Blockchain In Insurance Market Research, 2031

The global blockchain in insurance market was valued at $496.9 million in 2021, and is projected to reach $32.9 billion by 2031, growing at a CAGR of 52.4% from 2022 to 2031.

The blockchain in insurance market refers to integration of blockchain technology to enhance efficiency, transparency, and security. Blockchain creates decentralized, tamper-proof records, streamlining claims management, underwriting, and policy issuance. Smart contracts and decentralized risk oracles automate transactions, reduce fraud, and reduce administrative costs. In addition, this technology helps to improve data sharing between insurers and customers, boosting trust and enabling personalized insurance offerings. The blockchain in insurance market is growing as insurers leverage these benefits for better risk management and competitive advantage. Insurers and customers can use blockchain technology to create smart contracts that manage claims in a transparent and timely manner.

Technology Insights

Adoption of technologically advanced software platforms is driving the blockchain in insurance market growth. The increase in use of smart contracts providing automated, self-executing agreements that accelerate the claims process, eliminate intermediaries, and reduce administrative costs, is driving the adoption of blockchain technology among insurers seeking to improve operational efficiency. In addition, blockchain enables insurers to securely and transparently integrate real-time data, allowing for more accurate risk assessments and dynamic pricing models, thereby enhancing the personalization of insurance policies. Furthermore, the adoption of blockchain technology automates claims processing and settlement, reducing the need for manual intervention and lowering operational costs for insurance companies, augmenting the growth of the blockchain in insurance market.

However, the implementation of blockchain-based systems involves high upfront costs, such as technology investments, legacy system integration, and hiring skilled personnel, which may deter smaller insurance companies. In addition, the integration of blockchain with outdated legacy systems can be complex, time-consuming, and costly, which may cause barrier to many insurance companies to adopt blockchain technology. Furthermore, several insurance companies may find it challenging to hire professionals with the necessary technical expertise to design and maintain blockchain-based systems, potentially hindering the growth of the blockchain in insurance market.

On the contrary, the blockchain in insurance market is expected to present numerous opportunities for the growth of the market. Blockchain can streamline the reinsurance process by enabling real-time data sharing, ensuring transparency, and facilitating faster settlements. By digitizing reinsurance contracts and claims, blockchain reduces delays, enhances risk management, and lowers administrative costs. In addition, blockchain technology enables microinsurance more accessible to underserved populations by offering low-cost, transparent, and automated solutions for managing small-scale, affordable insurance policies, thus providind remunerative opportunities for the growth of the blockchain in insurance market.

Furthermore, the surge in use of blockchain reduces insurance fraud by creating immutable, transparent, and auditable records of transactions, making it difficult to manipulate claim data or policy details. In addition, smart contracts on blockchain can transform the claims process by automating claim validation and payment, benefiting industries like health, automotive, and property insurance where claims are often slow and error prone. Moreover, blockchain enables secure, transparent, and permissioned data sharing, allowing insurers to collaborate with health providers, transportation companies, and other industries to create accurate risk models and offer better products. This is expected to offer lucrative opportunities for the growth of the blockchain in insurance market.

For instance, in March 2025, Achmea, a Dutch mutual insurer and ICMIF member, joined the Blockchain Insurance Industry Initiative B3i. This project, involving 15 insurers, aimed to explore blockchain's potential to improve data exchange efficiency between reinsurance and insurance companies. Achmea believed blockchain could enhance inter-group retrocession transactions with a shared ledger, setting a new efficiency standard.

The report focuses on growth prospects, restraints, and trends of the blockchain in insurance market outlook. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, in the blockchain in insurance market.

The blockchain in insurance market is segmented into Component, Application and Enterprise Size.

