Biomass Boiler Market Research, 2032

The global biomass boiler market was valued at $5.5 billion in 2022, and is projected to reach $22.8 billion by 2032, growing at a CAGR of 15.4% from 2023 to 2032.

A biomass boiler is a type of boiler that utilizes organic materials derived from plants or animal waste as its fuel source. These organic materials are known as biomass include wood, agricultural residues, energy crops, and other biological materials. When biomass is burned in a biomass boiler, it undergoes a combustion process that releases heat energy, which is used to generate steam or hot water for heating purposes or to produce electricity.

Biomass boilers are available in various sizes and designs, ranging from small residential units to large industrial installations. They are often used in applications such as district heating systems, industrial processes, and residential heating, providing a greener and sustainable alternative to traditional fossil fuel-based boilers. Biomass boilers play a crucial role in addressing various environmental and energy challenges. It offers a sustainable and renewable solution for heat and power generation.

These boilers utilize organic materials derived from plant and animal waste, forestry residues, and dedicated energy crops which makes them an eco-friendly alternative to fossil fuels. Decarbonization involves moving away from carbon-intensive energy sources to cleaner alternatives. Biomass boilers use organic materials as fuel which emit CO2 during combustion; however, the carbon is offset by new biomass growth which makes it carbon-neutral or low-carbon.

Replacing fossil fuel-based heating with biomass boilers significantly reduces emissions, supporting decarbonization efforts. Bioenergy including biomass, is crucial in achieving climate goals, with its contribution to energy demand expected to triple by 2030. Government policies and international agreements like the Paris Agreement drive decarbonization by promoting renewable energy adoption and phasing out fossil fuel infrastructure, fueling the demand for biomass boilers.

However, biomass boilers are combustion systems that emit pollutants and create ash deposition. Concerns about air quality due to the emission of particulate matter, nitrogen oxides (NO), carbon monoxide (CO), and volatile organic compounds (VOCs) raise challenges for biomass boiler installations, especially in densely populated areas. Local regulations and community acceptance play a vital role in their deployment. Managing and disposing of ash in biomass boilers require proper practices to maintain efficiency and reduce maintenance requirements. Regulatory requirements for ash disposal impact operational costs and logistics. These challenges may lead consumers to choose alternative heating options and hamper the growth of the biomass boiler market.

Government incentives such as feed-in tariffs, renewable heat incentives, tax breaks, and grants, play a vital role in making biomass boilers financially viable. These incentives offset initial investment costs, shorten payback periods, and improve returns on investment making biomass boilers affordable compared to traditional fossil fuel-based heating systems. In addition, favorable government policies, including renewable energy targets, portfolio standards, and certificate systems create a conducive market environment for biomass boilers driving the demand, and benefiting biomass fuel suppliers, equipment manufacturers, and service providers. Renewable energy targets and obligations further promote the adoption of biomass boilers. All these factors are anticipated to offer new growth opportunities for biomass boilers during the forecast period.

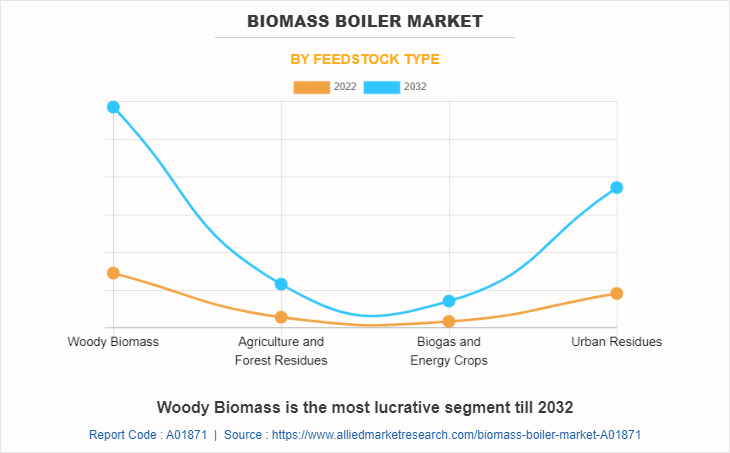

The biomass boiler market is segmented on the basis of feedstock, end user, and region. By feedstock, the market is segmented into woody biomass, agricultural & forest residue, urban residue, and biogas & energy crops.

