Bio-LNG Market Research, 2032

The global bio-LNG market was valued at $0.7 billion in 2022, and is projected to reach $3.4 billion by 2032, growing at a CAGR of 17.9% from 2023 to 2032.

Key Report Highlighters:

- The bio-LNG market has been analyzed in terms of value ($ million), covering more than 15 countries.

- For growth prediction, we have looked into historical trends including present and future activities of key business players.

- The report covers detailed profiling of the major 10 market players.

Bio-liquified natural gas (bio-LNG) is a renewable form of liquified natural gas (LNG). It is produced from organic waste obtained from industrial processes, households, agriculture, sewage sludge, energy crops, and animal manures. The organic waste is also known as biomass feedstock which is collected at a processing plant and then subjected to anaerobic digestion. Under anaerobic digestion, organic feedstock is broken down by microorganisms in the absence of oxygen. After anaerobic digestion, biogas is obtained which contains methane and carbon dioxide. It is further subjected to the purification and upgrading process. The end result of the process is biomethane which is further converted to liquid state and hence bio-LNG is obtained.

Bio-LNG is used in many sectors for power generation, heating, and as fuel in transportation. It is also used by blending with LNG. It is a cleaner fuel and is more environmentally friendly which makes it a good alternative to fossil fuel-based LNG. It helps in reducing greenhouse gas emissions and also drives organic waste management practices. Bio-LNG is transported through existing infrastructure via tanker trucks to distribution centers and end users. such benefits of bio-LNG drive the market growth for the bio-LNG market.

Organic feedstock procurement is a major challenge for the industry's growth. In the areas and regions where waste collection is held to a minimum or not very organized, the availability of the feedstock is uncertain and inconsistent. Moreover, the lack of infrastructure for further processing of the waste also significantly impacts the bio-LNG market growth. There is also a higher cost of investment associated with producing bio-LNG as compared to conventional LNG from fossil fuels. The economies of scale involved in the whole process are high and optimizing the efficiency of the production process is yet to be achieved which also further adds to the final cost of bio-LNG.

Market Dynamics

The growing awareness of the effects of climate change and the potential risks of greenhouse gas emissions have compelled global leaders to take significant actions. There is tremendous pressure on manufacturers and government bodies to search for alternatives and sustainable sources of energy which can be integrated in the present infrastructure at a large scale. Bio-LNG is a promising source of energy with a lower carbon footprint. Several policies and incentives are being given out globally by the governments to encourage the production and adoption of bio-LNG. These benefits include tax benefits and subsidies whereas several mandates are also being introduced for the inclusion of blended fuel majorly in the transportation and industrial sectors. Diversifying the energy mix by incorporating bio-LNG can enhance energy security by reducing dependence on fossil fuel imports and mitigating supply chain vulnerabilities. Bio-LNG provides an opportunity to convert organic waste and agricultural residues into valuable energy resources, thus contributing to better waste management practices.

The production of bio-LNG relies on organic waste, agricultural residues, or landfill gas as feedstock. The availability and consistency of these feedstocks can vary geographically and seasonally, which poses challenges in ensuring a stable and reliable supply. The production and purification processes for bio-LNG can be energy-intensive and costly. Establishing the necessary infrastructure for biogas upgrading, liquefaction, and distribution may require substantial investments. The overall energy efficiency of the bio-LNG production process can vary depending on factors such as feedstock type, transportation, and purification methods. In some cases, the energy expended in the production process might approach or even exceed the energy content of the final bio-LNG product. Thus, high investment costs act as a challenge for the bio-LNG market growth.

Bio-LNG production offers an opportunity to convert organic waste, agricultural residues, and landfill gas into valuable energy resources. Bio-LNG can be integrated with waste management practices and thus it is expected to reduce the environmental impact caused by improper waste disposal. It also aids in creating a circular economy model in which waste will be used as a feedstock for processing sustainable energy sources. Many countries and industries are striving to reduce their carbon footprint and transition to renewable energy sources; hence, bio-LNG is expected to play a crucial role in providing a cleaner and more sustainable alternative to conventional LNG and other fossil fuels. This transition can help meet climate goals and contribute to a greener energy mix.

The bio-LNG market size is studied on the basis of source, application, and region.

