Biometric Payment Card Market Research, 2032

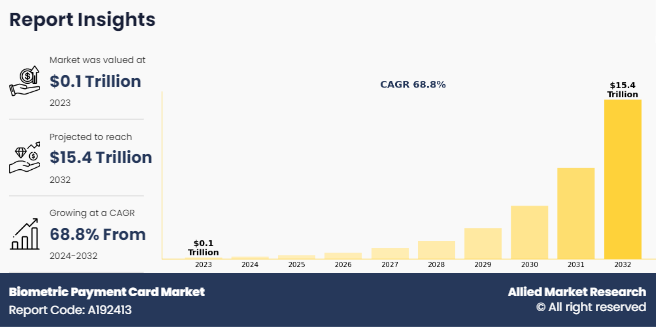

The global biometric payment card market size was valued at $144.25 billion in 2023 and is projected to reach $15,407.81 billion by 2032, growing at a CAGR of 68.8% from 2024 to 2032.

A biometric payment card is a type of debit or credit card that uses biometric authentication methods, such as fingerprints or facial recognition, to verify the cardholder's identity before a transaction is authorized. These cards are intended to improve security and convenience for users by combining an additional layer of authentication beyond the conventional PIN or signature. Further, these cards are increasingly being implemented in sectors such as finance, government, and corporate security to mitigate fraud and enhance user experience. The rise in advancements in authentication technology, along with the surge in cases of data breaches and identity thefts boosts the growth of the global biometric payment card market.

Key Takeaways:

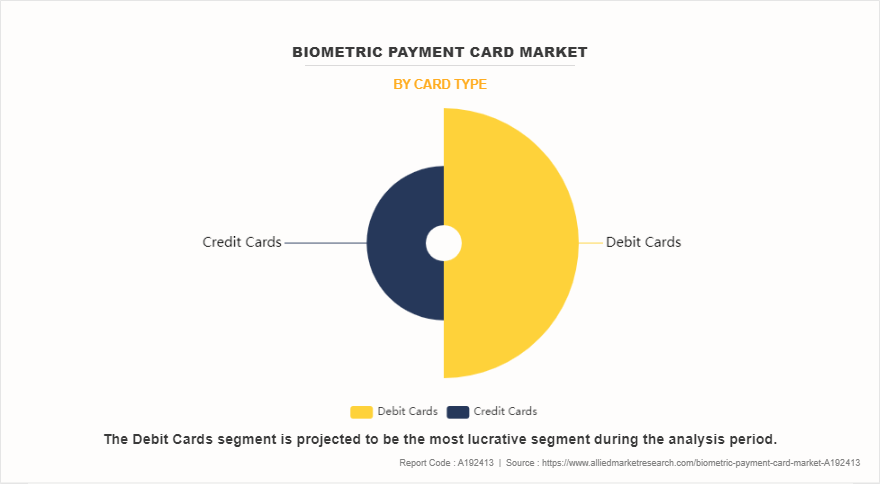

- By card type, the debit cards segment held the largest share in the biometric payment card market for 2023.

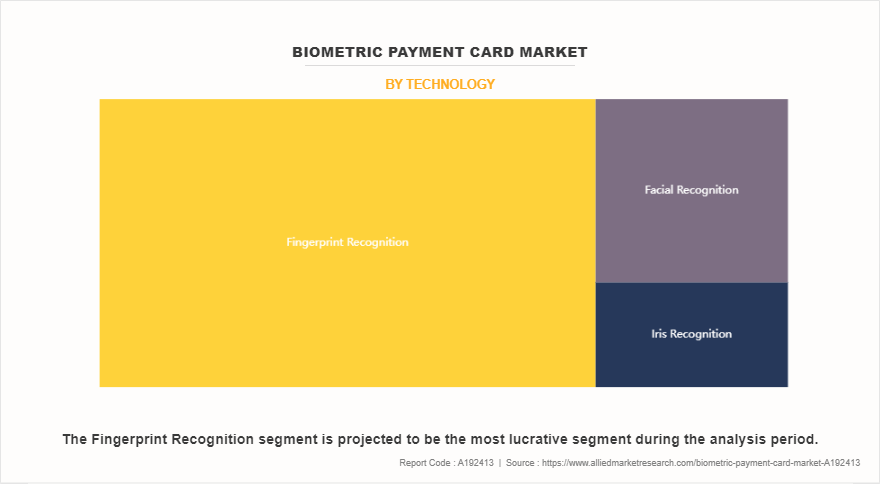

- By technology, the fingerprint recognition segment held the largest share in the biometric payment card market for 2023.

- By end-user, the retail segment held the largest share in the biometric payment card market for 2022.

