Biostimulant Market Summary

The global biostimulant market was valued at $3,051.1 million in 2021, and is projected to reach $8,004.1 million by 2031, registering a CAGR of 10.0% from 2022 to 2031.

Key Market Trends and Insights

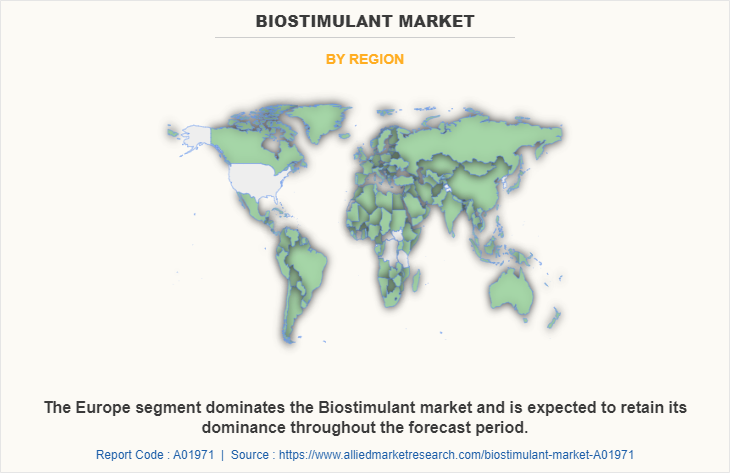

Region wise, Europe generated the highest revenue in 2021.

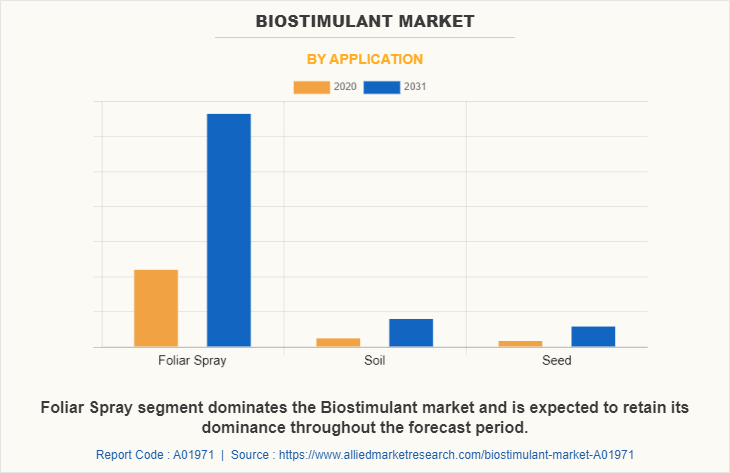

The global biostimulant market share was dominated by the foliar spray segment in 2021 and is expected to maintain its dominance in the upcoming years

The acid-based segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2021 Market Size: USD 3,051.1 Million

- 2031 Projected Market Size: USD 8,004.1 Million

- Compound Annual Growth Rate (CAGR) (2022-2031): 10.0%

- Europe: Generated the highest revenue in 2021

Key Takeaways

On the basis of market for region, Europe accounted for the largest revenue share of the global market, registering a significant CAGR from 2022 to 2031, followed by North America.

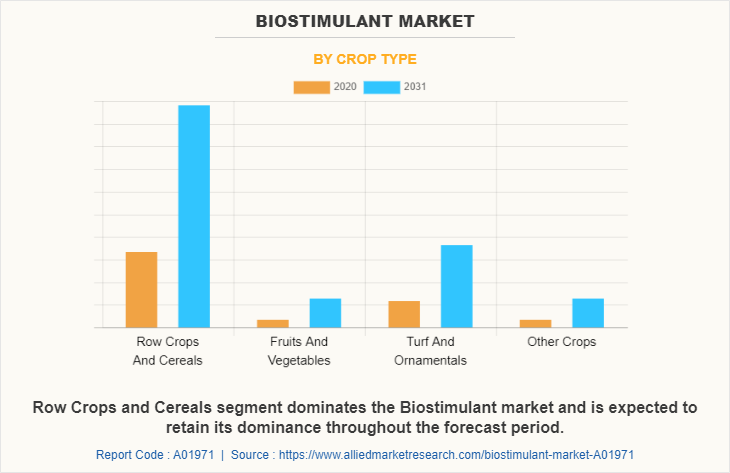

On the basis of biostimulant market growth in 2021, the row crops & cereals crop type segment accounted for the largest share, in terms of value, and is expected to grow at the highest rate.

