Biocides Market Research, 2033

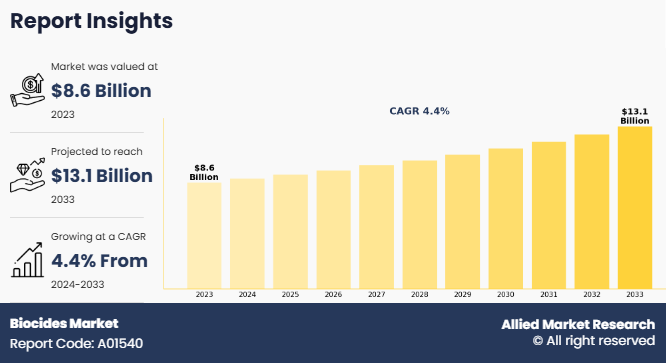

The global biocides market was valued at $8.6 billion in 2023, and is projected to reach $13.1 billion by 2033, growing at a CAGR of 4.4% from 2024 to 2033.

Introduction

Biocides are chemical substances or microorganisms intended to destroy, deter, or control harmful organisms through chemical or biological means. These organisms include bacteria, fungi, algae, viruses, and pests that threaten public health, industrial processes, or natural ecosystems. Biocides are commonly used in various industries such as water treatment, agriculture, healthcare, and manufacturing, to ensure hygiene, preserve materials, and prevent contamination or deterioration. Their application ranges from disinfectants and pesticides to preservatives in products such as paints, coatings, and textiles.

Key Takeaways

The global biocides market has been analyzed in terms of value ($Billion). The analysis in the report is provided on the basis of type, end-use industry, 4 major regions, and more than 15 countries.

The global biocides market report includes a detailed study covering underlying factors influencing industry opportunities and trends.

The biocides market is fragmented in nature with few players such as BASF SE, Clariant, Solvay S.A., Ecolab, LANXESS, THOR Group Limited, Stepan Company, Kemira, Arkema S.A., and Evonik Industries AG.

The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the biocides industry.

Countries such as China, the U.S., India, Germany, and Brazil hold a significant share in the global biocides market.

Market Dynamics

Increase in global demand for clean water and the growing emphasis on effective wastewater treatment drives the demand for biocides. As populations expand and urbanization accelerates, the need for safe and clean water supplies becomes more urgent, particularly in regions facing water scarcity. Biocides play a crucial role in water treatment by controlling microbial growth, preventing biofouling, and ensuring the safety of drinking water systems. They are widely used to disinfect water, remove harmful pathogens, and maintain the operational efficiency of water treatment plants. Moreover, stricter environmental regulations and sustainability goals have heightened the focus on wastewater treatment. All these factors drive the demand for the biocides market during the forecast period.

However, the development and registration of biocides involves significant costs due to rigorous testing and compliance requirements. These include extensive research to ensure efficacy, safety evaluations for human health and environmental impact, and adherence to regulatory standards in multiple regions. The need for long-term studies, specialized laboratory setups, and consultation with regulatory bodies further drives up expenses. In addition, the process of obtaining approvals is time-consuming, adding financial burdens for manufacturers before products enter the market. These high costs deter smaller companies from participating and lead to higher product prices for end-users. All these factors hamper the biocides market growth.

Moreover, innovations in eco-friendly and sustainable biocides create opportunities in the biocides market as industries and consumers increasingly prioritize environmental responsibility. Traditional biocides raise concerns about toxicity, persistence in the environment, and potential harm to non-target organisms. To address these issues, manufacturers are developing green biocide alternatives that deliver the desired antimicrobial performance while minimizing ecological and health risks. These innovations include biocides derived from natural sources such as plant-based extracts and enzymes, as well as biodegradable synthetic formulations designed to break down harmlessly in the environment. In addition, advancements in nanotechnology are enabling the creation of highly targeted biocides that require lower dosages, reducing their overall environmental footprint. Regulatory frameworks, such as the European Union’s Biocidal Products Regulation (BPR), are encouraging the adoption of sustainable solutions by setting strict criteria for environmental and human safety. All these factors are anticipated to offer new growth opportunities for the biocides market during the forecast period.

