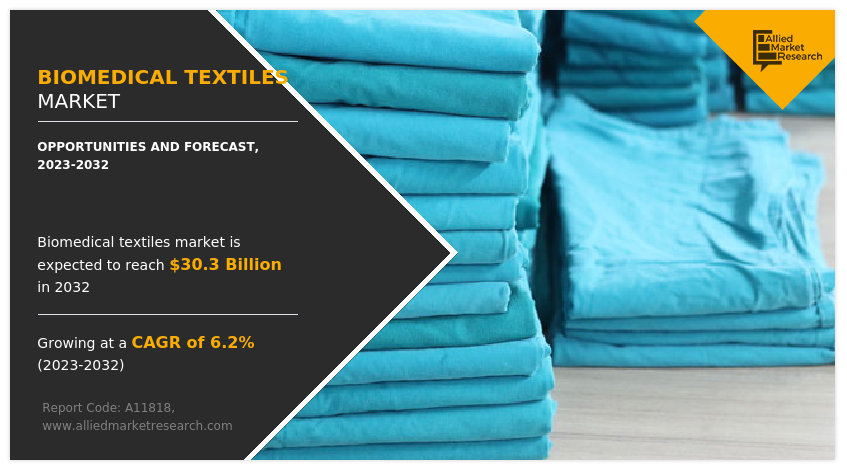

Biomedical Textiles Market Size & Insights:

The global biomedical textiles market size was valued at $16.6 billion in 2022, and is projected to reach $30.3 billion by 2032, growing at a CAGR of 6.2% from 2023 to 2032.

Introduction:

Biomedical textiles, also known as medical textiles or healthcare textiles, refer to textile materials and products specifically designed and used for medical and healthcare applications. These textiles play a crucial role in various medical fields, including wound care, implantable devices, surgical procedures, rehabilitation, and protective clothing for healthcare workers. Biomedical textiles are engineered to meet specific requirements such as biocompatibility, durability, sterility, comfort, and functionality.

Report Key Highlighters:

- The report outlines the current biomedical textile market trends and future scenario of the market from 2022 to 2032 to understand the prevailing opportunities and potential investment pockets.

- The global biomedical textile market has been analyzed in terms of value ($Million) and volume (Kilotons). The analysis in the report is provided on the basis of fiber type, fabric type, application, 4 major regions, and more than 15 countries.

- The biomedical textile market is consolidated in nature with few players such as Swicofil AG, DSM, CORTLAND BIOMEDICAL, Poly-Med Incorporated, Bally Ribbon Mills, ATEX Technologies, Integra Life Sciences Corporation, Medline Industries Inc., B. Braun Melsungen AG, and B. Braun Melsungen AG, which hold significant share of the market.

- The report proivdes strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the biomedical textiles industry.

- Countries such as China, U.S., India, Germany, and Brazil hold a significant share in the global biomedical textile market.

Market Dynamics:

The rising healthcare expenditure, driven by population growth, increasing healthcare needs, and advancing medical technologies, is a significant driver for the biomedical textiles market. In addition, healthcare systems are investing more in advanced medical treatments and technologies, due to which the demand for specialized biomedical textile materials has increased in various medical applications. This factor is anticipated to drive the market during the forecast period.

Government regulation and standard for using biomedical textile is expected to hamper the market expansion

However, the biomedical textiles industry is subject to strict regulatory standards and compliance requirements to ensure patient safety and product efficacy. The process of meeting regulatory standards, obtaining necessary certifications, and keeping up with evolving guidelines can pose challenges for manufacturers and suppliers. Despite the focus on infection control, there is still a potential risk of microbial colonization on biomedical textiles. If proper cleaning, sterilization, or disinfection protocols are not followed, there can be a risk of infection transmission. Therefore, it is crucial to adhere to strict hygiene practices to minimize this risk. This factor is projected to restrain market growth.

Growing awareness about sustainable solutions will offer new opportunities for the biomedical textiles market

The increasing demand for sustainable and eco-friendly solutions presents an opportunity for bio textiles made from biodegradable and renewable materials. The development of bio textiles using biopolymers, natural fibers, and bio-based materials can address environmental concerns and reduce the reliance on synthetic materials derived from fossil fuels. These factors are anticipated to offer remunerative opportunities for the biomedical textiles market during the forecast period.

