Biodegradable Plastics Market Outlook - 2033

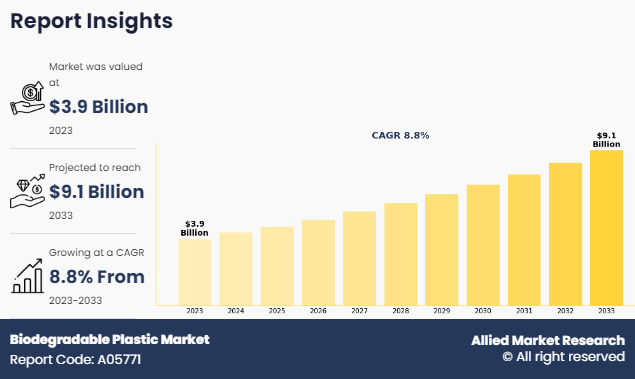

The global biodegradable plastics market size was valued at $3.9 billion in 2023, and is projected to reach $9.1 billion by 2033, growing at a CAGR of 8.8% from 2023 to 2033. Biodegradable plastic is a polymer that decomposes naturally in the environment through the action of microorganisms like bacteria and fungi. Unlike traditional plastics that persist for centuries, biodegradable plastics break down into non-toxic components, reducing environmental pollution. They can be derived from renewable resources like corn starch or synthesized through chemical processes. Examples include polylactic acid (PLA) and polyhydroxyalkanoates (PHA). While offering environmental benefits such as waste reduction and resource conservation, biodegradable plastics face challenges like limited performance and higher production costs. Nevertheless, ongoing research and regulatory support aim to enhance their effectiveness and promote their widespread adoption in various industries.

Introduction

Biodegradable plastics are a type of plastic material that can be broken down by microorganisms such as bacteria and fungi into natural elements like water, carbon dioxide, and biomass over time. Unlike conventional plastics, which can persist in the environment for hundreds of years, biodegradable plastics are designed to decompose more quickly under specific conditions, such as exposure to heat, moisture, and microbial activity. These plastics are often made from renewable raw materials like corn starch, sugarcane, or other plant-based substances, although some are derived from petrochemicals with additives that promote biodegradation. Biodegradable plastics are increasingly used as a sustainable alternative to traditional plastics in packaging, agriculture, and consumer products to help reduce environmental pollution and the burden on landfills.

Key Takeaways:

- The biodegradable plastics market report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The biodegradable plastics market is fragmented in nature among prominent companies such as BASF SE, NatureWorks, Total Corbion, Novamont, Biome Bioplastics, Mitsubishi Chemical Holding Corporation, Toray Industries, Plantic Technologies, Danimer Scientific, and Fkur Kunstsoff..

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), public policy analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions

- Latest trends in global biodegradable plastics market such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 3,000 biodegradable plastic-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global biodegradable market.

Market Dynamics:

At the forefront of the biodegradable plastics market is the growing awareness of environmental issues such as plastic pollution, oceanic debris, and landfill overflow. Conventional plastics, derived from non-renewable resources like petroleum, pose significant ecological threats due to their non-biodegradable nature. Biodegradable plastics offer a promising solution by breaking down into natural components, reducing their environmental footprint and alleviating pressure on ecosystems.

Furthermore, governments worldwide are implementing stringent regulations to mitigate plastic pollution and promote sustainable alternatives. Legislative measures such as bans on single-use plastics, extended producer responsibility (EPR) schemes, and mandates for eco-friendly packaging have incentivized the adoption of biodegradable plastics. These regulatory frameworks create a conducive environment for biodegradable plastics market growth by fostering innovation and driving investment in sustainable technologies.

Moreover, continuous research and development efforts have led to significant advancements in biodegradable plastic formulations, enhancing their performance, durability, and cost-effectiveness. Innovations in bio-based feedstocks, polymer chemistry, and manufacturing processes have expanded the applicability of biodegradable plastics across various industries, including packaging, agriculture, automotive, and textiles. Novel materials such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch-based polymers exhibit properties comparable to traditional plastics while offering superior environmental credentials.

Additionally, consumers are prioritizing sustainability and seeking eco-friendly alternatives to conventional products. Heightened awareness of plastic pollution, bolstered by media coverage and grassroots movements, has influenced purchasing behaviors and brand perceptions. As a result, businesses are under pressure to adopt sustainable practices throughout their supply chains, including the use of biodegradable packaging materials. Companies that adopt environmentally responsible strategies stand to gain a competitive edge and enhance their brand reputation among consumers.