Segments Overview

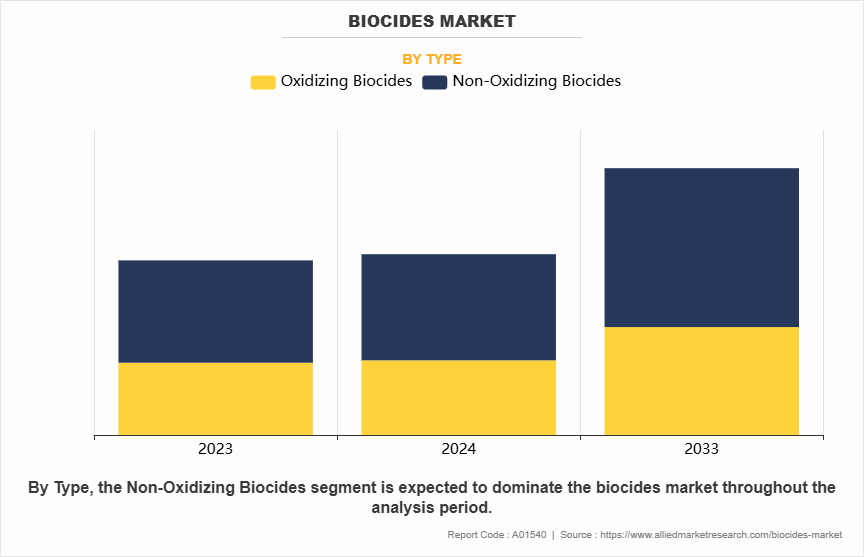

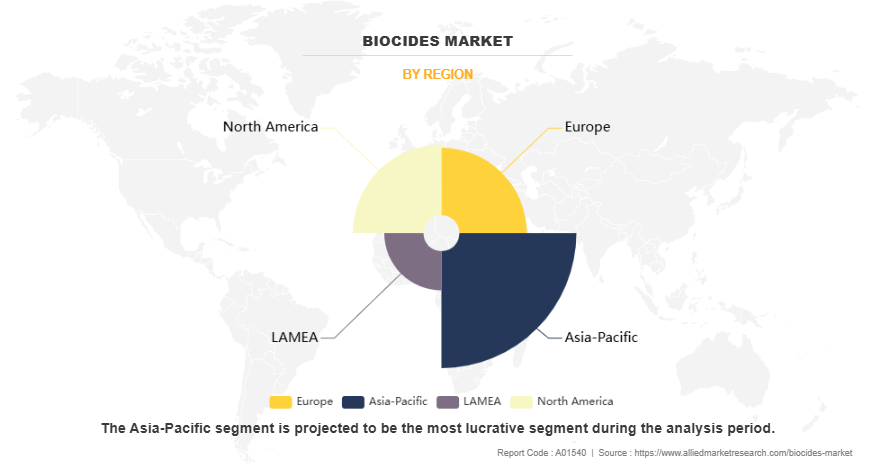

Biocides market is segmented on the basis of type, end-use industry, and region. On the basis of type, the market is bifurcated into oxidizing biocides and non-oxidizing biocides. As per end-use industry, the market is classified into personal care, food and beverage, home care, construction, agriculture, healthcare, water treatment, paints and coatings, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the market is bifurcated into oxidizing biocides and non-oxidizing biocides. The non-oxidizing biocides segment accounted for less than three-fifths of global biocides market share in 2023 and is expected to maintain its dominance during the forecast period. The versatility of non-oxidizing biocides in treating microbial contamination in environments with high organic loads enhances their demand. These biocides maintain efficacy even in challenging conditions, such as in the presence of slime or biofilms, where oxidizing agents might be less effective. This versatility, coupled with advancements in biocide formulations that improve performance and reduce toxicity, is driving their adoption across industries.