High investment in the medical industry is projected to drive the market demand

Segment Overview:

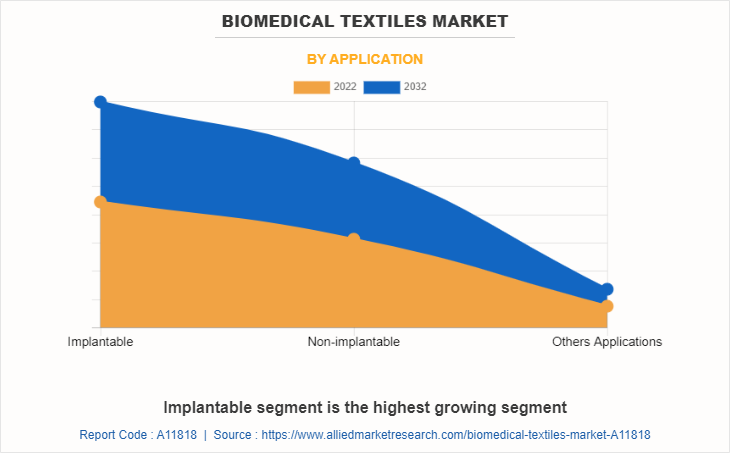

The biomedical textiles market is segmented on the basis of fiber type, fabric type, application, and region. On the basis of fiber type, the market is categorized into non-biodegradable fiber, biodegradable fiber, and others. On the basis of fabric type, the market is categorized into woven, non-woven, and others. On the basis of application, it is divided into implantable, non-implantable, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Biomedical Textiles Market By Region

The North America biomedical textiles market size is projected to grow at the highest CAGR of 6.8% during the forecast period and account for 33% of biomedical textiles market share in 2022. This is attributed to the fact that the Asia-Pacific Biomedical textiles market is anticipated to expand during the forecast period.

China's biomedical textiles market is witnessing robust growth due to the country's growing healthcare industry, expanding middle class, and increasing investment in healthcare infrastructure. The demand for wound care products, surgical textiles, and orthopedic applications is driving market growth. China's focus on research and development, as well as its strong manufacturing capabilities, contributes to the production of advanced biomedical textiles.

Furthermore, Japan is known for its advanced healthcare industry and technological innovation. The country has a mature biomedical textiles market and is a leader in the development of high-quality medical textiles. Japan's aging population, strong emphasis on healthcare research, and well-established healthcare infrastructure drive market growth. The demand for advanced wound care products, surgical textiles, and assistive devices fuels the market. These factors are anticipated to boost the Asia-Pacific Biomedical textiles industry during the forecast period.

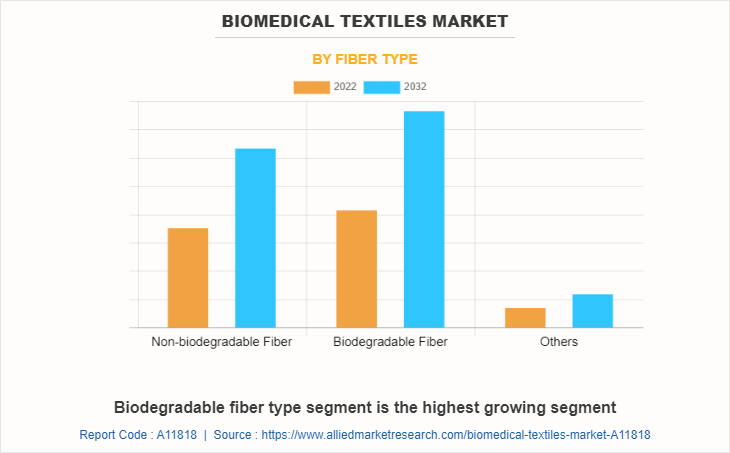

Biomedical Textiles Market By Fiber Type

By fiber type, the biodegradable segment dominated the global market in 2022 and is anticipated to grow at a CAGR of 6.4% during the forecast period. There is growing awareness of the environmental impact of non-biodegradable materials, including synthetic fibers, which can persist in the environment for extended periods and contribute to pollution and waste accumulation. Biodegradable fibers offer a more sustainable alternative as they can naturally decompose and break down into non-harmful components over time, reducing their impact on ecosystems and waste management.