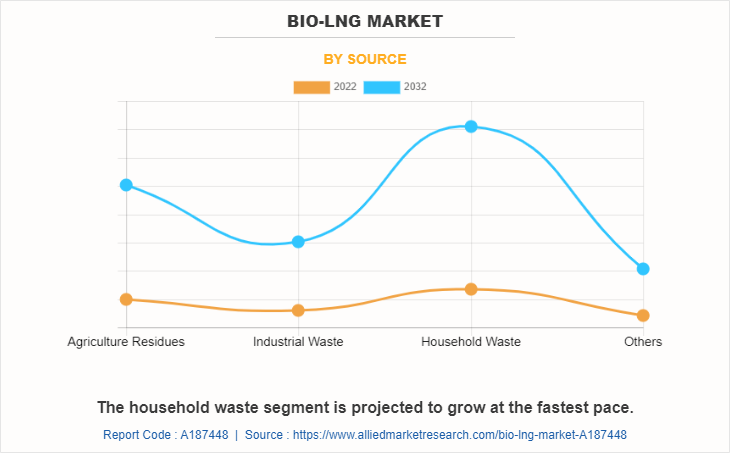

By source, the bio-LNG market is divided into agriculture residues, industrial waste, household waste, and others. The household waste segment dominated the bio-LNG market share for 2022 and is expected to grow at a higher CAGR during the projection period. Household waste is collected and taken to a waste sorting facility, where recyclables and non-organic materials are separated. The organic waste which consists of food waste and yard waste is collected for further processing. It is subjected to anaerobic digestion, where the waste is reduced to organic matter in the absence of oxygen. This process results in the production of biogas that comprises methane (CH4) and carbon dioxide (CO2). Household waste used for bio-LNG production is expected to offer significantly better solutions for waste management and sustainable energy production. Moreover, it aids in the encouragement of a circular economy, where waste materials are utilized to create valuable resources, reducing environmental impacts, and promoting a more sustainable future.

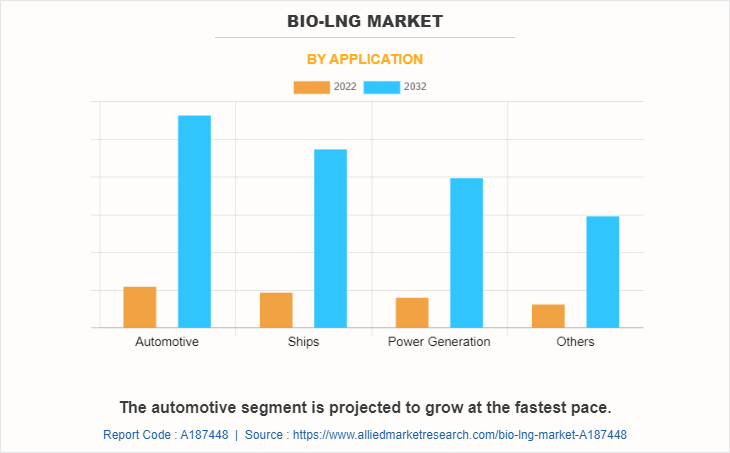

By application, the market is categorized into automotive, ships, power generation, and others. The automotive segment dominated the market for 2022 and is projected to grow at a higher CAGR during the bio-LNG market forecast period. Bio-LNG is a low-carbon emitting fuel as it is produced from renewable sources. These renewable resources including organic waste and agricultural residues are further processed through anaerobic digestion.

By region, the bio-LNG market analysis is done across North America, Europe, Asia-Pacific, and LAMEA. Europe region garnered the highest market share for bio-LNG in 2022 and the same is projected to grow at a higher CAGR. Bio-LNG is seen as a promising option to complement the region’s renewable energy mix. There are ongoing initiatives and investments in bio-LNG production facilities that utilize organic waste and biomass as feedstock. Efforts are underway to develop bio-LNG production facilities and infrastructure, enabling its use in transportation and industrial applications.

The Italy government is providing support through various incentives and programs to encourage the adoption of bio-LNG and other renewable energy sources. Spain is actively advancing its renewable energy sector, and bio-LNG is considered a viable option for reducing emissions in the transportation and industrial sectors. Several projects are underway to produce bio-LNG from organic waste and biomass. European Union policies and initiatives also play a crucial role in promoting the use of bio-LNG across member states. The region sees many ambitions on climate and energy targets to reduce greenhouse gas emissions and promote sustainability, which encourages the adoption of renewable energy sources such as bio-LNG.