Segment Review

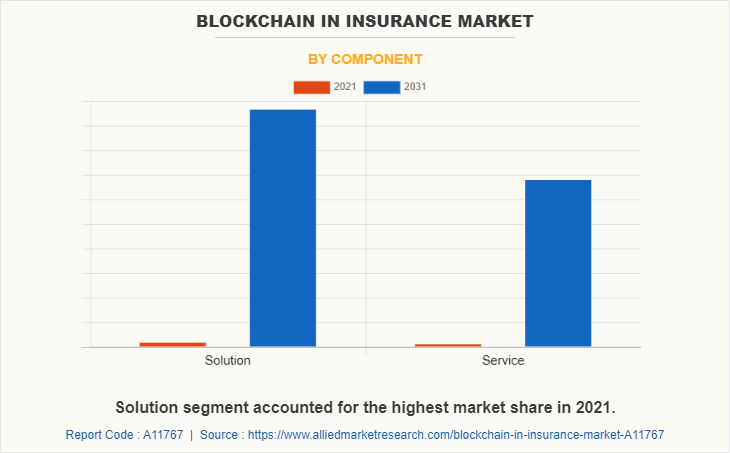

The blockchain in insurance market is segmented on the basis of component, application, organization size, provider, and region. By component, the market is divided into solution and services.

By application, the blockchain in insurance market is classified into GRC management, claims management, identity management and fraud detection, payments, and others.

By organization size, it is bifurcated into large enterprises and small and medium-sized enterprises.

By region, the blockchain in insurance market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of component, the solution segment attained the highest share in blockchain in insurance market in 2021. This is attributed to the fact that blockchain solutions can be decisive in transforming and simplifying the insurance industry to break free from outdated traditions with efficiency. Further, Increased customer distrust in centralized financial services, resulting in high underinsurance rates, is driving its reluctant yet solid interest in blockchain in insurance solution innovations.

Regional Insights:

By region, North America attained the highest blockchain in insurance market share in 2021. This is attributed to the fact that major retail banking service companies in North America are using blockchain services for the betterment of the customers and also to prevent fraud. Furthermore, the surge in adoption of blockchain technology for KYC/ID fraud prevention and risk scoring, as well as the rise in internet penetration rate, is expected to boost blockchain in insurance industry.

The report analyzes the profiles of key players operating in the blockchain in insurance market outlook such as Consensys, Auxesis Services & Technologies (P) Ltd., Amazon Web Services, Inc., ChainThat, IBM, Microsoft, Oracle, SafeShare Global, RecordsKeeper and Symbiont. These players have adopted various strategies to increase their market penetration and strengthen their position in the blockchain in insurance market.

Market Trends Insights:

The use of blockchain technology in the insurance industry has been gaining momentum in recent years. Blockchain is a distributed ledger technology that allows for secure, transparent and immutable record-keeping, making it a promising solution for the blockchain in insurance market. Moreover, blockchain is being used to extend insurance services to underserved markets, such as small and medium-sized businesses, freelancers, and individuals without access to traditional banking services. In addition, the insurance industry is increasingly focused on delivering a better customer experience, by leveraging new technologies and data analytics to improve customer engagement and satisfaction. This includes developing new products and services that are tailored to specific customer needs, as well as offering a more streamlined and personalized claims process.

The use of blockchain technology in the blockchain in insurance industry has been gaining momentum in recent years. InsurTech uses technology like AI, big data, and mobile apps to improve efficiency, customer experience, and business models in the insurance industry.

One of the significant trends is the increase in the adoption of InsurTech blockchain which leverages technology to innovate the insurance industry, making products and services more accessible, personalized, and cost-effective. In addition, there is a growing trend towards digital insurance ecosystem, as insurers develop integrated systems to provide seamless digital experiences, leveraging platforms, mobile apps, AI, and data analytics.

Another notable trend the market is expected to witness is the surge in use of crypto insurance, driving demand for insurance products that cover risks like digital wallet protection, smart contracts, cyber-attacks, and regulatory challenges. In addition, the shift in preferences toward risk assessment involves using big data, AI, machine learning, and IoT devices for more accurate, real-time assessments, enabling personalized policies and dynamic pricing.

Furthermore, the blockchain in insurance market is expected to continue to grow in the future as more companies and organizations adopt these technologies to improve efficiency, reduce costs and deliver a better customer experience, ultimately transforming the insurance industry for the better. Therefore, these are the major market trends for blockchain in insurance market forecast.

