Bio Plasticizers Market Size & Insights: 2032

The global bio plasticizers market size was valued at $1.4 billion in 2022, and is projected to reach $2.4 billion by 2032, growing at a CAGR of 5.5% from 2023 to 2032.

Report Key Highlighters:

- The bio plasticizers market is highly fragmented, with several players including Evonik Industries AG, Dow Chemical Company, Avient Corporation, Lanxess AG, MATRCA S.P.A., Vertellus, Emery Oleochemicals, Cargill, BASF SE, and DIC CORPORATION.

- More than 6,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study covers nearly 20 countries. The segment analysis of each country in terms of value and volume during the forecast period 2022-2032 is covered in the bio plasticizers market report.

- Production capacity of product segment for 2022 is also covered in the report.

Introduction

Bio plasticizer is a type of additive used in the production of plastics to improve their flexibility and durability. Unlike traditional plasticizers, which are often derived from petroleum-based sources, bio plasticizers are derived from renewable, bio-based feedstocks. They are considered more environmentally friendly and sustainable options for the plastic industry.

Surge in demand from automotive, construction, healthcare, and packaging industries are expected to drive bio plasticizers market growth during the forecast period.

Bio plasticizers find applications in a wide range of industries, including automotive, construction, healthcare, and packaging. Bio plasticizers are utilized in the automotive sector to enhance the flexibility and durability of various plastic components, such as PVC-based interiors, wiring insulation, and gaskets. They help improve the performance of automotive materials, making them more resistant to temperature fluctuations and mechanical stress. Besides, the automotive industry's growing emphasis on lightweight materials and sustainability aligns well with the use of bio plasticizers.

Moreover, in construction, bio plasticizers are added to concrete and mortar formulations to improve workability, reduce water content, and enhance the strength & durability of structures. They play a role in reducing the carbon footprint of construction materials by allowing more efficient cement production and reducing the need for water. Sustainable building practices boost the adoption of bio plasticizers in the construction industry.

Furthermore, bio plasticizers are used in medical-grade plastics and flexible PVC materials for medical devices, IV tubing, and pharmaceutical packaging. These materials require bio-compatible plasticizers to ensure safety and compatibility with healthcare applications. Bio plasticizers are favored over traditional plasticizers due to their lower risk of leaching harmful substances.

Furthermore, packaging materials, especially those used in food & beverage packaging, benefit from bio plasticizers as they are considered food-safe and environmentally friendly. Bio plasticizers are used to create flexible and rigid packaging materials that meet regulatory requirements for safety and sustainability. Consumer demand for eco-friendly packaging materials drives the use of bio plasticizers in this industry.

However, one of the significant challenges faced by the bio plasticizers market is the price competitiveness compared to traditional, petroleum-based plasticizers. The production processes for bio plasticizers are more complex and costlier compared to the production of conventional plasticizers, which are typically derived from readily available and inexpensive petroleum-based sources. Nevertheless, the rise in demand from packaging industry is anticipated to offer many opportunities for market growth in the coming years.

Segments Overview

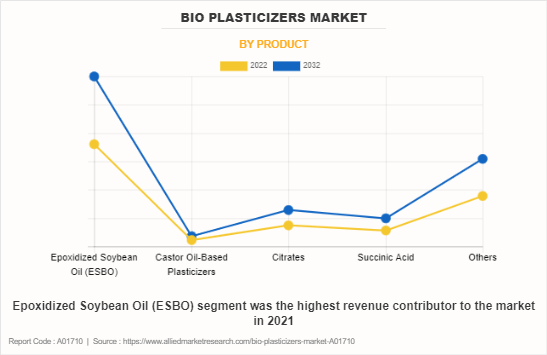

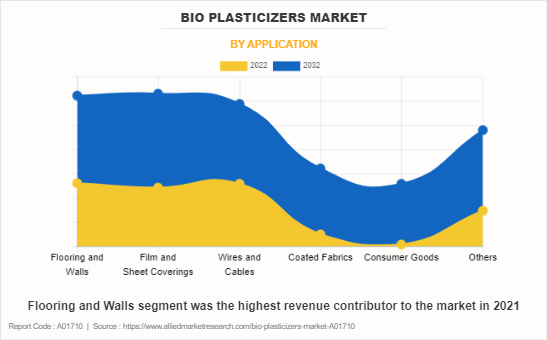

The bio plasticizers market is segmented on the basis of product, application, and region. By product, the market is categorized into epoxidized soybean oil (ESBO), castor oil-based plasticizers, citrates, succinic acid, and others. By application, the bio plasticizers market is classified into flooring & walls, film & sheet coverings, wires & cables, coated fabrics, consumer goods, and others. By region, the bio plasticizers market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Asia-Pacific dominated the market in 2021. The growing construction industry in the Asia-Pacific region is a significant driver for the bio plasticizers market. As the construction sector in this region experiences rapid growth and urbanization, there is an increasing demand for sustainable and eco-friendly construction materials. Bio plasticizers play a crucial role in meeting these demands by enhancing the properties of construction materials while reducing their environmental impact.