However, biodegradable plastics encompass a diverse range of materials, including polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch-based polymers. While these materials are designed to degrade more readily than conventional plastics, their performance characteristics may not always meet the requirements of certain applications. For instance, biodegradable plastics often exhibit inferior mechanical properties, such as lower tensile strength and durability, compared to traditional plastics like polyethylene and polypropylene. This limits their suitability for demanding applications in industries such as automotive, construction, and electronics.

On the contrary, the packaging industry represents a significant opportunity for biodegradable plastics, driven by the need for sustainable packaging solutions and growth in the e-commerce sector. Biodegradable packaging materials, such as bioplastics derived from renewable sources like cornstarch, sugarcane, and cellulose, offer advantages such as reduced carbon footprint, recyclability, and compostability. Moreover, biodegradable packaging can cater to various applications, including food packaging, beverage containers, shopping bags, and electronic device packaging.

Segment Overview:

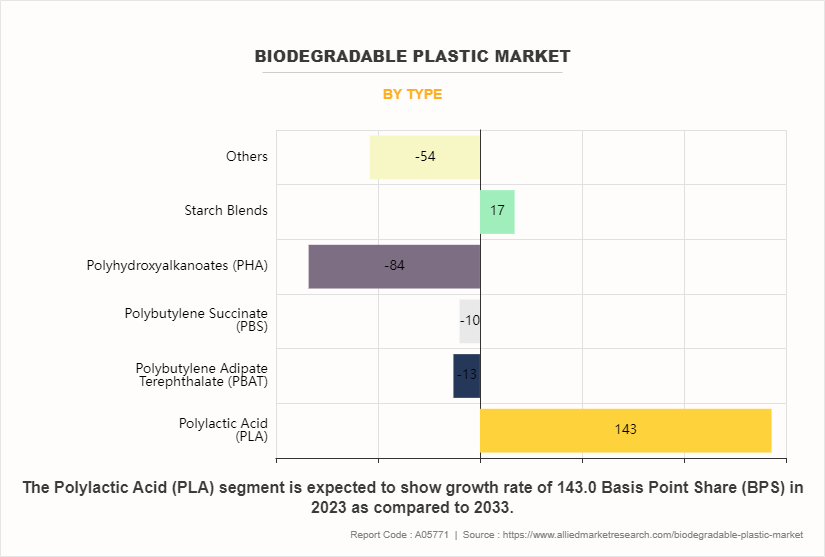

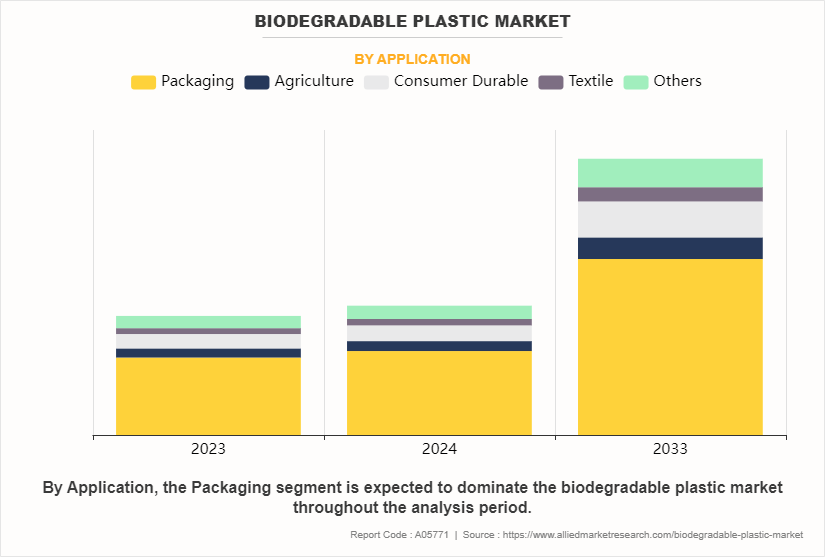

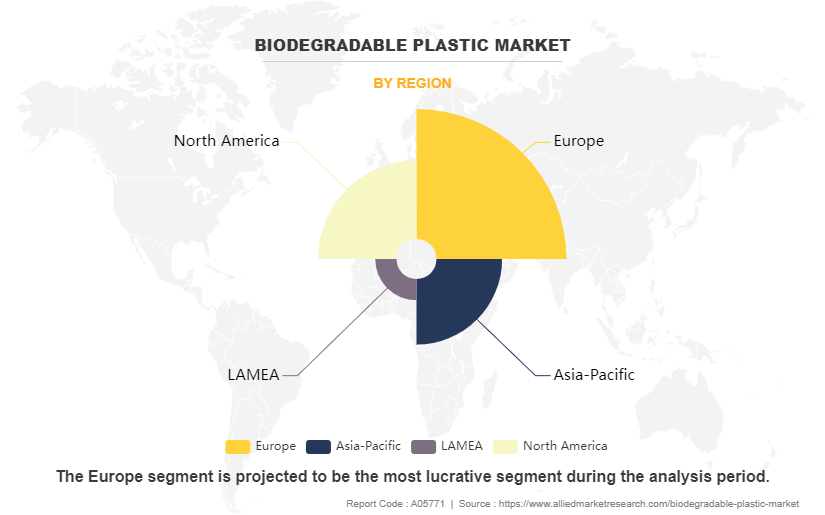

The biodegradable plastics market is segmented on the basis of type, application, and region. On the basis of type, the market is categorized into Polylactic Acid (PLA), Polybutylene Adipate Terephthalate (PBAT), Polybutylene Succinate (PBS), Polyhydroxyalkanoates (PHA), Starch Blends, and others. By application, the market is divided into packaging, Agriculture, Consumer Durable, textile, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Biodegradable Plastics Market By Type

In 2023, the polylactic acid segment was the largest revenue generator, and is anticipated to grow at a CAGR of 9.2% during the forecast period. With increasing awareness of environmental issues, consumers are actively seeking out eco-friendly products, including biodegradable plastics. PLA's biodegradability and renewable origins resonate with environmentally conscious consumers who are looking to reduce their ecological footprint. As a result, there is a growing market for PLA-based products, ranging from disposable cutlery and packaging to 3D printing filaments and textiles. Furthermore, technological advancements have improved the properties and performance of PLA, making it more competitive with traditional plastics in terms of durability, versatility, and cost-effectiveness. Innovations in polymer chemistry and processing techniques have led to the development of PLA formulations with enhanced strength, heat resistance, and processing characteristics, expanding its applicability in various industries.

