Global Bio-Alcohols Market Overview:

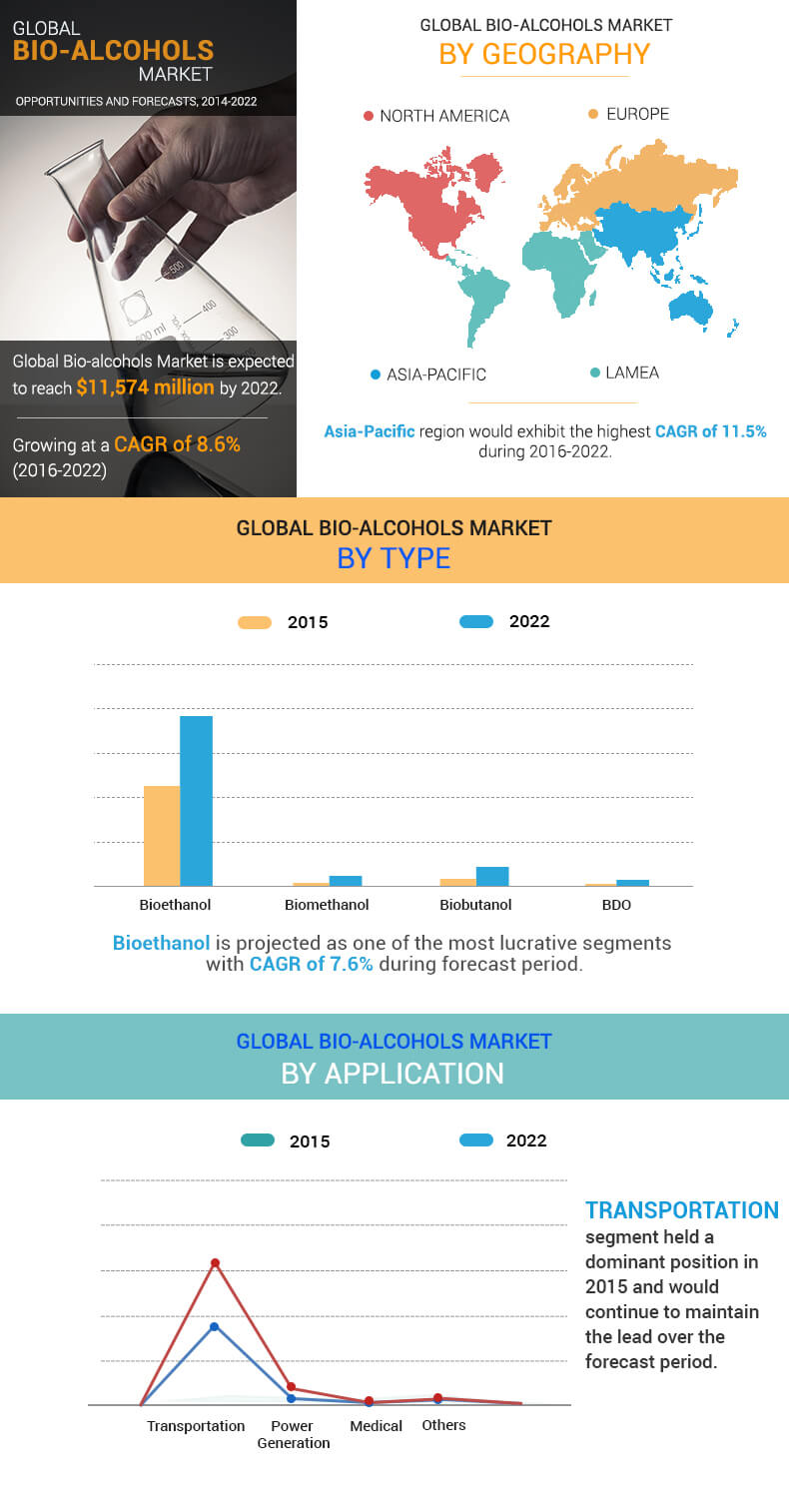

Bio-Alcohols market size was valued at $6,404 million in 2015, growing at a CAGR of 8.6% to reach $11,574 million by 2022. Bio-alcohols are preferred as automotive fuels to be utilized as additives or individually in engines. They can be used as a fuel additive in existing internal combustion engines without altering the distribution infrastructures. The current trend in bio-alcohols industry is the development of second generation biofuels that have the capability to interact with the existing engine infrastructure and are eco-friendly. Biocompatibility of these compounds has made it ideal for use in transportation and power generation applications.