The woody biomass segment accounted for more than half of biomass boiler market share in 2022 and is expected to maintain its dominance during the forecast period. Governments and organizations globally are prioritizing renewable energy goals, with woody biomass boilers playing a key role. The demand for woody biomass has risen as it offers a sustainable alternative to fossil fuels in the fight against climate change and reducing carbon emissions. Woody biomass, being carbon-neutral which help to reduce the carbon footprint. Biomass boilers efficiently use forestry residues and wood waste, contributing to waste management and a circular economy by converting biomass into valuable energy. Moreover, biomass combustion emits lower greenhouse gases and air pollutants compared to fossil fuels. All these factors create new growth opportunities for woody biomass feedstock type biomass boiler market forecast in coming years.

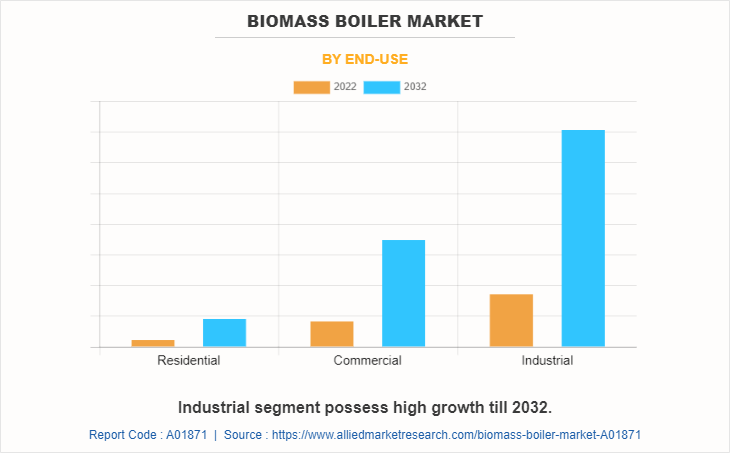

By end user, the market is divided into residential, commercial, and industrial. Industrial segment accounted for more than three-fifths biomass boiler market share in 2022 and is expected to maintain its dominance during the forecast period. Industrial facilities worldwide are embracing decarbonization goals to reduce greenhouse gas emissions, and biomass boilers are gaining popularity as a greener energy source.

These boilers utilize organic waste materials as fuel, aligning with circular economy principles. The industrial sector's demand for biomass boilers is rising due to their lower carbon footprint and competitive pricing with wood chips and pellets. This presents an opportunity for cost-effective and stable energy management amid fluctuating energy prices.

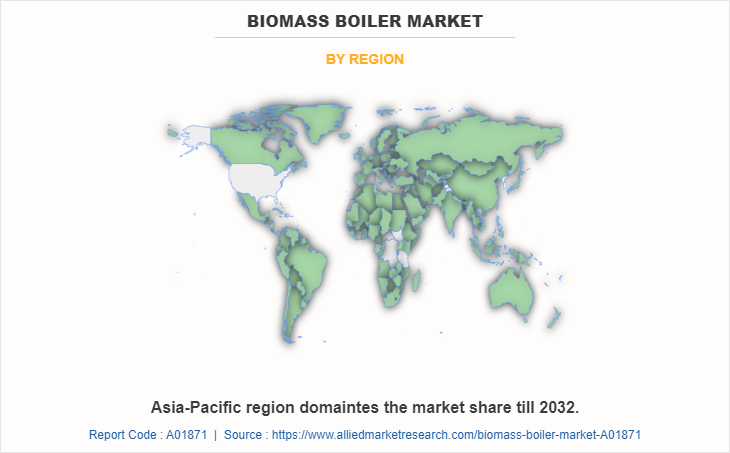

By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. On the basis of region, Asia-Pacific accounted for more than half biomass boiler market share in 2022 and is expected to maintain its dominance during the forecast period. The Asia-Pacific region is experiencing a notable rise in the adoption of renewable energy technologies, specifically biomass boilers. Countries in the region recognize the importance of transitioning to cleaner and sustainable energy sources, given their abundant biomass resources like agricultural residues, wood waste, and energy crops. India has significant biomass availability, driving the demand for biomass boilers. Additionally, deploying these boilers in rural areas improves energy access, enhances quality of life, and integrates waste management practices to reduce disposal issues.

Key players in the biomass boiler industry include Viessmann Group, ETA Heiztechnik GmbH, HARGASSNER GesmbH, Guntamatic Heiztechnik GmbH, Fröling Heizkessel- und Behälterbau Ges.m.b.H., Woodco, Thermax Limited., Forbes Marshall, Hurst Boiler & Welding Co, Inc., and HDG Bavaria GmbH.