Top Impacting Factors

Adoption of Technologically Advanced Software Platforms

The rise in the adoption of advanced technology is one of the reasons driving the growth of the blockchain in insurance market. Blockchain's unchangeable record ensures secure, unalterable transactions, improving trust and transparency. Every transaction is recorded on a public ledger, making data easily auditable and reducing fraud. In addition, blockchain enables smart contracts that automatically execute predefined actions when conditions are met, reducing human error and fraud, and ensuring accurate claims processing. Furthermore, the use of blockchain in insurance market reduces operational costs by eliminating intermediaries like third-party verifiers and brokers. In addition, blockchain automates claims verification and processing, cutting down on human resource expenses and manual processing costs, leading to significant savings for insurance companies.

For instance, in November 21, 2024, Tassat Group partnered with Veuu to enhance the healthcare claims and payment process using blockchain and AI. This collaboration improved traceability, immutability, and instant payments, providing full visibility and automation for payers, providers, and banks. It maximized cash flow management and operational efficiency, offering greater control, security, and efficiency in insurance claims. This partnership is expected to revolutionize the healthcare insurance industry by streamlining claims processing, reducing administrative costs, and improving overall customer satisfaction, which in turn, fueling the growth of the blockchain in insurance market.

Moreover, blockchain and smart contracts enhance customer experience by speeding up and making the claims process more transparent, resulting in quicker, more reliable payouts. In addition, blockchain enables self-service portals for policyholders to access and verify policy information and track claims in real time. Furthermore, the increase in use of blockchain in new business models like peer-to-peer (P2P) insurance allows individuals to pool resources to insure each other, reducing the need for traditional insurers. In addition, blockchain facilitates asset tokenization, leading to new products like fractional and parametric insurance, expanding market services. For instance, in July 2024, Oxbridge Re Holdings' subsidiary, SurancePlus Inc, partnered with Zoniqx to expand in the reinsurance industry using blockchain. This partnership aims to tokenize reinsurance contracts and deploy them on blockchain ecosystems. This is expected to accelerate the growth of the blockchain in insurance market.

Growing Number Fraudulent Insurance Claims

The insurance industry is one of the most vulnerable sectors subject to various frauds and data thefts. Implementing blockchain in insurance is one of the innovative ways to reduce fraud, minimize risks, and increase customer satisfaction. The rise in fraudulent activities has led to the increase in the demand for blockchain in the insurance industry, leading to surge in the need to adopt blockchain technology in insurance processes. As a result, insurance companies need to replace their inefficient legacy systems integrated in the insurance systems with better systems to effectively prevent fraudulent claims.

For instance, in April 2024, AXA and AWS partnered to create the AXA DCP, a cutting-edge risk management platform that integrated industry, business, and environmental data with geospatial analytics and AI. This platform helped clients monitor assets and manage risks like natural disasters, supply chain disruptions, and cyber threats. AXA used AWS’s analytics to offer new services through AWS Marketplace and Data Exchange, enhancing risk prevention, underwriting, and claims expertise. CEO Scott Gunter emphasized the importance of building resilience against extreme weather, cyber-attacks, and other disruptions.

Moreover, blockchain offers decentralized public ledger across multiple untrusted parties. Thus, it can be used to eliminate errors and identify fraudulent activities. In addition, blockchain technology, which can be used to verify the authenticity of insurance customers' policies by providing a complete historical record of a policy holder's past transactions, is built on the concept of validation. Therefore, blockchain technology improves the efficiency of fraud detection & prevention and with the adoption of blockchain technology in insurance. For instance, in February 2025, Blockchain Deposit Insurance Corporation (BDIC) chose Bermuda as the headquarters for its international subsidiary. BDIC aimed to revolutionize cryptocurrency insurance by providing digital wallet insurance for preferred cryptocurrencies. The company pursued Lloyd’s of London coverholder status to underwrite complex cryptocurrency risks. BDIC committed to ensuring financial security as digital currency adoption accelerated and planned to announce its executive team and key hires soon.

Increasing Demand for Secure Online Platforms

The adoption of secure online platforms is driving growth in the blockchain in insurance market, as the insurance industry is increasingly leveraging digital technologies to improve customer experience, streamline processes, and enhance their operations. This has led to a growing demand for secure online platforms that can provide a seamless and secure digital experience for customers. For instance, in March 2025, DXC Technology and ServiceNow announced new offerings to modernize the insurance industry. They introduced DXC Assure BPM, combining DXC's insurance expertise with ServiceNow's AI capabilities. This solution aimed to reduce process debt, enhance operational efficiency, and improve customer satisfaction across the entire policy lifecycle. It was expected to help insurers reduce up to 40% of operational costs typically spent on manual processing.

