Bioenergy Market Outlook - 2030

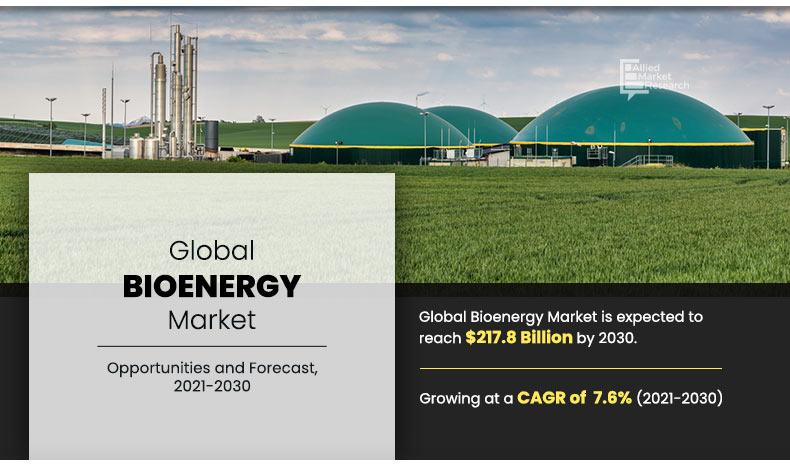

The global bioenergy market size was valued at $102.5 billion in 2020, and is expected to reach $217.8 billion by 2030, registering a CAGR of 7.6% from 2021 to 2030. Energy generated using bio-based renewable sources such as biofuel, biogas, biomass, and other bio-organic waste is known as bioenergy. Bioenergy is a promising source of renewable energy in achieving global climate change targets and wider environmental, socioeconomic, & sustainable targets. Feedstock used in producing bioenergy includes agricultural waste, solid waste, liquid biofuels, and others. Bioenergy possesses various key advantages such as reducing landfills, energy reliability & security, cost saving, biodegradability, better air quality, and others.

Growth of the global bioenergy market is driven by rise in demand for energy generated by using bio-based fuels from heat & power generation and transportation applications. In addition, implementation of stringent government regulations toward environmental pollution from carbon emitting fossil fuels in the transportation industry is anticipated to fuel growth of the market from 2021 to 2030. On the contrary, rapid transition from coal & other conventional power generation to renewable energy generation and rise in use of biofuels in vehicles are anticipated to provide lucrative growth opportunities for key players to maintain the position in the market in the upcoming years.

The global bioenergy market is segmented into product type, feedstock, application, and region. Depending on product type, the market is divided into solid biomass, liquid biofuel, biogas, and others. On the basis of feedstock, it is categorized into agricultural waste, wood waste, solid waste, and others. As per application, it is classified into power generation, heat generation, transportation, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The global market covers in-depth information of the major bioenergy industry participants. Some of the major players in the market include EnviTec Biogas AG, Babcock & Wilcox, Orsted A/S, Fortum Oyj, Hitachi Zosen Corporation, Pacific Bioenergy Corp, Royal Dutch Shell Plc, BP Plc, Enerkem, and MVV Energie AG.

Other players operating in the value chain of the global bioenergy market are POET, ADM, Ameresco, inc., Biomass Engineering Limited, A2A SPA, Drax Group, Enexor Energy, Green Plains, Inc., and others.

The key players are adopting numerous strategies such as investment, agreement, partnership, acquisition, collaboration, and business expansion, to stay competitive in the market.

For instance, in June 2021, EnviTec Biogas AG signed an agreement with Liquind 24/7 GmbH. This agreement aimed at transport & distribution of bio-LNG produced by EnviTec Biogas AG at Gustrow to heavy-duty customers at its truck fueling stations in Germany.

The bioenergy market is analyzed and estimated in accordance with the impacts of the drivers, restraints, and opportunities. The period studied in this report is 2021–2030. The report includes study of the market with respect to growth prospects and restraints based on regional analysis. The study includes Porter’s five forces analysis of the industry to determine impact of suppliers, competitors, new entrants, substitutes, and buyers on the market growth.

Bioenergy market, by product type

By product type, the liquid biofuel segment held the largest bioenergy market share in 2020. This is attributed to rise in demand for liquid biofuels from transportation applications such as passenger vehicles, trucks, ships, and airplanes. In addition, increase in demand for liquid biofuels from power generation applications in building & construction, residential, and other commercial applications is further anticipated to drive the market growth in the coming years.

By Product Type

Liquid Biofuel segment is projected as the most lucrative segment.

Bioenergy market, by feedstock

On the basis of feedstock, the solid waste segment dominated the global market in 2020, in terms of share, owing to rise in solid waste generation from residential, commercial, and industrial sectors, which can be increasingly used in bioenergy generation. In addition, rise in demand for sustainable electricity, transportation fuels, heat generation, and other purposes is expected to fuel growth of the market for solid waste during the analyzed time frame.

By Feedstock

Solid Waste is projected as the most lucrative segment.

