Bike And Scooter Sharing Telematics Market Research, 2033

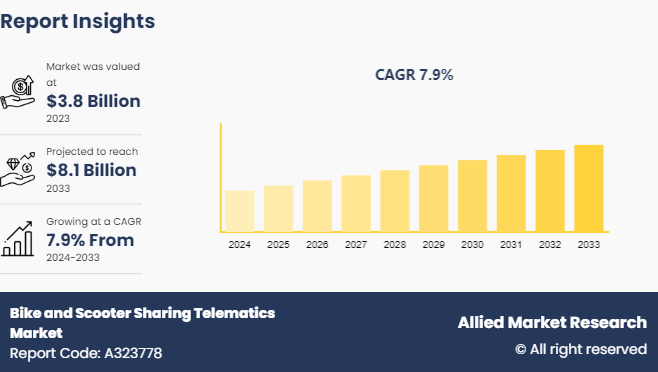

The global bike and scooter sharing telematics market was valued at $3.8 billion in 2023, and is projected to reach $8.1 billion by 2033, growing at a CAGR of 7.9% from 2024 to 2033.

Market Introduction and Definition

Bike and scooter sharing telematics means using telecommunications and information technology to send, receive and store information in relation to the vehicles, The bike and scooter sharing telematics technology comprises of different systems that help in observing, supervision and evaluation of data for shared mobility services. The bike and scooter sharing telematics include GPS tracking, data collection, health monitoring, predictive maintenance, incident reporting, theft prevention, fleet management and energy management.

Bike and scooter sharing telematics helps in offering real time information of bikes and scooters, thus helping users to access vehicles through mobile applications. In addition, the operators help in monitoring all the fleet, tracking the patterns of vehicle utilization, and optimizing the distribution and availability of bikes and scooter in different locations. The telematics technology also gathers information over duration of ride, travelling of distance, and behaviour of user for improving service performance.

Key Takeaways

The global bike and scooter sharing telematics market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major bike and scooter sharing telematics industry participants along with authentic industry journals, trade association releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Strategies and Developments

In July 2022, Lime Company launched a computer vision platform that is designed to power Lime’s safety innovations, initiating with advanced sidewalk detection that helps in reducing pavement riding in its scooters.

In June 2021, Bird Rider Inc., introduced a smart bikeshare platform and shared e-bikes, offering eco-friendly transportation options with high-powered motors, IoT capabilities, and robust designs for enhanced safety and durability. This strategic move will strenghen Bird Rider Inc. postion during the bike and scooter sharing telematics market forecast.

In July 2020, Uber Technologies Inc. launched first electric scooter “Jump” in Santa Monica. The dockless gadget is remarkable since it does not require specific docks to be parked, and users may rapidly switch scooters if they come across another one while walking to the one they reserved.

In August 2023, Lyft Media launched in-app advertising across the Lyft application, expand tablets, rooftop and bikeshare stations, thus giving brands the chance to connect with riders.

In June 2021, Cooltra launched electric-scooter sharing service in Paris. By September 2021, the business hoped to have 2, 000 scooters in service around Paris.

In February 2024, Yulu Bike company, a leading shared mobility services provider obtained $19.25 million in case of funding by existing investors Magna and Baja Auto. This capital will support the objectives of Yulu for the development of latest products, technologies and will also help in Yulu's service offerings. In addition, Yulu is planning to utilize its capital to enhance its electric vehicle fleet, and improve operational efficiency and scale up the presence in the existing and latest markets. This strategic move will strenghen Yulu Bike Company's postion in the bike and scooter sharing telematics market share.

In September 2021, HellBiz Inc., partnered with Drover AI to integrate Drover AI's pathpilot safety technology into HellBiz e-scooters. Hellbiz will act as exclusive operator of Pathpilot in Italy, with the first deployment in Milan. PathPilot technology uses artificial intelligence and computer vision to locate e-scooter's surroundings, reducing clutter and ADA ramp blocking. It verifies parking and automatically reduces speed in geofenced areas, ensuring safety for riders and pedestrians. This advanced technology enhances geo-fencing capabilities in dense urban cities. This strategic move will strenghen HellViz Inc., company's postion in the bike and scooter sharing telematics industry.

