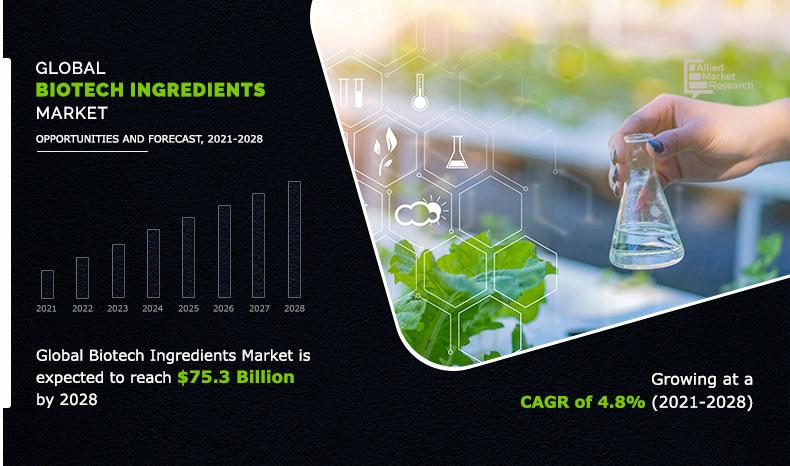

Biotech Ingredients Market Outlook - 2021–2028

The global biotech ingredient market size was valued at $51.3 billion in 2020, and is anticipated to generate $75.3 billion by 2028. The market is projected to experience growth at a CAGR of 4.8% from 2021 to 2028.

Biotech ingredients are chemical compounds that are similar to compounds found in nature. These ingredients have similar structure to that of natural ones and are produced through several complex processes. Genetic engineering, recombinant DNA technology, hybridoma technology, and gene transfer are some technologies that are used to produce these compounds. These ingredients are experiencing rapid growth from personal care, aromatic, and herbal products, which drives growth of the biotech ingredients market.

There is a notable shift in demand from synthetic ingredients to biotech ingredients. This is attributed to rise in awareness in consumers regarding harmful effects of synthetic products. In-addition, rise in use of generic medicines has also led to rise in demand for organic or herbal generics, i.e., generics made from biotech ingredients, which propels the market growth. Moreover, growth in use of biotech ingredients in the food and beverages industry also significantly acts as growth driver for the biotech ingredients market growth. However, limited availability of raw material acts as restraint for the biotech ingredients market growth.

The biotech ingredient market is segmented on the basis of type, product, application, and region. Depending on type, the market is bifurcated into active pharmaceutical ingredients (API) and Biosimilars. By product, it is categorized into monoclonal antibodies, vaccines, hormones & growth factors, cytokines, fusion proteins, therapeutic enzymes, and blood factors. By expression systems, it is divided into mammalian expression systems, microbial expression systems, yeast expression systems, plant expression systems, and insect expression systems. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa).

The key players operating in the market are Pfizer Inc., Novartis International AG, Merck & Co., Teva Pharmaceutical Industries Ltd., Mylan, Inc., Boehringer Ingelheim, Sanofi, AbbVie, Eli Lilly and Company, and AstraZeneca plc. The players in the market have adopted several strategies, such as product launch and business expansion, to sustain the market competition.

Biotech Ingredients Market, by Type

On the basis of type, the APIs segment garnered highest biotech ingredients market share in 2020, owing to increase in use of generic medicines in the wake of pandemic, especially herbal immunity boosters. The APIs segment garnered the highest market share for year 2020 owing to increased use of generic medicines in the wake of pandemic especially herbal immunity boosters. However, biosimilars are expected to dominate the market during the forecast period. This is owed to the fact that they are used abundantly as both finished as well as raw material for many generics as well as patent medicines and other products.

By Type

Biosimilars is projected as the most lucrative segment.

Biotech Ingredients Market, by Product

Depending on product, the monoclonal antibodies segment dominated the biotech ingredients market share for 2020, owing to growing demand for organic and herbal medicines for various diseases. However, hormones & growth factors segment is projected to grow at higher CAGR during the forecast period. this can be attributed to owing to increasing health and hormonal problems that arise from current lifestyles.

By Product

Hormones and Growth Factors Ingredients are projected as the most lucrative segment.

Biotech Ingredients Market, by Expression Systems

On the basis of expression systems, the microbial expression systems segment dominated the market share in 2020 owing to low cost of production and simple procedure. However, mammalian expression systems segment is expected to grow at faster pace during the forecast period owing to use in production of antibodies and therapeutic proteins.

By Expression Systems

Mammalian Expression Systems are projected as the most lucrative segment.