The major players operating in the bio-LNG industry are Linde plc, Nordsol, Flogas Britain Ltd., EnviTec Biogas AG, Biokraft International AB, Total Energies SE, Titan LNG, DBG Group B.V., BoxLNG Pvt. Ltd., and Shell Plc. The companies adopted key strategies such as collaboration to increase their market share.

In April 2023, Linde Plc expanded the capacity of its on-site facility in Tangjeong, South Korea, to increase its supply of high-purity industrial gases to Samsung Display. Furthermore, Linde Plc was awarded a major contract for an LNG plant in Russia. The plant will liquefy natural gas coming from the nearby compressor station which is part of Gazprom's Nord Stream pipeline.

In November 2022, Nordsol collaborated on the first bio2shipping project for the production of bio-liquefied natural gas (bio-LNG) to support sustainable maritime transport.

In June 2022, BIOKRAFT INTERNATIONAL AB entered a long-term agreement with Alternoil GmbH for the delivery of bio-LNG to be included in the climate-neutral fuel distributed on the German transportation market.

Policies and Initiatives:

- Renewable Fuel Standards (RFS) and Renewable Energy Targets: Many countries and regions have implemented renewable fuel standards or set ambitious renewable energy targets. These policies require a certain percentage of transportation fuels to come from renewable sources, which includes bio-LNG. These standards and targets create a market demand for bio-LNG and provide incentives for its production and use.

- Tax Incentives and Subsidies: Governments in various countries have provided tax incentives and subsidies to support bio-LNG production and infrastructure development. These financial incentives help reduce the cost of producing and using bio-LNG, making it more economically competitive with conventional fossil fuels.

- Carbon Pricing and Emissions Reduction Initiatives: Carbon pricing mechanisms, such as carbon taxes or cap-and-trade programs, have been implemented in some regions. These policies put a price on carbon emissions, creating economic incentives for industries and consumers to switch to low-carbon alternatives such as bio-LNG.

- Green Public Procurement: Some governments have adopted green public procurement policies, which prioritize the purchase of renewable and sustainable products, including bio-LNG. These policies create a market for bio-LNG and encourage its adoption in public transportation and government fleets.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bio-LNG market scope from 2022 to 2032 to identify the prevailing bio-LNG market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bio-LNG market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bio-lng market trends, key players, market segments, application areas, and market growth strategies.

Bio-LNG Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.4 billion |

| Growth Rate | CAGR of 17.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 235 |

| By Source |

|

| By Application |

|

| By Region |

|

| Key Market Players | Linde Plc, Flogas Britain Ltd., Titan LNG, Nordsol, BoxLNG Pvt. Ltd., DBG Group B.V., BIOKRAFT INTERNATIONAL AB, TotalEnergies SE., EnviTec Biogas AG, Shell Plc. |

Analyst Review

According to the insights from the CXO’s, the bio-LNG market has grown at a higher pace, owing to growing awareness of climate change and the need to reduce greenhouse gas emissions. Diversifying the energy mix by incorporating bio-LNG can enhance energy security by reducing dependence on fossil fuel imports and mitigating supply chain vulnerabilities. Bio-LNG can be used in existing LNG infrastructure and natural gas vehicles, making it easier to integrate into the current energy system without requiring substantial changes. This leads to growth in the bio-LNG market growth. The market faces challenges from the unavailability of organic and household waste feedstocks, which vary geographically and seasonally, which further pose challenges in ensuring a stable and reliable supply. Moreover, the production and purification processes for bio-LNG can be energy-intensive and costly, which hampers the bio-LNG market growth.

However, bio-LNG can serve as a sustainable fuel for long-haul transportation, addressing emissions from the transport sector, which is a significant contributor to greenhouse gas emissions and thus, offers lucrative opportunities for the market growth

Environment concerns and renewable energy policies, energy security & waste management, and low emissions and compatibility with existing infrastructure are the upcoming trends of Bio-LNG Market in the world.

Automotive is the leading application of Bio-LNG Market.

The estimated industry size of the bio-LNG market in 2032 is $3.4 billion.

Europe is the largest regional market for Bio-LNG.

Linde plc, Nordsol, Flogas Britain Ltd., EnviTec Biogas AG, Biokraft International AB, Total Energies, Titan LNG, DBG Group B.V., BoxLNG Pvt. Ltd., and Shell Plc are the top companies to hold the market share in bio-LNG market.

Loading Table Of Content...

Loading Research Methodology...