In addition, biodegradable fibers are often made from natural polymers, such as cellulose, chitosan, or collagen, which are inherently biocompatible. These fibers can integrate well with the body's tissues and facilitate tissue regeneration and healing without causing adverse reactions or foreign body responses. This factor is projected to boost the market demand during the forecast period.

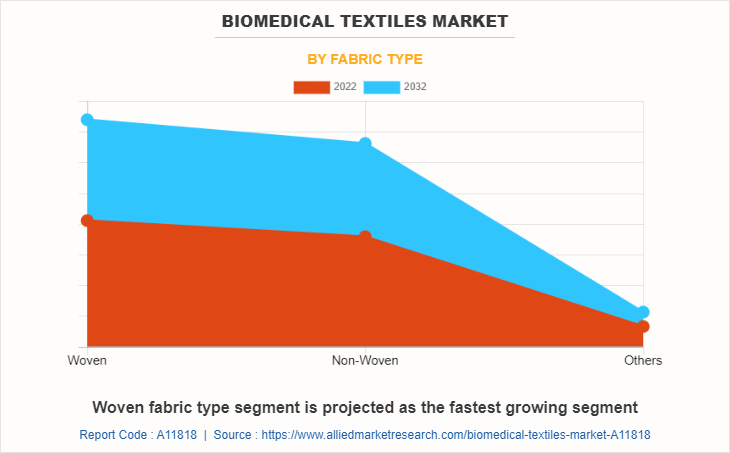

Biomedical Textiles Market By Fabric Type

By fabric type, the woven fabrics segment dominated the global market in 2022 and is anticipated to grow at a CAGR of 6.1% during the forecast period. This is due to the factor such as, woven fabrics offer excellent structural integrity and stability. The interlacing of warp and weft yarns creates a strong and stable fabric structure that can withstand the stresses and strains encountered in various biomedical applications, such as surgical meshes, wound dressings, or orthopedic supports.

Woven fabrics often have inherent breathability due to the natural spaces between the interlaced yarns. This breathability allows for air circulation and moisture management, making woven fabrics more comfortable for patients in applications such as wound dressings or garments.

Biomedical Textiles Market By Application

In 2022, the implantable segment was the largest revenue generator, and is anticipated to grow at a CAGR of 53% during the forecast period. Biomedical textiles are used in cardiovascular implants such as stents, heart valves, and vascular grafts. Textile-based stents provide support and maintain vessel patency after angioplasty, while textile-covered heart valves and vascular grafts offer durability, biocompatibility, and improved hemodynamics.

In addition, Biomedical textiles can be engineered to incorporate drug delivery functionalities. They can be designed to release drugs or therapeutic agents over time, allowing for controlled and localized delivery to specific implant sites. This factor is expected to boost the biomedical textiles market growth during the forecast period.

The global biomedical textiles market profiles leading players that include Swicofil AG, DSM, CORTLAND BIOMEDICAL, Poly-Med Incorporated, Bally Ribbon Mills, ATEX Technologies, Integra Life Sciences Corporation, Medline Industries Inc., B. Braun Melsungen AG, and B. Braun Melsungen AG. The global biomedical textiles market report provides in-depth competitive analysis as well as profiles of these major players.

Technology Trend Analysis

Advancements in textile engineering have led to the creation of smart textiles capable of monitoring vital signs, delivering medications, and aiding tissue regeneration. By incorporating sensors and microelectronics, these textiles offer real-time health monitoring, enabling early detection of health issues. This innovation is transforming the healthcare sector by providing more personalized, efficient, and non-invasive medical solutions.

3D printing is revolutionizing the biomedical textiles market by enabling the production of customized implants and prosthetics. This technology allows for the creation of patient-specific solutions, ensuring perfect fitness and improved functionality. By using precise design techniques, 3D printing enhances the performance of biomedical textiles, making them more effective in supporting healing, comfort, and long-term use.