Based on the type, the market is segmented into bioethanol, biomethanol, biobutanol, and BDO. On the basis of application, the market is categorized into transportation, power generation, medical, and others. By raw materials, the market is divided into grains, sugarcane, industrial beets, biowaste, and others.

Demand for long-term energy security, especially from the emerging countries, and the eco-friendly nature of bio-alcohols are the factors that drive the growth of the market. However, consumption of food grains as feedstock is anticipated to hamper the market growth in the coming years due to increase in population. The volatile prices of crude oil is a major trend expected to create opportunities for bio-alcohols market.

Bio-alcohols Market: Top Investment Pockets

The global bio-alcohols market is segmented based on type sector into bioethanol, biomethanol, biobutanol, and BDO. The following figure represents the market potential of different types of bio alcohols. It is evident from the figure that the biomethanol type is the top investment pocket for the market, owing to the growth in consumption and increase in production of biomethanol from waste or biomass. Biobutanol is projected to be the second lucrative segment, owing to adaptability of production process from bioethanol plants and compatibility with existing automotive engines. The biomethanol type is expected to grow at a CAGR of 16.2%, in revenue terms, during the forecast period.

Asia-Pacific Bio-alcohols Market Analysis

Growth in automotive industry, increase in energy demand, and stable economic growth fuel the rise of the bio-alcohols market in Asia-Pacific. Emerging markets such as China, Thailand, and India are expected to show the highest increase in demand for eco-friendly bio alcohols. Demand for biofuels is estimated to be high from developing economy of Asia-Pacific. India already has the infrastructure to produce over 4000 Million liters of bioethanol from molasses. Inadequate supply and lower purchase price of ethanol has been a constraint to successfully achieve blending targets.

Major companies in bio-alcohols industry have adopted agreement, product launches, and expansions to sustain the intense competition in this market. The key players profiled in the report include BASF SE, BioAmber Inc., BP Biofuels, Cargill Inc., Cool Planet Energy Systems Inc., Fulcrum BioEnergy Inc., Genomatica Inc., Harvest Power Inc., Mitsubishi Chemical Corporation, Myriant Corporation, Raizen S.A., and Valero Energy Corporation.

Others players (not profiled in the report) active in bio-alcohols industry value chain include, Mascoma LLC, SGBio, Abengoa S.A., Gevo Inc., Butamax Advanced Biofuels LLC, Red Rock BioFuels LLC, Ginkgo Bioworks, Maverick Biofuels Inc., Algenol Biofuels, and ZeaChem Inc.

KEY BENEFITS FOR STAKEHOLDERS:

- This report provides an extensive analysis of the current trends and emerging estimations & dynamics in the bio-alcohols industry.

- The bio-alcohols market forecast and in-depth analysis for key segments between 2014 and 2022 is provided.

- Competitive intelligence of leading manufacturers and distributors of bio-alcohols assists in understanding the competitive scenario across the geographies.

- Comprehensive analysis of factors that drive and restrain the growth of the global bio-alcohols market is provided.

- Extensive analysis of the bio-alcohols market is conducted by following key product positioning and monitoring the top competitors within the market framework.

- Key market players are profiled and their strategies are analyzed, which provide a competitive outlook of the market.

- Bio-alcohols market share by type, application, and raw material at all geographic levels are defined in this report

Bio-alcohols Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Row Material |

|

| By Geography |

|

| Key Market Players | COOL PLANET ENERGY SYSTEMS INC., E. I. DU PONT DE NEMOURS AND COMPANY, MITSUBISHI CHEMICAL CORP, GENOMATICA INC., BASF SE, CARGILL INC., RAIZEN S.A., BP BIOFUELS, BIOAMBER INC., MYRIANT CORPORATION |

Analyst Review

Transportation sector is the world's fastest growing energy user; all major countries have set biofuel quotas to reduce dependence on fossil fuels. For long term, biomethanol is a good alternative to bioethanol for replacing petrol in automotive engines. Biomethanol is produced without taking up the agricultural land, needed to feed the world's population. Countries looking for security of fuel supplies should regard biomethanol as a good contender for low-cost, sustainable fuel of the future. These strategies stretch beyond only the renewability aspect and emphasize a differentiated offer to satisfy varying functional and sustainability performance needs in different regions.

Geographically, the Asia-Pacific bio-alcohols market presents promising opportunities for biofuels as there exists a high rate of automotive ownership and demand, owing to the rise in disposable income demographic. The demand for BDO is also expected to rise in Europe, owing to the growth in demand for renewable plastic and fibers.

Loading Table Of Content...