Moreover, the COVID-19 pandemic has accelerated the trend towards remote work and remote access to services, including insurance. As more people are working from home and access insurance services online, there is an increasing need for secure online platforms that can provide reliable and secure access to data and services. In addition, the insurance industry is subject to strict regulations around data privacy and security, and non-compliance can result in serious consequences. This has led to an increased demand for secure online platforms that can meet these regulatory requirements. Therefore, insurers are investing in secure online platforms to meet the needs of their customers and ensure the security of their data, which is driving the growth of blockchain in insurance market.

For instance, in February 2025, Blockchain Deposit Insurance Corporation (BDIC) unveiled a new cryptocurrency insurance platform to protect digital wallet holders against exchange failures and cyber exploits. The platform featured multiple coverage tiers and used a risk assessment model considering wallet holdings, account longevity, and security measures. The company aimed to introduce institutional-grade security to the cryptocurrency ecosystem.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the blockchain in insurance market analysis from 2021 to 2031 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the blockchain in insurance market size segmentation assists to determine the prevailing blockchain in insurance market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global blockchain in insurance market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global blockchain in insurance market trends, key players, market segments, application areas, and market growth strategies.

Blockchain in Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 32.9 billion |

| Growth Rate | CAGR of 52.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 380 |

| By Component |

|

| By Application |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | Microsoft, RecordsKeeper, Xceedance, Oracle, IBM, SafeShare Global, Amazon Web Services, Inc., Consensys, Symbiont, Auxesis Services & Technologies (P) Ltd. |

Analyst Review

Blockchain is a data structure that enables the creation of a digital ledger of transactions and the ability to share them among a distributed network of computers. The core benefit of blockchain is that it builds trust between parties sharing information. The information shared is encrypted as an electronic list of records or blocks. It cannot be erased, which helps to ensure trust between users. Moreover, blockchain has the ability to help automate claims functions by verifying coverage between companies and reinsurers. It will also automate payments between parties for claims and thus lower administrative costs for insurance companies.

Furthermore, market players are adopting partnership strategies for enhancing their services in the market and improving customer satisfaction. For instance, in Nov 2022, flac Incorporated (NYSE: AFL), a Fortune 500 company that helps protect more than 50 million people in Japan and the United States, and Trupanion, Inc. (Nasdaq: TRUP), a leader in medical insurance for cats and dogs, are announcing a joint venture between Aflac Life Insurance Japan and Trupanion to provide high-value pet insurance in Japan. The joint venture, Aflac Pet Insurance, will leverage Aflac's strong brand, insurance expertise, and broad distribution network in Japan with Trupanion's expertise and leadership in pet insurance. This product partnership helped both the companies to grow its market in terms of revenue and attract more customers.

Some of the key players profiled in the report include Consensys, Auxesis Services & Technologies (P) Ltd., Amazon Web Services, Inc., IBM, Microsoft, Oracle, SafeShare Global, RecordsKeeper and Symbiont. These players have adopted various strategies to increase their market penetration and strengthen their position in the blockchain in insurance market.

The global blockchain in insurance market was valued at $496.9 million in 2021 and is projected to reach $32.9 billion by 2031, growing at a CAGR of 52.4% from 2022 to 2031.

The blockchain in insurance market involves the adoption of blockchain technology to enhance efficiency, security, and transparency in insurance processes, including claims management, identity verification, and fraud detection.

Key players in the blockchain in insurance market include Consensys, Auxesis Services & Technologies (P) Ltd., Amazon Web Services, Inc., ChainThat, IBM, Microsoft, Oracle, SafeShare Global, RecordsKeeper, and Symbiont.

North America attained the highest blockchain in insurance market size in 2021, attributed to major retail banking service companies using blockchain services to enhance customer experience and prevent fraud.

Factors driving the blockchain in insurance market include the adoption of technologically advanced software platforms, increasing demand for secure online platforms, and the growing number of fraudulent insurance claims.

Challenges facing the blockchain in insurance market include high initial setup costs and a lack of standardization and awareness in blockchain technology.

Loading Table Of Content...