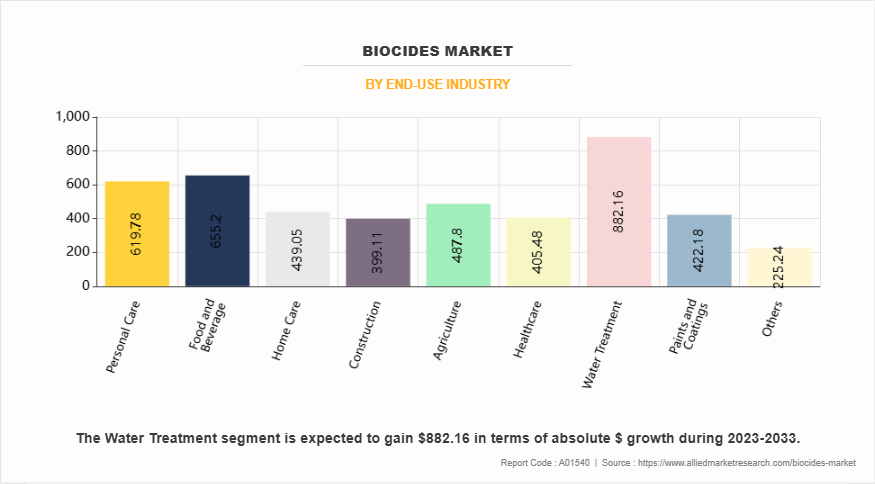

On the basis of end-use industry, the market is classified into personal care, food and beverage, home care, construction, agriculture, healthcare, water treatment, paints and coatings, and others. The water treatment segment accounted for one-fifth of global biocides market share in 2023 and is expected to maintain its dominance during the forecast period. The growing need for clean water, wastewater management, and the treatment of industrial effluents plays a crucial role in the demand for biocides in this segment. In addition, the rise in waterborne diseases and increasing awareness about sanitation further fuel the market for water treatment biocides, driving growth in this segment.

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific accounted for more than two-fifths of the global biocides market share in 2023 and is expected to maintain its dominance during the forecast period. The growing need for clean water, wastewater management, and the treatment of industrial effluents plays a crucial role in the demand for biocides in this segment. In addition, the rise in waterborne diseases and increasing awareness about sanitation further fuel the market for water treatment biocides, driving growth in this segment.

Competitive Analysis

Key players in the biocides market include BASF SE, Clariant, Solvay S.A., Ecolab, LANXESS, THOR Group Limited, Stepan Company, Kemira, Arkema S.A., and Evonik Industries AG.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the biocides market analysis from 2023 to 2033 to identify the prevailing biocides market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the biocides market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global biocides market trends, key players, market segments, application areas, and market growth strategies.

Biocides Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 13.1 billion |

| Growth Rate | CAGR of 4.4% |

| Forecast period | 2023 - 2033 |

| Report Pages | 350 |

| By Type |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Arkema S.A., LANXESS, Thor Group Limited, Evonik Industries AG, Solvay S.A., CLARIANT, Kemira, Ecolab, BASF SE, Stepan Company |

Analyst Review

According to the opinions of various CXOs of leading companies, the biocides market is expected to witness growth during the forecast period owing to increase in demand for clean water and wastewater treatment and stringent regulatory standards for hygiene and sanitation which have increased the demand for biocides. Global concerns over water scarcity and pollution prioritize the treatment of water to ensure it is safe for consumption and reuse. Biocides play a critical role in water treatment processes by eliminating harmful microorganisms, controlling biofilm formation, and preventing microbial-induced corrosion in pipelines and equipment. This makes them indispensable in ensuring the quality and safety of potable water and treated wastewater.

In addition to water treatment, strict hygiene and sanitation regulations across industries such as healthcare, food and beverage, and manufacturing have driven the need for effective biocides. Regulatory authorities worldwide have set stringent standards to prevent microbial contamination and safeguard public health. For instance, in healthcare settings, biocides are essential for sterilizing medical equipment, disinfecting surfaces, and controlling hospital-acquired infections (HAIs). Moreover, in food processing, biocides ensure compliance with food safety regulations by maintaining clean production environments and extending the shelf life of products.

Increase in demand for clean water and wastewater treatment, stringent regulatory standards for hygiene and sanitation are the upcoming trends of Biocides Market in the world.

Water Treatment is the leading application of Biocides Market.

Asia-Pacific is the largest regional market for Biocides.

$13.1 billion is the estimated industry size of Biocides by2033.

BASF SE, Clariant, Solvay S.A., Ecolab, LANXESS, THOR Group Limited, Stepan Company, Kemira, Arkema S.A., and Evonik Industries AG are the top companies to hold the market share in Biocides

Loading Table Of Content...

Loading Research Methodology...