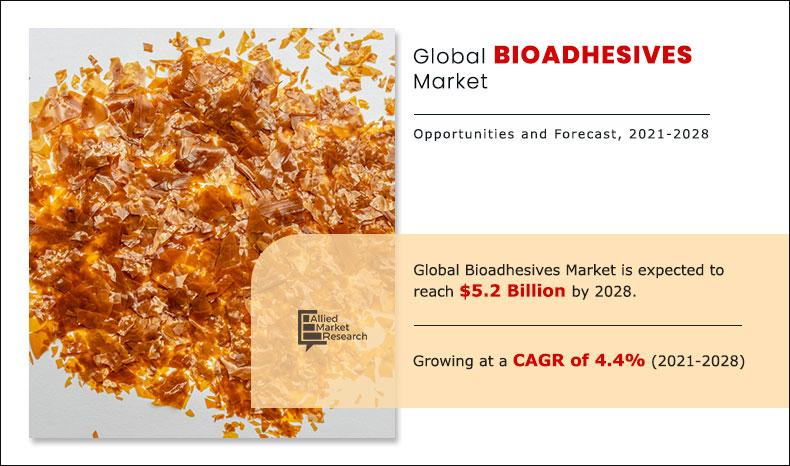

Bioadhesives Market Outlook - 2021–2028

The global bioadhesives market size was valued at $3.7 billion in 2020, and is projected to reach $5.2 billion by 2028, growing at a CAGR of 4.4% from 2021 to 2028.

Bioadhesives are naturally occurring polymeric materials with adhesive properties and the ability to bind to biological surfaces. Biological intermediates, such as starch, cellulose, or gelatin, are used to make this substance. Bioadhesives are becoming more common due to their environment-friendly nature, and are now favored over synthetic adhesives. These adhesives are used in a variety of end-use industries, including wood, packaging & paper, manufacturing, and medicine.

The global bioadhesives market is being driven by a diverse set of applications. Public understanding of the negative effects of synthetic materials as well as the preference for natural products has resulted in increased demand for bioadhesives. The bioadhesives market has grown significantly as a result of increased manufacturer investments in biotechnology and innovation as well as increased demand for bioadhesives in a variety of applications. Furthermore, government regulations aimed at protecting the environment and encouraging the use of bio-based products have aided the market expansion. As a result, manufacturers have begun to introduce innovative bioadhesive products to the market. Other factors driving the global bioadhesives market growth include increased end-use industry growth, rise in R&D, and increased investment. In addition, the International Market Analysis Research and Consulting (IMARC) Group expects the market to exhibit strong growth during the next five years.

The global bioadhesives market is segmented into type, application, and region. By type, the market is divided into plant based and animal based. On the basis of application, it is differentiated into paper & packaging, construction, woodworking, personal care, medical, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The major players operating in the global bioadhesives market include Adhesives Research, Inc., Arkema, Ashland Global Holdings Inc., Beardow Adams, Camurus, DuPont de Nemours, Inc., Henkel AG, Jowat SE, Paramelt BV, and U.S. Adhesives.

Bioadhesives Market, by Type

The plant based segment held a significant share in the bioadhesives market in 2020. During the forecast period, the plant-based sector is expected to account for the majority of the bioadhesives market share. For the production of adhesives, biodegradable and biological plant-based renewable resources are being used as a replacement for petro-based raw materials.

By Type

Plant Based is projected as the most lucrative segment.

Bioadhesives Market, by Application

The packaging and paper segment accounted for the largest share of the bioadhesives market in 2020. Packaging and paper was the leading application in the bioadhesives market. Bioadhesives are used in a variety of applications, including lamination of printed sheets, cigarettes and filters, flexible packaging, and specialty packaging.

By Application

Paper & Packaging is projected as the most lucrative segment.

Bioadhesives Market, by Region

The Europe region has witnessed rapid growth of the bioadhesives industry. The European market for bio-adhesives is expected to continue this trend in near future owing to strong demand from bio-medical applications.

By Region

Europe holds a dominant position in 2019 and would continue to maintain the lead over the forecast period.

Key Benefits For Stakeholders

- The report provides in-depth analysis of the global bioadhesives market along with the current trends and future estimations.

- This report highlights the key drivers, opportunities, and restraints of the market along with the impact analysis during the forecast period.

- Porter’s five forces analysis helps to analyze the potential of the buyers & suppliers and the competitive scenario of the global bioadhesives market for strategy building.

- A comprehensive market analysis covers the factors that drive and restrain the global bioadhesives market growth.

