Big Data Analytics in Semiconductor & Electronics Market Overview

The global big data analytics in semiconductor & electronics market was valued at USD 18.7 billion in 2021, and is projected to reach USD 47.2 billion by 2031, growing at a CAGR of 9.9% from 2022 to 2031.

Big data analytics in semiconductor & electronics is to help organizations get better understanding of their customers, business processes, and help organizations to narrow down their targeted audience, thus improving the marketing campaign of companies. Numerous benefits are associated with big data and business analytics such, as it allows customers to capture & process different services, modify existing orders, and process customer moves.

![]()

The key factors impacting the growth of the global big data analytics and semiconductor & electronics market include surge in adoption of big data analytics software by various organizations to facilitate enhanced & faster decision-making and to provide competitive advantage by analyzing and acting upon information in a timely manner.

In addition, numerous benefits provided by big data and business analytics such as faster data processing positively impacts the growth of the big data analytics in semiconductor & slectronics market. Moreover, high implementation cost and dearth of skilled workforce are expected to affect the growth of the big data analytics in semiconductor & electronics market. Increase in need to gain better insights for business planning and emerging trends such as social media analytics are further expected to impact the expansion of the market during the forecast period. However, each of these factors is projected to have a definite impact on the big data analytics in semiconductor & electronics industry.

Segment Review

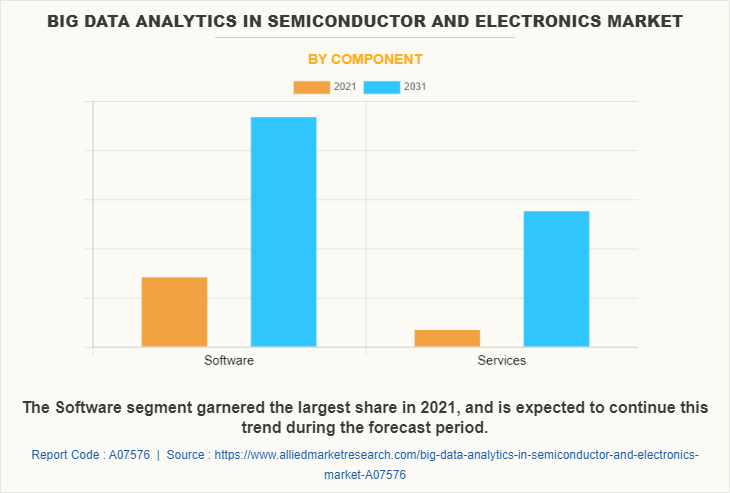

The global big data analytics in semiconductor & electronics market analysis is segmented into component, end user, analytics tool, application, and region. In terms of component, the market is fragmented into software and services. Depending on end user, it is bifurcated into semiconductor and electronics. On the basis of analytics tool, it is categorized into dashboard & data visualization, data mining & warehousing, self-service tools, reporting, and others. By application, it is segregated into customer analytics, supply chain analytics, marketing analytics, pricing analytics, workforce analytics, and others. By Usage, the big data analytics in semiconductor & electronics market is segmented into sales & marketing, fault detection & classification, predictive maintenance, virtual meterology, process optimization, yield prediction, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of component, the software segment garnered the largest big data analytics in semiconductor & electronics market share in 2021, and is expected to continue this trend during the forecast period. The software segment help organizations leverage the best return by providing data-based insights, enabling better decision-making, and garnering more revenue. However, the Services segment is expected to witness highest big data analytics in semiconductor & electronics market forecast in the upcoming years. Surge in demand for cloud-based big data analytics services is expected to provide lucrative opportunities for the market growth during the forecast period. Moreover, rise in demand for software-as-a-service (SaaS) due to its numerous benefits such as scalability and one-time customer acquisition cost is expected to provide lucrative opportunities for the big data analytics in semiconductor & electronics market growth.

Region wise, the big data analytics in semiconductor & electronics industry was dominated by North America in 2021, and is expected to retain its position during the forecast period. Upsurge in penetration of smartphones, wearable devices, and other smart connected devices is one of the major factors that drives the growth of the market in North America. In addition, increase in demand for digital transformation across numerous industry verticals and rise in convergence of different technologies, such as big data & analytics and AI, have created an impact on the region and managed to increase its IT budget, thus drive the growth of the market in this region.

However, Asia-Pacific is expected to grow at the highest rate during the forecast period. Owing to increase in penetration of tablets and smartphones across countries such as China and India. In addition, governments in Asia-Pacific countries are actively investing in big data analytics solutions and services, which is expected to significantly contribute toward the growth of the market.

Top Impacting Factors

Surge in Adoption of Big Data Analytics Software by Multiple Organizations:

Increase in investments in big data and business analytics tools among large number of semiconductor & electronics organizations to drive revenue growth and improve service efficiencies fuels the adoption of big data analytics. Moreover, senior executives of many organizations are increasingly using different types of analytics to resolve their business requirements due to emerging importance of big data analytics, which boosts the market growth.