Biodegradable Plastics Market By Application

By application, the packaging segment dominated the global market in 2023, and is anticipated to grow at a CAGR of 8.6% during forecast period. Governments around the world are implementing regulations to reduce plastic waste and promote sustainable packaging practices. This includes bans or restrictions on single-use plastics, mandates for recycling and composting, and incentives for the use of biodegradable materials. Regulatory pressures create a favorable market environment for biodegradable plastic packaging and drive demand from companies seeking compliance with regulations. Furthermore, many companies are setting ambitious sustainability targets and integrating environmental considerations into their packaging strategies. Switching to biodegradable plastics aligns with these corporate sustainability goals, allowing companies to reduce their carbon footprint, enhance their brand image, and meet the expectations of environmentally conscious consumers. As a result, there is growing demand from businesses across industries for biodegradable packaging solutions.

Biodegradable Plastics Market By Region

The Europe biodegradable plastics market size accounted for 44% share in 2023. European governments provide incentives and support for the development and adoption of biodegradable plastics through funding programs, grants, and tax incentives. These initiatives encourage research and innovation in bioplastic technologies, promote investment in biodegradable infrastructure, and facilitate the transition to a circular economy. Government support plays a significant role in driving the growth of the biodegradable plastics industry in Europe. Furthermore, European businesses are increasingly integrating sustainability into their corporate strategies and supply chains. Many companies are setting ambitious sustainability targets, including goals to reduce plastic waste and transition to biodegradable or compostable packaging materials. These corporate commitments create demand for biodegradable plastics as companies seek to align with consumer preferences, reduce their environmental footprint, and enhance their brand reputation.

Competitive Analysis:

The global biodegradable plastics market profiles leading players that include BASF SE, NatureWorks, Total Corbion, Novamont, Biome Bioplastics, Mitsubishi Chemical Holding Corporation, Toray Industries, Plantic Technologies, Danimer Scientific, and Fkur Kunstsoff. The global biodegradable plastics market report provides in-depth competitive analysis as well as profiles of these major players.

