Bifacial Solar Market Research, 2031

The global bifacial solar industry was valued at $8.7 billion in 2021, and bifacial solar market size is projected to reach $31.1 billion by 2031, growing at a CAGR of 13.6% from 2022 to 2031.The growing installations of renewable energy source for power generation across the globe are boosting the demand for bifacial solar panel module systems. The key market players are focusing on improving the disadvantages of the bifacial solar panels and lowering the cost price of bifacial PV modules will stimulate the market. In addition, increasing investment in green energy resources among the developing and developed countries are fueling the bifacial solar market growth.

Introduction

Bifacial solar is different from conventional monofacial solar modules as it can generate electricity from both the front and back sides of the panels; hence increasing the energy yield. It is made up of bifacial solar cells and a back cover glass. The photons which are not absorbed in the front layer can be absorbed by the back layer when they bounce off any surface. It is covered with dual glass which has several advantages such as reduced delamination, micro cracking, and moisture corrosion. It has low degradation rate and high cell temperature, as well as high flame proof rating, less flexibility, and mechanical strength.

Bifacial solar systems play an important role in expansion of energy access in various regions such as South Asia and African countries. The private investors have embraced the standalone products as sustainable solutions for electricity access as these systems offer low management and maintenance costs for the deployment of solar panels, which likely boost bifacial solar market. Increasing awareness regarding the use of low carbon intensive technologies to mitigate GHG emission will drive the market. Furthermore, the presence of government incentives and reduction in taxes in developing countries promote the use of solar have positive impact on the development of the market.

Report Key Highlighters:

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The bifacial solar market is fragmented in nature among prominent companies such as Jinko Solar Holdings, Canadian Solar, Yingli Green Energy, LG Electronics, LONGi, JA Solar Holding Co. Ltd., Sharp Corporation, Sun Power Corporation, Trina Solar, and Wuxi Suntech Power Co., Ltd.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), key regulation analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in global bifacial solar market such as undergoing R&D activities, public policies, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 2,500 bifacial solar-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global bifacial solar market.

Market Dynamics

The market for bifacial solar panels is experiencing significant growth, driven by various factors. Key drivers include the rise in demand for renewable energy, the decline in solar panel costs, and the increased efficiency of bifacial technology, which allows the panels to capture sunlight from both sides. This feature makes them particularly valuable in areas with high solar irradiance and reflective surfaces, such as deserts in the Middle East and North Africa, boosting energy yield and making them attractive for large-scale solar installations such as the Noor Energy project in Dubai.

Despite the positive outlook, the bifacial solar market faces some restraints. High initial costs of installation and infrastructure, particularly in developing countries with limited resources, pose challenges. For example, rural installations in South Asia might struggle with the upfront costs. Additionally, ensuring optimal performance under diverse environmental conditions, such as snow-covered surfaces or high dust areas, adds complexity. Moreover, the industry is highly competitive, with companies such as LONGi and JA Solar continuously innovating, which can strain smaller players trying to keep up with technological advancements.

Opportunities in the bifacial solar market are vast, particularly in emerging markets with ample sunlight and supportive government policies. For instance, in countries such as India, with its aggressive solar targets and investment in solar farms such as the Pavagada Solar Park, bifacial technology has a bright future. As governments in Latin America and Africa push for more renewable energy projects, bifacial solar technology is expected to dominate new installations, especially in regions with high solar exposure like Chile's Atacama Desert.

