Bleeding Disorders Market Research, 2032

The global bleeding disorders market size was valued at $13.8 billion in 2022, and is projected to reach $26 billion by 2032, growing at a CAGR of 6.6% from 2023 to 2032. A bleeding disorder is a medical condition that affects the ability of the body to form blood clots properly. Blood clots are essential in stopping bleeding after an injury or trauma. Bleeding disorders may lead to excessive bleeding, even with minor injuries, and may also cause internal bleeding in some cases. There are several different types of bleeding disorders, including hemophilia A, hemophilia A, Von Willebrand disease, and other rare bleeding disorders. Hemophilia is a genetic bleeding disorder that affects the ability of the blood to clot due to a deficiency in clotting factors. Bleeding disorders may be diagnosed through blood tests and genetic testing. Treatment options for bleeding disorders may include plasma-derived coagulation factor concentrates, recombinant coagulation factor concentrates, desmopressin, antifibrinolytics, and fibrin sealant.

Market dynamics

The incidence of bleeding disorders such as hemophilia, Von Willebrand disease, and other clotting factor deficiencies is increasing globally due to factors such as population growth, aging, and improved diagnosis and awareness of these disorders. The increase in the population suffering from bleeding disorders drives the growth of the bleeding disorders market share. For instance, according to Hemophilia News Today of BioNews, Inc. report, published in April 2021, an estimated 400,000 people globally have severe hemophilia.

In addition, the increase in funding for research and to help hemophilic patients in their treatment drives the growth of bleeding disorders industry. For instance, according to the National Hemophilia Foundation for all bleeding disorders, the Hemophilia Federation of America (HFA) and their funding partners offer annual educational scholarships for bleeding disorders patients and their families to defer costs and Kevin Child family gives Kevin Child Scholarship awards $1,000 to a U.S. student with hemophilia A or B yearly.

Moreover, the increase in focus on bleeding disorders, increase in the number of partnerships between the foundations to reduce the burden of hemophilic disease drives the growth of the bleeding disorders market. For instance, in September 2021, the National Hemophilia Foundation (NHF) joins the Hemophilia Federation of America (HFA) in announcing the “Together Project,” a new initiative that unites resources and aligns the mission of the two organizations. The Together Project begins with a focus on mental health, an issue of importance for many in the bleeding disorders community, those living with an inheritable blood disorder.

Furthermore, a rise in the number of clinical trials, and the rise in research and development activities are anticipated to drive the growth of the bleeding disorders market during the forecast period. For instance, in August 2021, Medexus Pharmaceuticals Inc. announced that it has completed enrollment in its Phase 4 Clinical Trial of IXINITY, targeting label expansion for pediatric hemophilia B patients. The Trial is investigating IXINITY as a prophylactic treatment for pediatric patients under 12 years of age with hemophilia B, a hereditary bleeding disorder characterized by a deficiency of clotting factor IX. IXINITY is currently an FDA-approved intravenous recombinant factor IX therapeutic for use in patients 12 years of age or older with hemophilia B. Such factors drive the growth of the bleeding disorders market. In addition, the rise in awareness regarding bleeding disorders in developing countries will drive the growth of the bleeding disorders market during the forecast period.

Segmental Overview

The bleeding disorders market is segmented on the basis of disease type, treatment type, distribution channel and region. On the basis of disease type, the market is classified into hemophilia A, hemophilia B, Von Willebrand disease and others. On the basis of treatment type, the market is classified into factor replacement therapy, and drug therapy (desmopressin, antifibrinolytics, fibrin sealant). The factor replacement therapy segment is further bifurcated into plasma-derived coagulation factor concentrates, and recombinant coagulation factor concentrates. On the basis of distribution channel, the bleeding disorders market is segmented into hospital pharmacies, drugs stores and retail pharmacies, and online pharmacies. On the basis of region, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