Nanomaterials are being integrated into biomedical textiles to improve their performance in medical applications. These materials enhance antimicrobial resistance, preventing infections in wound care and surgical applications. They also improve the strength and durability of textiles, making them more effective in supporting healing. In addition, nanomaterials boost the biocompatibility of textiles, ensuring they are safe and well-tolerated by the human body.

The use of sustainable, biodegradable polymers in biomedical textiles is increasing owing to rise in environmental concerns. These materials offer the same functionality and performance as traditional textiles but break down naturally over time, reducing waste and pollution. This trend supports eco-friendly practices while ensuring that medical applications, such as implants and wound care, remain effective and safe.

Russia/Ukraine War Impact:

Russia and Ukraine are significant players in the production or supply of biomedical textiles or their raw materials, any disruption in their supply chain could lead to shortages or delays in product availability. This could affect manufacturers and healthcare providers reliant on these materials.

Geopolitical tensions can lead to economic uncertainties in the affected regions and beyond. Changes in trade policies, tariffs, and sanctions can affect international trade and impact companies financial stability, investment decisions, and growth plans in the biomedical textile market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the biomedical textiles market analysis from 2022 to 2032 to identify the prevailing biomedical textiles market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the biomedical textiles market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global biomedical textiles market trends, key players, market segments, application areas, and market growth strategies.

Biomedical Textiles Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 30.3 billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 317 |

| By Application |

|

| By Fiber Type |

|

| By Fabric Type |

|

| By Region |

|

| Key Market Players | Medline Industries Inc., Integra LifeSciences, Atex Technologies Inc., Bally Ribbon Mills, Inc., Poly-Med Incorporated, Swicofil AG, DSM, Elkem ASA, Cortland Biomedical, B. Braun Melsungen AG |

Analyst Review

According to CXOs of leading companies, the global biomedical textiles market is expected to exhibit high growth potential. Biomedical textiles are specialized textiles designed for use in medical and healthcare applications.

In addition, rising demand for minimally invasive procedures are becoming increasingly popular due to their benefits such as reduced scarring, faster recovery, and shorter hospital stays. Biomedical textiles play a crucial role in these procedures by providing specialized materials for surgical meshes, endoscopic devices, and wound closure materials, contributing to the market growth.

Moreover, the growing aging population worldwide is driving the demand for healthcare services and products. As the elderly population increases, there is a greater need for wound care, orthopedic support, and other medical textiles that cater to age-related conditions. Additionally, the prevalence of chronic diseases, such as diabetes and cardiovascular diseases, further fuels the demand for biomedical textiles for wound management and treatment. These factors have also boosted the growth of biomedical textiles during the forecast period.

The CXOs further added that sustained economic growth and the development of the healthcare industry have surged the popularity of biomedical textiles.

The biomedical textiles market is segmented on the basis of fiber type, fabric type, application, and region. On the basis of fiber type, the market is categorized into non-biodegradable Fiber, biodegradable fiber, and others. On the basis of fabric type, the market is categorized into woven, non-woven, and others. On the basis of application, it is divided into implantable, non-implantable, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Implantable is the leading applications of biomedical textile market.

Biomedical textiles are specialized textiles and textile-related products designed and engineered for use in medical and healthcare applications. These textiles are manufactured using various fibers, yarns, and fabric structures to meet specific medical requirements. Biomedical textiles play a critical role in modern healthcare, contributing to advancements in medical treatments, wound care, tissue engineering, and other medical applications.

North America is the largest regional market for biomedical textiles.

Swicofil AG, DSM, CORTLAND BIOMEDICAL, Poly-Med Incorporated, Bally Ribbon Mills, ATEX Technologies, Integra Life Sciences Corporation, Medline Industries Inc., B. Braun Melsungen AG, and B. Braun Melsungen AG

Nanofiber-based biomedical textiles are gaining prominence due to their unique properties, such as high surface area, enhanced mechanical strength, and controlled drug release capabilities. Nanofiber technology is being applied to wound dressings, tissue engineering scaffolds, and drug delivery systems.

Nanofiber-based biomedical textiles are gaining prominence due to their unique properties, such as high surface area, enhanced mechanical strength, and controlled drug release capabilities. Nanofiber technology is being applied to wound dressings, tissue engineering scaffolds, and drug delivery systems.

Loading Table Of Content...

Loading Research Methodology...