Segmentation Overview

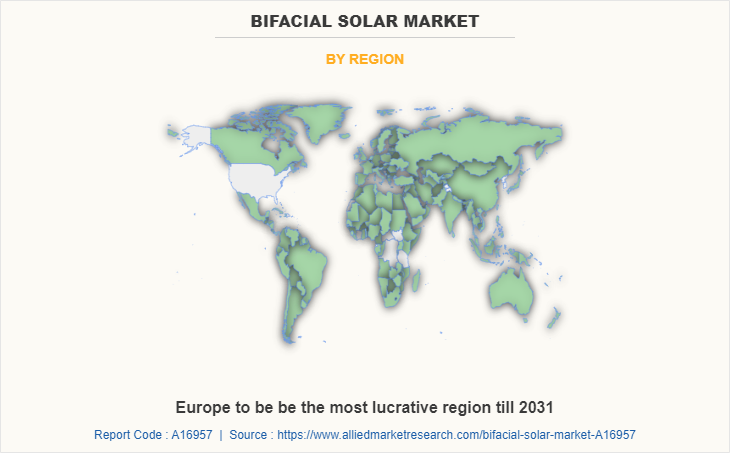

The global bifacial solar market is segmented on the basis of by cell type, frame type, end use and region. On the basis of cell type, the market is segmented into heterojunction cell and passivated emitter rear cell. On the basis of frame type, it is bifurcated into framed, and frameless. On the basis of end use, it is segmented into residential, commercial and industrial. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. Presently, Europe accounts for the largest bifacial solar market share of the market, followed by North America and Asia-Pacific.

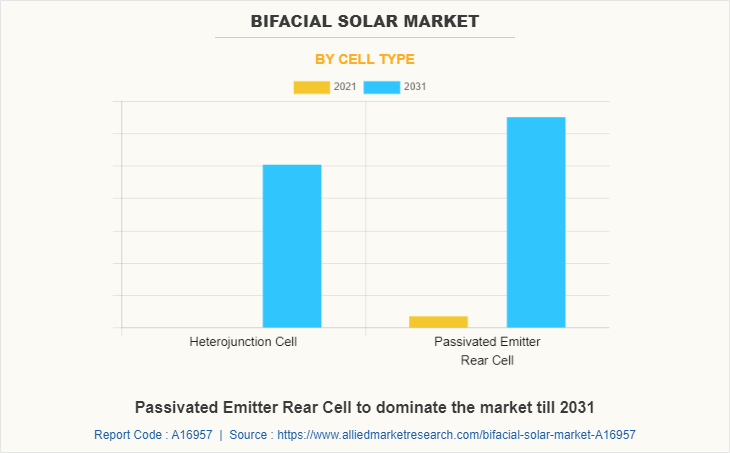

By Cell Type

The Passivated emitted rear cell segment dominates the global bifacial solar market. It is a new technology aimed to achieve higher energy conversion efficiency by adding a dielectric passivation layer on the rear of the cell. Dielectric passivation layer contributes towards increase the efficiency of solar panel through reducing electronic recombination, increase in ability of solar cells to capture light, reflecting specific wavelengths that normally generate heat out of solar cells. PERC solar cells are modified conventional cells that enable the cells to produce 6 to 12 % more energy than conventional solar panels. Increase in demand for the highly efficient and affordable solar power generation have led to growth of the market. Since PERC are a modification of conventional cells and can be manufactured using the present industrial infrastructure, which will reduce the investment cost on manufacturing equipment. Hence, makes it easy for the manufacturers to change and produce the higher efficient cells. The presence of above mentioned factors will provide ample opportunities for the development of the market.

