Battlefield Management Systems Market Research, 2033

The global battlefield management systems market was valued at $9.6 billion in 2023, and is projected to reach $14.9 billion by 2033, growing at a CAGR of 4.5% from 2024 to 2033. The battlefield management system market is experiencing growth due to increased defense spending, data-driven decision-making and integration of autonomous systems.

Market Introduction and Definition

Battlefield management systems industry offers an integrated, real-time command and control system designed to enhance the situational awareness and operational effectiveness of military forces in a combat environment. It provides commanders at various levels with accurate, up-to-date information on the battlefield, allowing for faster decision-making and better coordination among units. The battlefield management system integrates data from various sources, such as sensors, reconnaissance, intelligence, and communication systems, to provide a comprehensive picture of the tactical situation. In addition, battlefield management system includes real-time mapping, GPS-based troop and asset tracking, communication links, and data sharing capabilities. This system enables forces to plan, execute, and monitor operations more efficiently, while reducing the chances of execution and miscommunication.

Key Takeaways

The battlefield management systems market forecast study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major battlefield management systems industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

Increased defense spending drives the growth of the battlefield management systems market owing to several important factors that align with modern military needs and technological advancements. As the global defense budgets expand, nations are investing significantly in enhancing their command, control, communications, and intelligence capabilities. This heightened investment directly benefits the battlefield management system sector by fostering the development and deployment of advanced systems designed to improve battlefield effectiveness and operational efficiency, which propels the market growth. However, the high costs are a major barrier for the battlefield management system market owing to developing, implementing, and maintaining advanced technologies which require substantial financial investment. This investment includes purchasing sophisticated hardware and acquiring cutting-edge software, which hampers the battlefield management systems market growth.

Furthermore, technological advancements, particularly in 5G/6G networks, artificial intelligence (AI), and the Internet of Things (IoT), present significant opportunities for the battlefield management system market. The rapid evolution of 5G/6G networks enables ultra-fast, low-latency communication, crucial for real-time battlefield data sharing and command coordination. AI enhances decision-making through advanced analytics, predictive modeling, and autonomous systems, improving situational awareness and response times. Moreover, IoT integration allows for seamless connectivity and data exchange among diverse sensors and devices, creating a more cohesive and responsive battlefield management system. These innovations collectively enable more effective, integrated, and adaptive battlefield management system, which further drives the market growth.

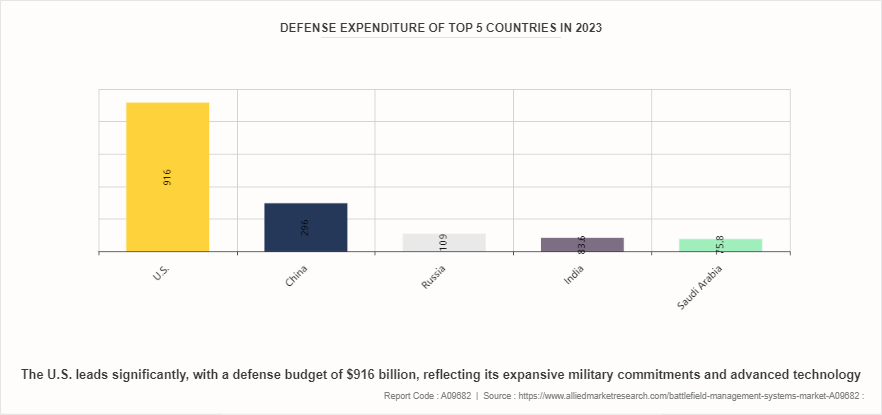

Defense Expenditure of Top 5 Countries in 2023 ($Billion)

According to Stockholm International Peace Research Institute (SIPRI) fact sheet global defense spending shows marked differences among key military powers. The U.S. leads significantly, with a defense budget of $916 billion, reflecting its expansive military commitments and advanced technology. China ranks second, allocating $296 billion, highlighting its increasing military capabilities and strategic global aspirations. Russia follows with $109 billion, maintaining a strong military stance despite economic pressures. India’s defense expenditure stands at $83.6 billion, aimed at securing its defense capabilities amid regional tensions. Saudi Arabia completes the top five with a $75.8 billion budget, driven by regional security concerns. This spending data emphasize not only the large disparities in military investments but also the broader implications for international security and geopolitical strategies. The differences in defense budgets among these nations reveal their unique strategic priorities and military objectives on the global stage.