Biotech Ingredients Market, by Region

By region, the biotech ingredient market analysis is done across North America, Europe, Asia-Pacific, and LAMEA. Europe region dominated the market in 2020 on account of large consumer base, end-use sectors, and favorable support from government. Asia-Pacific is expected to grow fastest forecast period owing to presence of large bio-pharmaceutical companies in the countries such as China, India, Japan, and South Korea. In-addition the region also has a rich history of using herbal medicines that also adds to its rich expertise in the biotech ingredients.

By Region

Asia-Pacific is projected as the most lucrative market.

COVID-19 Impact Analysis

The outbreak of COVID-19 pandemic had led to partial or complete shutdown of production facilities, which do not come under essential goods, owing to prolonged lockdown in major countries such as the U.S., China, Japan, India, and Germany. It has led to either closure or suspension of their production activities in most industrial units across the globe. Furthermore, the global economy was deeply impacted by implementation of lockdown, as many activities came to halt. The biotech ingredients market saw a decline in its growth as the pandemic progressed. This can be attributed to the fact that research and development activities were halted as funds were being directed for sustaining economic unrest by many players. Moreover, supply demand chain for raw materials was disrupted that only added to already scarce availability pertaining in the market.

Key Benefits For Stakeholders

- The report provides an in-depth analysis and biotech ingredients market forecast along with the current and future market trends.

- This report highlights the key drivers, opportunities, and restraints of the biotech ingredients market along with the impact analyses during the forecast period.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the biotech ingredients industry for strategy building.

- A comprehensive analysis of the factors that drive and restrain the market growth is provided.

- The qualitative data in this report aims on biotech ingredients market trends, dynamics, and developments.

- The biotech ingredients market size is provided in terms of revenue.

Key Market Segments

By Type

- Active Pharmaceutical Ingredients

- Biosimilars

By Product

- Monoclonal Antibodies

- Vaccines

- Hormones and Growth Factors

- Cytokines

- Fusion Proteins

- Therapeutic Enzymes

- Blood Factors

By Expression Systems

- Mammalian Expression Systems

- Microbial Expression Systems

- Yeast Expression Systems

- Plant Expression Systems

- Insect Expression Systems

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- South Africa

- Saudi Arabia

- Rest of LAMEA

Key Players

- Pfizer Inc.

- Novartis International AG

- Merck & Co.

- Teva Pharmaceutical Industries Ltd.

- Mylan, Inc.

- Boehringer Ingelheim

- Sanofi

- AbbVie

- Eli Lilly and Company

- AstraZeneca plc

Biotech Ingredients Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Product |

|

| By Expression Systems |

|

| By Region |

|

| Key Market Players | NOVARTIS INTERNATIONAL AG, SANOFI S.A., Abbvie, .MYLAN N.V., PFIZER INC., Merck & Co., AstraZeneca plc, ELI LILLY AND COMPANY, TEVA PHARMACEUTICAL INDUSTRIES LTD., Boehringer Ingelheim |

Analyst Review

According to the insights from CXOs, the biotech ingredients market is highly fragmented in nature. Biotech ingredients are substances made from biologically copying DNA or engineering similar compounds that offer several benefits. This is also marked with significant shift experienced in consumers opting for biotech ingredient-based products instead of synthetic ingredients harmful for human as well as environment. The market is still at a stage where research and development activities are still large part of the industry’s growth. Market players are continuously engaged in launching new products with increased application of biotech ingredients. Moreover, demand from food & beverages, personal care, and health supplements industries act as growth drivers for the industry. In addition, production process for the same is costly and have high complexities. This leads to low availability of raw materials, which restrains the biotech ingredients market growth. However, technological advancements aimed at reducing cost and increasing product output are expected to offer significant growth opportunities for the industry growth in the coming years.

The notable shift in demand from synthetic ingredients to biotech or organic ingredients attributed to the rising awareness in consumers regarding the harmful effects of synthetic products are the key factors driving the Biotech Ingredients market.

The market share of Biotech Ingredients market $51.3 billion in 2020.

The rising use of generic medicines has also led to rise in demand for organic or herbal generics and growing use of biotech ingredients in food & beverage industry.

Europe and Asia-Pacific will provide more business opportunities for Biotech Ingredients market in future.

Product launch and acquisition are the key growth strategies of Biotech Ingredients market players.

The leading players in the market are Pfizer Inc., Novartis International AG, Merck & Co., Teva Pharmaceutical Industries Ltd., Mylan, Inc., Boehringer Ingelheim, Sanofi, AbbVie, Eli Lilly and Company, and AstraZeneca plc.

Active Pharmaceutical Ingredients segment based on type of ingredients holds the maximum market share of the Biotech Ingredients market.

Food & beverage, medicine, personal care, and cosmetics are the potential customers of Biotech Ingredients industry.

Loading Table Of Content...