Recent Key Developments:

- In November 2023, Mitsubishi Chemical Holding Corporation developed plant-derived compostable biodegradable plastic named as BioPBS. This strategic product launch may surge the demand for biodegradable plastic among marine sector.

- In October 2023, Versalis, a leading Italian chemical manufacturing company has acquired Novamont's biodegradable plastic business. This strategic acquisition may enhance the product offering of Versalis for biodegradable plastics.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the biodegradable plastics market analysis from 2023 to 2033 to identify the prevailing biodegradable plastics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the biodegradable plastics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global biodegradable plastics market trends, key players, market segments, application areas, and market growth strategies.

Key Developments

In August 2024, Lidl Switzerland launched a major initiative to reduce plastic consumption by introducing innovative, eco-friendly packaging in collaboration with Hardegger Käse AG. The new packaging, made from cellulose derived from leftover wood sourced from FSC-certified forestry, is free from crude oil-based materials. It is now being used for the retailer’s organic Alpstein and Usserrhödler mountain cheeses. This cellulose-based film not only maintains optimal product safety and taste but also marks a significant shift away from traditional plastic packaging.

In February 2024, the VTT Technical Research Centre of Finland announced breakthrough findings on the performance capabilities of its highly extensible and formable cellulose-based webs. These materials are now being explored as viable alternatives to rigid plastic packaging, enabling the development of sustainable, three-dimensional, cardboard-like packaging solutions. This advancement opens new possibilities for brand owners to meet growing consumer demand for environmentally responsible packaging options.

Biodegradable Plastics Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 9.1 billion |

| Growth Rate | CAGR of 8.8% |

| Forecast period | 2023 - 2033 |

| Report Pages | 349 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | DaniMer Scientific, LLC, Mitsubishi Chemical Holding Corporation, Novamont, BASF SE, Total Corbion, TORAY INDUSTRIES, INC., Plantic Technologies Ltd., NatureWorks LLC., Fkur Kunstsoff, Biome Bioplastics |

Analyst Review

According to the CXOs of leading companies, the biodegradable plastic market is experiencing robust growth driven by several factors. Increasing environmental awareness and concerns over plastic pollution have prompted governments, businesses, and consumers to seek sustainable alternatives to conventional plastics. Regulatory initiatives aimed at reducing plastic waste, such as bans on single-use plastics and mandates for compostable packaging, are driving the adoption of biodegradable plastics.

Consumer preferences are also shifting towards eco-friendly products, leading to greater demand for biodegradable packaging in various industries, including food and beverage, cosmetics, and healthcare. Companies are responding to this demand by investing in research and development to improve the performance and cost-effectiveness of biodegradable plastics, expanding their application potential.

Moreover, technological advancements in biopolymer production and processing techniques are making biodegradable plastics more competitive with traditional plastics in terms of performance, scalability, and cost. Innovations such as bio-based feedstocks, enzymatic degradation processes, and biodegradable additives are enhancing the sustainability and functionality of biodegradable plastics, further driving market growth.

Overall, the convergence of environmental concerns, regulatory pressures, consumer preferences, and technological innovations is fueling the expansion of the biodegradable plastics market. As sustainability becomes increasingly integral to business strategies and consumer choices, biodegradable plastics are poised to play a significant role in shaping the future of the plastics industry. However, continued collaboration among stakeholders, along with ongoing research and development efforts, will be crucial for realizing the full potential of biodegradable plastics in mitigating plastic pollution and advancing towards a more sustainable future.

Rise in environmental concerns, growing regulatory pressures, corporate sustainability initiatives, and technological advancements are the upcoming trends of Biodegradable Plastic Market in the world

Packaging is the leading application of Biodegradable Plastic Market

Europe is the largest regional market for Biodegradable Plastic

The global biodegradable plastics market was valued at $3.9 billion in 2023, and is estimated to reach $9.1 billion by 2033, growing at a CAGR of 8.8% from 2023 to 2033.

BASF SE, NatureWorks, Total Corbion, Novamont, Biome Bioplastics, Mitsubishi Chemical Holding Corporation, Toray Industries, Plantic Technologies, Danimer Scientific, and Fkur Kunstsoff are the top companies to hold the market share in Biodegradable Plastic

Loading Table Of Content...

Loading Research Methodology...