Apart from these major players, there are other key players in the biomass boiler market. These include WDS GREEN ENERGY LTD, Babcock & Wilcox, Innasol, Eco-Vision, BAXI, AMP Clean Energy, DP clean tech, Siemens energy global, Power Technology, Polytechnik Biomass Energy GmbH, GETABEK, Uniconfort srl, KMW Energy Inc., Schmid AG Energy Solutions, Gilles Energie- und Umwelttechnik GmbH & Co. KG, Justsen Energiteknik A/S, Lindner & Sommerauer GmbH, Weiss A/S, Janfire AB, and BINDER Energietechnik GmbH.

Historical Trends Of Biomass Boiler:

- In the early 1970s, the concept of biomass energy gained attention as industries and researchers recognized the value of utilizing organic materials such as wood, agricultural residues, and other organic waste, as a renewable and sustainable source of energy. Initial efforts focused on small-scale applications in rural areas and for heating purposes.

- During the 1980s, advancements were observed in biomass boiler technologies, with improved combustion efficiency and better control systems. These advancements increased the use of biomass boilers to larger-scale applications, such as district heating systems and industrial processes.

- In the 1990s, biomass energy and biomass boilers gained momentum as a viable solution for addressing environmental concerns related to fossil fuels and greenhouse gas emissions. Many countries and regions started implementing policies and incentives to promote biomass energy production and utilization.

- The early 2000s marked a significant expansion of biomass energy production, driven by increasing concerns about climate change and the need for more sustainable energy sources. Technological innovations, such as improved gasification and co-firing technologies, enhanced the efficiency and versatility of biomass boilers.

- By the 2010s, biomass boilers were integrated into energy production and renewable energy strategies. Stricter environmental regulations and growing awareness of the importance of renewable energy sources further boosted the adoption of biomass boilers in various sectors, including power generation and heating.

- In the 2020s, there was an observed increase in the trend of using biomass boilers. Surge in concerns about climate change and the transition to a low-carbon economy have accelerated the deployment of biomass energy technologies. In addition, research and development efforts have led to more advanced biomass conversion processes and the utilization of a wider range of biomass feedstock.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current biomass boiler market trends, estimations, and dynamics of the biomass boiler market analysis from 2022 to 2032 to identify the prevailing biomass boiler market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the biomass boiler market size, segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global trends, key players, market segments, application areas, and biomass boiler market growth strategies.

Biomass Boiler Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 22.8 billion |

| Growth Rate | CAGR of 15.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 209 |

| By Feedstock Type |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | ETA Heiztechnik GmbH, Guntamatic Heiztechnik GmbH, Forbes Marshall Private Limited, Thermax Limited, HARGASSNER GesmbH, Hurst Boiler & Welding Co, Inc., Froling Heizkessel- und Behalterbau Ges.m.b.H., HDG Bavaria GmbH, Viessmann Group, Woodco |

| | Mitsubishi Hitachi Power Sytems, IHI, Harbin Electric, Doosan Heavy Industries, Bharat Heavy Electricals, Ansaldo, Siemens, Thermax |

Analyst Review

According to the opinions of various CXOs of leading companies, the biomass boiler market is expected to witness increased demand during the forecast period. Surge in focus toward decarbonization, energy efficiency, and technological advancements increase the demand for biomass boilers during the forecast period.

A biomass boiler is a type of heating system that uses organic materials derived from plants or animal waste as its fuel source. These organic materials include wood pellets, wood chips, agricultural residues, and various forms of organic waste. When biomass is burned in a biomass boiler, it undergoes combustion, releasing heat energy, and producing steam or hot water that can be used for heating spaces or generating electricity.

The market is being driven by an increasing focus on decarbonization in the energy sector. Biomass boilers offer a cleaner alternative to fossil fuel-based heating systems, significantly reducing carbon emissions. Technological advancements in modern biomass boilers have improved fuel efficiency and emissions control, while integration with other renewable energy systems enhances overall energy efficiency. In addition, government policies and international agreements further support the adoption of renewable energy technologies which drive the growth of biomass boilers during the forecast period.

$6.3 billion is the estimated industry size of Biomass Boiler.

Hybrid Energy Systems, Waste-to-Energy Solutions, Sustainable Biomass Sourcing are the upcoming trends of Biomass Boiler Market in the world.

Increase in focus toward decarbonization, and rise in energy efficiency and technological advancements are the major driving factors for Biomass Boiler Market

Industrial is the leading application of Biomass Boiler Market.

Asia-Pacific is the largest regional market for Biomass Boiler

Viessmann Group, Thermax Limited, Froling Heizkessel-und Behalterbau Ges.m.b.H, and ETA Heiztechnik GmbH, are the top companies to hold the market share in Biomass Boiler

Loading Table Of Content...

Loading Research Methodology...