The Asia-Pacific region is witnessing a surge in sustainable construction practices and green building initiatives. Bio plasticizers are used in eco-friendly construction materials to meet sustainability goals and gain certifications like LEED (Leadership in Energy and Environmental Design).

Many countries in the Asia-Pacific region are implementing stricter environmental regulations related to construction materials and practices. Bio plasticizers, being derived from renewable sources, help construction companies comply with these regulations. Moreover, bio plasticizers are preferred over traditional plasticizers as they are biodegradable and less toxic. Their use helps reduce the environmental impact of construction materials and minimizes harm to ecosystems.

Further, bio plasticizers are used in the production of flexible PVC products widely used in construction, including vinyl flooring, wall coverings, and cables. The construction industry relies on these flexible materials for their versatility and durability.

Epoxidized Soybean Oil (ESBO) segment was the highest revenue contributor to the market in 2021. Epoxidized Soybean Oil (ESBO) is used in the production of food packaging materials, such as cling films and food wraps. Its food-safe nature and biodegradability make it a preferred choice in the food packaging industry. Besides, ESBO is utilized in medical-grade PVC materials for applications like IV tubing and pharmaceutical packaging, where safety and compatibility are critical.

Moreover, ESBO is employed in the manufacturing of toys and consumer goods, especially those intended for children, to replace traditional phthalate-based plasticizers. It is used in automotive applications to improve the flexibility and performance of PVC materials used in interiors.

Flooring and Walls segment was the highest revenue contributor to the market in 2021. Bio plasticizers are commonly used in the production of vinyl flooring, including luxury vinyl tiles (LVT) and vinyl composite tiles (VCT). They enhance the flexibility and workability of the vinyl composition, making it easier to install and more resistant to cracking and tearing. Moreover, bio plasticizers are used in vinyl sheet flooring to improve its flexibility, making it easier to lay flat and adhere to the subfloor.

In linoleum flooring, which is a natural and sustainable flooring option, bio plasticizers are used to adjust the properties of the linoleum composition. This helps achieve the desired flexibility, durability, and ease of installation. Besides, bio plasticizers are incorporated into wallpaper formulations to enhance their flexibility and ease of application. They help prevent the wallpaper from tearing up during installation.

Competitive Analysis

Key players in the bio plasticizers industry include Evonik Industries AG, Dow Chemical Company, Avient Corporation, Lanxess AG, MATRCA S.P.A., Vertellus, Emery Oleochemicals, Cargill, BASF SE, and DIC CORPORATION. Nowadays, the key manufacturers operating in the bio plasticizers market have adopted strategies such as product innovation, joint venture, expansion, partnership, agreement, investment, and collaboration to increase their market share.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bio plasticizers market analysis from 2022 to 2032 to identify the prevailing bio plasticizers market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bio plasticizers market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bio plasticizers market trends, key players, market segments, application areas, and market growth strategies.

Bio Plasticizers Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.4 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 311 |

| By Product |

|

| By Application |

|

| By Region |

|

| Key Market Players | Vertellus, Avient Corporation, LANXESS, Dow, BASF SE, Matrca S.p.A., Cargill, Incorporated., Evonik Industries AG, DIC CORPORATION, Emery Oleochemicals |

Analyst Review

According to the opinions of various CXOs of leading companies, the bio plasticizers market is expected to witness increased demand during the forecast period due to several drivers, such as increase in environmental awareness, regulatory restrictions on conventional plasticizers, and the demand for sustainable & eco-friendly products. Rise in concerns about plastic pollution and its impact on the environment have led to a shift toward more sustainable and biodegradable materials. Bio plasticizers, derived from renewable sources, are seen as an environmentally friendly alternative to conventional plasticizers.

Furthermore, regulatory bodies in various regions have imposed restrictions on the use of certain phthalate-based plasticizers due to their potential health and environmental risks. This has created a need for safer and more sustainable alternatives such as bio plasticizers. In addition, consumers have become significantly conscious of the environmental and health implications of the products they use. This has led to a rise in demand for products that are labeled as "green," "eco-friendly," or "bio-based," which includes products containing bio plasticizers.

The global bio plasticizers market was valued at $1.4 billion in 2022, and is projected to reach $2.4 billion by 2032, growing at a CAGR of 5.5% from 2023 to 2032.

Asia-Pacific is the largest regional market for Bio Plasticizers.

The top companies to hold the market share in Bio Plasticizers include Evonik Industries AG, Dow Chemical Company, Avient Corporation, Lanxess AG, MATRCA S.P.A., Vertellus, Emery Oleochemicals, Cargill, BASF SE, and DIC CORPORATION.

Surge in demand for bio plasticizers from various industries such as packaging, construction, healthcare, and automotive is a significant driver for the Bio Plasticizers Market.

Flooring and walls is the leading application of Bio Plasticizers Market.

Loading Table Of Content...

Loading Research Methodology...