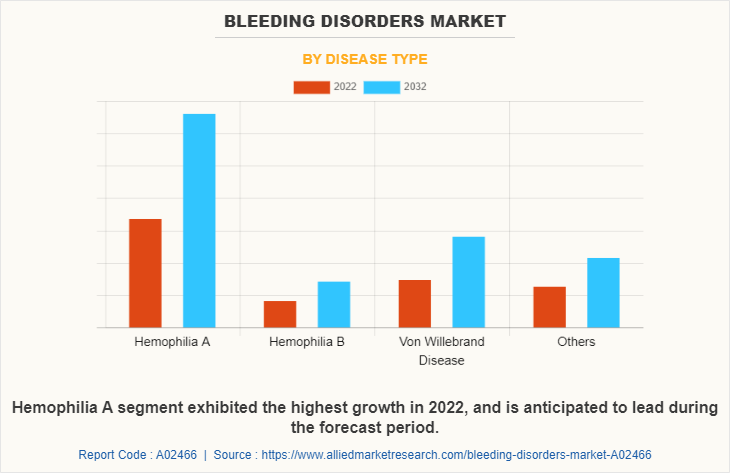

By Disease type:

The bleeding disorders market size is segmented into hemophilia A, hemophilia B, Von Willebrand disease and others. The hemophilia A segment generated maximum revenue in 2022, owing to high adoption of drugs for the treatment of hemophilia A and the availability of various medicines for hemophilia A. The same segment is expected to witness the highest CAGR during the forecast period, owing to rise in cases of hemophilia A and increase in research regarding hemophilia A.

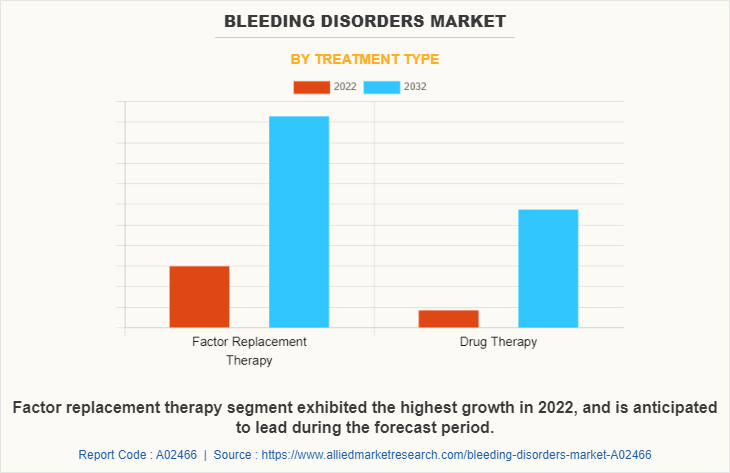

By Treatment type:

The bleeding disorders market share is segregated into factor replacement therapy, and drug therapy. The factor replacement therapy segment dominated the market in 2022, owing to high demand for factor replacement therapy and surge in incidence of clotting factor deficient diseases. The same segment is expected to witness the highest CAGR during the forecast period, owing to an increase in the number of research, clinical trials, for the development of factor replacement therapy medicines.

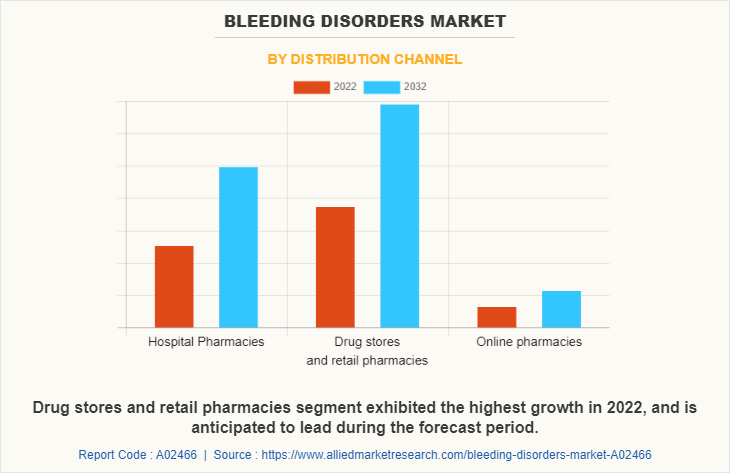

By Distribution channel:

The bleeding disorders market is segregated into hospital pharmacies, drugs stores and retail pharmacies, and online pharmacies. The drugs stores and retail pharmacies segment dominated the market in 2022, owing to higher number of people take medicines from drugs stores and retail pharmacies and surge in number of drugs stores and retail pharmacies. The hospital pharmacies segment is expected to witness the highest CAGR during the forecast period, owing to hospital pharmacy offers the precise drug according to severity of bleeding disorder in patient. Therefore, patients mostly prefer hospital pharmacy.

