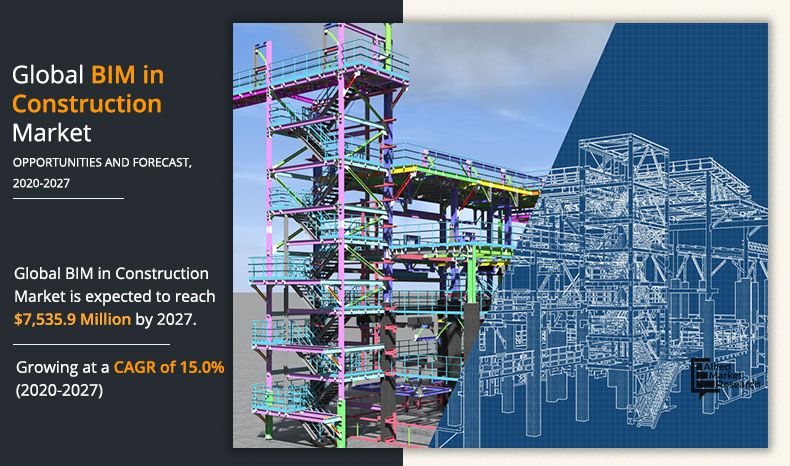

BIM in Construction Market Research, 2027

The global BIM in construction market size is expected to reach $7,536.0 million in 2027, from $2,514.5 million in 2019, growing at a CAGR of 15.0% from 2020 to 2027.

Building Information Modeling or Building Information Management (BIM) is often termed as software or a process of generating 3D models of a building or structure to ensure efficient designing, planning, and construction of the project. BIM software is majorly aimed for architects, engineers, and construction (AEC) users. Utilization of BIM offers better control over construction processes by providing assistance during construction techniques, scheduling materials & resources, maintaining quality, estimating costs, and sequencing construction processes to gain maximum productivity.

BIM in Construction Market Dynamics

Reduction in construction costs and decrease in wastage of resources and time in construction projects are driving the demand for BIM, which, in turn, boosts the growth of the global BIM in construction market. Construction projects include various activities, which are not managed properly, thereby causing the risks of over budgeting and completion delays. Use of BIM assists in managing and estimating the quantities of resources, which reduces the costs incurred on wastage of resources. Moreover, the introduction of BIM in prefabricated or modular construction is also expected to drive the BIM in construction market growth.

Modular or prefabricated construction refers to manufacturing of building units away from the job site and assembling them on-site, which is expected to witness high growth, owing to the increasing demand for affordable housing. BIM allows proper designing, execution, and management of time and costs in modular construction activities. This propels the demand for BIM in the modular construction industry, which, in turn, drives the growth of the market.

By Phase Of Work

Construction segment is projected to grow at a significant CAGR

However, data security is a major drawback of utilizing BIM in construction. Data collection and on-cloud storage are relatively unsafe in case of infrastructural construction. Therefore, cyber-security concerns are hindering the growth of the market.

In addition, the COVID-19 pandemic has shut-down the on-going construction projects, owing to the prolonged lockdown in major global countries including the U.S., Italy, the UK, and others. People are forced to work-from-home to maintain safety rules posed by the government. This has opened new opportunities for the use of BIM in construction.

By End User

Contractors segment is projected to grow at a significant CAGR

On the contrary, increasing awareness regarding the features and benefits of using BIM in construction projects is expected to boost the growth of the BIM in construction market share during the forecast period.

The global BIM in construction market is segmented on the basis of phase of work, end user, deployment model, and region. Based on phase of work, the BIM in construction market is fragmented into construction and operation. According to end user, the global BIM in construction market is categorized into engineers and contractors. According to application, the global BIM in construction market is categorized into residential and non-residential. By deployment model, the market is classified into cloud-based and on-premise.

By Application

Non-residential segment holds dominant position in 2019

The global BIM in construction market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). North America is expected to hold the largest market share over the study period and Asia-Pacific is expected to grow at the fastest rate.

