficient recycling solutions. Innovations in recovery technologies are enabling material reuse while supporting sustainability goals.

Key Market Trend & Insights

- Lithium-ion batteries lead as the fastest-growing chemistry segment with an 11.7% CAGR.

- Hydrometallurgy remains the most lucrative recycling process with an 11.4% CAGR.

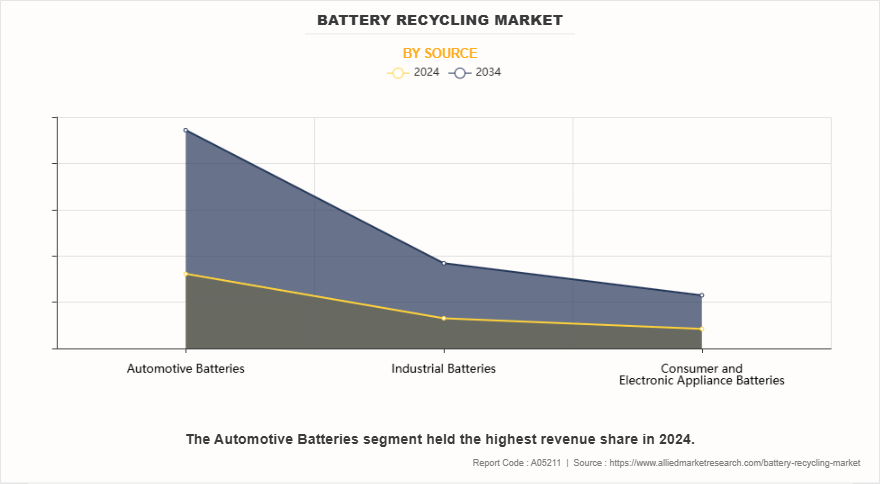

- Automotive batteries dominate as the primary source segment in 2024.

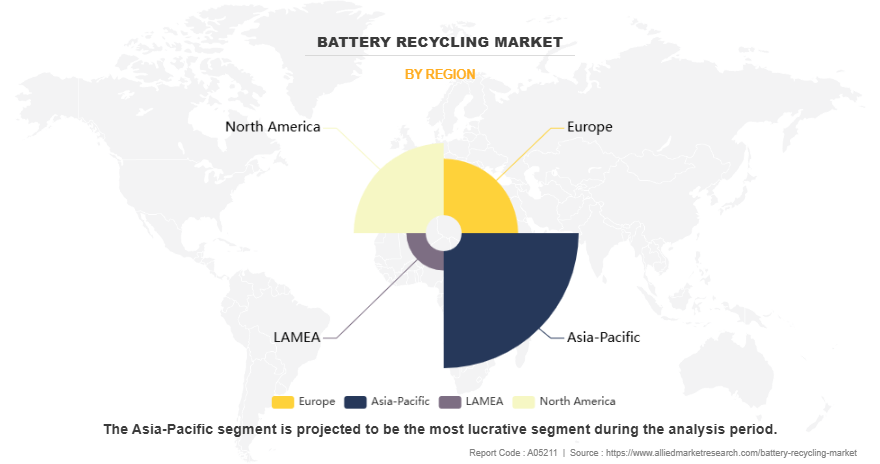

- Asia-Pacific holds the largest regional share, growing at an 11.7% CAGR.

Market Size & Forecast

- 2034 Projected Market Size: USD 77.1 billion

- 2024 Market Size: USD 26.9 billion

- Compound Annual Growth Rate (CAGR) (2025-2034): 11.2%

Introduction

Battery recycling is the process of collecting and processing used or waste batteries to recover valuable materials and prevent environmental hazards. As the global demand for batteries rises, particularly with the growth of electric vehicles (EVs), renewable energy storage systems, and portable electronics, the importance of sustainable battery management has intensified. The process of battery recycling varies depending on the type of battery, lithium-ion, nickel-metal hydride, lead-acid, and alkaline, each requiring different technological approaches for safe disassembly and resource recovery. Most battery recycling involves several steps: collection, sorting, mechanical processing (such as shredding and separation), chemical treatment (such as hydrometallurgy or pyrometallurgy), and finally, refining. Some advanced facilities use direct recycling methods that aim to retain the structure of cathode materials, making them reusable without the need for complete chemical breakdown.