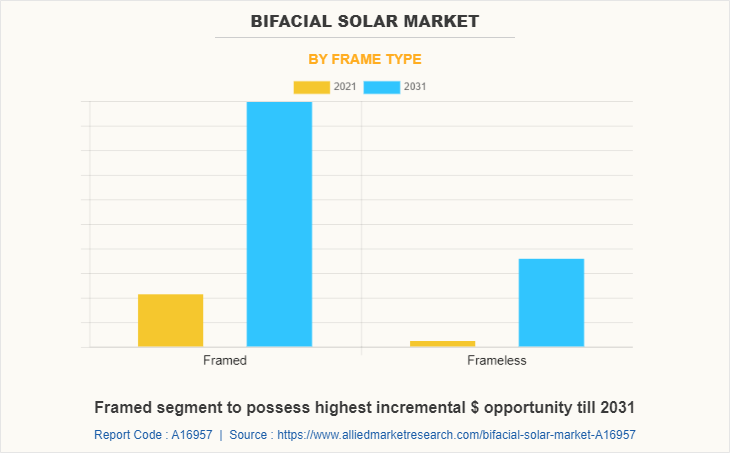

By Frame Type

The framed segment dominates the global bifacial solar market. The frame of solar panels has ability to weather outdoor operations over time. Its role lies in its mechanical characteristics which bring several benefits such as handling, storage, grounding, fixation, and resistance against mechanical load such as wind, snow, and other environmental hazards. Increase in the demand for the green energy source has led to the utilization of the solar panels in various countries. Increase in natural disaster across the globe has led to rise in demand for the framed solar panels. Rise in investment of the key players to invent various alternative materials for frame to increase the ability of the product to withstand extreme outdoor weather operations is a major factor that drives the market growth. The presence of above mentioned advantages will drive the bifacial solar market forecast growth.

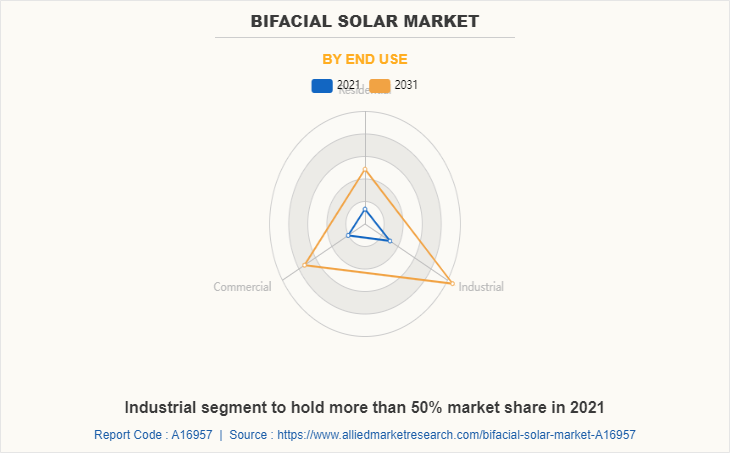

By End Use

The industrial segment dominates the global bifacial solar market. It is widely used in the industrial applications such as off grid power source for the manufacturing factories. Industrial sector is one of the huge consumers of world electricity across the globe. Moreover to reduce the dependency of the industrial manufacturers on the on-grid energy resources, industrial players have started to the investing on off-grid renewable power generation source. In addition, bifacial solar panels are used as a power source for the EV charging industry. Furthermore, it can be used in food, non-metallic, textile, building, and chemical industries. In addition, it is also used in the telecommunication, agricultural, water desalination and other industries. The presence of above mentioned wide range of utilization of bifacial solar panels in various industrial applications will provide ample opportunities for the market.

By Region

Europe market is shared between various countries such as France, Germany, Italy, Spain, U.K, and other countries. Germany, Italy and U.K. are the countries in Europe which uses the most solar energy. The presence of stringent regulations regarding the reduction of carbon footprint across the country and rapid developments in recent years have surpassed the expectations regarding steep cost reduction, flexibility, user-friendliness, and its manifold applications in many sectors. This has fuelled the manufacturer to expand their manufacturing capabilities. European Union (EU) and various national associations with corporate members are helping policy makers to enable solar to deliver on its immense potential to meet the 2030 targets of the EU. Technological advances and lower costs of capital have propelled renewables into the mainstream energy market. Furthermore, the boom of green investments in Asia and the ambitious policies in order to dominate the global renewable energy in terms of capacity, technology development, and energy demand. The above mentioned initiatives are major factor driving the growth of the market in this region during the forecast period.

Competitive Landscape

Major companies in this report include Jinko Solar Holdings, Canadian Solar, Yingli Green Energy, LG Electronics, LONGi, JA Solar Holding Co. Ltd., Sharp Corporation, Sun Power Corporation, Trina Solar, and Wuxi Suntech Power Co., Ltd. Rapid development of industrialisation, modernization and spread of information through internet led to the development of tourism industry, which fuels the demand for bifacial solar system. Furthermore, growth strategies such as expansion of production capacity, acquisitions, partnerships and research & innovation in the solar energy application which lead to attain key developments in the global bifacial solar market trends.

