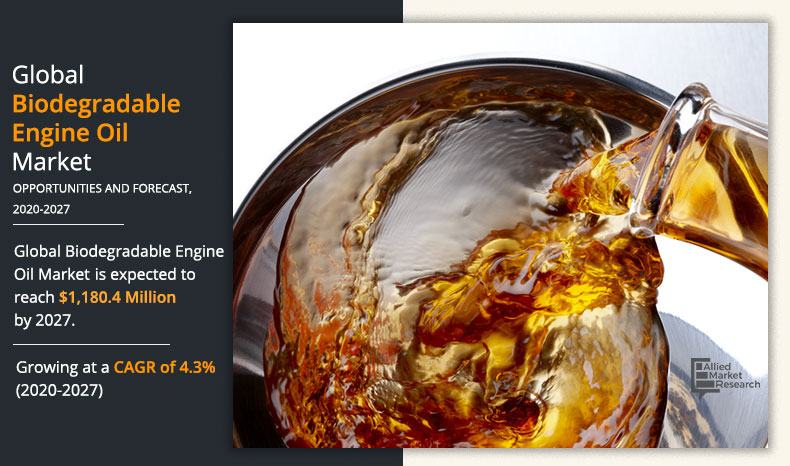

Biodegradable Engine Oil Market Overview - 2027

The global biodegradable engine oil market size was valued at $931.2 million in 2019, and is projected to reach $1,180.4 million by 2027, growing at a CAGR of 4.3% from 2020 to 2027. Biodegradable engine oils, also known as bio-lubricants and bio-lubes, are biodegradable and nontoxic lubricants. Organic lubricants are usually made by using raw materials such as rapeseed oil, sunflower oil, palm oil, coconut oil, and animal fats. In terms of non-toxicity, sustainability, carbon neutral, and environmentally safe, bio lubricants provide many advantages over conventionally used petroleum-based product offerings. Attributed to the high flash point and high stability, the use of bio-lubricants over traditional lubricants is comparatively better. Bio-lubricants are used for a variety of applications across diverse set of industries, including automotive, marine, construction, among others.

Rise in demand for sustainable and high-performance lubricants is expected to accelerate market growth along with increase in environmental concerns. In addition, with the growth of the construction sector in China, the demand for heavy machinery lubricants in the construction sector, such as wire rope lubricants for penetration and coating, diesel fuel, engine oil, bearing grease, and others, is expected to increase over the forecast period. Moreover, high cost and poor performance of biodegradable engine oil are the major factors that restrict the biodegradable engine oil market growth. Additionally, it is a very demanding job to convince small-scale farmers to use agricultural lubricants. Low capital is also an obstacle to the adoption of agricultural lubricants by small-scale farmers as they tend to stick to conventional cost-friendly methods.

The global biodegradable engine oil market is segmented on the basis of type, application, and region. By type, the market is classified into vegetable oils, polyalkylene glycols, synthetic esters, and others. According to application, it is divided into agriculture, transportation, construction, and others. Based on region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Type

Vegetable oils is projected as the most lucrative segment.

Global Biodegradable Engine Oil Market, by Type

By type, the vegetable oil segment garnered 54.6% share in 2019, in terms of revenue. Vegetable oils are increasingly being used for bio lubricant development due to their advantageous characteristics such as renewability, non-toxicity, economic & environmental friendliness, and others.

By Application

Transportation is projected as the most lucrative segment.

Global Biodegradable Engine Oil Market, by Application

By application, the use of biodegradable engine oil is expected to increase in the transportation sector in the near future. It consumes biodegradable engine oil on a large scale. Lubricants are utilized in heavy vehicles such as lorries, buses, agricultural machines, and marine transport.

By Region

Europe holds a dominant position in 2019 and would continue to maintain the lead over the forecast period.

Global Biodegradable Engine Oil Market, by Region

By region, Europe is expected to be the fastest-growing region in terms of revenue. Demand for biodegradable engine oil in Europe is strong in the UK, Spain, Italy, Germany and France, owing to the rapid growth in the industrial sector in those countries. The European Union stresses the protection of the environment and provides subsidies to biodegradable engine oil producers. In order to encourage the use of biodegradable engine oil, the Organization for Economic Co-operation & Development (OECD) has set such regulatory requirements.