In the automotive industry, battery recycling has emerged as a crucial component of electric vehicle (EV) lifecycle management. EVs use high-capacity lithium-ion batteries that lose efficiency over time and need replacement after several years of use. Instead of landfilling these batteries, posing risks due to flammable electrolytes and toxic metals, automakers are now forming partnerships with recycling firms to extract and reuse lithium, nickel, cobalt, and manganese. This helps reduce the cost of new EV batteries and addresses supply chain vulnerabilities associated with mining and geopolitical dependencies. Companies such as Tesla, Nissan, and BMW have incorporated recycling into their sustainability agendas, often leveraging second-life battery applications or sending batteries to specialized recyclers such as Redwood Materials, Li-Cycle, and Umicore.

Key Takeaways

- The battery recycling market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global battery recycling markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the battery recycling market share.

- The battery recycling companies operating in the report are Cirba Solutions, Contemporary Amperex Technology Co., Limited, Aqua Metals, Inc., ACCUREC Recycling GmbH, EnerSys, American Battery Technology Company, Teck Resources Limited, East Penn Manufacturing Company, Ecobat, and Element Resources. They have adopted strategies such as acquisition, product launch, merger, and expansion to gain an edge in the market.

Market Dynamics

The surge in electric vehicle (EV) adoption is expected to drive the battery recycling market growth. According to the International Energy Agency (IEA), more than one in four cars sold worldwide in 2025 is expected to be electric, with global EV sales projected to surpass 20 million units. This marks a significant increase from 17 million electric cars sold in 2024, a rise of more than 25% year-on-year. The global stock of electric cars reached almost 58 million by the end of 2024, representing about 4% of the total passenger car fleet, and this figure continues to climb as EVs become more affordable and accessible in both developed and emerging markets. This adoption rate is directly inked to the surge in need for battery recycling. As millions of new EVs enter the market each year, the volume of batteries reaching end-of-life and the amount of production scrap are both increasing sharply. Sustainable battery solutions are driving innovations in battery recycling, ensuring efficient recovery of valuable materials while minimizing environmental impact.

However, safety and environmental risks are expected to hamper the growth of battery recycling market. The risks associated with spent batteries extend beyond environmental contamination. Lithium-ion batteries, for instance, are highly reactive and can ignite or explode if damaged or improperly handled, leading to incidents of fire and release of toxic gases. These risks necessitate stringent regulations for the storage, transportation, and processing of spent batteries. In the U.S., the Department of Transportation (DOT) classifies batteries as hazardous materials and enforces specific packaging, labeling, and documentation requirements to ensure safe transport. The Resource Conservation and Recovery Act (RCRA) further mandates that most lithium-ion batteries discarded by businesses be treated as ignitable and reactive hazardous waste, subject to rigorous handling and disposal protocols. Automotive battery recycling plays a crucial role in reducing environmental impact and recovering valuable materials like lead, lithium, and nickel for reuse in new batteries.