Policies and Regulations

U.S.:

- The Inflation Reduction Act (IRA) of 2022 promotes bifacial solar panels via tax credits, grants, and subsidies.

- As of Q2 2024, 11.8 GW of solar capacity was installed, with bifacial panels favored in utility-scale projects due to higher efficiency.

- The Department of Energy supports bifacial solar through research initiatives and boosting domestic production.

China:

- China, the world’s largest producer of solar energy, supports bifacial panel production with government subsidies and incentives.

- The National Energy Administration promotes large-scale solar farms using bifacial technology.

- By 2024, China is expected to drive market growth, with the global market projected to reach more than $31.0 billion by 2031.

Germany:

- The Renewable Energy Sources Act (EEG) promotes bifacial solar adoption via feed-in tariffs and financing models.

- Bifacial panels are becoming popular due to high output across varied climate conditions.

India:

- The National Solar Mission supports large-scale solar installations using bifacial panels.

- Incentives are provided for solar infrastructure, increasing bifacial panel adoption in diverse climates.

European Union (EU):

- The EU’s Green Deal and Renewable Energy Directive encourage high-efficiency bifacial solar adoption.

- Member states offer grants, tax rebates, and research funding to optimize bifacial solar usage.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bifacial solar market analysis from 2021 to 2031 to identify the prevailing bifacial solar market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bifacial solar market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bifacial solar market trends, key players, market segments, application areas, and market growth strategies.

Bifacial Solar Market Report Highlights

| Aspects | Details |

| By Cell Type |

|

| By Frame Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Trina Solar, JA Solar Holding Co. Ltd., LG Electronics, Canadian Solar, Jinko Solar Holdings, Sun Power Corporation, LONGi, Wuxi Suntech Power Co., Ltd., Yingli Green Energy, Sharp Corporation |

Analyst Review

The global bifacial solar market is expected to witness increased demand during the forecast period, owing to rapidly growing awareness among people regarding advantages of green energy and high efficiency conversion of bifacial solar panels.

Bifacial solar is a new generation solar technology with high efficiency bifacial modules on both sides producing electricity at the same time. Bifacial solar panels are more durable as both sides are UV resistant, reduce cost of balancing of system, and concerns over potential induced degradation. In comparison with traditional solar panels, which have limited light exposure, bifacial panels generate power from both sides.

The bifacial solar market is growing rapidly, owing to several advantages that have made it competitive. Presence of key characteristics, such as their design that allows module to capture sunlight from both sides of the panel, helps to increase solar generation capacity up to 25% depending on various factors such as albedo and height. This efficiency improves cell structures, resulting in increased durability and longevity while lowering the balance of system costs.

Increase in electricity demand from commercial & industrial sectors is a major market driver, especially during peak hours. As demand for solar based electricity is increasing across the globe, key market players are coming up with latest advanced solar modules focusing on efficiency, cost, and design of solar panels. Higher installation cost is the major factor that hinders growth of the market.

Rise in demand from commercial and industrial sectors for electricity and technological breakthroughs in solar energy and affordability of solar panels are the key factors boosting the Bifacial Solar Market growth

Adoption of solar electricity, reduced price, and presence of abundant renewable sources is the Main Driver of Bifacial Solar Market

Solar Holdings, Canadian Solar, Yingli Green Energy, LG Electronics, LONGi, JA Solar Holding Co. Ltd., Sharp Corporation, Sun Power Corporation, Trina Solar, and Wuxi Suntech Power Co., Ltd.

Industrial applications are projected to increase the demand for Bifacial Solar Market

The global bifacial solar market is segmented on the basis of cell type, frame type, end use, and region. On the basis of cell type, the market is segmented into heterojunction cells and passivated emitter rear cells. On the basis of frame type, it is bifurcated into framed and frameless. On the basis of end use, it is segmented into residential, commercial, and industrial. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The market value of Bifacial Solar in 2031 is expected to be $31.1 Billion

The decrease in demand for many non-essential products and shut down of construction and tourism related industries have created a negative impact on the development of global bifacial solar market.

Loading Table Of Content...