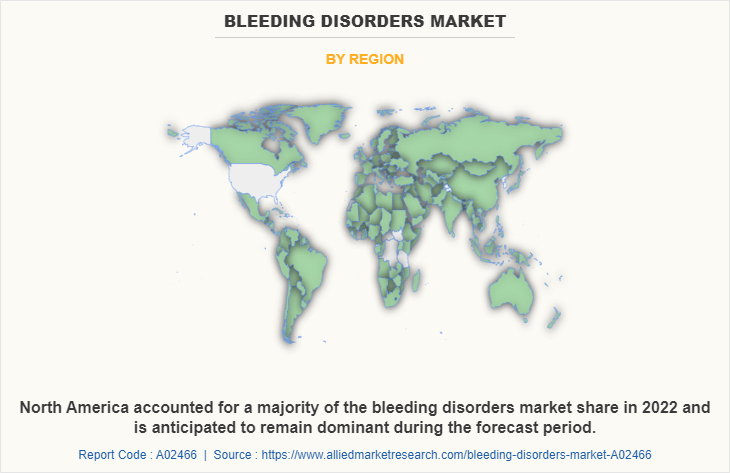

By Region:

The bleeding disorders market is studied across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the bleeding disorders market in 2022 and is expected to maintain its dominance during the forecast period. The presence of major players, such as Pfizer Inc. (U.S.) and Medexus Pharma, Inc. (Canada), and the rise in the number of bleeding disorders in this region drive the growth of the market.

Asia-Pacific is expected to grow at the highest rate during the bleeding disorders market forecast period. The bleeding disorders market growth in this region is attributable to a rise in the number of bleeding disorders such as hemophilia A and B in this region, as well as increase in the purchasing power of populated countries, such as China and India.

Competition Analysis

Competitive analysis and profiles of the major players in the bleeding disorders industry, such as Bayer AG, CSL Ltd. (CSL Behring), F. Hoffmann-La Roche AG, Grifols, S.A., Medexus Pharma, Inc., Novo Nordisk A/S, Octapharma AG, Pfizer Inc., SANOFI CORPORATION, and Takeda Pharmaceutical Company Limited are provided in the report. There are some important players in the market such as CSL Ltd. (CSL Behring), Pfizer Inc., Novo Nordisk A/S, SANOFI CORPORATION, and Takeda Pharmaceutical Company Limited which have adopted investment, partnership and product approvals as key developmental strategies to improve the product portfolio of the bleeding disorders market.

Recent product approvals in the bleeding disorders market

In February 2023, CSL announced that the European Commission has granted conditional marketing authorization (CMA) for HEMGENIX (etranacogene dezaparvovec), the first and only one-time gene therapy for the treatment of severe and moderately severe hemophilia B (congenital Factor IX deficiency) in adults without a history of Factor IX inhibitors. In the ongoing clinical trial, HEMGENIX reduced the rate of annual bleeds with a single infusion by delivering a functional gene that acts as a blueprint for coagulation Factor IX, a protein important for blood clotting. 1 It is the first approved gene therapy for hemophilia B in the European Union (EU) and European Economic Area (EEA).

In February 2023, Roche announced that the European Commission approved the expansion of the Hemlibra (emicizumab) European Union (EU) marketing authorization. The label is expected to now include the routine prophylaxis of bleeding episodes in people with hemophilia A (congenital factor VIII deficiency) without factor VIII inhibitors, who have a moderate disease (FVIII 1% and 5%) with a severe bleeding phenotype. Hemophilia A affects around 900,000 people worldwide, approximately 14% of whom have a moderate form of the disease.

In February 2023, The U.S. Food and Drug Administration (FDA) approved ALTUVIIIO [Antihemophilic Factor (Recombinant), Fc-VWF-XTEN Fusion Protein-ehtl], previously referred to as efanesoctocog alfa, a first-in-class, high-sustained factor VIII replacement therapy. ALTUVIIIO is indicated for routine prophylaxis and on-demand treatment to control bleeding episodes, as well as perioperative management (surgery) for adults and children with hemophilia A.