- The qualitative data about market dynamics, trends, and developments is provided in the report.

Impact Of Covid-19 On The Global Bioadhesives Market

- COVID-19 has spread to almost 213 countries around the globe with the World Health Organization declaring it a public health emergency on March 11th, 2020.

- Some of the major economies suffering the COVID-19 crises include Germany, France, Italy, Spain, the UK, and Norway.

- Bioadhesive is primarily used in paper & packaging, construction, woodworking, personal care, and medical sectors. Furthermore, due to the impact of national lockdown, these sectors were experiencing slight decline in the growth rate.

- In many countries, the economy has dropped due to the halt of several industries, especially transport and supply chain. Demand for the product has been hindered as there is no development due to the lockdown.

- The demand–supply gap, disruptions in raw material procurement, and price volatility are expected to hamper the growth of the chemical industry during the COVID-19 pandemic.

- According to economists, the Chinese economy is anticipated to be hit further by reduced global demand for its products due to the effect of the pandemic. As the coronavirus pandemic escalates, the growth rate falls sharply against the backdrop of volatile markets and growing credit stress.

- The economy of China has been hit far harder than projected, although a tentative stabilization has begun. In European countries and the U.S., increasing restrictions on travel & transportation and prolonged lockdown have reduced the product demand during the first quarter of 2020. However, the market is expected to recover by the end of 2021.

Key Market Segments

By Type

- Plant based

- Animal based

By Application

- Paper & Packaging

- Construction

- Woodworking

- Personal Care

- Medical

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- Spain

- Italy

- UK

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- South Africa

- Saudi Arabia

- Rest of LAMEA

Key Market Players

- Adhesives Research, Inc.

- Arkema

- Ashland Global Holdings Inc.

- Beardow Adams

- Camurus

- DuPont de Nemours, Inc.

- Henkel AG

- Jowat SE

- Paramelt BV

- U.S. Adhesives

Bioadhesives Market Report Highlights

| Aspects | Details |

| By TYPE |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | DUPONT, .ASHLAND GLOBAL HOLDINGS INC., Camurus, ARKEMA S.A., U.S. Adhesives, Jowat SE, Paramelt BV, Adhesives Research, Inc., Beardow Adams, HENKEL AG |

Analyst Review

The global bioadhesives market is moving toward the growth stabilization phase in its industry life cycle. The factors driving the growth of the bioadhesives market are surge in demand from paper & packaging, construction, woodworking, personal care, and medical sectors. During the forecast period, the plant-based segment is expected to account for the largest share of the bioadhesives market. Natural adhesives derived from organic sources, such as soy protein, starch (dextrin), and lignin, are known as plant-based adhesives. Green, renewable, natural, environment-friendly, and bio-based adhesives are the other terms used for them. Bioadhesives are used in a variety of industries, including woodworking, packaging, and construction.

During the forecast period, the medical segment is expected to be the fastest-growing application industry in the bioadhesives sector. Attributed to the growing population and increased understanding of the benefits of bio-based products, the demand for healthcare products and services has skyrocketed. These adhesives, for example, are used in healthcare product formulations for use in drug delivery systems, which enable drugs to be absorbed into biological elements such as body tissues. Bioadhesives may be used in biomedical applications that require skin or other body tissue. Therefore, the increasing use of bioadhesives in the medical segment is expected to drive the market growth over the next five years.

China, India, Japan, South Korea, Indonesia, Thailand, and the rest of Asia-Pacific are the countries that are in Asia-Pacific. The bioadhesives market in China is expanding rapidly as a result of increased exports of biodegradable products to North America, Europe, and other developed countries where consumer knowledge of sustainability is high and bioadhesives are in high demand. In addition, major regional companies have ramped up their production capacities of biodegradable adhesives, which is fueling the growth of bioadhesives manufacturing in China.

Growing demand for bio-adhesives from healthcare and personal care industries is expected to bolster the demand in near future.

The market value of bioadhesives in the forecast period is anticipated to be $5.2 Billion.

Major players in the market are Arkema, Ashland Global Holdings Inc., Beardow Adams, Camurus, DuPont de Nemours, Inc., and Henkel AG among others.

Paper & Packaging industry is projected to increase the demand for bioadhesives market

Europe region accounted for the largest bioadhesives market share

Growing demand for bio-adhesives across the globe due to increasing awareness about bio-based products is driving the market.

Medical application is expected to drive the adoption of bioadhesives

As the manufacturing units across the globe were shutdown due to the COVID-19 pandemic, the market has been impacted negatively.

Loading Table Of Content...