North America is anticipated to grow at the highest CAGR of 9.8% from 2022 to 2031 in the market forecast period.

In 2021, the U.S. generated the highest revenue, accounting for less than one-fourth share of the global market.

Brazil is anticipated to grow at a significant CAGR of 10.2% during the forecast period.

Market Dynamics

Biostimulant are biologically produced fertilizers that are used to stimulate plant development and productivity, in addition to the nourishment of agrarian products. A biostimulant boosts plant development and growth throughout the crop life cycle, i.e., from seed germination to plant maturity. These fertilizers further help in facilitating nutrient translocation, assimilation, and use; and enhance soil fertility mainly by stimulating the development of interdependent soil microorganisms.

The growing emphasis on sustainable agriculture has driven up demand for biostimulants, which play an important role in raising crop output while minimizing the environmental effect of farming. Biostimulants promote plant growth, nutrient uptake, and stress resistance, making them an essential component of environmentally friendly farming operations. With growing worldwide concerns about environmental sanitation, water sustainability, and climate change, farmers and politicians are turning to biostimulants as a long-term option to address food security demands while maintaining environmental integrity.

The absence of standardized rules is a key impediment to the expansion of the biostimulant sector. Inconsistent definitions, processes for approval, and usage standards between nations cause confusion and issues for manufacturers and distributors. This regulatory ambiguity makes it challenging for businesses to bring goods to market and acquire farmer trust, eventually restricting the use of biostimulants. Harmonizing rules on a worldwide scale is critical to realizing this market's full potential and generating growth.

Segment Overview

The biostimulant market is segmented on the basis of product type, crop type, application, and region. On the basis of product type, the market is segmented into acid-based, extract-based, and others. By crop type, the market is segmented into row crops & cereals, fruits & vegetables, turfs & ornamentals, and others. On the basis of application, the market is segmented into foliar spray, soil, and seed. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, UK, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, Turkey, South Africa, and rest of LAMEA).

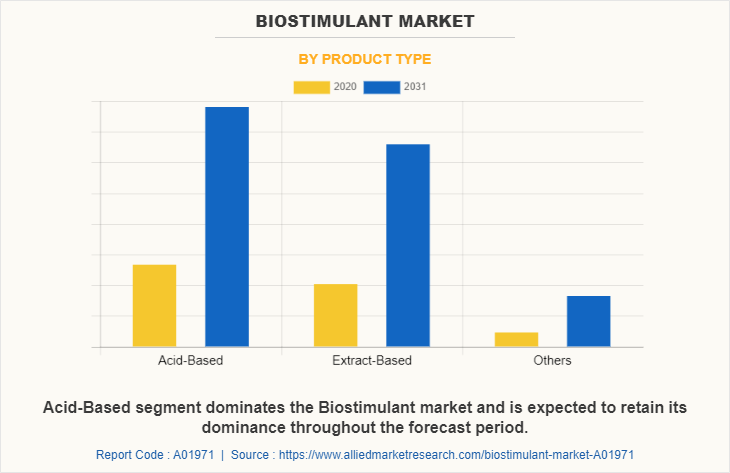

By Product Type

According to biostimulant market trends, on the basis of product type, the acid-based segment dominated the global market in 2021 and is expected to be dominant during the biostimulant market forecast period. The acid-based segment is expected to grow with a CAGR of 9.4%. Acid-based biostimulant have gained popularity that has increased substantially in recent years, as extensive usage of the types of acid-based biostimulant has enhanced the crop quality and had helped to increase the yield of the crops.