Segments Analysis

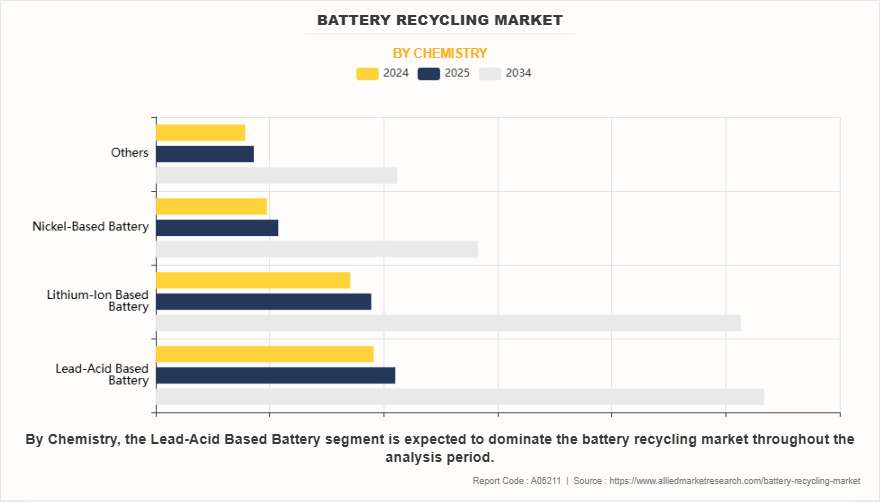

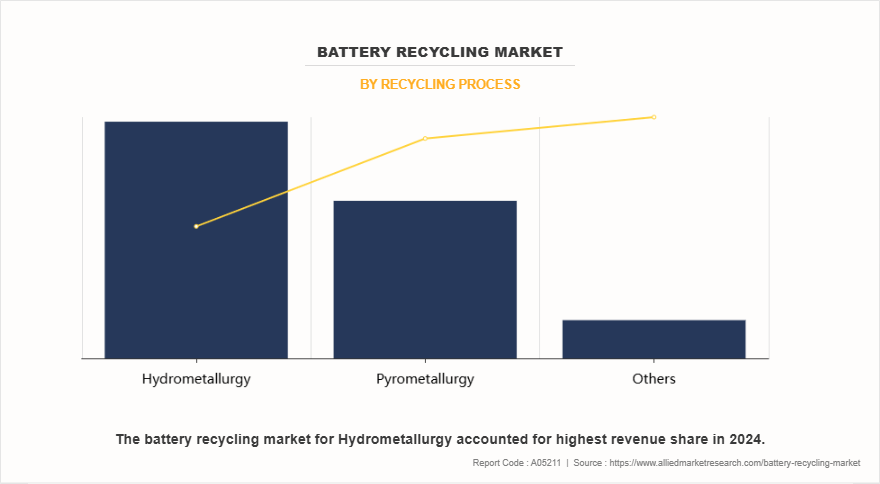

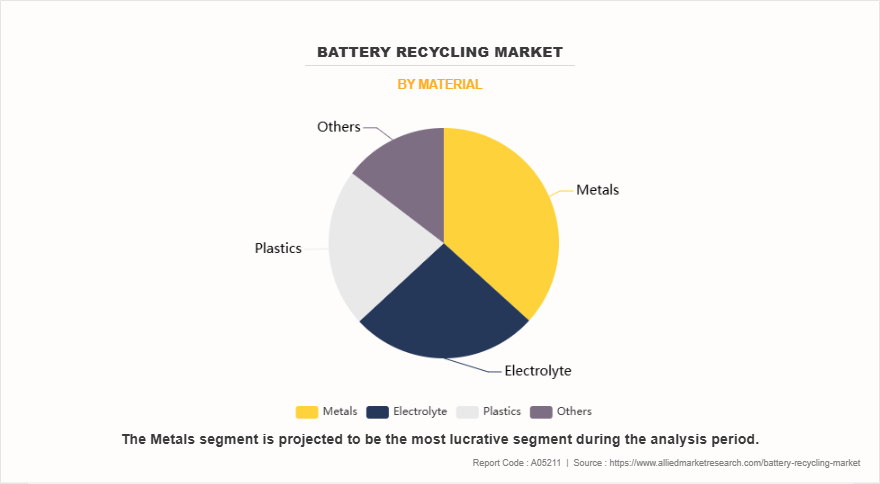

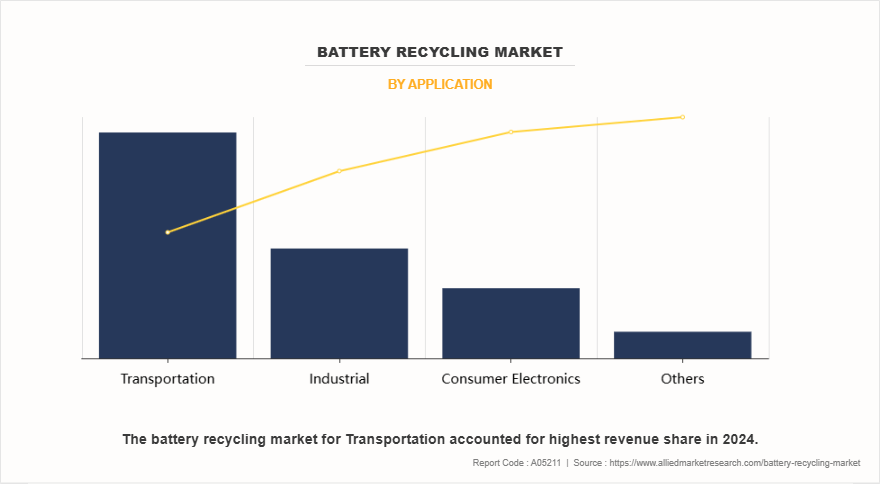

The battery recycling market is segmented into chemistry, recycling process, material, source, application, and region. On the basis of chemistry, the market is divided into lead-acid based battery, lithium-ion based battery, nickel-based battery, and others. On the basis of recycling process, the battery recycling market is categorized into hydrometallurgy, pyrometallurgy, and others. On the basis of material, the market is divided into metals, electrolytes, plastics, and others. On the basis of source, the market is classified into automotive batteries, industrial batteries, and consumer & electronic appliance batteries. On the basis of application, the market is segregated into transportation, consumer electronics, industrial, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of chemistry, the lead-acid based battery segment dominated the market, accounting for more than one fourth of the market share in 2024. Lead-acid batteries are among the most widely recycled battery chemistries globally due to their established infrastructure, economic viability, and regulatory mandates. These batteries, commonly used in automobiles, uninterruptible power supplies (UPS), industrial forklifts, and renewable energy storage, contain valuable materials such as lead and sulfuric acid that are efficiently recovered and reused. In August 2023, Exide Industries (via Chloride Metals) launched its fourth lead-acid battery recycling facility in Supa-Parner, Maharashtra, with initial capacity of 96,000million tons per annum (MTPA), scalable to 120,000MTPA.

On the basis of the recycling process, the hydrometallurgy segment dominated the market in 2024. The adoption of hydrometallurgical processes has gained momentum due to its lower environmental impact compared to pyrometallurgy, as it operates at lower temperatures and emits fewer greenhouse gases. Furthermore, hydrometallurgy allows for more precise separation of materials, which