Bioenergy market, by application

By application, the transportation segment garnered highest market share in 2020. This is attributed to stringent government regulations toward carbon emissions from conventional fuel sources such as diesel, kerosene, petrol, and others in transportation applications. In addition, rapid growth of the transportation sector across the globe is expected to fuel growth of the global market from 2021 to 2030.

By Application

Transportation is projected as the most lucrative segment.

Bioenergy market, by region

Europe garnered highest share in the bioenergy market in 2020, in terms of revenue, and is anticipated to maintain its dominance throughout the forecast period. This is attributed to presence of key players and huge consumer base in the region. In addition, increase in investments and R&D toward bioenergy to achieve future renewable energy targets by European Union member states is expected to augment growth of the Europe market during the forecast period.

By Region

Europe holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

COVID-19 impact on the market

Lockdowns imposed due to the outbreak of COVID-19 pandemic resulted in temporary ban on import & export and manufacturing & processing activities across various industries, which decreased demand for bioenergy and related products from these consumers. This resulted in decline in market growth in the second, third, and fourth quarters of 2020. However, the bioenergy market is expected to recover by the second quarter of 2021 as COVID-19 vaccination has started in various economies across the globe, which is expected to improve the global economy.

Key Benefits For Stakeholders

- The report provides an extensive qualitative and quantitative analysis of the current bioenergy market trends and future estimations of the global market from 2021 to 2030 to determine the prevailing opportunities.

- A comprehensive bioenergy market analysis of the factors that drive and restrict the market growth is provided.

- Estimations and bioenergy market forecast are based on factors impacting the market growth, in terms of value.

- Profiles of leading players operating in the global market are provided to understand the global competitive scenario.

- The report provides extensive qualitative insights on the significant segments and regions exhibiting favorable bioenergy market growth.

Key Market Segments

By product type

- Solid Biomass

- Liquid Biofuel

- Biogas

- Others

By feedstock

- Agricultural Waste

- Wood Waste

- Solid Waste

- Others

By application

- Power Generation

- Heat Generation

- Transportation

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Spain

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest of LAMEA

Bioenergy Market Report Highlights

| Aspects | Details |

| By PRODUCT TYPE |

|

| By FEEDSTOCK |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | .ENVITECH BIOGAS AG, ORSTED A/S, PACIFIC BIOENERGY, POET, LLC, BP PLC, Royal Dutch Shell Plc, .BABCOCK & WILCOX ENTERPRISES, INC., ADM, HITACHI ZOSEN CORPORATION, FORTUM |

Analyst Review

Rapid industrialization and urbanization are the key factors responsible for the leading position of Europe and Asia-Pacific in the global bioenergy market. Europe is further expected to provide lucrative opportunities to leading bioenergy manufacturers, owing to its huge potential to set up manufacturing plants, surge in demand for sustainable energy generation, and renewable energy targets by the European Union member states.

Increase in demand for heat & power generation is the key factor that drives growth of the global bioenergy market during the forecast period. In addition, implementation of stringent government regulations toward environmental pollution, owing to use of gasoline, diesel, or kerosene is expected to fuel growth of the market during the analyzed time frame. However, high initial investments and rapid growth of electric vehicle industry are the key factors expected to hamper the market growth during the forecast period. On the contrary, rapid growth of renewable energy industry and rise in use of biofuels in vehicles are anticipated to provide remunerative opportunity for key players to maintain the pace of the bioenergy market in the upcoming years.

Among the analyzed regions, Europe is expected to account for the highest revenue in the market by the end of 2030, followed by Asia-Pacific, North America, and LAMEA.

Favorable government policies encouraging cleaner and greener sources of energy is expected to be the key trend in the bioenergy market.

The potential customers of the bioenergy market are transportation, industrial, buildings, power utilities and others.

To get latest version of bioenergy market report can be obtained on demand from the website.

On the basis of product type, liquid biofuel segment will drive the bioenergy market growth during the forecast period. On the basis of feedstock, solid waste segment will drive the growth of the bioenergy market. By application, transportation will fuel the growth of the market.

The key growth strategies adopted by bioenergy market players are investment, agreement, partnership, acquisition, collaboration, and business expansion.

The top ten market players are selected based on two key attributes - competitive strength and market positioning

Top players in the bioenergy market are EnviTec Biogas AG, Babcock & Wilcox, Orsted A/S, Fortum Oyj, Hitachi Zosen Corporation, Pacific Bioenergy Corp, Royal Dutch Shell Plc, BP Plc, Enerkem, and MVV Energie AG.

In terms of revenue, the market size of bioenergy market is anticipated to reach $217.8 billion by 2030, growing at CAGR of 7.6% from 2021 to 2030.

Increase in concern towards reducing carbon emissions, rise in demand for electricity generation and production of renewable bi-products are key factors drives the bioenergy market growth during the forecast period.

Europe will provide business opportunities for bioenergy market during the forecast period. This is attributed to the huge consumer base in the region. In addition, In addition, increase in investment and R&D towards bioenergy in order to achieve future renewable energy targets by European Union member states, which, in turn, is expected to augment the growth of the Europe bioenergy market during the forecast period.

Loading Table Of Content...