In January 2022, Takeda Pharmaceutical Company Limited announced that the U.S. Food and Drug Administration (FDA) approved VONVENDI [Von Willebrand factor (Recombinant)] for routine prophylaxis to reduce the frequency of bleeding episodes in patients with severe Type 3 Von Willebrand disease (VWD) receiving on-demand therapy. VONVENDI is the only recombinant Von Willebrand factor (VWF) replacement therapy, and the first and only treatment to reduce the frequency of bleeding episodes for severe Type 3 VWD approved by the FDA for routine prophylactic use.

In November 2022, Novo Nordisk A/S announced that ESPEROCT is now available in the U.S. for the treatment of adults and children with hemophilia A. ESPEROCT is a recombinant extended half-life factor VIII replacement therapy used to prevent or reduce the number of bleeding episodes, to treat and control bleeding, and to manage bleeding during surgery in people with hemophilia A.

Recent partnership in the bleeding disorders market

In May 2022, Roche announced that it has extended its commitment to the World Federation of Hemophilia (WFH) Humanitarian Aid Program until the end of 2028. prophylactic treatment of Roche’s is projected to be provided to the WFH Humanitarian Aid Program to continue to treat as many as 1,000 people with hemophilia A in locations where there is little to no access to treatment. The partnership, which was originally formed by Roche and the WFH in February 2019, marked the first time that patients in developing countries had received access to prophylactic treatment. The donated treatment has since benefited more than 940 people across 30 countries.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bleeding disorders market analysis from 2022 to 2032 to identify the prevailing bleeding disorders market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bleeding disorders market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bleeding disorders market trends, key players, market segments, application areas, and market growth strategies.

Bleeding Disorders Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 26 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 458 |

| By Disease Type |

|

| By Treatment Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | F. Hoffmann-La Roche Ltd., Octapharma AG, Takeda Pharmaceutical Company Limited, Pfizer Inc., Bayer AG, Sanofi, Grifols, S.A., Novo Nordisk A/S, Medexus Pharma, Inc., CSL Limited |

Analyst Review

According to the insights of CXOs, the bleeding disorders market has witnessed notable growth, owing to rise in prevalence of bleeding disorders such as hemophilia, and Von Willebrand disease, which further increases the demand for drugs of bleeding disorder.

The significant technological advancements in hemophilia treatment products lead to the provision of advanced treatment options for the management of hemophilia in population. The demand for new hemophilia treatment options is on a continuous rise, due to surge in target population and increase in number of diagnostic procedures globally. Moreover, emerging markets gain importance for the majority of the hemophilia treatment products manufacturers and distributors, as they focus on unmet demand for treating the disease in these regions. Hence, many companies have started introducing technologically advanced products to cater to the needs of a rise in population, especially in developing economies. Rapid growth was observed in the shipments of these products to provide improved healthcare services in emerging nations, and this is expected to offset the challenging conditions in mature markets, such as North America and Europe.

North America has the highest market share in 2022 and is expected to maintain its lead during the forecast period, in terms of revenue, owing to an increase in cases of hemophilia, availability of robust healthcare infrastructure, strong presence of key players, and rise in healthcare expenditure. However, Asia-Pacific is anticipated to witness notable growth, owing to increase in use of anti-hemophilic drug, unmet medical demands, presence of high population base, and increase in public–private investments in the healthcare sector.

A bleeding disorder is a medical condition characterized by inability of a person to form blood clots properly. Blood clots are essential in stopping bleeding after an injury or trauma. Bleeding disorders may lead to excessive bleeding, even with minor injuries, and may also cause internal bleeding in some cases.

The total market value of the Bleeding Disorders is $13,789.66million in 2022.

The forecast period for Bleeding Disorders market is 2023 to 2032.

Top companies such as Bayer AG, CSL Ltd. (CSL Behring), F. Hoffmann-La Roche AG, Novo Nordisk A/S, SANOFI CORPORATION, and Takeda Pharmaceutical Company Limited held a high market position in 2022.

Rise in prevalence of hemophilia, Technological advancements in treatment of hemophilia, Favorable government initiatives for hemophilia management

The factors that restrain the growth of the market is High cost of bleeding disorders treatments.

Factor replacement therapy segment dominated the global market in 2022 and expected to continue this trend throughout the forecast period.

The overall impact of COVID-19 remains negative on the Bleeding Disorders Market.

Loading Table Of Content...

Loading Research Methodology...