Market Segmentation

The battlefield management systems market size is segmented into by component, solution, platform, system, installation type, end user and region. On the basis of component, the market is divided into communication devices, imaging devices, display devices, tracking devices, computer hardware devices, data distribution unit, night vision devices and others. As per mode of solution, the market is segregated into hardware and software. On the basis of platform, the market is divided into armored vehicle, headquarter & command centers and soldier systems. As per mode of installation type, the market is segregated into new installation and upgradation. On the basis of end user, the market is divided into army, navy and air force. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The battlefield management systems market size exhibits diverse regional dynamics influenced by varying defense priorities and technological capabilities. In North America, particularly the U.S, the market is driven by substantial defense budgets and a focus on modernizing military infrastructure. The U.S. military's emphasis on advanced technologies and interoperability ensures robust demand for cutting-edge BMS solutions. In addition, in Asia-Pacific, countries such as India, Japan, and South Korea are expanding their defense capabilities in response to regional security challenges. These nations are increasingly integrating in BMS technologies to modernize their military operations and enhance strategic agility.

Industry Trends

In December 2023, the Indian Army announced the development of military-grade 5G and 6G telecom applications, along with AI-enabled decision-making tools and predictive analytics, to meet future warfare needs and enhance intelligence, operational efficiency, and overall technological capabilities. With the integration of AI-enabled decision-making tools, predictive analytics and 5G and 6G telecom application drives the demand for battlefield management system solutions.

In April 2024, Lockheed Martin Australia signed a landmark AUD $500 million contract with the Department of Defense to develop Australia’s future Joint Air Battle Management System under Project AIR6500 Phase 1 (AIR6500-1) . This system will provide advanced, integrated air and missile defense capabilities, utilizing next-generation technologies to counter high-speed threats.

Competitive Landscape

The major players operating in the battlefield management systems market include Collins Aerospace, Rolta India Limited., Verdict Media Limited, General Dynamics Mission Systems, Inc., L3Harris Technologies, Inc., Lockheed Martin Corporation, Elbit Systems Ltd., Leonardo DRS, Inc., Thales, Atos SE, BAE Systems Plc, Northrop Grumman Systems Corporation and Saab Group.

Recent Key Strategies and Developments

In July 2024, Collins partnered with the U.S. Army's 1st Multi-Domain Task Force to conduct the experiments inside a ground vehicle to rapidly reconfigure and deploy capabilities based on evolving mission needs. The mission command 'on-the-move' concept uses commercial and military communications networks to provide access to multiple intelligence sources. To make sense of the data from various sources, the company used an AI/ML battle management software. This created fused situational awareness that can be shared with bilateral and joint force partners.

In January 2024, Booz Allen Hamilton announced a partnership with L3Harris Technologies to enhance battlefield management systems. This partnership aims to address the department of defense’s critical need to modernize and swiftly enable Combined Joint All-Domain Command & Control (CJADC2) , ultimately supporting the future warfighter in contested environments.

Key Sources Referred

Defense Advanced Research Projects Agency

United Nations Office for Disarmament Affairs

European Defense Agency

U.S. Department of Defense

Military & Aerospace Electronics Magazine

Australian Department of Defense

Defense Intelligence Agency

The Aerospace Corporation

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the battlefield management systems market analysis from 2024 to 2033 to identify the prevailing battlefield management systems market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the battlefield management systems market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the battlefield management systems market share.

The report includes the analysis of the regional as well as global battlefield management systems market trends, key players, market segments, application areas, and market growth strategies.

Battlefield Management Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 14.9 Billion |

| Growth Rate | CAGR of 4.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 200 |

| By Component |

|

| By Solution |

|

| By Platform |

|

| By Installation Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | General Dynamics Mission Systems, Inc., Northrop Grumman Systems Corporation, Saab Group, L3Harris Technologies, Inc., Leonardo DRS, Inc., Thales, Elbit Systems Ltd., Collins Aerospace, Verdict Media Limited?, Rolta India Limited, BAE Systems Plc?, Lockheed Martin Corporation, Atos SE |

The battlefield management systems market was valued at $9.6 billion in 2023.

By platform, the headquarters and command centers segment held the highest market share in 2023.

North America led the battlefield management systems market share in 2023.

The battlefield management systems market is estimated to reach $14.9 billion by 2033.

Collins Aerospace, Rolta India Limited., Verdict Media Limited, General Dynamics Mission Systems, Inc., L3Harris Technologies, Inc., Lockheed Martin Corporation, Elbit Systems Ltd., Leonardo DRS, Inc., Thales, Atos SE, BAE Systems Plc, Northrop Grumman Systems Corporation, and Saab Group.

Loading Table Of Content...