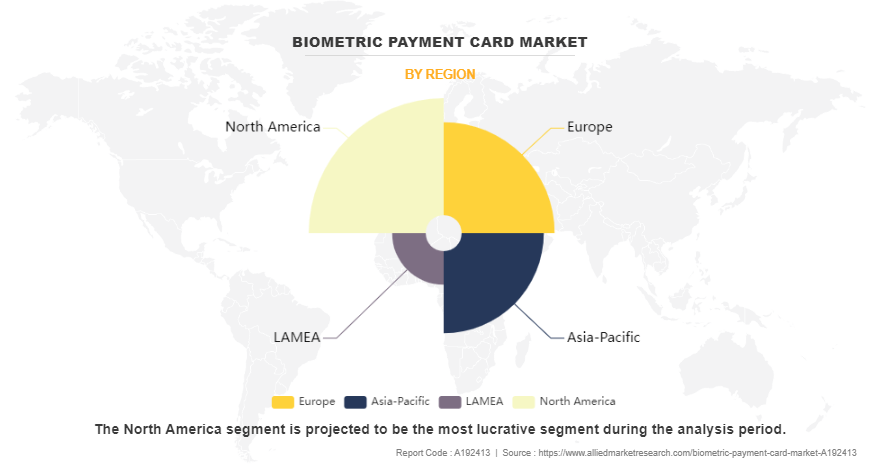

- Region-wise, North America held the largest market share in 2022. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

In addition, the shift towards contactless payment methods, driven by consumer demand for faster and more convenient transactions presents a significant growth prospect for the biometric payment card market. However, the high cost of biometric payment cards and increase in security & privacy concerns among businesses hamper the biometric payment card market growth. On the contrary, the increase in advanced information and communications technology and the robust growth of the e-commerce sector are expected to offer remunerative opportunities for the expansion of the biometric payment card market during the forecast period.

The report focuses on growth prospects, restraints, and analysis of the global biometric payment card market trend. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global biometric payment card market opportunity.

Segment Review

The biometric payment card market is segmented on the basis of card type, technology, end-user, and region. By card type, the market is bifurcated into credit cards and debit cards. By technology, it is classified into fingerprint recognition, iris recognition, and facial recognition. By end-user, the market is divided into retail, transportation, healthcare, hospitality, government, and others. By region, the market is analyzed across North America (U.S. and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Based on card type, the debit cards segment dominated the biometric payment card market in 2023 and is expected to maintain its dominance in the upcoming years, owing to the numerous companies involved in handling debit cards integrated with biometric authentication technologies, such as fingerprint or palm print. Further, the increasing role of government and financial institutions in promoting cashless transactions and debit card usage is expected to expand the growth of the biometric debit card market. However, the credit cards segment is expected to witness the highest growth, owing to factors such as broader acceptability at shops and better product offerings in a competitive landscape in the coming years.

Region-wise, the biometric payment card market was dominated by North America in 2023 and is expected to retain its position during the forecast period, owing to increase in adoption and usage of contactless cards as a payment method, and the presence of a large number of firms operating in the market has boosted the growth of the biometric payment card industry in this region. However, Asia Pacific is expected to witness significant growth during the forecast period, owing to increasing requirements for enhanced security in the payment industry and the shifting inclination of consumers towards contactless payment modes are acting as growth catalysts for the biometric payment card market analysis.

Competitive Analysis

In March 2024, Fingerprint Cards AB (Fingerprints) announced the development of a new generation of Thales Gemalto biometric payment cards, which marks Fingerprints’ and Thales’ eleventh commercial rollout for biometric payment cards across the world. This new Thales solution is featured with Fingerprints’ T-Shape sensor (T2) and biometric payment software platform, offering users advanced transaction speed, enhanced power efficiency, and improved security.

In September 2023, IDEX Biometrics ASA and KL HI-TECH, a global card manufacturer and prominent provider of secure printing products and smart cards for central and state governments, joined forces to launch a biometric payment card market in the Indian market. KL HI-TECH holds certifications in numerous ISO classes and is authorized by Visa, Mastercard, and RuPay.

In November 2023, Mastercard introduced a biometric payment partnership with NEC to bring a biometric checkout to the Asia-Pacific region. This partnership integrates NEC’s facial recognition and liveness verification technology with Mastercard’s payment operations.

In June 2022: IDEX Biometrics ASA and Linxens Holding SAS entered into an agreement whereby Linxens became a global provider of IDEX's complete biometric smart-card turnkey solution, influencing both companies' technologies and expertise. This enables cardmakers to pioneer smart cards faster by embracing the highest-performing fingerprint sensor.

In June 2022, Verizon completed the partnership with Mastercard and First National Bank of Omaha (FNBO) to introduce a credit card designed to bring value to small business owners.

Top Impacting Factors

Rise in adoption of contactless payment methods

The surge in demand and acceptance of contactless payment methods has been a significant trend in recent years, driven by the proliferation of mobile wallets, faster and more convenient ways of transactions, and promotional incentives. Advancements in technology have made contactless payments more secure and versatile, which is further accelerated by the advent of biometric payment cards. EMV chip technology, tokenization, and biometric authentication methods (such as fingerprint or facial recognition) are breakthroughs in payment technology that offer additional layers of security to contactless transactions, improving consumer confidence in using these methods.