Competition Analysis

The key market players profiled in the report include Autodesk Inc., AVEVA Group, Bentley Systems, Hexagon AB, NEMETSCHEK, Oracle Corporation, Procore Technologies, Inc., Trimble, Inc., Vectorworks, Inc., and Vizerra SA. Many competitors in the BIM in construction market adopted product launch as their key developmental strategy to expand their geographical foothold and upgrade their product technologies. For instance, in November 2020, Autodesk, Inc. based in the U.S. launched the Autodesk BIM Collaborate software. The software offers solutions, such as design collaboration and model coordination, which assist in aligning and executing high-quality designs while ensuring proper workflow on site. In addition, Autodesk also launched the Autodesk Build software, which includes the benefits of the PlanGrid software and BIM 360 software, which are used in field collaboration and project management, respectively. This enhances the product portfolio of Autodesk in the BIM in construction market.

By Region

North America holds a dominant position in 2019 and Asia-Pacific is expected to grow at a highest rate during the forecast period.

Key Benefits For Stakeholders

The report provides an extensive analysis of the current and emerging global BIM in construction market trends and dynamics.

In-depth analysis of the market is conducted by constructing market estimations for the key segments between 2019 and 2027.

- Extensive analysis of the global BIM in construction market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of market opportunities of all the countries is also provided in the report.

- The global BIM in construction market forecast analysis from 2020 to 2027 is included in the report.

- The key players within the global BIM in construction market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the industry.

BIM in Construction Market Report Highlights

| Aspects | Details |

| By Phase Of Work |

|

| By End User |

|

| By Application |

|

| By Deployment Model |

|

| By Region |

|

Analyst Review

The UK, France, Scandinavia, Singapore, and the U.S. are the top five countries with highest BIM adoption. High government support is majorly responsible for the large-scale penetration of BIM in the already established construction industry in these countries. However, other nations are also witnessing increased adoption of BIM by realizing the benefits of BIM. For instance, a leading Korean engineering firm, Dasan Consultants, adopted the 3DEXPERIENCE platform using the BIM design approach. It made a switch from 2D modeling to 3D modeling, which assisted in centralizing databases and secure sharing of data within stakeholders.

Moreover, rapid urbanization and growth in economies especially in nations, such as India, China, the UAE, and others, are the major factors influencing the growth of the BIM in construction market. Furthermore, according to the survey conducted by Centre for Integrated Facilities Engineering (CIFE) of Stanford University, based in the U.S., extra expenditure upto 40% can be saved by eliminating sudden changes in the budget of the construction project during the construction phase. The use of BIM ensures proper planning of construction projects, thereby reducing the risk of over budgeting.

Many competitors in the BIM in construction market adopted product launch as their key developmental strategy to expand their geographical foothold and upgrade their product technologies. For instance, in November 2020, Autodesk, Inc. based in the U.S. launched the Autodesk BIM Collaborate software. The software offers solutions, such as design collaboration and model coordination, which assist in aligning and executing high-quality designs while ensuring proper workflow on site. In addition, Autodesk also launched the Autodesk Build software, which includes the benefits of the PlanGrid software and BIM 360 software, which are used in field collaboration and project management, respectively. This enhanced the product portfolio of Autodesk in the BIM in construction market.

The global BIM in construction market size was $2,514.5 million in 2019 and is projected to reach $7,536.0 million in 2027, growing at a CAGR of 15.0% from 2020 to 2027.

The forecast period considered for the global BIM in construction market is 2020 to 2027, wherein, 2019 is the base year, 2020 is the estimated year, and 2027 is the forecast year.

The base year considered in the global BIM in construction market is 2019.

No, the report does not provide Value Chain Analysis for the global BIM in construction market. However, it provides market share analysis for the top players in the BIM in construction market.

On the basis of phase of work, the construction segment is expected to be the most influencing segment growing in the global BIM in construction market report.

Based on the application, in 2019, the non-residential segment generated the highest revenue, accounting for 78.5% of the market, and is projected to grow at a CAGR of 14.5% from 2020 to 2027.

The report contains an exclusive company profile section, where leading 10 companies in the market are profiled. These profiles typically covers company overview, geographical presence, and market dominance (in terms of revenue and volume sales).

The market value of global BIM in construction market is $2,841.7 million in 2020. COVID Banner Statement: The COVID-19 pandemic has negatively affected the global BIM in construction market mainly due to the halt in international trade, prolonged lockdowns, and reduced construction activities, globally.

Loading Table Of Content...