In May 2023, Uber Technologies, Inc. entered into a multi-year strategic partnership with Waymo. This aim of the partnership was to align Uber's strategy to enhance its telematics and mobility solutions, providing users with more seamless and efficient transportation options.

In October 2021, Dott launched, a new e-bike in Paris. The new e-bikes are integrated into the fleet management system of Dott allowing seamless operations and maintenance. The fleet management system includes advanced telematics, which ensures efficient operations through in-house repairs, maintenance, and logistics.

Key Market Dynamics

Increase in urban population and growing environmental challenges are the two primary factors driving the growth of bike and scooter sharing telematics market size. Furthermore, governing and functional challenge is an important factor restraining the growth of bike and scooter sharing telematics market size. Moreover, escalating uncovered zones and technological innovations are the two significant opportunities that can strenghen the growth of bike and scooter sharing telematics market opportunity.

The increasing number of people in developed regions are resulting in an improved demand for effective, and adaptable transportation alternatives. Furthermore, increasing traffic overload in cities is making bike and scooter sharing telematics market growth more relevant as people are opting for riding share facilities to travel shorter distances. Moreover, eletric bikes and electric scooters are further increasing the importance of the bike and scooter sharing telematics service as the electric bikes and scooters result in low carbon emissions in comparison to conventional vehicles, thus adjusting with urban sustainability and eco-friendly objectives.

Market Segmentation

The bike and scooter sharing telematics market is segmented into service type, operation model, propulsion, vehicle type and region. By service type, the market is bifurcated into pay-as-you-go and subscription pay-as-you-go. By operation model, the market is bifurcated into dockless and station-based. By propulsion, the market is classified into pedal, electric and gasoline. By vehicle type, the market is categorised into bike, scooter and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Regional/ Country Market Outlook

As per the National Association of City Transportation Officials source, in 2022, the commuters in U.S booked 113 million trips on shared bike and e-scooters application. This showed a 40% increase share bike and scooter trips since 2018. Therefore, as the demand for bike and scooter sharing services is growing simultaneouly the demand for bike and scooter sharing telematics market is also growing.

As per the infomration published by movmi 06/03/2023, a pilot program was introduced in early 2022, in Qubec and Montreal City in Canada, due to important adoption of shared electric bicycle. Over 1500 shared electric bikes were made avaialble by taking more than 50000 trips during the pilot period.

As per the information published by Mckinsey & Company on 01/05/2023, the e-scooter market revenue sharing reached 46 million euros ($49.1 million) in UK. The increase in scooter sharing services is attributed to its convenience and flexibility that offer short distance travel specially in urban areas. Furthermore, the adoption of bikesharing in UK is growing significantly. There is a critical increase in the utilization of both traditional and electric bikes due to factors such as urbanization, traffic overcrowding and environment issues.

Competitive Analysis

The major players operating in the global bike and scooter sharing telematics market are Beam Mobility Holdings Pte. Ltd., Bolt Technology Ou, Dott, Helbiz, DSV, Lime, Lyft, Inc., Marti Technologies, Inc., Neuron Mobility, Ridemovi S.p.A., The Swing Corporation, Tier, Yulu Bikes Pvt. Ltd., Anywheel Pte. Ltd., Blinkee.city, Bixi Montreal, Bird Rider, Inc., Uber Technologies, Inc., Cooltra, Bixi Montreal, Blue Bikes, and Didi Chuxing Technology Co. Ltd. These players adopted product launch, and strategic partnership strategies to increase their market share in the global bike and scooter sharing telematics industry.