Furthermore, biometric payment cards are designed to work seamlessly with contactless payment terminals, enabling users to tap their cards to make purchases quickly and securely. By leveraging the existing infrastructure for contactless payments, biometric cards may easily integrate into the payment ecosystem, making them a natural extension of the strengthening trend toward contactless transactions. Moreover, the robust growth in contactless and cashless transactions has driven the demand for various modes of payment, which is expected to accelerate the growth of the biometric payment card market. According to the World Bank Group, two-thirds of adults across the world are making or receiving digital payments, with the share in developing economies increasing from 35% in 2014 to about 57% in 2021. Also, in developing economies, around 71% have an account at a bank, other financial institution, or with a mobile money provider, up from 63% in 2017 and 42% in 2011. Hence, these aforementioned factors are projected to contribute to the expansion of the biometric payment card market.

Growth in regulatory support and government initiatives

Globally, governments are increasingly focused on data protection and privacy regulations, such as the European Union's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Biometric payment cards, with their advanced authentication methods, may often help financial institutions comply with these regulations by proposing secure and privacy-improving payment solutions. Regulatory support for biometric authentication technologies may provide transparency and guidance to organizations on how to embrace these solutions in a manner that esteems user privacy and data security. Hence, compliance with data protection regulations is expected to propel the growth prospect for biometric payment card market share.

Furthermore, governments and regulatory bodies in numerous countries are actively working to endorse financial inclusion and access to banking services for underserved populations. Biometric payment cards have the prospective to support these initiatives by offering secure and convenient payment solutions that do not depend on conventional banking infrastructure. Through leveraging biometric authentication, governments may further facilitate the delivery of financial services to unbanked and underbanked individuals, empowering them to participate more fully in the digital economy. Thus, the rapid growth in financial inclusion initiatives is expected to accelerate the biometric payment card industry.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the global biometric payment card market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on global biometric payment card market trends is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the market from 2023 to 2033 is provided to determine the potential of biometric payment card market outlook.

Biometric Payment Card Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2032 |

| Report Pages | 249 |

| By End-User |

|

| By Card Type |

|

| By Technology |

|

| By Region |

|

| Key Market Players | Zwipe, IDEX Biometrics ASA, NXP Semiconductors, Mastercard, BNP Paribas, Goldpac Fintech, Bio-idz, Thales Group, Visa Inc., Infineon Technologies AG |

Analyst Review

The global biometric payment card market is witnessing decent growth, due to the growing trend of contactless payment and the favorable regulatory support for payment authentication technology. According to CXOs of the leading companies in the market, consumers value convenience and efficiency in their payment experiences. Biometric payment cards deliver a seamless and intuitive payment solution that eliminates the need to remember PINs or carry multiple cards. The convenience factor, integrated with improved security, makes biometric payment cards an attractive option for consumers, driving demand in the market.

Further, financial institutions and card issuers across the globe are gradually focused on differentiating their offerings and providing innovative solutions to attract and retain customers, making the biometric payment card market more competitive globally. In addition, the competitive environment is often expected to intensify with the rise in technological innovations, product extensions, and different strategies adopted by key vendors, such as product launches, partnerships, agreements, and technology initiatives, among others.

Key players in the biometric payment card market such as IDEX Biometric ASA, Thales Group, Zwipe, Mastercard, and Visa Inc., account for a significant share of the market. With larger requirements for biometric payment cards, companies introduced various strategies to strengthen their market position capabilities. For instance, in September 2023, IDEX Biometrics ASA and KL HI-TECH, a global card manufacturer and prominent provider of secure printing products and smart cards for central and state governments, joined forces to launch a biometric payment card in the Indian market. KL HI-TECH holds certifications in numerous ISO classes and is authorized by Visa, Mastercard, and RuPay.

Moreover, with the increase in competition, major market players have started the acquisition of companies to expand their market penetration and reach. For instance, in October 2023, Zwipe, the global leader in biometric payment and access cards, completed the partnership with Schneider Electric's Security Solutions Group, focusing on the integration of access control, intrusion detection, video surveillance, and other security technology sub-systems, to provide the revolutionary "biometric system-on-card" solution to Schneider Electric's global customer base. Schneider Electric's clientele spans diverse sectors, such as airports, data centers, transportation, critical infrastructure, healthcare, government, manufacturing, and education.

The shift towards contactless payment methods, driven by consumer demand for faster and more convenient transactions presents a significant growth prospect for the biometric payment card market. However, the high cost of biometric payment cards and increase in security & privacy concerns among businesses hamper the biometric payment card market growth.

On the basis of end-users, the retail segment dominated the biometric payment card market in 2023 and is expected to maintain its dominance in the upcoming years. However, the hospitality segment is expected to witness the highest growth during the forecast oeriod,

By region, the biometric payment card market was dominated by North America in 2023 and is expected to retain its position during the forecast period.

The global biometric payment card market generated $144.25 billion in 2023 and is estimated to reach $15,409.67 billion by 2032, witnessing a CAGR of 68.8% from 2023 to 2032.

The key players profiled in the biometric payment card industry analysis are Bio-idz, BNP Paribas, Goldpac Fintech, IDEX Biometrics ASA, Infineon Technologies AG, MasterCard, NXP Semiconductors, Thales Group, Visa Inc., and Zwipe.

Loading Table Of Content...

Loading Research Methodology...