By Crop Type

According to the biostimulant market analysis, by crop type, the row crops & cereals segment was the segment in which the biostimulant are used the most for improving the quality and boosting yield of the crop. Row crops & cereals are the crop that is most common crop that is consumed from all over the globe, hence the demand for the crops are higher and biostimulant helps to decrease the growing time and helps in high production. Therefore the usages of biostimulant on row crops & cereals are the most. The emerging economies, such as India and China, have witnessed significant adoption of orchard farming due to which the use of biostimulant have increased in their regions.

By Application

On the basis of application, the foliar spray segment dominated the global biostimulant market in 2021. Foliar spray is the most common way of spreading biostimulant on the crops. The spraying mechanism helps to spread the biostimulant evenly on every corner of the field and it helps to reduce the wastage of the biostimulant.

By Region

Region wise, Europe dominated the biostimulant market in 2021, and is expected to be dominant during the forecast period. The dominance in the market is largely due to existence of agricultural operations in Europe region, and the availability of several variants of acid and extract-based biostimulants for different crop types that are preferred by the user. Increase in demand for biostimulants in the agricultural sector of Europe drives the growth of the biostimulants products.

Competition Analysis

The players operating in the global market have adopted various developmental strategies to expand their biostimulant market share, increase profitability, and remain competitive in the market. The key players profiled in this report include BASF SE, Biolchim S.p.A., Biostadt India Limited, Biovert S.L., Hello Nature, Isagro S.p.A., Koppert B.V., Lallemand, Inc., Novozymes A/S, and Valagro.

KEY BENEFITS FOR STAKEHOLDERS

The report provides a quantitative analysis of the current market trends, estimations, and dynamics of the biostimulant market size from 2022-2031 to identify the prevailing opportunities.

Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

In-depth analysis and the market size and segmentation assist to determine the prevailing biostimulant market opportunities.

The major countries in each region are mapped according to their revenue contribution to the market.

The market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of the market players in the biostimulant industry.

Biostimulant Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Crop Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Isagro S.p.A., Novozymes A/S, Valagro, Koppert B.V., biostadt india limited, Lallemand, Inc., BASF SE, Biolchim S.p.A., Hello Nature, Biovert S.L. |

Analyst Review

Product innovation, processing, and regulations are main areas for market growth in the biostimulant industry. Agri-food product market expansion and economic growth in advanced and emerging economies also support the market growth. However, low awareness among farmers about biostimulants hinders the market growth. Asia-Pacific is projected to register a significant growth as compared to the saturated markets in Europe and North America, due to increase in initiatives regarding sustainable agricultural by local government bodies and other favorable regulations.

Biostimulants have also been found to aid to enhance disease and pest resistance. A plant with a robust root system will be able to withstand external pressures better since its growth rate will be faster, and insect assaults will be less frequent. With the advent of new biostimulant variations, the support provided to plants and crops is assisting them in activating the plant's autoimmune system to cope with foreign invasion or growth.

The global biostimulant market size was valued at $3,051.1 million in 2021, and is projected to reach $8,004.1 million by 2031.

The global biostimulant market is projected to grow at a compound annual growth rate of 10.0% from 2022 to 2031 $8,004.1 million by 2031.

The major players operating in the biostimulant market include BASF SE, Biolchim S.p.A., Biostadt India Limited, Biovert S.L., Hello Nature, Isagro S.p.A., Koppert B.V., Lallemand, Inc., Novozymes A/S, and Valagro.

On the basis of region, Europe accounted for a major share of the biostimulant market in 2021

Rising Demand for Sustainable Agriculture, Improved Plant Performance and Stress Tolerance, Shifts in Consumer Preferences and Market Demand, Government Support and Eco-Friendly Policies, Advances in Agricultural Biotechnology.

Loading Table Of Content...