The other players include Docomo Bike Share, Inc., Donkey Republic, The Forest Company, Freebike, Hello Cycling, Hellobike, JCDecaux, Mevo, Inc., MYBYK, Nextbike GmBH, BinBin, Poppy, Hop Electric Mobility, Voi Technology AB, Zoomo, Splinster, YEGO Urban Mobility SL, Spin, Emmy Sharing, Jump, Inc., and Cityscoot.

Industry Trends

In April 2024, Canadian city Mississauga launched a fleet of 300 electric pedal-assist bicycles and 900 electric kick-style scooters through partnerships with Lime Micromobility?and Bird Canada.

The City of Surrey in Great Britain has selected Bird Canada as its exclusive supplier and operator for its bike share system, and the service began on Saturday, 04/27/2024.

Toronto-based micro-mobility software start-up Joyride raised about $3.7 million in funding to build on its recent growth and capitalize on the rise in demand for mobility solutions such as bikes and scooters sharing. Joyride contains a white label feature that helps in the launch, management and growth of public fleets and private fleets of scooters, bikes, electric bikes and mopeds.

According to a survey by Oliver Wyman Forum, in 2021, riders in U.S., France, Italy, and China are increasingly opting for shared bike and scooter services.

Key Sources Referred

Intelligenttransport.com

Ir.bird.com

Cooltra.Com

Lyft.com

Appinventiv.com

Tier.app

Economic Times

Dailyhive.com

CBC news

Brink News

National Association of City Transport Officials

movmi

Mckinsey & Company

EU-Startups

Businesswire (Helbiz)

Uber Investor

Bird Press Release

Tech Startup

Uber Newsroom

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bike and scooter sharing telematics market analysis from 2024 to 2033 to identify the prevailing bike and scooter sharing telematics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bike and scooter sharing telematics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bike and scooter sharing telematics market trends, key players, market segments, application areas, and market growth strategies.

Bike and Scooter Sharing Telematics Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 8.1 Billion |

| Growth Rate | CAGR of 7.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Service Type |

|

| By Operational Model |

|

| By Propulsion |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | MYBYK, Didi Chuxing Technology Co. Ltd., Freebike, Marti Technologies, Inc., Lime, Hellobike, JCDecaux, Voi Technology AB, BinBin, Hello Cycling, Cityscoot, Blue Bikes, Bolt Technology OU, Spin, TIER, YEGO Urban Mobility SL, Uber Technologies, Inc., Ridemovi S.p.A., Spinlister, Cooltra, The Forest Company, Neuron Mobility, Mevo, Inc., Poppy, Lyft, Inc., Emmy Sharing, Jump, Inc., Donkey Republic, Zoomo, DOTT, The Swing Corporation, Anywheel Pte. Ltd., Yulu Bikes Pvt Ltd, Docomo Bike Share, Inc., Bixi Montreal, Helbiz, Hop Electric Mobility, DSV, Nextbike GmbH, Bird Rider Inc., Beam Mobility Holdings Pte. Ltd., Blinkee.city |

Increase in government initiatives and collaborations between companies are the upcoming trends of Bike and Scooter Sharing Telematics Market in the globe.

Subscription-based model is the leading application of Bike and Scooter Sharing Telematics Market.

Asia-Pacific is the largest regional market for Bike and Scooter Sharing Telematics.

$8.1 Billion is the estimated industry size of Bike and Scooter Sharing Telematics.

Beam Mobility Holdings Pte. Ltd., Bolt Technology Ou, Dott, Helbiz, DSV, Lime, Lyft, Inc., Marti Technologies, Inc., Neuron Mobility, Ridemovi S.p.A., The Swing Corporation, Tier, Yulu Bikes Pvt. Ltd., Anywheel Pte. Ltd., Blinkee.city, Bixi Montreal, Bird Rider, Inc., Uber Technologies, Inc., Cooltra, Bixi Montreal, Blue Bikes, and Didi Chuxing Technology Co. Ltd., Docomo Bike Share, Inc., Donkey Republic, The Forest Company, Freebike, Hello Cycling, Hellobike, JCDecaux, Mevo, Inc., MYBYK, Nextb

Loading Table Of Content...