is essential for the circular economy and sustainable battery supply chains. In May 2025, GEM’s China-based hydrometallurgical EV battery recycling technology produces 200,000 batteries/year (~20% of China’s nickel/cobalt needs). This method is particularly effective in processing lithium iron phosphate (LFP) and nickel-manganese-cobalt (NMC) batteries, which are common in electric vehicles and consumer electronics.

On the basis of material, the metal segment dominated the market in 2024. Battery recycling plays a crucial role in the recovery of valuable and finite metals, particularly in the surge in demand for electric vehicles, renewable energy storage, and portable electronics. Nickel and manganese are also widely recovered from used batteries, those used in electric vehicles (EVs). Nickel's high thermal stability and energy density make it an essential metal in NMC (Nickel Manganese Cobalt) cathodes. Battery recycling processes help reintroduce nickel into the supply chain, reducing the need for energy-intensive mining and refining.

On the basis of source, the automotive batteries segment was the most lucrative segment in the market in 2024. Battery recycling plays a crucial role in the lifecycle of automotive batteries, particularly with the rise in demand for electric vehicles (EVs), hybrid electric vehicles (HEVs), and conventional internal combustion engine (ICE) vehicles that rely on lead-acid or lithium-ion batteries. In conventional vehicles, lead-acid batteries have long been used for ignition and power supply, and they have well-established recycling processes. In March 2023, POSCO Future M, a South Korean company, announced significant advancements in battery material innovation. Specializing in cathode and anode materials, the company has achieved 100% recycling of refractory materials and is actively enhancing its recycling capabilities. As part of its long-term sustainability goals, POSCO Future M aims to expand its cathode production capacity to 1 million tonnes by 2030, reinforcing its commitment to a more sustainable and secure battery materials supply chain.