Key benefits for stakeholders

- The report provides in-depth analysis of the biodegradable engine oil market along with the current and future market trends.

- This report highlights the key drivers, opportunities, and restraints of the market along with the impact analyses during the forecast period.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the global biodegradable engine oil industry for strategy building.

- A comprehensive biodegradable engine oil market analysis covers factors that drive and restrain the market growth.

- The qualitative data in this report focuses on market dynamics, trends, and developments.

Impact of COVID-19 on the global biodegradable engine oil market

- The world is battling the contagious COVID-19 pandemic, which has spread across the globe.

- Some of the major economies suffering the COVID-19 crises include Germany, France, Italy, Spain, the UK, and Norway.

- The outbreak has forced many industries to shut down due to lack of raw material availability and disruptions in the supply chain. The global lockdown has suspended the activities of construction and many other industries, which declined the demand for biodegradable engine oil.

- The demand-supply gap, disruptions in raw material procurement, price volatility, and many other factors are expected to hamper the growth of the chemical industry during the COVID-19 pandemic.

- Biodegradable engine oil is primarily used in manufacturing, transportation, construction, consumer goods, and others. As a reaction to the national lockdown, these sectors were experiencing sudden decline in growth rates.

- Less usage of machinery results in reduced demand for industrial lubricants from various end-use sectors. Subsequent downfall in the construction industry across various nations further hinders the market growth.

Biodegradable Engine Oil Market Report Highlights

| Aspects | Details |

| By Type |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | Renewable Lubricants, Royal Dutch Shell plc., FUCHS Group, Total SE, Condat, NANDAN PETROCHEM LTD, Repsol, Exxon Mobil Corporation, BP p.l.c, Croda International Plc. |

Analyst Review

The global biodegradable engine oil market is moving toward growth stabilization phase in its industry life cycle. Increase in demand from agriculture, transportation, construction, and others sectors drives the global biodegradable engine oil market. Earlier, the dominant raw material for lubricant production was vegetable oil due to its beneficial characteristics such as renewability, non-toxicity, and economic & environmental friendliness. Therefore, this oil is increasingly used for bio-lubricant processing. Additionally, the largest demand for biodegradable engine oil is from transportation. In emerging regions, such as India, China, South Africa, and Brazil, the expansion of the transport sector is also intended to drive the consumption of sustainable goods, thereby leading to higher fuel efficiency and lower carbon emissions from vehicles. In addition, Demand for biodegradable engine oil in Europe is strong in the United Kingdom, Spain, Italy, Germany and France, owing to the rapid growth in the industrial sector in those countries. The European Union stresses the protection of the environment and provides subsidies to biodegradable engine oil producers. In order to encourage the use of biodegradable engine oil, the Organization for Economic Co-operation & Development (OECD) has set such regulatory requirements.

Rise in demand for sustainable and high-performance lubricants is expected to accelerate market growth along with increase in environmental concerns

Transportation is the largest application in the global biodegradable engine oil.

To get latest version of biodegradable engine oil market report can be obtained on demand from the website.

Some of the drivers of the market are environmental regulations, increased production of vegetable oils, and emerging bio-lubricant applications

Croda International Plc., Exxon Mobil, FUCHS Group, Repsol, and Royal Dutch Shell are the top companies in the biodegradable engine oil industry.

The top ten market players are selected based on two key attributes - competitive strength and market positioning

Europe region is holding the highest share in this market.

Types sgment is the leading segment in the market

The market value of biodegradable engine oil in the forecast period is anticipated to be $ 1,180.4 million

The COVID-19 pandemic has impacted the biodegradable engine oil market in a negative way. Due to COVID-19 pandemic all the industries across the globe had shut down for a certain period of time (Feburary 2020-September2020 approx.) which has resulted in the non usage of machinery. Thus, the consumption of biodegradable engine oil has decreased in 2020.

Loading Table Of Content...