Furthermore, semiconductor & electronics industry is utilizing big data and business analytics to improve predictive maintenance & yield, boost sales, and improve pricing & market-entry strategies. For instance, in June 2022, Synopsys Inc. launched the award-winning AI-driven design-space-optimization solution, Synopsys DSO.ai™. The Synopsys DesignDash design optimization solution greatly enhances design productivity by providing extensive real-time design status through powerful visualizations and interactive dashboards; deploying deep analytics and machine learning to extract and reveal actionable understanding from vast volumes of structured and unstructured EDA metrics and tool-flow data; and quickly classify design trends, identify design limitations, provide guided root-cause analysis, and deliver flow consumable, prescriptive resolutions. Such enhancement boosts the productivity and efficiency of the market. On the contrary, organizations are adopting big data analytics to enhance customer experience, which significantly contributes toward the growth of the global market.

Numerous Benefits Provided by Big Data and Business Analytics Solutions:

The ability of big data analytics software to deliver better and faster decision-making and to provide competitive advantage by analyzing & acting upon information in a timely manner propels the growth of the market. In addition, the demand for big data analytics software is continuously increasing, owing to the benefits offered such as easy access to vital business metrics, useful insight on customer behavior, and improved efficiency of organizations & employees.

It further helps semiconductor & electronics companies in next-generation fault detection and classification (NG-FDC), predictive maintenance, and improved use of cyber-physical systems (CPS). Moreover, companies are adopting big data and business analytics for real-time forecasting and monitoring various occasions that may affect the performance of organizations. In addition, the ability of the solution to mitigate risks by optimizing complex decisions about unplanned events more quickly augments the growth of the global big data analytics in semiconductor & electronics market.

Key Benefits for Stakeholders

The study provides an in-depth analysis of the big data analytics in semiconductor & electronics market share along with current trends and future estimations to elucidate the imminent investment pockets.

Information about key drivers, restraints, and opportunities and their impact analysis on the big data analytics in semiconductor & electronics market size is provided.

The Porter’s five forces analysis illustrates potency of buyers and suppliers operating in the accounting software market.

The quantitative analysis of the big data analytics in semiconductor & electronics market share from 2022 to 2031 is provided to determine the market potential.

Big Data Analytics in Semiconductor & Electronics Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 47.2 billion |

| Growth Rate | CAGR of 9.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 482 |

| By Component |

|

| By End User |

|

| By Usage |

|

| By Analytics Tool |

|

| By Application |

|

| By Region |

|

| Key Market Players | Galaxy Semiconductor Inc., Microsoft Corporation, Dell EMC, Onto Innovation Inc., Amazon Web Service Inc., Qualtera Inc., OptimalPlus Ltd., International Business Machines Corporation, DR YIELD SOFTWARE AND SOLUTION GMBH, Cisco Systems, Inc., Kx Systems, Inc. |

Analyst Review

As per the insights of industry executives of the leading companies, the adoption of big data and business analytics software has increased over the time to boost the decision-making capability and improve the business insights of organizations. In addition, the ability of the big data analytics software to provide potential opportunities for business and gain new insights to run the business efficiently is increasing its popularity among end users. Furthermore, many banking and manufacturing industries are investing in big data analytics to increase security and reduce compliances issues in organizations.

Presently, every organization, regardless of its size, is shifting its focus toward data analytics capability and is deploying data analytics tools and platforms to manage disparate data sets with higher volume to develop deeper insights from the data.

This is attributed to the adoption of technology to sustain in a saturated and competitive market and to gain competitive advantages over the other players. Moreover, increase in economic strength of the developing nations such as China, India, Indonesia, and Thailand are expected to provide lucrative opportunities for the market growth. North America and emerging countries in Asia-Pacific are projected to offer significant growth opportunities during the forecast period. CXOs further added that global players are focusing toward product development to increase their geographical presence, owing to rise in competition among local vendors in terms of features, quality, and price.

For instance, in May 2021, Dialog Semiconductor plc., a leading provider of battery and power management, Wi-Fi®, Bluetooth® low energy (BLE) and Industrial edge computing solutions expanded its SmartServer IoT Partner Program to include businesses that offer data analytics platforms with artificial intelligence (AI)-led outcomes that transform industrial operations.

In addition, many players are adopting various business strategies to enhance their product offerings and strengthen their foothold in the market. For instance, in June 2022, Altair, a global leader in computational science and artificial intelligence (AI) expanded its electronic system design technology with Acquisition of Concept Engineering, a leading provider of electronic system visualization software that accelerates development, manufacture, and service of complex electrical and electronic systems. Through this acquisition, Altair, will integrate “Concept Engineering” technology into its electronic system design suite, that offer customers comprehensive and fast visual representations of complex system models and debug capabilities for electronic systems. Such initiatives drive growth of the market.

Big Data Analytics in Semiconductor & Electronics Market Expected to Reach $47,160.64 Million by 2031.

The Big Data Analytics in Semiconductor & Electronics market is projected to grow at a compound annual growth rate of 9.9% from 2022 to 2031.

Amazon Web Services, Cisco Systems, Inc., Dell EMC, Dr yield software & solutions GmbH, Galaxy semiconductor Inc., IBM corporation, Kx systems, Microsoft corporation, Qualtera (Synopsys, Inc.), SAP SE and others

The North America is the largest market for Big Data Analytics in Semiconductor & Electronics.

Factor such as surge in adoption of big data analytics software by various organizations to facilitate enhanced & faster decision-making and to provide competitive advantage by analyzing and acting upon information in a timely manner significantly boosts the growth of the global big data analytics in semiconductor & electronics market.

Loading Table Of Content...