On the basis of application, the transportation segment was the highest revenue contributor to the market in 2024. In electric mobility, the growing volume of spent EV batteries pushes automakers and battery manufacturers to establish reverse logistics and recycling partnerships. Companies such as Tesla, General Motors, and BYD are increasingly investing in battery recycling technologies or collaborating with recyclers to ensure sustainable disposal. Second-life applications are also gaining ground, where EV batteries are repurposed for stationary storage before being recycled, extending their economic and environmental value.

By region, Asia-Pacific was the highest revenue contributor to the battery recycling market in 2024. Battery recycling has gained significant traction across the Asia-Pacific region, propelled by the region's accelerating shift toward electric mobility, rapid industrialization, and growing environmental concerns. Countries including China, Japan, South Korea, India, and Australia are witnessing increasing adoption of battery recycling practices to mitigate the environmental impact of hazardous waste and recover valuable materials such as lithium, cobalt, and nickel. This uptake is further reinforced by government mandates and incentives that emphasize circular economy principles and sustainable waste management. In March 2025, China's Ministry of Ecology and Environment proposed redefining recyclable lithium-ion battery “black mass” (residual nickel‐‘cobalt mix, including LFP) as non‐‘waste, allowing free imports, part of a broader push under the China Resources Recycling Group in Tianjin.

Which are the Top Batter Recycling companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the batter recycling industry.

- Cirba Solutions

- Contemporary Amperex Technology Co., Limited

- Aqua Metals, Inc.

- ACCUREC Recycling GmbH

- EnerSys

- American Battery Technology Company

- Teck Resources Limited

- East Penn Manufacturing Company

- Ecobat

- Element Resources

What are the Recent Developments in the Battery Recycling Market

In May 2025, The Battery Waste Management Rules, have been fully enforced, introducing Extended Producer Responsibility (EPR) for electric vehicle (EV) OEMs and battery manufacturers. These rules mandate the collection and recycling of used batteries, with phase-wise recovery targets set to increase from 70% in FY 2025 to 90% by FY 2027 for lithium-ion batteries (LiB) in EVs. The policy covers all entities in the battery lifecycle and requires recyclers to register with state pollution control boards.

In May 2025, companies such as Attero Recycling, Lohum, and Ecolife have significantly expanded their recycling activities. Attero, for example, plans to recycle 15,000 tons of lithium-ion batteries in FY 2024-25, aiming to reach 50,000 tons annually by 2027, with recovery rates exceeding 95% for critical metals such as lithium, cobalt, and nickel.

In April 2025, Contemporary Amperex Technology Co., Limited (CATL) partnered with Chinese automakers and battery recyclers to build a closed-loop recycling system.

In March 2023, Cirba Solutions announced a $300 million investment to expand lithium-ion battery recycling capabilities across the U.S., supported by the U.S. Department of Energy (DOE).

Import Export Analysis on Battery Recycling Industry, Asia Pacific dominates both battery consumption and recycling capacity, with China leading the world in lithium-ion battery (LIB) recycling, boasting over 1.1 million tons per year of capacity and ambitious plans for further expansion. India, South Korea, and Japan are also scaling up their recycling infrastructure, with India aiming for a significant increase in capacity to meet domestic and regional demand.

Policy frameworks are central to shaping import and export dynamics. China, for example, has implemented strict regulations, including the Law on the Prevention and Control of Solid Waste Pollution, which bans solid waste imports and enforces Extended Producer Responsibility (EPR). The upcoming "National Standard for Recycled Black Mass in Lithium-Ion Batteries (GB/T 45203-2024)" (effective July 2025) will standardize the quality of imported recycled battery materials and set high thresholds for recovery rates—lithium at ≥90% and nickel, cobalt, and manganese at ≥98% while also requiring a high degree of process wastewater recycling. These standards are expected to raise the bar for both domestic recyclers and foreign exporters wishing to access the Chinese market, promoting quality and traceability but potentially limiting imports that do not meet these criteria.

Europe and North America are also expanding their recycling capacity, with Europe projected to reach over 1.1 million tons per year by 2030, supported by new regulations and investments in large-scale facilities. The U.S. is increasing its recycling infrastructure, aided by government funding and incentives, and is expected to add over 300,000 tons per year in new capacity. However, both regions face challenges in securing a steady supply of recyclable batteries and often depend on imports of end-of-life batteries or intermediate materials (such as black mass) from Asia and other markets.‐‹‐‹‐‹‐‹‐‹‐‹‐‹

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the battery recycling market analysis from 2024 to 2034 to identify the prevailing battery recycling market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the battery recycling market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global battery recycling market trends, key players, market segments, application areas, and market growth strategies.

Battery Recycling Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 77.1 billion |

| Growth Rate | CAGR of 11.2% |

| Forecast period | 2024 - 2034 |

| Report Pages | 408 |

| By Chemistry |

|

| By Recycling Process |

|

| By Material |

|

| By Source |

|

| By Application |

|

| By Region |

|

| Key Market Players | Element Resources DE LLC, Contemporary Amperex Technology Co., Limited, EnerSys, Ecobat, ACCUREC Recycling GmbH, Exide Industries Limited, Aqua Metals, Inc., American Battery Technology Company, Cirba Solutions, East Penn Manufacturing Company |

Analyst Review

According to the opinions of various CXOs of leading companies, decarbonization and ethical sourcing are expected to drive the growth of the battery recycling market. Decarbonization and ethical sourcing are key reasons for advancement of battery recycling, as recycled battery materials substantially reduce environmental and social harms compared to newly mined resources. For instance, a 2023 report by the European Commission found that recycling lithium-ion batteries cuts CO? emissions by up to 80% compared to primary production. Similarly, the U.S. Department of Energy’s Argonne National Laboratory reported in 2024 that recycled nickel and cobalt from spent batteries emit 70–80% less CO? per kilogram than their mined counterparts. These findings support the adoption of recycled materials as a key strategy for automakers and electronics manufacturers aiming to meet increasingly stringent decarbonization targets set by governments and international agreements. Companies reduce reliance on raw materials sourced from regions with documented risks of conflict financing, human rights abuses, and child labor issues particularly associated with cobalt mining by increasing the use of recycled battery materials. The European Union’s Battery Regulation, effective from 2023, requires manufacturers to disclose the origin of battery materials and incentivizes the use of recycled content to promote ethical supply chains. According to the International Energy Agency, the share of recycled cobalt in new batteries is projected to rise from 8% in 2022 to over 20% by 2025, further diminishing the industry’s dependence on high-risk sources.

However, the high costs of the recycling process are expected to hamper the growth of battery recycling market. The high initial capital investment required to establish advanced recycling facilities that use hydrometallurgical or direct recycling technologies acts as a barrier to entry for new players and makes short-term profitability elusive. Around 44% of announced recycling projects in Europe are on hold or face uncertainty due to project complexity, high capital & operating costs, and financing or permitting challenges. For instance, operational expenses for recycling NMC811 cell packs at integrated plants in Europe average about $14/kWh, while in China, the figure is closer to $11/kWh a 25% disparity. For lithium iron phosphate battery (LFP) batteries, the gap widens, with Europe at $7/kWh versus $4.5/kWh in China, driven by electricity costs that are 60% higher and labor costs that are 35% higher in Europe. Transportation and dismantling costs also add to the financial strain, with European recyclers spending $5/kWh and $15/kWh, respectively, compared to $3/kWh for both in China. These differences largely stem from lower economies of scale and less mature recycling infrastructure in Europe, where the market is still developing and project volumes remain relatively small.

The key players operating in the battery recycling market include Cirba Solutions, Contemporary Amperex Technology Co., Limited, Aqua Metals, Inc., ACCUREC Recycling GmbH, EnerSys, American Battery Technology Company, Teck Resources Limited, East Penn Manufacturing Company, Ecobat, and Element Resources.

The global battery recycling market was valued at $26.9 billion in 2024, and is projected to reach $77.1 billion by 2034, growing at a CAGR of 11.2% from 2025 to 2034.

Asia-Pacific is the largest region in the battery recycling market.

Transportation is the leading application of battery recycling market.

Expansion of battery collection networks via retail and service centers are the upcoming trends of battery recycling market in the world.

Loading Table Of Content...

Loading Research Methodology...